(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – May 15, 2025 (After Market Close)

U.S. equity indices extended their upward momentum on May 15, 2025, with all major ETFs showing continued bullish trends in the short term.

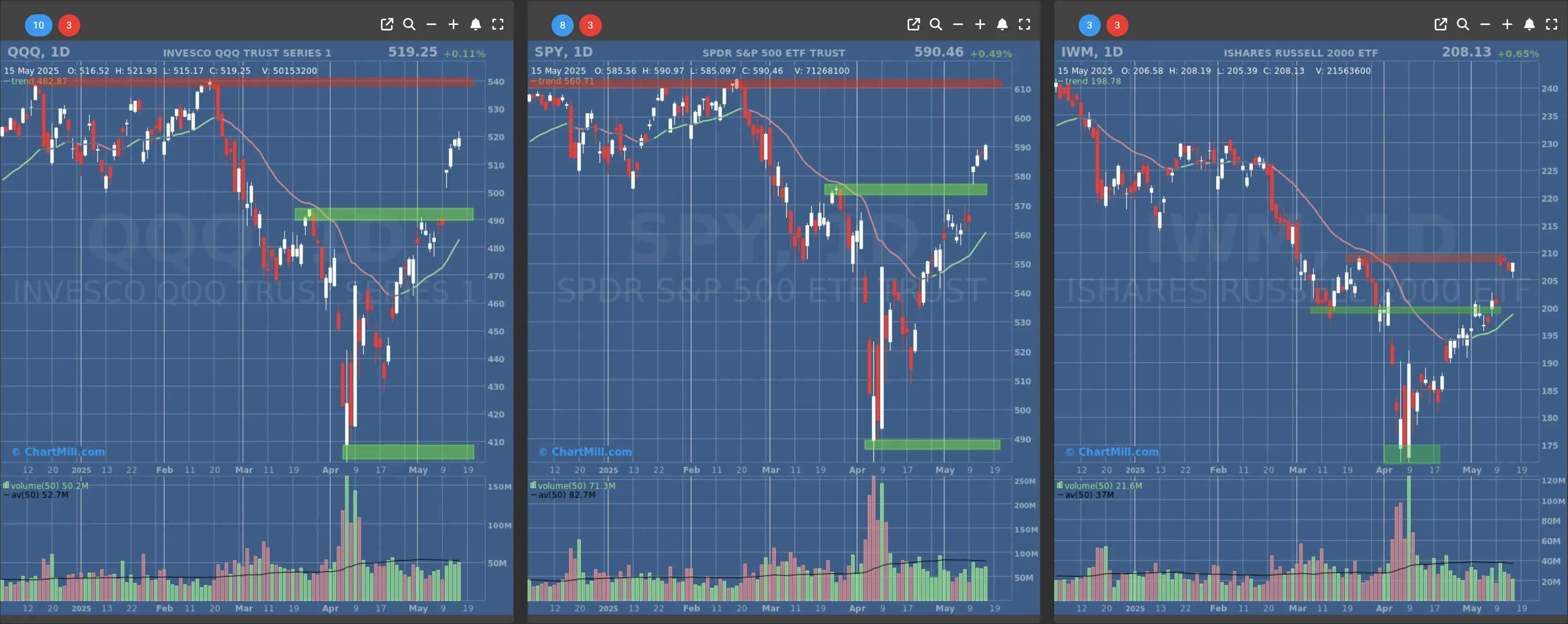

The SPY (S&P 500 ETF) and QQQ (Nasdaq-100 ETF) held their gains above recent support levels on average volume, while IWM (Russell 2000 ETF) also closed higher despite trading on notably lower volume.

Short Term Trend

- Short-Term Trend: Bullish (no change)

- Support at $560 - $570

- Resistance at $610

- Volume: At average (50)

- Pattern: Bullish Engulfing Candle

- Short-Term Trend: Bullish (no change)

- Support at $490 - $500

- Resistance at $540

- Volume: At average (50)

- Pattern: Up day

- Short-Term Trend: Bullish (no change)

- Support at $200

- Resistance at $210-215

- Volume: Well below average (50)

