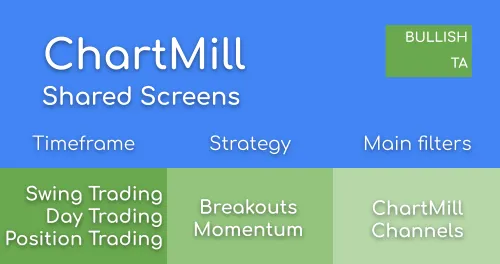

Breakout Screens - Finding Narrow Trading Ranges using ChartMill Channels

Find strong stocks in the market that are in a narrow trading range. We use Chartmill Channels to determine the trading range. By using the Chartmill Technical Quality Score we make sure to select stocks that are in an uptrend and technically solid.

Related Articles

Popular Screens: Finding narrow trading ranges using Chartmill Channels

Finding narrow trading ranges with ChartMill Channels

Chartmill Channels

A Chartmill Channel is a horizontal channel wherein prices move sideways

Related Videos

Screening For Tight Price Ranges | ChartMill Channels

In this video, I demonstrate the use of ChartMill Channels, a specific feature that allows you to screen for tight price ranges when selecting stocks for swing trading.

How to Use ChartMill part 9 Support and resistance filter capabilities

Did you know that the stock screener ChartMill is capable of automatically recognizing support and resistance levels? Even more so! You can use specific support and resistance filters to screen stocks based on their proximity to their next support or resistance zone and thus discover great swing trading setups!

Using ChartMill Channels To Find High Quality Swing Trading Breakout Setups

In this video, you'll discover a more advanced method to identify breakout stocks using ChartMill Channels, a powerful and exclusive tool available only on ChartMill.

UCC Strength: UCC Strength > 3

The Upper Chartmill Channel has at least been tested 3 times

Average Volume: 50 SMA > 500K

The minimum average volume is above 500K

Price: Above 5

Price is at least 5

LCC: close 3% from LCC

Price is currently maximum 3% above the Lower Chartmill Channel

LCC Length: LCC Length > 20

The Loweer Chartmill Channel has a minimum length of 20

Chartmill TA Rating: Rating >= 7

A minimum technical Rating of 7 ensures we have technically solid stocks

UCC: close 3% from UCC

Price is currently less than 3% from the Upper Chartmill Channel

UCC Length: UCC Length > 20

The Upper Chartmill Channel has a minimum length of 20 days

ATR in %: ATR > 1

This filters out dead stocks. We require a minimum average movement in the stock

CC Width: max 5%

The Chartmill channel has a maximum width of 5%

LCC Strength: LCC Strength > 3

The Lower Chartmill Channel has been tested at least 3 times

Chartmill Channels are on the charts

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.