(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – June 25, 2025 (After Market Close)

The existing resistance levels are playing their role to the fullest...

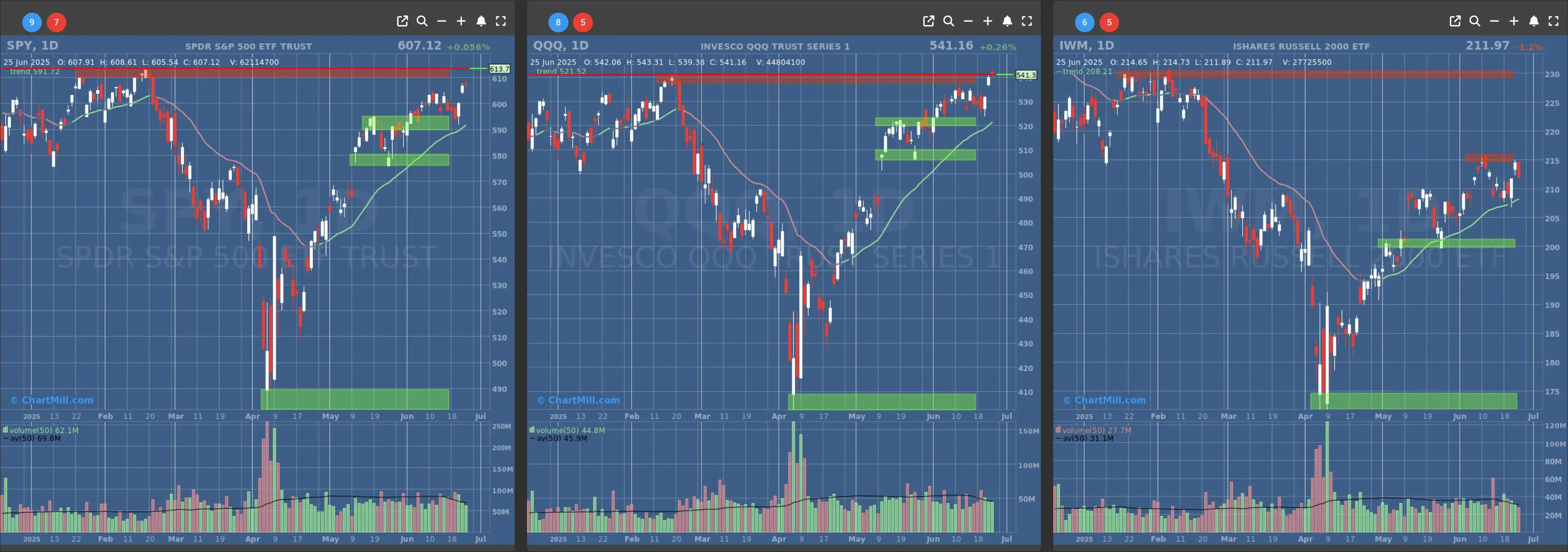

Short Term Trend

- Short-Term Trend: Bullish (no change)

- Next Support at $580

- Next Resistance at $610

- Volume: Slightly Below Average (50)

- Pattern: Hanging Man Candlestick

- Short-Term Trend: Bullish (no change)

- Next Support at $520

- Next Resistance at $540

- Volume: At Average (50)

- Pattern: Doji Candle

- Short-Term Trend: Bullish (no change)

- Next Support at $210 & $205

- Next Resistance at $215 & $230

- Volume: Slightly Below Average (50)

- Pattern: Down Day

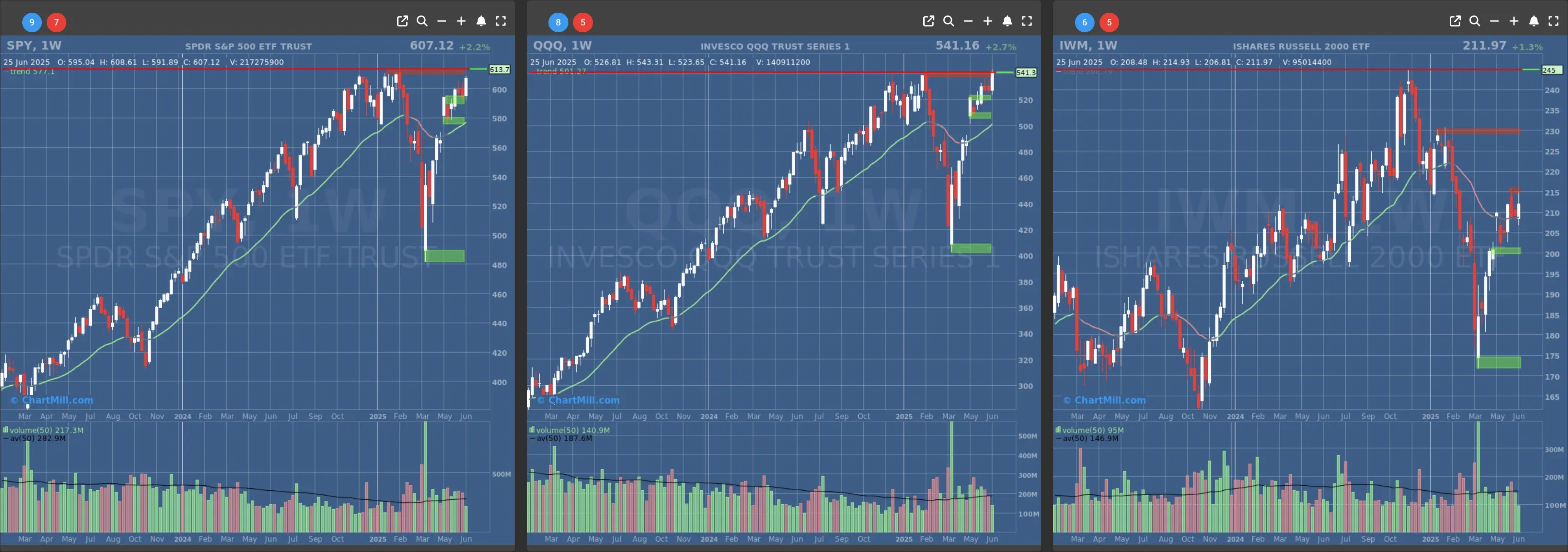

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Neutral (no change)

