(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – November 10, 2025 (After Market Close)

All three major index-etf's gapped up

Short Term Trend

- Short-Term Trend: Neutral (No Change)

- Next Support at $653

- Next Resistance $674

- Volume: At Average (50)

- Pattern: Up Day -Gap Up - Strong Close - Doji Reversal Pattern Confirmed

- Short-Term Trend: Neutral (No Change)

- Next Support at $610

- Next Resistance $637

- Volume: At Average (50)

- Pattern: Up Day -Gap Up - Strong Close - Doji Reversal Pattern Confirmed

- Short-Term Trend: Neutral (No Change)

- Next Support at $237

- Next Resistance at $253

- Volume: Below Average (50)

- Pattern: Down Day - Gap Up - Hanging Man

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

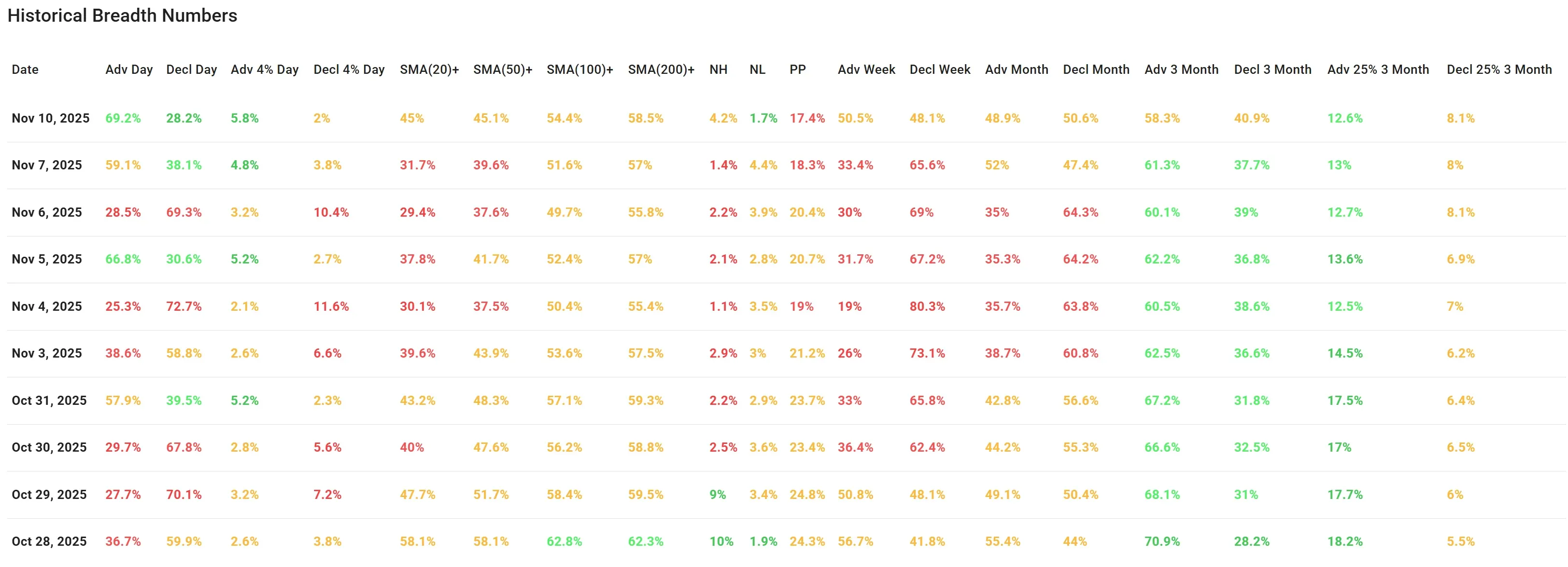

Daily Market Breadth Analysis – November 10, 2025 (After Market Close)

U.S. equities started the week with a clear breadth surge.

Monday’s session (Nov 10) saw a convincing shift in participation, with improving leadership and technical strength across multiple timeframes. While not yet indicative of a full-blown uptrend, the breadth recovery strengthens the case for bullish continuation if follow-through persists.

Advancers Dominate as Buying Pressure Returns

The first session of the new trading week opened with strong participation:

-

69.2% of stocks advanced, the highest one-day reading in the past 10 sessions.

-

Only 28.2% declined, while 5.8% of stocks rose more than 4%, compared to a modest 2% falling more than 4%.

This signals strong bullish intent and widespread participation, a shift from the fragmented sessions earlier in the month. It's a continuation of the modest strength seen on Nov 7, but Monday’s action marked a clear escalation in breadth quality.

Momentum Builds Across Moving Averages

Participation above key moving averages saw solid gains:

-

SMA(20)+ 31.7% → 45%

-

SMA(50)+ 39.6% → 45.1%

-

SMA(100)+ 51.6% → 54.4%

-

SMA(200)+ 57% → 58.5%

All four categories moved higher, a sign that Monday’s rally wasn't just noise, it pushed more stocks back above critical trend levels, especially the short-term 20-day and 50-day SMAs. This confirms a constructive shift in market structure.

New Highs Rise, Lows Shrink

Leadership metrics also improved:

-

New Highs (NH): Jumped from 1.4% to 4.2%

-

New Lows (NL): Dropped from 4.4% to 1.7%

This shift ends a multi-day stretch where new lows regularly outnumbered new highs. The positive NH–NL spread (+2.5%) is a subtle but important early indicator of leadership rotation in favor of bulls.

Intermediate Trends Still Building, Not Yet Bullish

Looking at broader timeframes:

-

Advancers over 1 Week: 50.5%, vs. 33.4% on Nov 7

-

Advancers over 1 Month: 48.9%, flat compared to 52% Friday

-

Advancers over 3 Months: Slight dip from 61.3% → 58.3%

The week-over-week surge marks an improvement in short-term breadth, though the 3-month and 1-month readings are relatively stable. The percentage of stocks with 25%+ gains over 3 months remains strong at 12.6%, supporting a longer-term bullish bias, particularly for growth and momentum names.

What Changed from Friday?

Compared to Friday (Nov 7), Monday's session delivered a clear follow-through:

-

Higher advancing participation (69.2% vs. 59.1%)

-

Stronger net performance in big movers (+4% stocks)

-

Sharp gains in SMA-based participation

-

Reversal in New Highs vs. New Lows

This kind of follow-up action is critical to building sustained market momentum - and Monday delivered.

Breadth Trend Rating: Positive

Based on Monday's breadth metrics, improving trend participation, and early signs of returning leadership, the market breadth trend now shifts to a “Positive”. Bulls are taking back control, but confirmation through continuation is key for sustaining the move into more optimistic territory.

Kristoff - ChartMill

Next to read: Shutdown Deal Breathes New Life Into Wall Street