(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – October 20, 2025 (After Market Close)

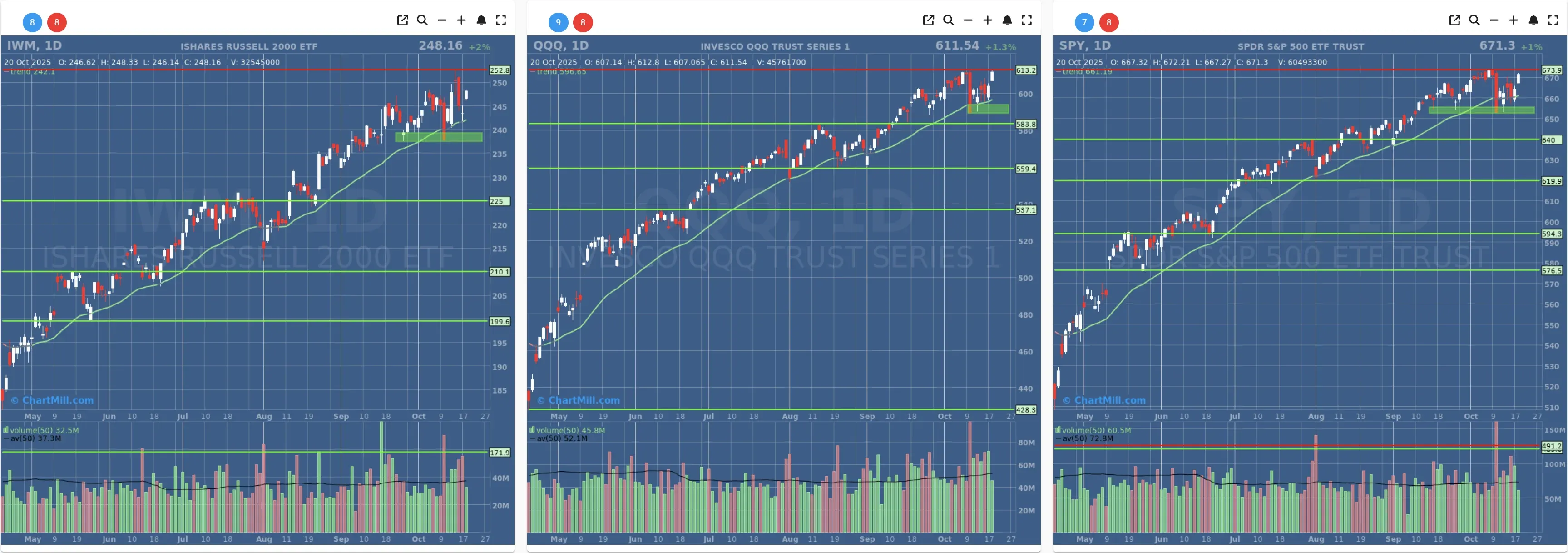

QQQ close to All Time High

Short Term Trend

- Short-Term Trend: TREND CHANGE! > Positive (Up from Neutral)

- Next Support at $650 - $640

- Next Resistance at $673

- Volume: Slightly Below Above Average (50)

- Pattern: Up Day - Gap Up - Strong Candle Close

- Short-Term Trend: Positive (No Change)

- Next Support at $583

- Next Resistance at $611

- Volume: Slightly Below Above Average (50)

- Pattern: Up Day - Gap Up - Strong Candle Close - Close to ATH

- Short-Term Trend: TREND CHANGE! > Positive (Up from Neutral)

- Next Support at $235

- Next Resistance at $248

- Volume: Slightly Below Above Average (50)

