Stock Screener Ideas & Example Trading Strategies

Explore Ready-to-Use Stock Screener Ideas

Discover a collection of proven stock screener ideas and trading strategies based on real-world experience, popular investing books, and insights shared by the ChartMill community. Each setup offers a quick starting point for your own screening — from technical breakout and pullback screens to fundamental growth and value filters. Use the filters below to browse through different trading styles, timeframes, and market focuses — and quickly find screeners that match your own strategies and preferences.

Showing 289 Stock Screener configurations

Breakout Screens - Good Technical and Setup ChartMill Ratings

The Technical Breakout Setups will filter for stocks with a good Technical Rating and a good Setup Rating, leading to a list of breakout setups in the best performing stocks in the market.

Squeeze Play Setups

This screen finds squeeze play setups on stocks that are in a strong uptrend. A squeeze play setup occurs when the Bollinger Bands are inside the Keltner channels. When this happens, the stock has been trading in a narrow range for a while. A major move could happen when the stock breaks out of this trading range.

Bull Flags

This screen finds bull flag patterns. A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. The pattern takes shape when the stock retraces by going sideways (or by slowly declining) after an initial big rise in price. When you see the graphical representation of this pattern, you’ll notice that it somehow looks like a flag on a pole.

Strong Growth Stocks with good Technical Setup Ratings

The Strong Growth Stock Technical Setups combines Technical and Fundamental analysis and will filter for technical breakout patterns in stocks which are growing strongly while having decent profitability and health.

Momentum Screens - High Trend Intensity on Increased Volume

This screen finds stocks in a strong trend that are moving on increased volume. There is not necessarily a good entry point, if not it may still be interesting to put these stocks on a watch list.

Breakout Screens - Near 52 week High + High Relative Strength

This screen finds strong stocks near a new high. This list allows you to find stocks 'about to make a new high'. Good bases still need to be found either by further filtering or by manual inspection.

large effective volume + pocket pivot today

nice alternative to a basic pocket pivot screen that incorporates effective volume

Weinstein Stage 1 Setups

From the popular book by Stan Weinstein 'Secrets for profiting in Bull and Bear markets', using the chartmill Weinstein indicators.

Breakout Screens - Weekly Chartmill Channel Breakout

This screen finds stocks that have a long upper weekly chartmill channel. The stock is currently trading near the upper channel line. The channel line acts as resistance, when the stocks breaks this resistance a possible strong move may follow.

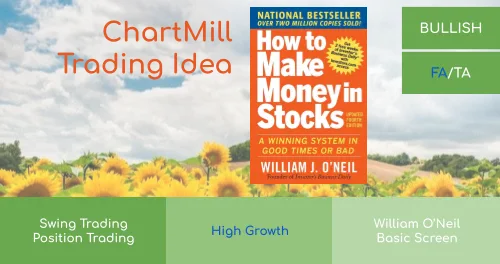

O'Neill CANSLIM High Growth screen

This is a base stock screener configuration for the CANSLIM system introduced by William O'Neill. It is intended as a starting point and the settings are discussed in more detail in the linked article. CANSLIM is a system with strong fundamental criteria related mostly to EPS growth, but also has some pure technical requirements as well as entry and exit rules.

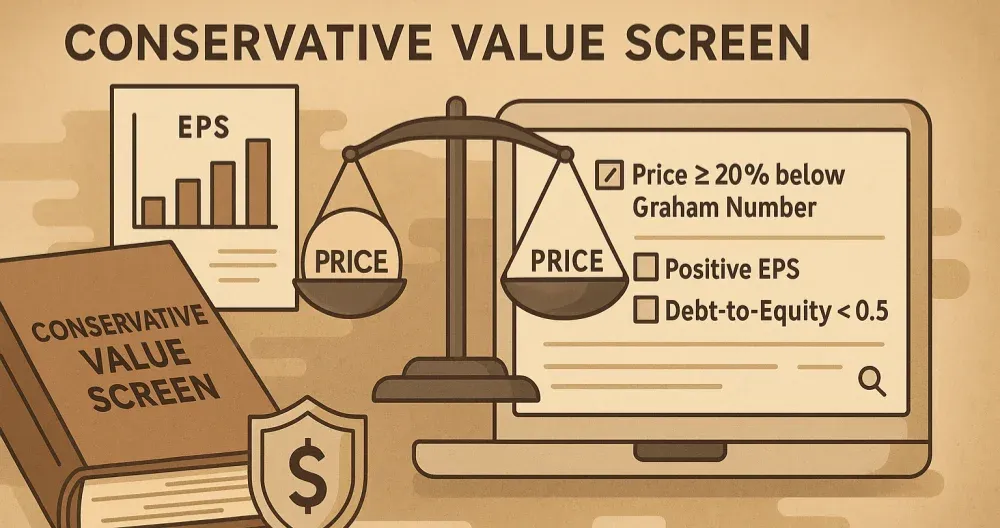

Valuation Screens - Undervalued Stocks

The Decent Value Stocks screen is a Fundamental (FA) screen which will filter for stocks with a good fundamental valuation, while still showing decent profitability, health and growth.

