What is Swing Trading?

Are you interested in the world of stock market swing trading? Do you want to learn about a trading technique that offers flexibility and potential profits?

If so, you've come to the right place! In this basic article, we will explore the exciting world of this specific approach and provide you with valuable insights into its strategies and techniques.

So, let's dive in and answer the burning question: “What is swing trading?”

Swing Trading Meaning

Swing trading is an active trading strategy where positions are held for one to several days or weeks. The trader tries to anticipate, and profit from, a future price trend. It is used by traders in various financial markets, including stocks, forex, and commodities.

This approach allows traders to take advantage of both upward and downward price swings, maximizing profit potential.

The Benefits

This type of trading offers several benefits that make it an attractive option for traders looking to capitalize on short-term market movements. Here are some key advantages:

Flexibility

Swing trading provides traders with flexibility in terms of time commitment. Unlike day trading, which requires constant monitoring of the market, swing trading allows individuals with full-time jobs to participate in the market without being glued to their screens all day.

Profit Potential

By capturing short-term price swings, swing traders can potentially generate significant profits. They aim to buy low and sell high within the context of an established trend, maximizing gains in a relatively short period.

In this way, invested capital is released faster than in strategies where positions are held for as long as possible (position trading, buy and hold,...). This allows you to react more quickly to new opportunities.

Reduced Stress

Compared to day trading, it is less stressful as it doesn't require constant monitoring of the market. Swing traders can analyze the market in the evening and make trading decisions accordingly.

Trend Riding

Swing trading aligns with the concept of "riding the trend". By identifying and trading in the direction of the overall trend, swing traders increase their chances of success.

Ease of Use

The basis of this trading approach is technical analysis, which is a lot easier to learn than strategies that make use of fundamental analysis. Of course, combining both TA and FA in this type of strategy is also a valid option.

Disadvantages using this type of trading

Overnight Risk

Unlike day trading, swing trading does involve overnight risk. This means that an open position that was still in profit yesterday can suddenly show a large loss today. This can happen if, for example, the company has announced bad news after trading hours.

So always keep an eye on when the company publishes important news such as quarterly figures.

Transaction costs

An active strategy logically generates more brokerage fees than a buy-and-hold strategy. This disadvantage is especially apparent if you are trading with a relatively small amount so the costs are quite large relative to the position size.

Thus, always keep a close eye on your fees and see what percentage they make up of your total profit/loss result.

Proven Swing Trading Strategies

To successfully engage in this kind of trading, it's essential to have a solid understanding of various strategies and techniques. Let's explore some of the most effective and proven Swing Trading Strategies:

Breakout Trading Strategy

Breakout trading is a popular strategy among swing traders. It involves identifying key price levels and entering a trade when the price breaks above or below those levels. This strategy aims to capitalize on the momentum generated by the breakout, potentially leading to significant profits.

Trend Reversal Strategy

Swing traders also employ trend reversal strategies to identify potential turning points in the market. By analyzing indicators such as moving averages, candlestick patterns, and volume, traders can spot signs of a trend reversal and enter trades accordingly.

Retracement Strategy

The retracement strategy seeks to take advantage of temporary price declines in an overall upward trend (or temporary price increases in an existing downward trend).

Pure price action levels such as classic support and resistance levels, as well as technical indicators can be used for this purpose.

Swing traders use these to determine entry and exit points, increasing the likelihood of successful trades.

Can Swing Trading Make You Rich?

If you are willing to take huge risks you can get rich in the stock market with any strategy. But that is gambling and has absolutely nothing to do with investing.

The question that really matters is ‘can swing trading be profitable?’

The answer to this question is definitely positive, as long as you take into account the following points:

Remain consistent

Even a proven strategy that is successful over a long term has good, weaker and even bad periods. It depends heavily on market trends, sentiment and volatility. No strategy works 100%.

But - taking into account the long-term success rate - it is important to stick with the strategy and not immediately change certain parts of the strategy (or even change the strategy completely) if things go down a bit for a period or if you face several consecutive loss positions.

Keep Losses Small

This is one of the most important aspects in any type of investment strategy. By focusing on carefully managing loss positions, you keep your assets intact even when the strategy temporarily underperforms. So instead of focusing so much on maximizing your profits, keep an eye on the size of your loss positions!

“The goal of a successful trader is to make the best trades. Money is secondary.” – Alexander Elder

Is It the Right Strategy For You?

This kind of strategy is suitable for a wide range of individuals, including both beginners and experienced traders.