- Pattern: Up Day - Gap Up - Strong Candle Close

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

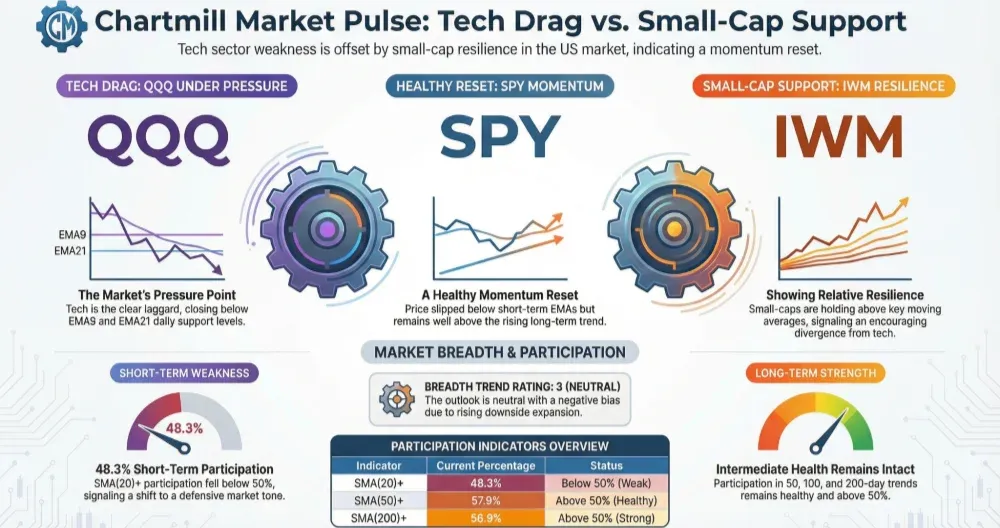

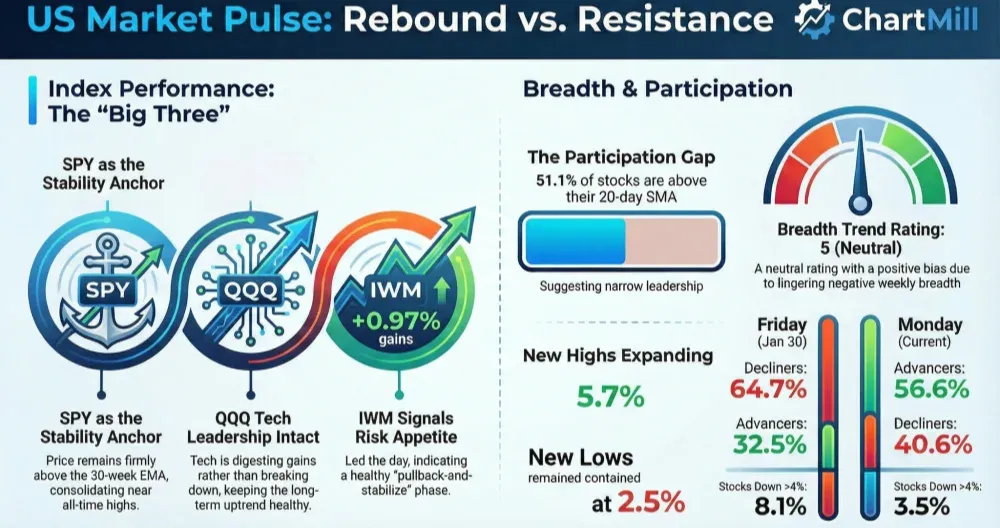

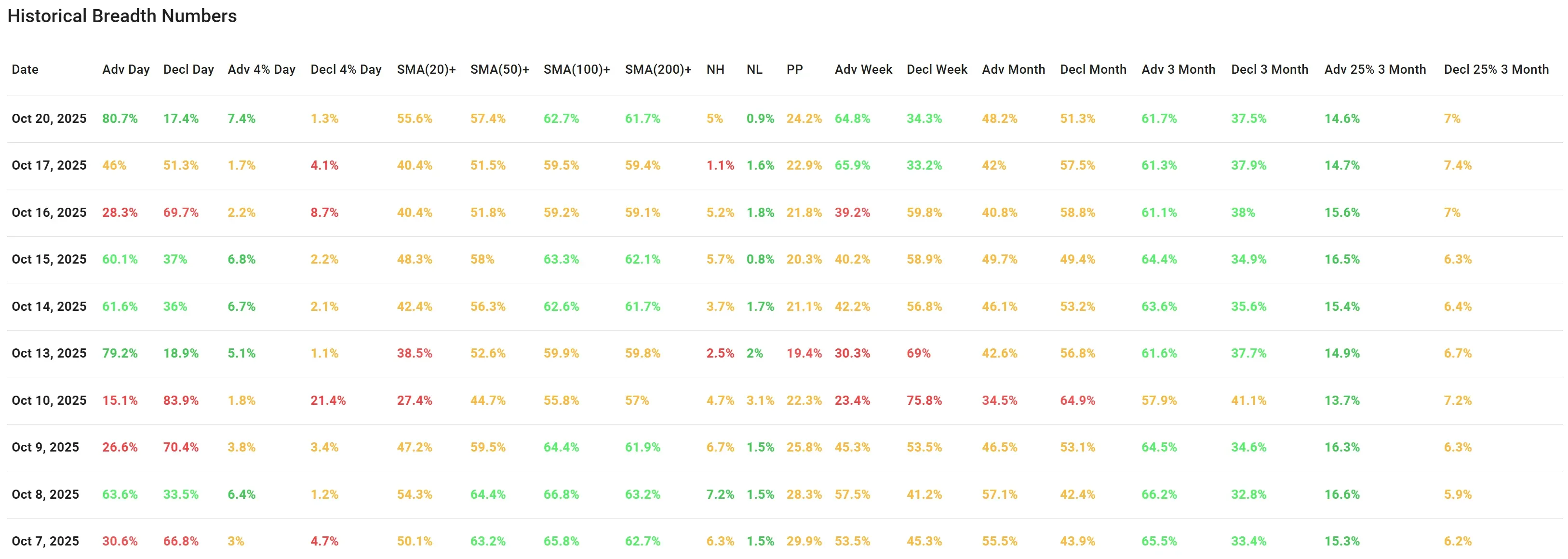

Daily Market Breadth Analysis – October 20, 2025 (After Market Close)

After Friday’s stabilization, Monday delivered a powerful upside breadth thrust (81% advancers) with clear improvement across all moving-average cohorts and a jump in new highs.