Mean Reversion Screens - Stocks nearing Support Line

This screen finds stocks approaching a strong support line and where there may be opportunities to buy the stock.

Growth Screens - Affordable Growth Stocks

The Affordable Growth screen will filter for stocks which are showing good growth, decent profitability and health and are not overvalued from a fundamental perspective.

Momentum Screens - Pocket Pivot Today in Strong Stocks (high relative strength)

This screens searches for Pocket Pivots in Strong stocks that happen near the SMA(10). A pocket pivot is a positive sign of price/volume behavior. Whether the stock is a buy or not remains to be judged on a case by case basis.

Mark Minervini - Trend Template

Trend Template from Mark Minervini's book 'Trade Like a Stock Market Wizard'.

Momentum Screens - Large Players Buy

This screen finds stocks that are being bought by large players based on the Effective Volume indicator. Whether the stock offers a good entry point is to be determined on a case by case basis.

Bear Flags

This screen finds bear flag patterns. A bear flag is a consolidation after a strong move down. The downtrend may continue when the stocks moves out of the consolidation zone.

Breakout Screens - Finding Narrow Trading Ranges using ChartMill Channels

Find strong stocks in the market that are in a narrow trading range. We use Chartmill Channels to determine the trading range. By using the Chartmill Technical Quality Score we make sure to select stocks that are in an uptrend and technically solid.

Mark Minervini - Trend Template + FA Screen 6

Trend Template + A combination of basic screens 2 and 4 (quarterly EPS and Revenue growth and acceleration)

Kristjan Kullamägi Continuation Breakout Screen

This screen looks for stocks that have risen sharply over a relatively short period, followed by an orderly pullback and consolation.

Breakout Screens - Finding Horizontal Bases using ChartMill Channels

Using chartmill channels in combination with trend intensity can find some nice horizontal basing patterns.

Dividend Screens - Best Dividend Stocks using the ChartMill Dividend Rating Filter

The "Best Dividend Stocks" screen uses the ChartMill Dividend Rating to find the best stocks for dividend investing. The dividend rating takes into account reliability and sustainability of the dividend. We also use the health and profitability ratings to make sure only solid stocks are selected.

High Tight Flag

Only stocks in bullish trend, showing strong price run-up, decent relative strength and diminishing volume in the flag itself.

Breakout Screens - Ascending Triangle Pattern

An Ascending Triangle Pattern is a bullish pattern and is formed when the price is trapped between horizontal resistance above and an upwards support trendline.

Squeeze Play Setups (short)

Squeeze plays indicate a narrow range. This screen additionally filters for a short term downtrend, listing short opportunities

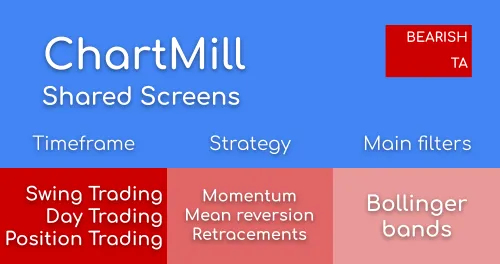

Bollinger Bands

This screen finds reversals at the Bollinger Band for Swing Trading. A swing trade can be made in the direction of the reversal. The screen uses custom expressions to determine the reversal condition at the Bollinger Band.

Mark Minervini - Trend Template + FA Screen 5

Trend Template + A combination of basic screens 1 and 3 (yearly EPS and Revenue growth and acceleration)

Caviar Cruise Full - Finding Stocks for Quality Investing

This screen also has a base version, but in this version we added some additional criteria to find stocks which qualify for quality investing. Quality investors only invest in the best and most profitable companies available. The screener can filter for criteria which are quantifiable, but besides this more research should be done on the results. Make sure to check the linked article for more information on quality investing and the screen.

Mark Minervini - Trend Template + FA Screen 1

Trend Template + Decent Yearly Earnings Growth and Acceleration (EPS)

Mark Minervini - Trend Template + FA Screen 2

Trend Template + Decent Quarterly Earnings Growth and Acceleration(EPS)

Explosive move, pullback and bounce

I have found this scanner to find good, volatile, low-priced stocks that has made an explosive move, pulled back slightly and about to make a low (reverse back up)