- Pattern: Up day

Long Term Trend

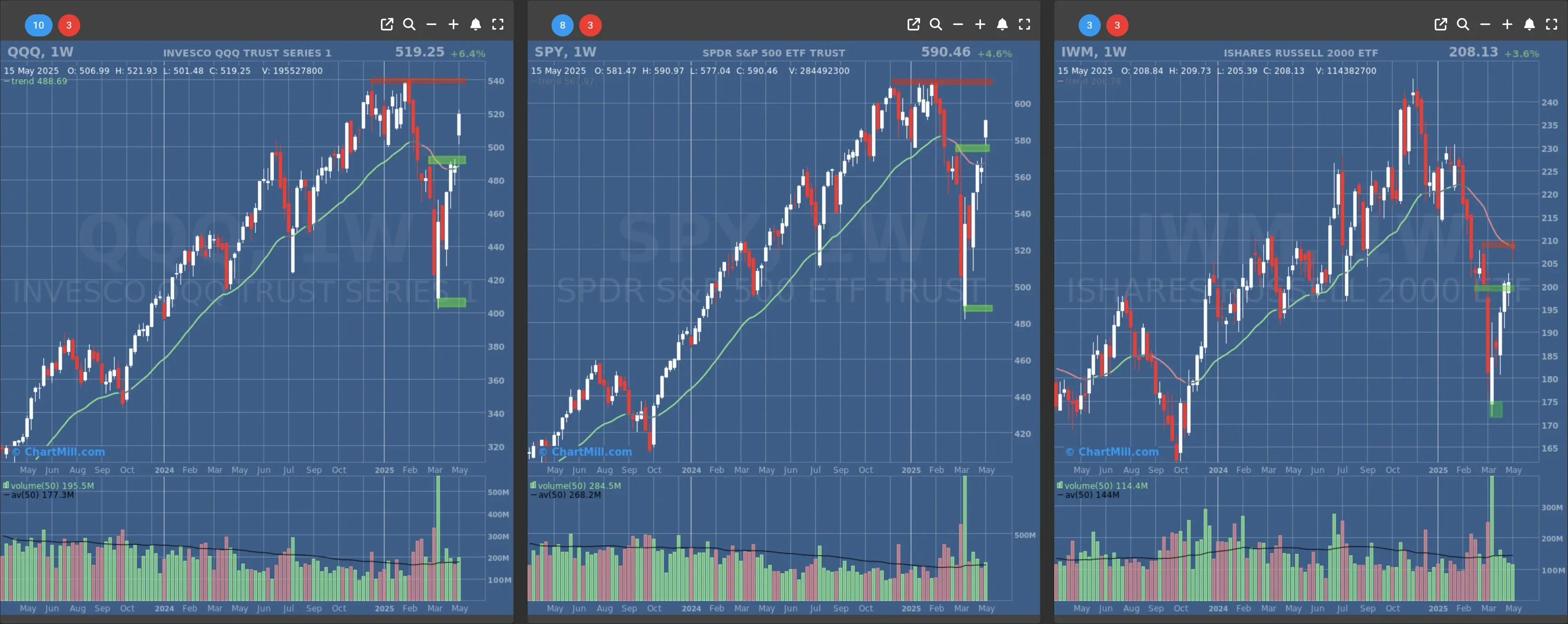

- Long-Term Trend: Neutral (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Neutral (no change)

Daily Market Breadth Analysis – May 15, 2025 (After Market Close)

