(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – November 5, 2025 (After Market Close)

IWM trying to regain the short term positive trend

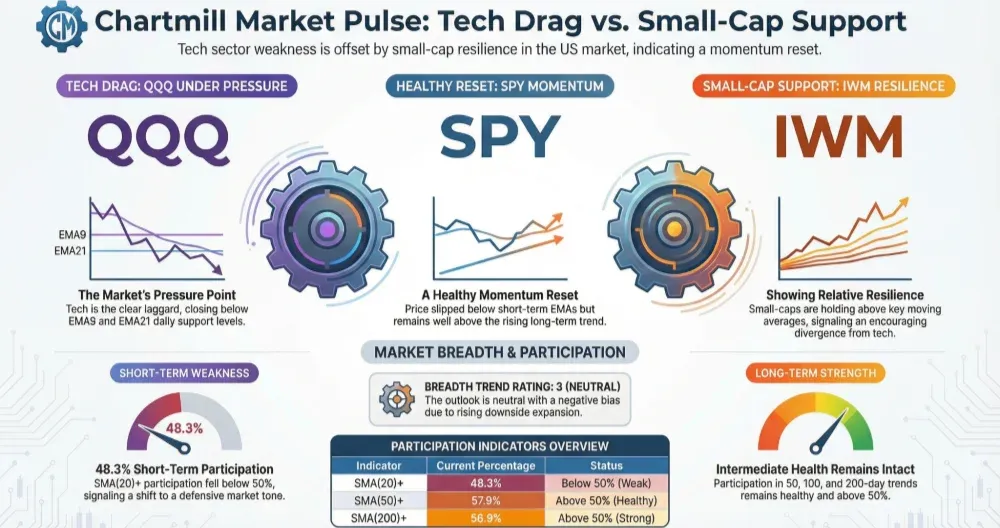

Short Term Trend

- Short-Term Trend: Positive (No Change)

- Next Support at $673

- Next Resistance $690

- Volume: At Average (50)

- Pattern: Up Day - Mini Double Bottom

- Short-Term Trend: Positive (No Change)

- Next Support at $612

- Next Resistance $637

- Volume: Slightly Below Average (50)

- Pattern: Up Day

- Short-Term Trend: Neutral (No Change)

- Next Support at $237

- Next Resistance at $253

- Volume: At Average (50)

- Pattern: Up Day - Strong Candle Close

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

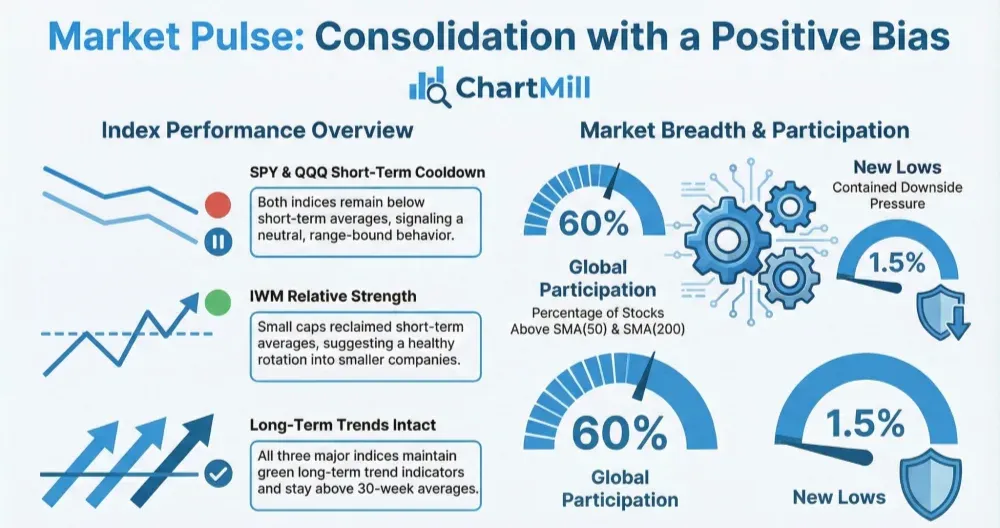

Daily Market Breadth Analysis – November 5, 2025 (After Market Close)

Market breadth improved across nearly all metrics on Wednesday, following Tuesday’s broad-based sell-off.

Advancing issues surged to 66.8%, up dramatically from just 25.3% the previous session. Decliners fell to 30.6%, marking a complete reversal of the prior day’s imbalance (72.7%).

The percentage of stocks advancing by more than 4% (5.2%) also doubled compared to Tuesday (2.1%), while strong downside movers (>4% declines) dropped from 11.6% to 2.7% — a clear sign that selling pressure eased considerably.

This rebound was visible across most moving average participation metrics as well:

-

SMA(20)+ rose modestly to 37.8% (from 30.1%)

-

SMA(50)+ improved to 41.7% (from 37.5%)

-

SMA(100)+ ticked higher to 52.4% (from 50.4%)

-

SMA(200)+ increased slightly to 57.0% (from 55.4%)

While these levels remain far from bullish territory, the upward move halts the declining trend that had persisted since late October.

In terms of new highs and new lows, conditions remain fragile. The percentage of stocks hitting new highs stayed extremely low at 2.1%, while new lows eased only marginally to 2.8% (from 3.5%). This continues to reflect hesitation among investors to push prices to fresh highs.

On a weekly and monthly timeframe, breadth metrics showed mixed but generally stabilizing signals:

-

Advancing week stocks rose to 31.7% (from 19%)

-

Advancing month remained roughly stable at 35.3% (vs. 35.7%)

-

Advancing 3-month stocks ticked higher to 62.2%, consistent with the recovery that began in early November

This one-day surge suggests that buyers stepped back in force after two sessions of capitulation.

The improvement may have been helped by stabilizing yields and calmer macro sentiment during Wednesday’s session, following a brief bond market pullback earlier in the week.

Still, context matters. Despite the broad rebound, participation above key moving averages remains historically weak. Only about half of all listed stocks are trading above their 100-day average, and fewer than 40% are above the 20-day, indicating that short-term trends remain fragile.

Conclusion:

The strong rebound in advancing issues marks a welcome change in tone after the recent selling wave. However, the overall trend becomes neutral , as longer-term indicators have yet to confirm a decisive shift back to strength. Sustained improvement over the next few sessions will be needed to validate this initial bounce.

Breadth Trend Rating: Neutral

Kristoff - ChartMill

Next to read: Wall Street Shakes Off Jitters as AMD and McDonald’s Impress