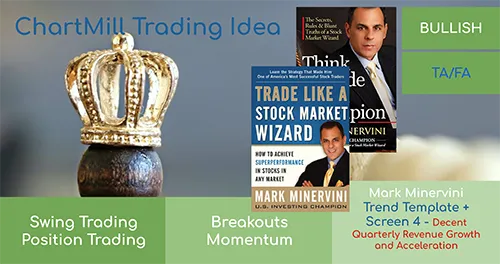

Mark Minervini - Trend Template + FA Screen 4

Trend Template + Decent Quarterly Revenue Growth and Acceleration

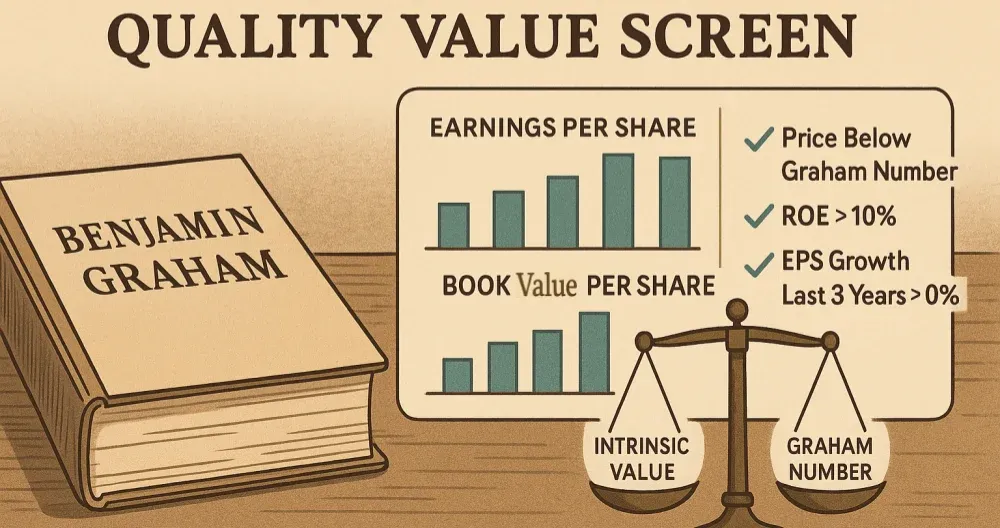

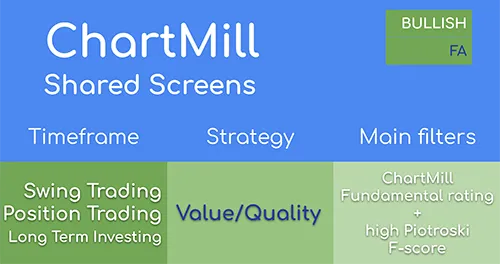

Valuation/Quality Screens - Undervalued Stocks with High Piotroski F-score

This screen lists stocks with a high Piotroski F-score (8 or 9), while having a low Price/Book value and a good ChartMill valuation rating. So we are looking for quality companies which are undervalued.

High Growth Momentum + Trend Template

The screens filters for stocks which meet the Minervini Trend Template and have a ChartMill High Growth Momentum score of at least 6. The trend template makes sure the results are stocks which are in an uptrend, not too far of their highs and well above their yearly lows. The ChartMill HGM rating assures the results show high EPS and Sales growth and acceleration.

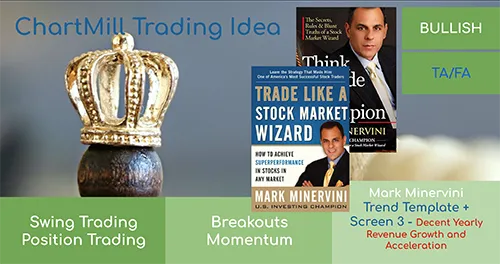

Mark Minervini - Trend Template + FA Screen 3

Trend Template + Decent Yearly Revenue Growth and Acceleration

Swing Trade Set-ups

I use this screen to find neutral/positive stocks that have recently missed earnings estimates or have been otherwise whacked with bad news.

Compounding Quality Screener

A screen as described by Compounding Quality (@QCompounding), a former professional investor. The screen focusses on quality stocks with low capital intensity and generating increasingly large free cash flows. A detailed description and discussion of the screen can be found in the linked article.

Bullish Engulfing Pattern in Strong Stocks

Consistent strong performing stocks that show a bullish engulfing pattern

Momentum Screens - Recent Pocket Pivot in Strong Stocks

This screen finds strong stocks with at least one pocket pivot in the last 5 days. Whether an entry is possible should be judged on a case by case basis.

Strong Stocks, IBD names

This screen is for strong stocks and I've found alot of stocks found mentioned in IBD pop up on this list.

Mark Minervini's Trend Template (TTP)

This screen is based on the Trend Template (TTP) by 2 times US Investing Champion Mark Minervini. He uses the Trend Template as the first step for his stock selection. The criteria are described in his book "Think and trade like a stock market wizard" : The current stock price is above both the 150-day (30-week) and the 200-day (40-week) moving average price lines. The 150-day moving average is above the 200-day moving average. The 200-day moving average line is trending up for at least 1 month (preferably 4–5 months minimum in most cases). The 50-day (10-week) moving average is above both the 150-day and 200-day moving averages. The current stock price is trading above the 50-day moving average. The current stock price is at least 30% above its 52-week low. The current stock price is within at least 25% of its 52-week high (the closer to a new high the better). The Relative Strength ranking (RS ranking) is no less than 70.

Strong Stocks Nearing Resistance Line

Stocks with high relative strength, nearing a predefined resistance line (close < 3% from resistance)

Mean Reversion Screens - Stocks nearing Resistance Line

This screen finds stocks approaching a strong resistance line where there may be opportunities to short the stock.

Large Return Opportunities

Bottom fishing stocks that have large upside potential. Watch for increasing volume before purchasing.

Oversold, near 20 EMA

This screen is for stocks under $20 that are oversold on Slow Stochastics and are extremely close to the 20 day EMA. Many stocks ride along their 20 day EMA so using candle signals and this screen will help find long reversal candidates. The 8 EMA is the T-Line (Trend Line) inspired by candlestick authority Stephen Bigalow from his online chats. This line will alert you early to a potential trend change.