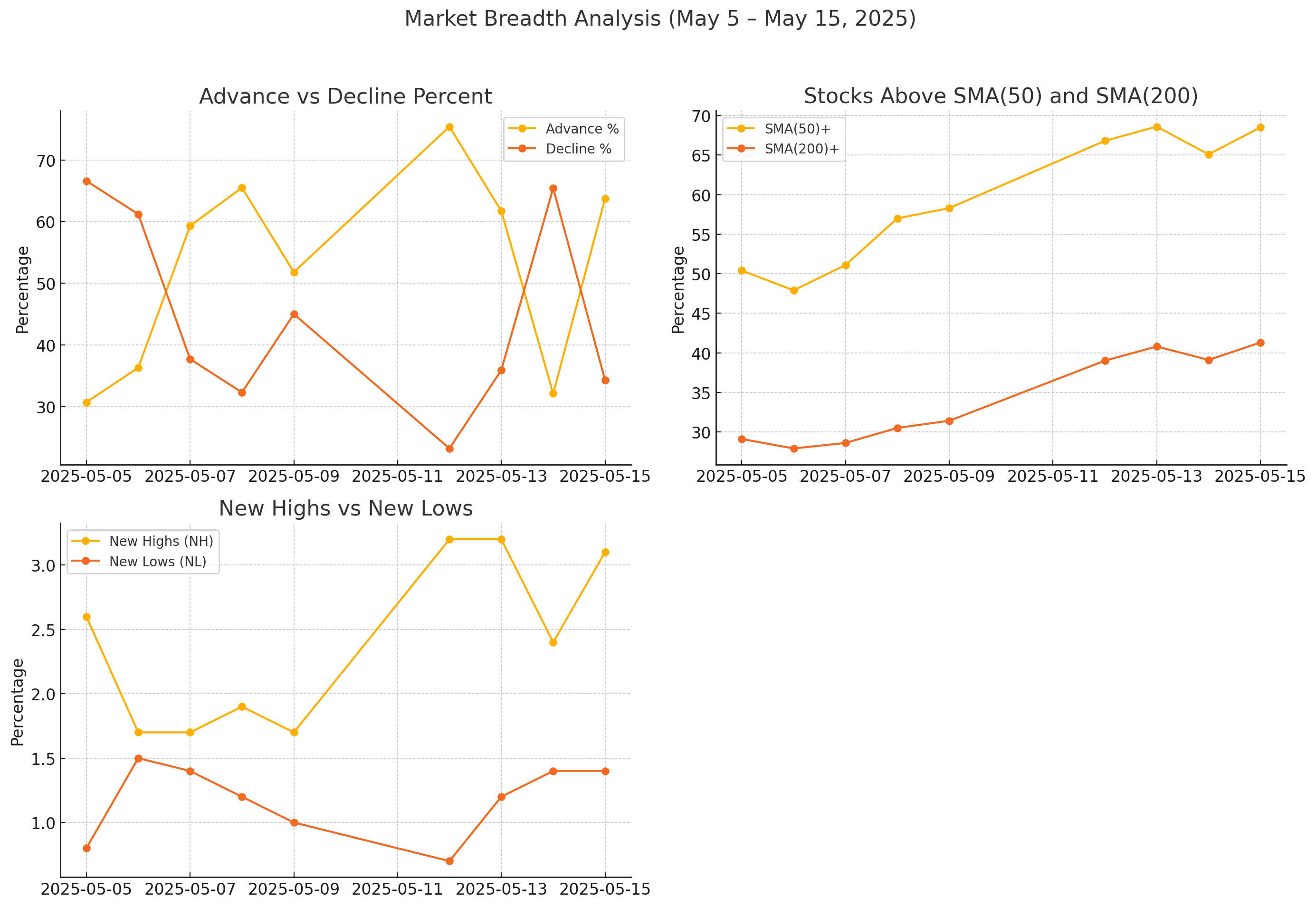

The market breadth data from the past two weeks reflects a broadly supportive internal structure for the recent rally across major U.S. indices, despite intermittent dips.

Breadth Strength and Volatility

On May 15, 2025, 63.7% of stocks advanced versus 34.3% that declined, a strong recovery after May 14 saw the inverse (32.1% advancing vs 65.4% declining).

This back-and-forth pattern highlights short-term volatility but confirms that buyers are generally regaining control, particularly evident in the higher advancing ratios on most days between May 8 and May 13.

The percentage of stocks above their 50-day SMA has steadily risen from 50.4% on May 5 to 68.5% on May 15. Similarly, stocks above the 200-day SMA increased from 29.1% to 41.3%, showing improving medium-term technical health across the market.

New Highs vs. New Lows

New highs (NH) have also picked up, reaching 3.1% on May 15, while new lows (NL) have remained subdued, fluctuating narrowly around 1–1.5%.

This divergence is a bullish sign, indicating that more stocks are breaking out of prior resistance than are breaking down.

Overall Takeaway

Major U.S. indices continued their upward trajectory as short-term trends remain firmly bullish. Both the S&P 500 and Nasdaq-100 ETFs are holding well above key support levels, while even the lagging small caps are catching up.

Under the surface, market breadth confirms the strength of the rally: a growing number of stocks are trading above key moving averages, and new highs are outpacing new lows. While the long-term outlook for some indices remains neutral, short-term participation is broadening, a positive signal for trend continuation.

- Next to read: Market Monitor News May 16