Here are some of the skills you need to master as a swing trader:

Active Trading Style

This type of trading requires active involvement in monitoring the markets and making trading decisions. If you enjoy actively managing your trades and are willing to dedicate time to market analysis, swing trading may be suitable for you.

Intermediate-term

The strategy typically involves holding positions for a few days to a few weeks. If you prefer a trading style that falls between day trading (which involves closing positions within a day) and long-term investing, swing trading can be a good fit.

Volatility? Bring It On!

Like any trading strategy, it carries risks. The market can be volatile, and swing traders need to be comfortable with the potential for short-term price fluctuations. Having a risk-tolerant mindset and the ability to manage and control risk is important.

Understanding Technical Analysis

This strategy relies on technical analysis, which involves studying price charts, indicators, and patterns to identify potential trade setups. If you have a good understanding of technical analysis or are willing to learn it, swing trading may be the right fit for you.

Some Swing Trading Setup Examples

Arthur J. Gallagher & Co

Ferguson PLC

How to Scan Stocks for Swing Trading?

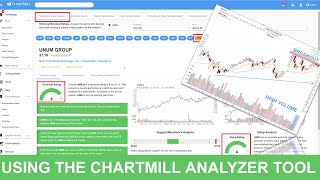

A stock screener is the ideal way to quickly and accurately find stocks that qualify for a swing trade. ChartMill has a lot of filter options to find such stocks.

However, the easiest way is through our Trading Ideas page where you can find many predefined swing trading screens. You can use these immediately to find suitable stocks or you can adapt the filters used to your own needs and insights.

Here are some useful links to start with!

FAQ

Which Indicators to Use?

There are a lot of different indicators that can be used in swing trading. The most popular ones are "moving averages," RSI, Bollinger bands,... etc. And don't forget volume.

More detailed information about swing trading indicators can be found in this article:“Best Indicators For Swing Trading Stocks | Enhance Your Swing Trading Setups.”

Swing Trading Time Frames: Which One to Use?

Swing Traders will primarily use the daily timeframe to open and monitor their positions. However, sometimes the intraday 4H timeframe is also used, in an attempt to fine-tune entry points even better but that is purely a personal preference.

In addition, the weekly timeframe is also frequently used to keep an eye on the long-term trend and identify support and resistance zones associated with it. These are important to determine potential price targets and stop losses.

Day Trading vs Swing Trading?

Both strategies differ in terms of the time horizon and frequency of trades. While swing traders hold positions for several days to weeks, day traders close their positions within the same trading day.

Hence, follow-up is required during the trading day. A day trader will therefore need to actively monitor his position and be able to control his emotions at all times.

Is Swing Trading Better for Beginners?

This strategy is indeed better suited for beginners than day trading. After all, buy/sell decisions should not be made until the markets are closed. So there is plenty of time to review things calmly and enter orders for the next trading day.

What is the Best Swing Trading Strategy?

The best strategy is the one that most closely matches your own trading style and that you feel comfortable with. For example, some investors have a hard time buying stocks that break out above their highest price and prefer to choose a strategy that looks for opportunities when the price temporarily drops in an uptrend.

Choose the strategy that you know you are going to be able to sustain best, even when faced with a number of consecutive losing positions.

What is the 1% Rule in Swing Trading?

The 1% rule states that you never risk more than 1% of your total trading capital in any one position. For example, if you have a $20,000 account, this means that you can lose a maximum of $200 on any position in case your initial stoploss is hit.

It ensures that your loss positions remain small so that you can continue trading even after a number of consecutive loss trades.

In conclusion, swing trading is a versatile and potentially lucrative trading strategy that allows individuals to take advantage of short-term price movements within a larger trend. By employing various strategies and techniques, swing traders aim to capture profits while minimizing risk. Remember, successful swing trading requires discipline, patience, and a commitment to ongoing learning.

Want to learn more about swing trading?

Swing Trading Risk Management: Navigating the volatile waters of trading.

In this article, we highlight some decent swing trading risk management practices to minimize your risk, so that your trading capital enjoys maximum protection. Read more...

Best Indicators For Swing Trading Stocks | Enhance Your Swing Trading Setups.

In this article, we discuss some of the best indicators and patterns for swing trading in stocks. Using them will make your trading strategy a lot more consistent, allowing you to better control your emotions while trading. Read more...

Exploring The Best Moving Averages For Swing Trading Success

Traders employ various tools and indicators to make decisions regarding entry and exit points. One such tool that plays a crucial role in swing trading is the moving average. Read more...

Learn How To Swing Trade | A complete step by step guide for swing traders

This comprehensive guide is an extension of our basic "what is swing trading" article and contains a lot of valuable information and insights for beginning swing traders. Read more...