The little book that makes you rich - growth stocks

This configuration of the stock screener was created based on the rules described in the book "The little book that makes you rich", by Louis Navellier. The book defines eight criteria that should be met before a stock qualifies as growth stock which fits the system. These eight rules were converted into screener settings and there is a linked article available which discusses this screen a bit deeper.

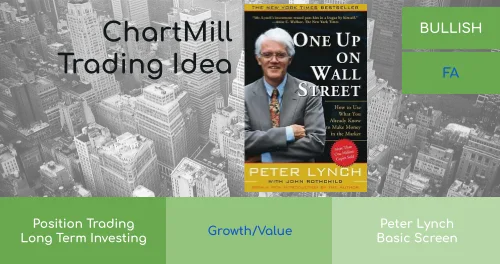

Peter Lynch Strategy

The Peter Lynch Strategy is a long term investing strategy, combining growth and value: finding decent stocks which are able to grow to hold for the long term, while not overpaying.

Caviar Cruise Base - Searching for Quality

In this screen we apply some basic filters to find stocks which qualify for quality investing. Quality investors only invest in the best and most profitable companies available. The screener can filter for criteria which are quantifiable, but besides this more research should be done on the results. Make sure to check the linked article for more information on quality investing and the screen.

OVERSOLD NEAR SUPPORT

I would buy any stock on this list that has a buy rating with Fidelity Equity Score or Zacks.

High Growth Momentum Breakout Setups

This screens finds potential Breakout setups in High Growth Momentum stocks. At the same time it demonstrates the power of the ChartMill Rating by just using 3 filters: we find stocks which are high growth stocks (HGM rating above 6), with decent technicals (TA rating above 7), which show a setup pattern (setup rating above 7).

Terry Smith: Quality at fair price

A screener inspired by the work of Terry Smith, founder of Fundsmith. The screen finds quality companies while also taking into account a fair pricing. The output is meant to be investigated deeper for long term buy and hold.

Momentum Screens - Large Players Sell

This screen finds stocks that are being sold by large players based on the Effective Volume indicator. Whether the stock offers a good short entry point is to be determined on a case by case basis.

MomentumScreener high volume

Screen stocks that are in an longterm uptrend and high volume in the last 5 days

Breakout Screens - Above 52 Week High + Increased Volume

This screen looks for stocks breaking out above their highest annual price with increased volume.

Breakout Screens - Symmetrical Triangle Pattern

The Symmetrical Triangle Pattern can be considered both Bullish and Bearish and occurs when price is trapped between a declining resistance line and a rising support line.

GST Positive Divergence

Detect early buying and positive divergence between large players volume and a sideways moving stock. The idea is to pick up rising large player volume and a rising Twiggs Money Flow, while the stock is still trading sideways. Great way to get ahead of big moves.

Martin Zweig: Growth at Reasonable Price

This screen implements the strategy of Martin Zweig as described in the book "Winning on Wall Street". The strategy focusses on Growth stocks at reasonable price (GARP) and has also looks at the general market performance as well as the relative price performance of the individual stocks. Check the linked article for more details.

James O’Shaughnessy: Tiny Titans

An implementation of the 'Tiny Titans' screen by James O’Shaughnessy, as published in the book "Predicting the Markets of Tomorrow". The screen finds micro cap stocks with a low Price/Sales ratio and sorts them by relative strength.

Stocks under $5 nearing support.

I use this screen to find stocks nearing support with upward trend. I buy the stock in lots and if stocks continues to fall I buy and average down. I also look closely at energy stocks and mining stocks. Stocks that correlate with the oil and gold market.

Strong Stocks with High RS > 90 - GW

Chartmill Strong stocks with high volume and High Relative Strength. Look for stocks forming bases before purchase.

The Qullamaggie Episodic Pivot Setup

The Qullamaggie episodic pivot setup is a highly effective strategy for identifying stocks that showed significant upward momentum following a major catalyst.

Breakout Screens - Descending Triangle Pattern

A Descending Triangle Pattern is a bearish pattern which has horizontal support and a descending resistance line.

Breakout Screens - Near 52 week High + increased volume

This screen filters out stocks whose price is at less than 5% of the highest price in the past 52 weeks.

Bullish retracement

Price is above 50 DMA, trending up. Made bullish weekly hammer, ready to regain momentum.

Finding Multibagger Stocks

A multibagger stock is a term used in the stock market to describe a stock that has delivered returns several times its original investment value.

Volatility contraction and secure entry point inspired by Minervini

The VCP by Minervini (author of the book "Trade like a stock market wizard") is very similar to the concept of classic volume dry ups from CANSLIM by O'Neil. Many VCPs are similar to classic cup & handles, but the focus is on shares with multiple contractions, which is why they look like mini-cups with many handles (T3, T4 ...). The background is that with each contraction more shares move from weak to strong hands. This screen looks for stocks that match the secure entry point analysis as closely as possible, meaning that they are in an uptrend and between the 52-week lows as highs, but just completing a pullback under volatility contraction. Relative strength must be high and some level of growth must be present. Fortunately, Chartmill offers a very powerful Growth and RS Rating that is applied here and I recommend everyone to experiment with it. The idea of the screener is to find stocks that fit these criteria and thus pre-select them for a potential swing or position trade. The screener looks for stocks that are in a consolidation. An entry into such stocks can be a high volume trendline breakout from a contraction pattern and cannot be determined without classical charting. As an example, it was possible to find the pattern in TSLA in 11.2020. This strategy works best in bull markets with institutional demand for high-growth stocks.

