(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – November 26, 2025 (After Market Close)

All three ETFs show strong recent uptrends and follow-through from the bounce at last week's support levels.

Short Term Trend

- Short-Term Trend: Neutral (no change)

- Next Support at $676

- Next Resistance $689

- Volume: Slightly Below Average (50)

- Pattern: Up Day - Gap Up

- Short-Term Trend: Neutral (no change)

- Next Support at $635

- Next Resistance $635

- Volume: Below Average (50)

- Pattern: Up Day -Gap Up - Close Above Descending Trendline - At Horizontal Resistance

- Short-Term Trend: Neutral (no change)

- Next Support at $245

- Next Resistance at $245

- Volume: Below Average (50)

- Pattern: Up Day - Closed Above Horizontal Resistance

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: !!TREND CHANGE - POSITIVE!! (from neutral) - NOT CONFIRMED (intraweek close)

Daily Market Breadth Analysis – November 26, 2025 (After Market Close)

After three consecutive strong sessions, the market breadth on Wednesday confirmed further improvement in underlying participation. The data shows another healthy advance, though slightly less powerful than Tuesday, with 72.1% of stocks finishing in the green.

Comparison with Previous Session

Advancing vs. Declining Stocks:

-

Advancing volume remained high (72.1%), down marginally from 78.6% on Tuesday, but still firmly positive.

-

Declining volume ticked up slightly (25.3% vs. 19% on Tuesday), but the bullish skew is still dominant.

High-Impact Moves:

- 5.9% of stocks advanced more than 4%, a touch lower than Tuesday (6.4%), while just 1% declined more than 4%.

This again indicates more upside thrust among individual stocks than downside risk.

Moving Average Metrics

-

SMA(20)+: 62.3% (+7.9% from Tuesday)

-

SMA(50)+: 51.9% (+5.2%)

-

SMA(100)+: 54.5% (+2.1%)

-

SMA(200)+: 58.7% (+0.7%)

For the first time in several sessions, more than half of all stocks are trading above their 50-day and 100-day moving averages, confirming medium-term strength. These are crucial technical thresholds and the pace of recovery here is noteworthy.

New Highs vs. New Lows

-

New Highs (NH): 5.1% (highest since the October rally)

-

New Lows (NL): 0.4% (lowest in 10 sessions)

This shift in NH/NL signals improving internal strength and market confidence. It’s a continuation of the trend observed Tuesday and a very bullish signal if sustained.

Short-Term Trend: Price Chart Observations

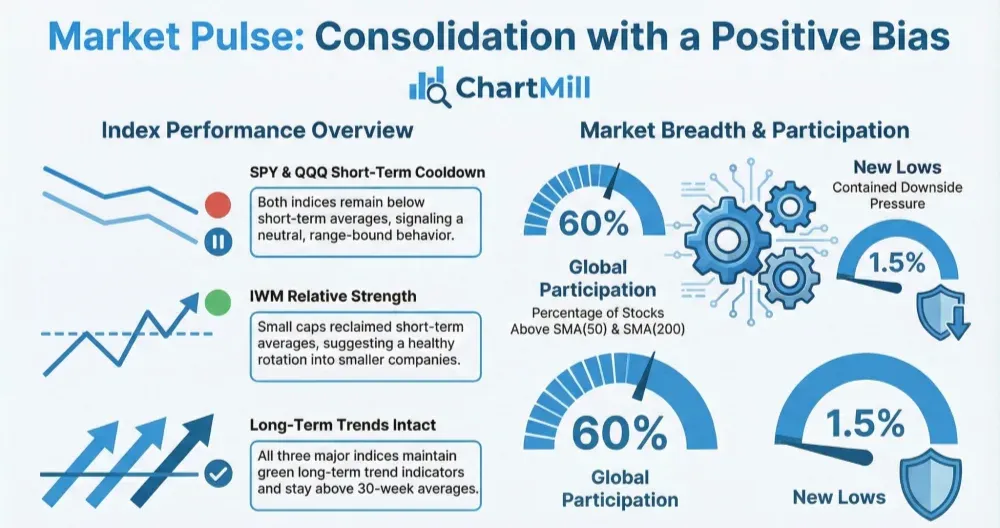

IWM (Russell 2000) broke out above its descending trendline and horizontal resistance near 245. It’s showing relative strength and could target the 252 zone next.

QQQ (Nasdaq 100) reclaimed its short-term downtrend and is now trading firmly above its 20MA, heading toward the 620 resistance level.

SPY (S&P 500) also surged into a key resistance area near 680. It’s approaching prior highs but still has work to do to break out definitively.

All three ETFs show strong recent uptrends and follow-through from the bounce at last week's support levels. However, they are approaching potential resistance zones where sellers could re-emerge, especially after a multi-day run.

Intermediate-Term Metrics

-

% of stocks in monthly uptrend: 45.7% (up from 34.8% on Tuesday)

-

% of stocks in 3-month uptrend: 53.2% (up from 51.4%)

The shift here reflects not just short-term momentum, but a possible trend change taking hold over longer time frames. It’s also consistent with the improving breadth from earlier in the week.

Summary and Outlook

This was another constructive day for the market, both technically and in terms of participation. The broadening strength across all indices and sectors is particularly encouraging, as it supports the sustainability of this rally.

However, caution is still warranted. Most major indices are bumping into areas of prior resistance (notably SPY and QQQ), which could cause temporary hesitation or even a pullback. It’s also worth noting that volume wasn’t particularly strong across the board, suggesting a need for confirmation before declaring a breakout.

The market appears to be transitioning from a recovery phase into a more robust uptrend, but it’s not out of the woods yet.

Breadth Trend Rating: Positive

While not yet in “very positive” territory, the consistent improvement across multiple timeframes, the increased percentage of stocks above key moving averages, and the breakout attempts by major indices justify a positive trend assessment.

Kristoff - ChartMill

Next to read: Wall Street Heads Into Thanksgiving With a Grin — Rate-Cut Fever Lifts Markets Again