Big picture

-

Adv/Decl day: 80.7% / 17.4% - a decisive risk-on session and one of the strongest single-day breadth readings of the last two weeks.

-

Upside momentum: Adv 4% Day = 7.4% vs Decl 4% Day = 1.3% - a genuine thrust day with far more stocks posting large gains than large losses.

MAs participation: Broad improvement across the curve:

-

20-DMA: 55.6% (from 40.4% Fri, +15.2 pts)

-

50-DMA: 57.4% (from 51.5%, +5.9)

-

100-DMA: 62.7% (from 59.5%, +3.2)

-

200-DMA: 61.7% (from 59.4%, +2.3)

Participation is now majority above every key MA, with the longer-term 200-DMA cohort back above 60%, a constructive shift in trend quality.

New highs/lows: NH 5.0% vs NL 0.9% (Fri: 1.1% / 1.6%) - leadership breadth improved and downside tail risk narrowed.

Pocket Pivots (PP): 24.2% (from 22.9%) - incremental improvement, consistent with a broadening advance.

Timeframe lenses

-

Weekly window: Adv Week 64.8% / Decl Week 34.3% — still firmly supportive; the current rally attempt retains weekly breadth backing.

-

Monthly window: Adv Month 48.2% / Decl Month 51.3% — still fractionally negative but improving (Fri: 42.0% / 57.5%).

-

3-month view: Adv 61.7% / Decl 37.5% — medium-term breadth remains net positive and ticked higher.

Read-through vs. Friday’s take

In the prior update we noted stabilization after a slide and flagged the need for follow-through. Monday delivered exactly that: a broad, high-intensity advance that lifted participation above key moving averages and flipped the NH/NL balance decisively in favor of bulls.

The improvement in the monthly lens suggests the broader tape is close to turning the corner if buyers can string together additional constructive sessions.

What to watch next

-

Can >20-DMA continue to expand toward ~60–65% over the next few sessions?

-

Does NH% stay elevated while NL% remains suppressed (<1–2%)?

A push of Adv Month above 50% would confirm the transition from repair to expansion.

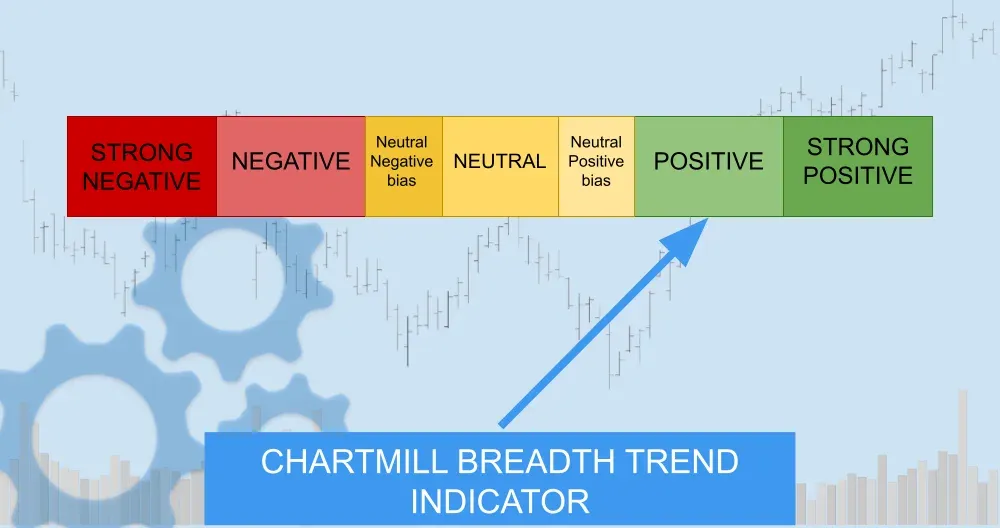

Breadth Trend Rating: Positive.

Strong daily thrust, rising participation across all MAs, and supportive weekly breadth. A still-slightly negative monthly window tempers the score one notch below “very positive,” pending further follow-through.

Kristoff - ChartMill

Next to read: Wall Street Rallies as Yields Fall and Apple Hits Record Highs