Breakout Screens - Weekly ChartMill Channel Breakdown

This screen finds stocks that are nearing a long lower chartmill channel line that acts as support. This screen finds short setups: when the channel is broken, a possible strong move down may follow.

Strong ETF's - CM relative strength

Screen to find strong US ETF's using the CM relative strength feature

Momentum Screen - Golden Cross

This scan looks for stocks where the famous golden cross occurs (50SMA intersects the 200SMA upward).

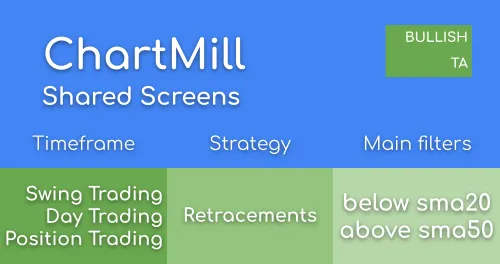

Retracement Screens - Price below SMA20 and above SMA50

This swing trading screen is based on the relationship between the price and two moving averages, being the 20 and 50SMA.

Retracement Screens - Using the Force Index Indicator

Look for minor price retracements in strong trends, using the Force Index Indicator

Retracement Screens - Price near SMA50

Price retracements to the 50sma level in stocks that are in a rising trend.

BMF - Institutions buying on Bull Flag

Institutions are buying these stocks on a bull flag set-up. Visually confirm that Large Player is Volume is rising during the Bull Flag.

Mean Reversion Screens - RSI Indicator

This screen shows stocks that have experienced a sharp decrease in price in a short time and are therefore at least 9% away from their 10-day moving averages and where the RSI2-indicator is extremely oversold (<10). This makes these stocks ideal candidates to look for mean reversion LONG setups on the assumption that the price will at least temporarily move back towards the average price. Remember that these candidates are merely watchlist setups. Confirmation is still needed, so be sure to read the article below that explains exactly what the strategy entails and how to apply it. Trade safe!

Under 10 looking to Move

Under 10 Stocks that have been above average performance with increasing volume

Bull Flag Screener

A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. The pattern takes shape when the stock retraces by going sideways (or by slowly declining) after an initial big rise in price. When you see the graphical representation of this pattern, you’ll notice that it somehow looks like a flag on a pole.

US STOCKS BEGINNGING UPTREND

US stocks with low capitalisation beginning a movement of uptrend detected by Bollinger Bands

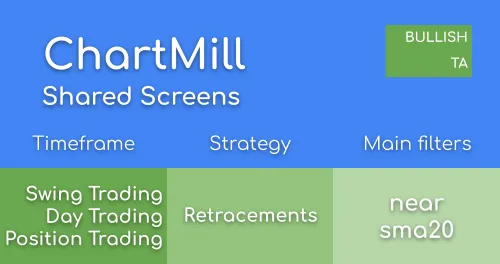

Retracement Screens - Price near SMA20

Price retracements to the 20sma level in stocks that are in a rising trend.

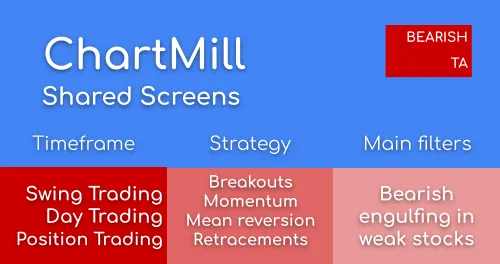

Bearish Engulfing Pattern in Weak Stocks

Weak performing stocks (low relative strength) that show a bearish engulfing pattern

7 x 7 scan

This scan selects stocks with high growth, relative strength and profitability, but also have good fundamentals and technical properties.

Breakout Screens - Falling Wedge Pattern

A falling wedge pattern is considered a reversal pattern within technical analysis. The wedge formation consists of a support and resistance line running in the same direction (downwards) but with different slopes. The formation gradually narrows until eventually the upper trend line is broken, leading to a buy setup.

Current Market Sentiment

These high momentum stocks and ETF’s are currently in incredible, white-hot uptrends!

Growth Small & Mid Cap Stocks

A trading idea created from a combination of fundamental and technical individual filters to find promising and financially sound growth companies with a market capitalization of up to maximum 10 billion (small & mid caps).

