(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – October 17, 2025 (After Market Close)

3 consecutive narrow range candles for SPY and QQQ

Short Term Trend

- Short-Term Trend: Neutral (No Change)

- Next Support at $650 - $640

- Next Resistance at $673

- Volume: Well Above Average (50)

- Pattern: Up Day

- Short-Term Trend: Positive (No Change)

- Next Support at $583

- Next Resistance at $611

- Volume: Well Above Average (50)

- Pattern: Up Day

- Short-Term Trend: Positive (No Change)

- Next Support at $235

- Next Resistance at $248

- Volume: Well Above Average (50)

- Pattern: Down Day - Doji Candle

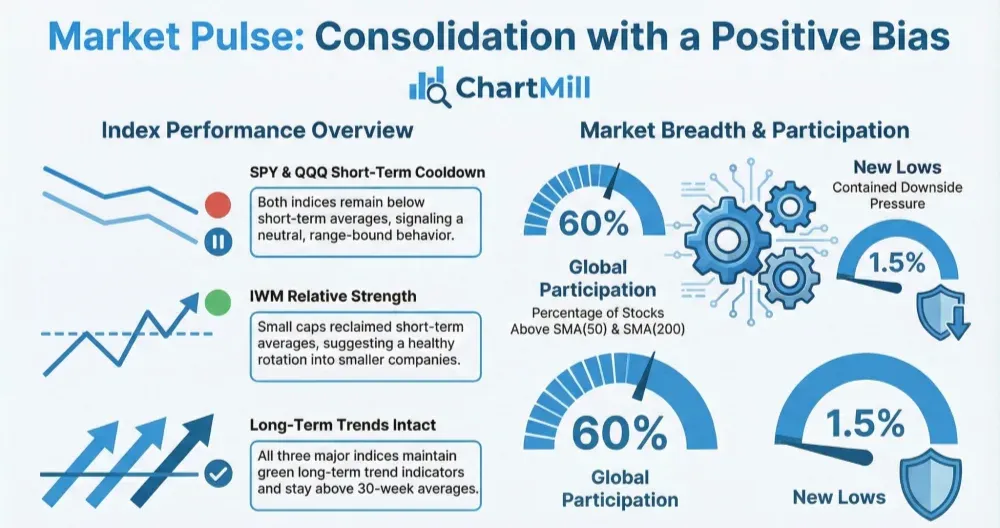

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

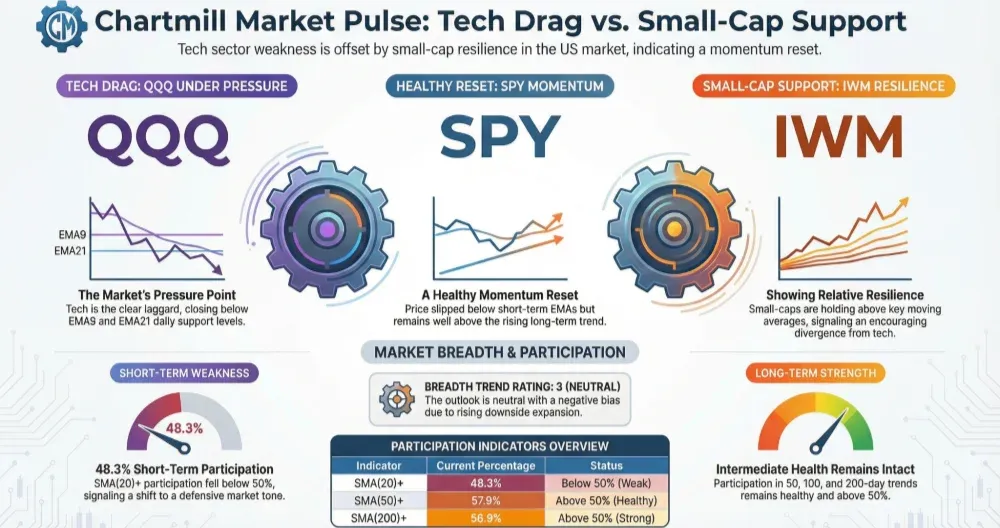

Daily Market Breadth Analysis – October 17, 2025 (After Market Close)

Friday’s session (Oct 17) delivered a mixed, slightly negative breadth day, but the 1-week picture remains constructive thanks to earlier gains. Participation above the 20-day remains soft, new highs dwindled, and monthly breadth is still net-negative—suggesting a market pausing rather than breaking.

Friday vs Thursday

-

Adv/Decl (day): 46% advancers vs 51.3% decliners. That’s an improvement from Thursday’s heavy 28.3% / 69.7% skew, but still a modestly negative day.

-

PP (Pocket Pivots): 22.9%, essentially unchanged vs 21.8%, no fresh momentum signal.

-

New Highs/Lows: NH 1.1% / NL 1.6%. New highs fell sharply from 5.2% on Thursday, and new lows ticked up, leadership narrowed.

Participation vs. Key MAs

-

SMA(20)+: 40.4% (flat day-over-day).

-

SMA(50)+: 51.5% (flat).

-

SMA(100)+ / SMA(200)+: 59.5% / 59.4% (a touch better than Thursday’s 59.2% / 59.1%).

Timeframe Mix

-

1 Week: Adv 65.9% / Decl 33.2% (constructive).

-

1 Month: Adv 42% / Decl 57.5% (still net-negative).

-

3 Months: Adv 61.3% / Decl 37.9% (positive tilt).

-

3-mo extremes: Up 14.7% vs Down 7.4%—outsized winners outnumber losers, but leadership is thin (low NHs).

Bottom Line

Breadth stabilized but didn’t advance. The market avoided further internal deterioration but didn’t confirm a new leg higher either. To upgrade the bias, we’d want:

-

SMA(20)+ back above ~50%, and

-

NH > NL for several sessions.

Current breadth trend rating: Neutral.

- Kristoff - ChartMill

Next to read: Trump’s Softer Tone Lifts Wall Street as Regional Banks Bounce Back