Daily Market Breadth Analysis – June 25, 2025 (After Market Close)

You’d think after Tuesday’s powerful breadth surge - where over 75% of stocks advanced - we might see some follow-through.

But no. On Wednesday, the market once again showed its split personality. If you were watching only the indices, the picture might have seemed neutral. But under the hood? Not great.

From Broad Strength… Back to Weak Breadth

So what are we looking at here? A complete 180 in participation. On Tuesday, nearly 77% of the market was in the green, a clear sign of broad-based strength. By Wednesday, that collapsed to just 31.6%. That’s a nasty swing.

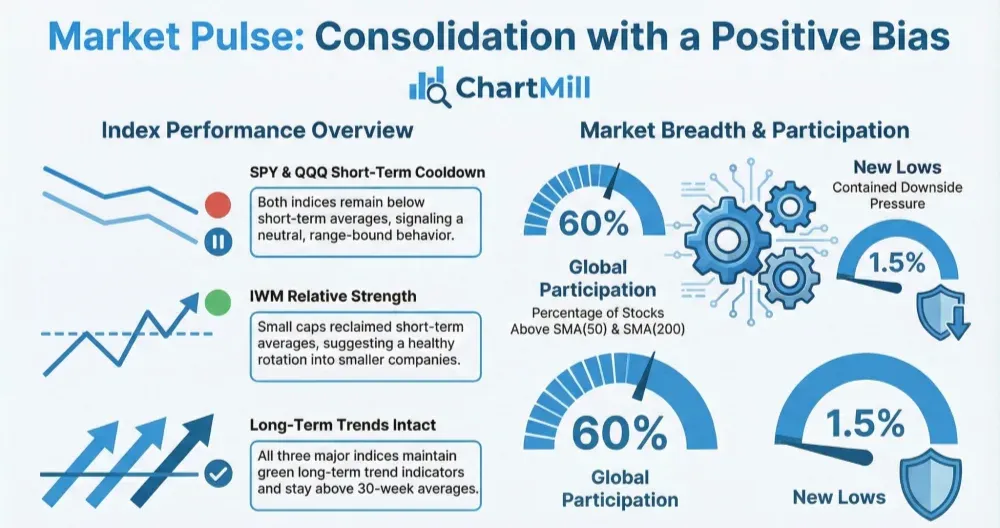

While price levels on the indices held reasonably well, we’re again dealing with a declining percentage of stocks holding their ground above major moving averages. For example, only 58% of stocks are now above their 100-day SMA, and that number continues to drift lower.

This isn’t panic territory yet, but it is weakening breadth, and that never happens in a vacuum.

Advance/Decline Momentum: Cooling Off

The week-over-week numbers show a similar picture. The 5-day average for advancing stocks has started to contract again:

-

Adv Week: Down to 64.8% from 62.6% the day before—yes, a small bump. But it’s fragile.

-

Decl Week: Back up to 34.3%, erasing much of Tuesday’s drop.

-

Adv 25% over 3 months: Edged slightly lower to 13.5% from 13.9%. That confirms fewer stocks are delivering outsized gains.

The "up volume" we saw on Tuesday now looks more like a single-day anomaly than the start of a trend.

Short-Term Pop, Long-Term Grind

It’s interesting to see that even as daily breadth fluctuates wildly, the longer-term metrics are holding relatively steady:

-

50SMA+: 71.3% — slightly lower, but still showing decent medium-term strength.

-

200SMA+: 45.3% — this hasn’t budged much in weeks, a classic sign of broad indecision. We're not trending down, but we're not convincingly climbing either.

Momentum is being squeezed toward a pivot—either we get a genuine breakout and breadth follows, or this resolves downward with market leaders losing their grip.

Context: Sentiment Still Vulnerable

There wasn’t a major catalyst on Wednesday that justified the broad drop in advancing stocks, but remember: Tuesday’s strength came on the heels of a relatively calm session and strong tech-led optimism (thanks again to Nvidia). Wednesday may have simply been a digestion day, a classic post-bounce cooldown.

Also, investor sensitivity to headlines around tariffs, Fed policy, and geopolitical tensions (especially the Israel-Iran situation) remains very high. That makes breadth swings more abrupt and less predictable.

Bottom Line

Tuesday looked like a turning point. Wednesday reminded us that confidence is fragile. Market breadth is still stuck in a frustrating cycle: enough strength to prevent a breakdown, but not enough participation to fuel a sustained breakout.

Until we see several consecutive days of solid breadth, especially with more stocks reclaiming the 100- and 200-day SMAs, I remain cautiously skeptical.

The trend hasn’t broken, but it’s definitely wobbling.

Kristoff - Co-founder, ChartMill

Next to read: Market Monitor News, June 26