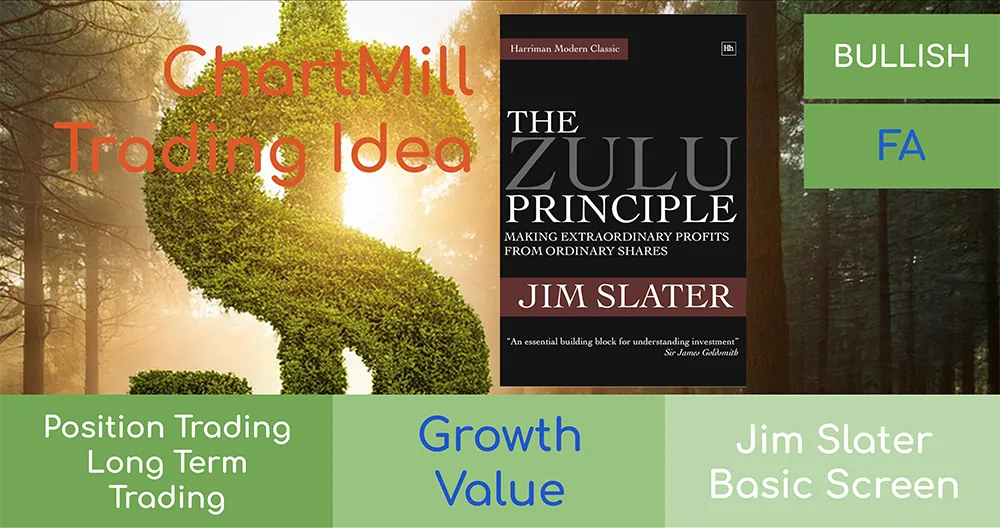

The Zulu Principle by Jim Slater

Making Extraordinary Profits from Ordinary Shares with a Combination of Fundamental Growth and Value Screening Filters

Bottomline

Build a watch list of pending reversal at significant resistance level after prior uptrend, Inverse of TopOut Screen.

10ema, STO oversold and turning higher with MACD above its signal

Searching for stocks ready to pop with 10ema, STO oversold and turning higher with MACD above its signal

Basic Short Squeeze Screen

Aimed at identifying stocks with the foundational characteristics of a potential short squeeze, using basic filters like short float%, short interest, minimum price and average daily volume.

Low Float Stocks

Low float stocks are stocks with a relatively small number of shares available for public trading. These kind of stocks can offer incredible profit opportunities, but they also come with significant risks.

Breakout Screens - Near 52 Week Low + Increased Volume

This screen filters out stocks whose price is at less than 5% of the lowest price in the past 52 weeks.

Mean Reversion Screen - Short Price Extreme UP

This screen shows stocks that have experienced a sharp increase in price in a short time and are therefore at least 9% away from their 20-day moving averages. This makes these stocks ideal candidates to look for mean reversion SHORT setups on the assumption that the price will at least temporarily move back towards the average price. The stocks you have witheld from this screen can be added into your actual trading platform, ready for the next trading day. Be sure to read the articles below and watch the accompanying video that explains exactly what the strategy entails and how to apply it. Good luck!

Momentum Screen - Death Cross

This scan looks for stocks where the famous death cross occurs (50SMA intersects the 200SMA downward).

Mean reversion screens (short) - RSI Indicator

This screen shows stocks that have experienced a sharp increase in price in a short time and are therefore at least 9% away from their 10-day moving averages and where the RSI2-indicator is extremely overbought (>90). This makes these stocks ideal candidates to look for mean reversion SHORT setups on the assumption that the price will at least temporarily move back towards the average price. Remember that these candidates are merely watchlist setups. Confirmation is still needed, so be sure to read the article below that explains exactly what the strategy entails and how to apply it. Trade safe!

Retracement Screens - Using the Bullish Hammer Pattern

This screen searches for minor price retracements while a bullish hammer pattern is formed.

Bull Flag (US Stocks only)

This is a bull flag screen, looking at US stocks with strong growth (above 5) and strong health (above 5). Volume above 500K

High Pressure Short Squeeze Screen

Focuses on fine-tuned parameters for stocks on the verge of a squeeze and Includes additional filters like float < 20M, short interest ratio > 5, recent price breakout, and days to cover > 3.

Mean Reversion Screens - Failed Breakouts above 52 week High

This screen looks for stocks that have broken through their 52-week high within the past five days but have fallen more than 2% on the most recent trading day while closing lower than the previous trading day's low. In addition, the previous trading day must have ended positively.

Breakout Screens - Rising Wedge Pattern

A rising wedge patterns is considered a reversal pattern within technical analysis. The wedge formation consists of a support and resistance line running in the same direction (upwards) but with different slopes. The formation gradually narrows until eventually the lower trend line is broken, leading to a sell setup.

BMF - Institutions buying on Pull Back

Institutions are buying these stocks on a bull flag set-up. Visually confirm that Large Player is Volume is rising during the Pull Back.

A better screen with fewer results for aprofit

Easy to scan for potential squeeze play based on RSI crossover from 0

ChartMill Momentum Screen modified for SmallCap+

ChartMill Momentum Screen modified for SmallCap and above

Breakout Screens - Symmetrical Triangle Pattern (short)

The Symmetrical Triangle Pattern can be considered both Bullish and Bearish and occurs when price is trapped between a declining resistance line and a rising support line.

Dividend Screens - Decent Dividend Yield (minimum 3%), decent financial Health and Good Dividend Growth (between 10% and 20%)

This screen shows somewhat financially stable companies that pay reasonable dividends and maintain a good dividend growth%.

Mean Reversion Screen - Short Price Extreme DOWN

This screen shows stocks that have experienced a sharp price drop in a short time and are therefore at least 9% away from their 20-day moving averages. This makes these stocks ideal candidates to look for mean reversion LONG setups on the assumption that the price will at least temporarily move back towards the average price. The stocks you have witheld from this screen can be added into your actual trading platform, ready for the next trading day. Be sure to read the articles below and watch the accompanying video that explains exactly what the strategy entails and how to apply it. Good luck!

Breakout Screens - Using the Aroon Indicator

The Aroon indicator measures trends, but can also be used to spot consolidations. When both Aroon levels are low (below 30 in this case) it means that the stock has not made a new short term high or low in a while. Therefor it is trading in a price range and it could be an interesting trade when it breaks out of this range.

Dividend Screens - Basic Dividend Yield (minimum 2%), Decent Financial Health and Good Payout Ratio (maximum 60%)

This screen applies a maximum payout percentage (up to 60%) so that enough cash remains in the company itself to invest.

Postive Momentum

The trend is bull as MACD >0 and golden crosses 0 from below with Stochastics > 70 for strong stock

Strong Stocks Long ( MC, LC )

We look for shortterm setbacks of stocks in strong longer term trend. You can choose also to invest in installments . 1/3 when signal is fired ( Stock pops up in screen ) 1/3 when the signal is confirmed by the stocks move, 1/3 when the stocks resuming of the uptrend is fully confirmed by a new high. Portfolio Approach : You could buy the first ten stocks with the strongest Chartmill fundamental ratings i.e. Use position sizing based on volatility ( ATR ;10) to determine how much to invest. Finally, use trailing stops to secure any profits and avoid too much losses. Exit : You can sell the 1. 1/3 of a position once it is well in the plus zone, thereby enjoying a free ride for the rest of the position and generating liquidity for the next stock. Check daily or weekly , but let your profits run and tighten your stops once you're in trade. You might get stopped out early sometimes though. Some traders use mental stops, but with 10 positions this might be difficult to to manage

Selling Premium screen

Looking for stocks with earnings in next 2 weeks with the idea of selling premium: strangles, call or put spreads, condors

Dividend Screens - Highest Dividend Yield (minimum 8%)

This screen shows companies offering the highest dividend yields (minimum 8%). Keep in mind that high-dividend stocks are not without risk. Be sure to read the article "evaluating stocks for dividend investing" for more detailed information (see Related Articles and videos below).

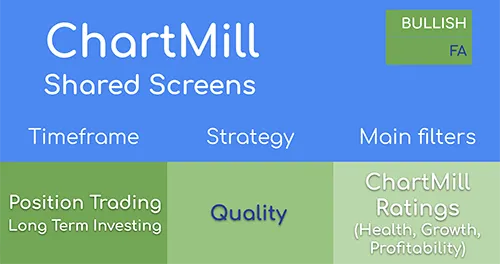

Finding Quality with ChartMill Ratings

A broad selection of quality stocks can easily be found by using the ChartMill Fundamental Ratings. We need stocks with great health and profitability, while also showing decent growth. You can find tune the list with some additional quality filters or use the valuation Rating to find stocks at an attractive valuation.

3 Bar Play

The 3 Bar Play is a bullish continuation pattern that appears after a stock has made a strong directional move. It signals that a brief pause in price is likely to be followed by a continuation in the same direction.

Stocks with price increase during last 2 weeks, that may have been consolidating during last week.

Stocks with price increase during last 2 weeks, that may have been consolidating during last week. Volume is key. Filter based on how the chart looks.

Low volatility squeeze daily breakout in any direction

depending on the momentum of adx and dmi this volatility squeeze can bring a high return if found on the lower end of the linear regression on the weekly chart or at least on the bigger time frames if you're trading on a shorter time frame

Dividend Screens - Good Dividend Yield (minimum 5%) and Decent Financial Health

This screen shows companies that are financially stable and have a dividend yield of at least 5%.

Bollnger Bands (short)

This screen finds reversals at the Bollinger Band for Swing Trading. A swing trade can be made in the direction of the reversal. The screen uses custom expressions to determine the reversal condition at the Bollinger Band.

Technical Reversals

Stocks with a bullish indicator and rising stochastic. Look for bullish confirmation for entry, price should rise and not fall below half way point of the bullish candle in order to enter / stay in. Even better if price is greater than 50 SMA. Watch price action at 50 SMA and 200 SMA

BMF - Institutions buying on Quality Technicals & Set-up

Institutions are buying these stocks that have quality technicals and a quality set-up.

Trend crossover to get in after it breaks range

You need to wait for price to break its range and enter on a position sort like a breakout. watching for bull traps is better to enter on the re test

Valuation Screens - Decent Value Stocks

This screen provides a selection of stocks that may be of interest to the value investor. Be sure to read the accompanying article for more detailed explanations regarding the use of the filters.

Retracement Screens - Using the Stochastics Indicator

This screens searches for stocks where the stochastics indicator crosses the 20-level upwards after a minor price retracement

Growth at reasonable price combined with F-score

Screen is designed to leverage on time tested value investing strategies.

Swing Trade with Lowest Risk and high Gain

The Filter is aimed to enter trade to have no more than 4% loss. All trades taken on this filter should have at least 1:2 ratio minimum gain or more. Its important to respect the stop loss rule. Overall the filter looks for leaders in the last 3 months with at least 20% or more gain (you can chang it to 30% during solid bull run). The 10 day SMA should be above 20 day SMA to indicate a short term and trend to a continued upside. with no earnings in the next 2 weeks guarantees no surprise gap down of the stock and makes the stock at least 2 week hold candidate. The stock should be on the up above 10 day SMA so that the entry is done on the up day.

Strong stocks in uptrend, close to breaking out

Hoping to capture strong stocks in uptrend that are about to breakout into new highs.

Retracement Screens - Using the Macd Indicator

This screen looks for small price retracements based on the macd indicator which is still below '0' but already rising.

Pocket Pivot Pullback

As described by Gilbert Morales and Chris Kacher in their books on the O'Neil Disciple, the Pocket Pivot is an early buy point. This screener looks for strong stocks (with a high chartmill RS rank and near the 52 week high) with a pocket pivot off the 20-sma in the last 5 days that have made a pullback into the pocket pivot. According to Mr. Morales, it is recommended to buy as close as possible to the low of the pocket pivot. Since this is a screener that puts pocket pivots in a breakout context, it is important for the trader to have a constructive base. Since this screener looks for stocks that are in 2% range to their 10-sma and 20-sma, some sideways consolidation should have taken place at these averages.

Analysts Strongest Buys - NYSE

NYSE listed stocks with at least a 90% BUY recommendation as at the viewing date.

Reversal on Volume

Based on VPA's concept of stopping volume, this screener looks for stocks in a downtrend that have completed a price reversal under increased volume, showing a strong close.

Discount Buys for Swing Trade

The Filter give the user a list of stock which are in uptrend and has recently retraced. The stock picks out stocks which are negative on a given day so that the entry is done at a discount price. It is important to make sure that the trade is followed according to a strict stop loss on the breach of the support. In some occasions the stocks may break the support and continue downside so its key to keep stop loss. On entering any trade from this filter key is to see the nearest support line below the price and keep 1:2 profit and enter the trade. The Trade needs to be taken with approximately 3-5% stop loss for a profit margin of 6-10%. This is a general guide but will vary based on stock volatility. The Trader would be required to draw simple horizontal lines as support lines. Or use chartmill support lines for extra information to make sure the entry is done above the support and the support line is used as stop loss.

CM_Breakout1

Screen for Long entries. Looking to isolate large number of US Companies with decent technical and setup ratings down to a select few for further analysis. All companies listed will be relatively close to horizontal support (possible demand zone) and should be fundamentally sound as well. Please note these companies are not actively breaking out but rather have the potential for a next move up.

BMF - Institutions buying on Tight Short Term Consolidation

Institutions are buying these stocks in a Tight Short Term Consolidation. Visually confirm that Large Player is Volume is rising during the consolidation.

Rubber Band Long ( Reversion to the Mean). Momentum trade.

As long as 50SMA remains angled up with price below. Use your preferred entry trigger, 50SMA is first TP level. If 50SMA flattens or curls down, close the position !!!

Rubber Band Short.

As long as 50SMA remains angled down with price above. Use your preferred entry trigger, 50SMA is first TP level. If 50SMA flattens or curls up, close the position !!!

Relative Strength Screener

Stocks that have outperformed tend to continue outperforming. This screen identifies stocks with RS of 80 or higher with a trend that is gaining momentum.

Buyable Gap Ups (ATR based)

This screnner is based on the buyable gap up criteria from the book "In The Trading Cockpit with the O'Neil Disciples" by Gil Morales and Chris Kacher. The deviating criterion is the average true range, this is calculated here as 0.6*ATR(14), where 0.75*ATR(40) is recommended, this is due the limitations. How to handle this: 1. it occurs in a fundamentally good and/or leading stock after a consolidation phase 2. volume (EOD) > 1.5*volume(50) 3. gap > 0.6*ATR(14) 4. it should hold the daily low

Hot IPO's that recently broke out

This screen searches for IPO's in the last year that just broke out from a 10-day high

Quality Dividend Growth

Select High Quality Large caps > 2BLN with growing dividend and fair valuation

Dividend screens - Best dividend stocks whose dividends have increased every year for the past five years.

This is an extension of the “Best Dividends Stocks” trading idea where one additional filter was added that determines that the dividend has been increased year after year over the past 5 years.

Dividend screens - Best dividend stocks whose dividends have increased every year in the last five years.

Extension-of-the-best-dividend-screen

ABC CORRECTION

REACCUMULATION PATTERN WITHIN STAGE 2 . THE WYCKOFF DEFINITION IS PRELIMINARY SUPPLY (PSY). BY DEFINATION WILL END IN A PRICE TOP AFTER THE PATTERN COMPLETES.

US only , IPO 5 years . Scan for less is more

Hi ! I created scan that makes easy job to school best and have only limited numbers