The possibility that the longest US government shutdown ever may finally come to an end worked like a much-needed painkiller for the markets. Wall Street took a deep breath and went risk-on.

Macro & Politics: A Shutdown That Finally Shows Cracks

Federal services in the US have now been paralyzed for 40 days. But on Monday, progress emerged: the Senate approved a funding bill that would keep the government open until January 30. The House still needs to vote, but markets are already pricing in a temporary ceasefire in Washington’s political drama.

That sense of relief set the tone:

-

The S&P 500 closed +1.5%.

-

The Dow Jones added +0.8%.

-

The Nasdaq +2.27% finally found some breathing room after a week of tech profit-taking.

A key consequence of a deal? Economic data from the US government can start flowing again, inflation, retail sales, jobless claims, producer prices. Investors have been operating in partial darkness, and fresh data will be vital.

But the political compromise also has a sting in the tail: ACA insurance subsidies were not extended.

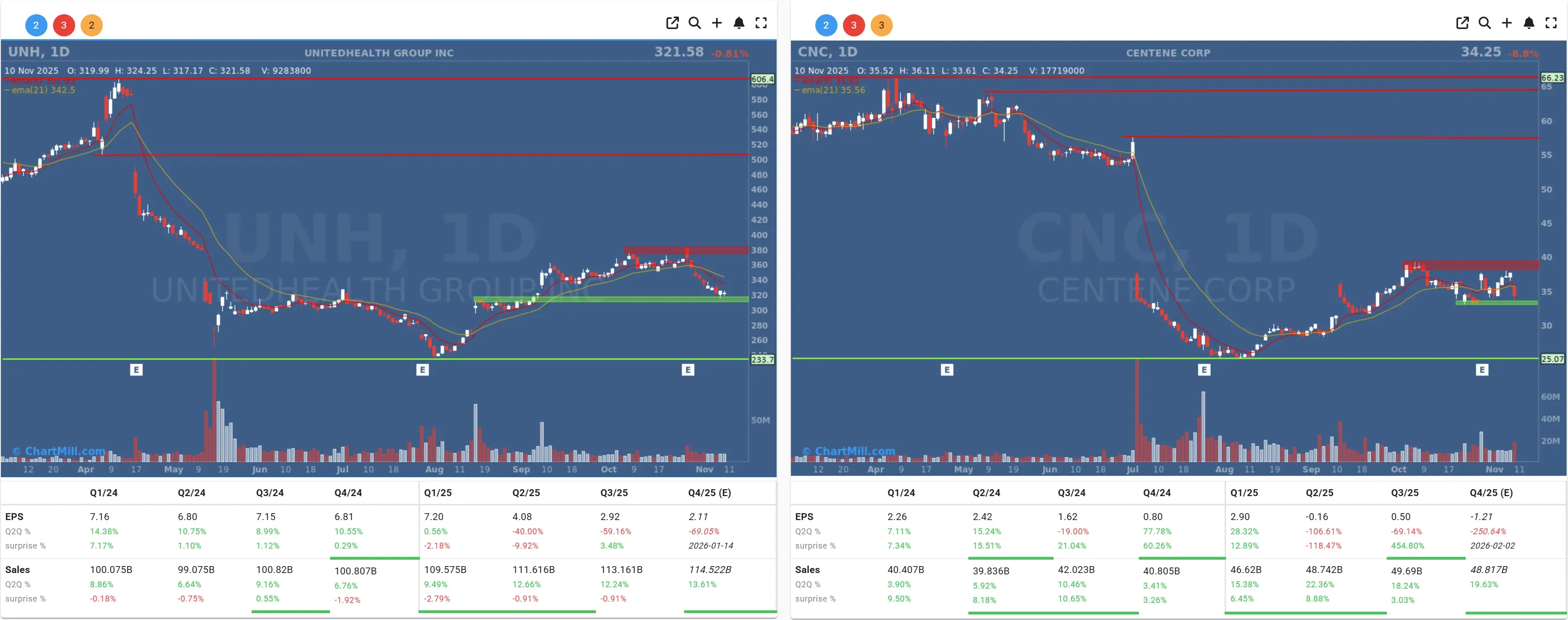

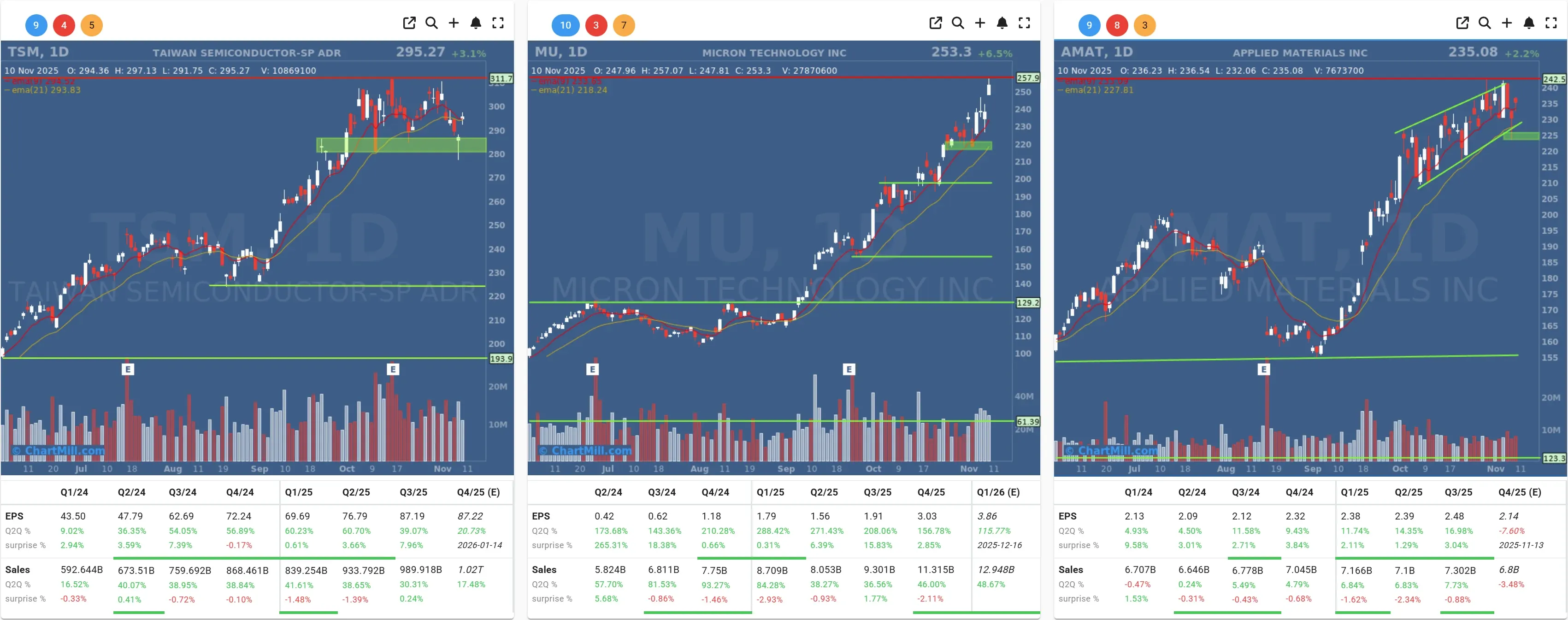

That instantly hit the healthcare sector, including heavyweights such as UnitedHealth (UNH | -0.81%), Centene (CNC | -8.81%), Molina Healthcare (MOH | -7.34%), and Elevance Health (ELV | -4.41%).

Tech & Semiconductors: Nvidia Leads a Mini-Rally

With shutdown uncertainty easing, semiconductor stocks woke up sharply. Investors stopped trimming profits and jumped back in:

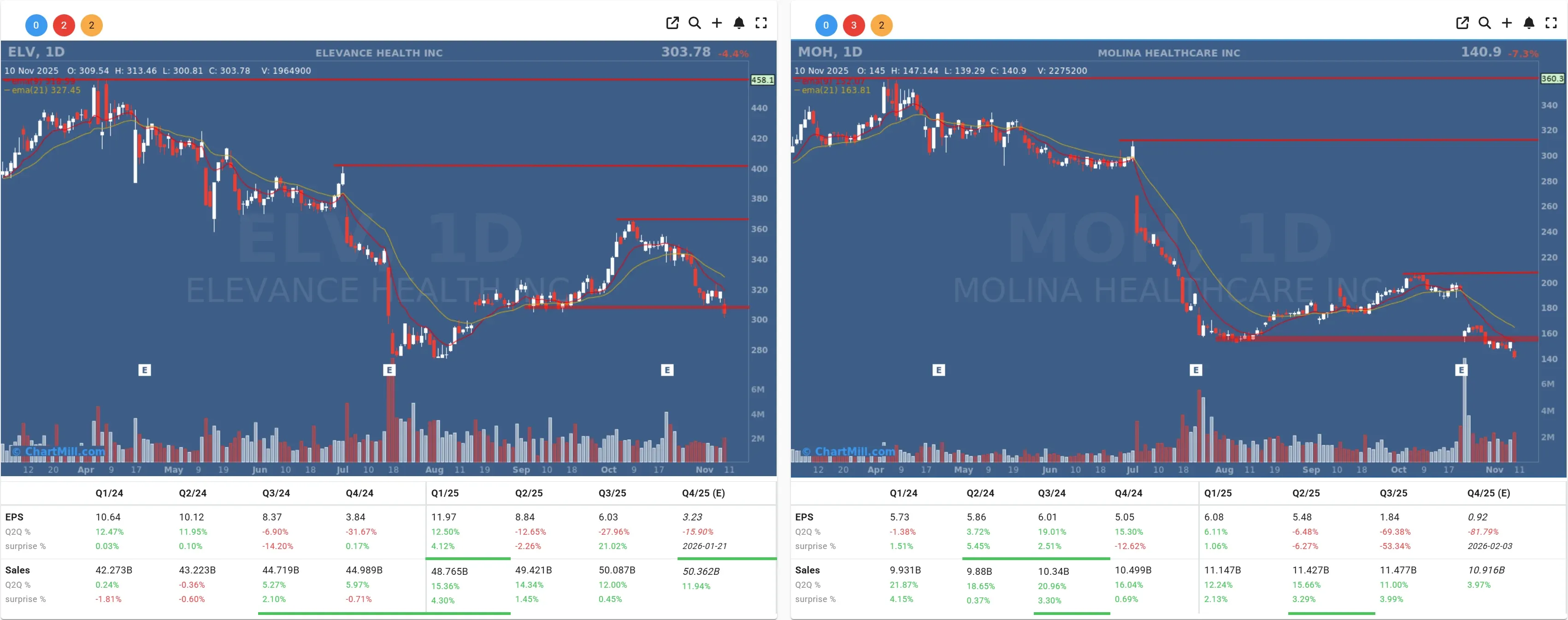

Nvidia (NVDA | +5.79%) delivered a standout performance.

Advanced Micro Devices (AMD | +4.47%) also bounced firmly.

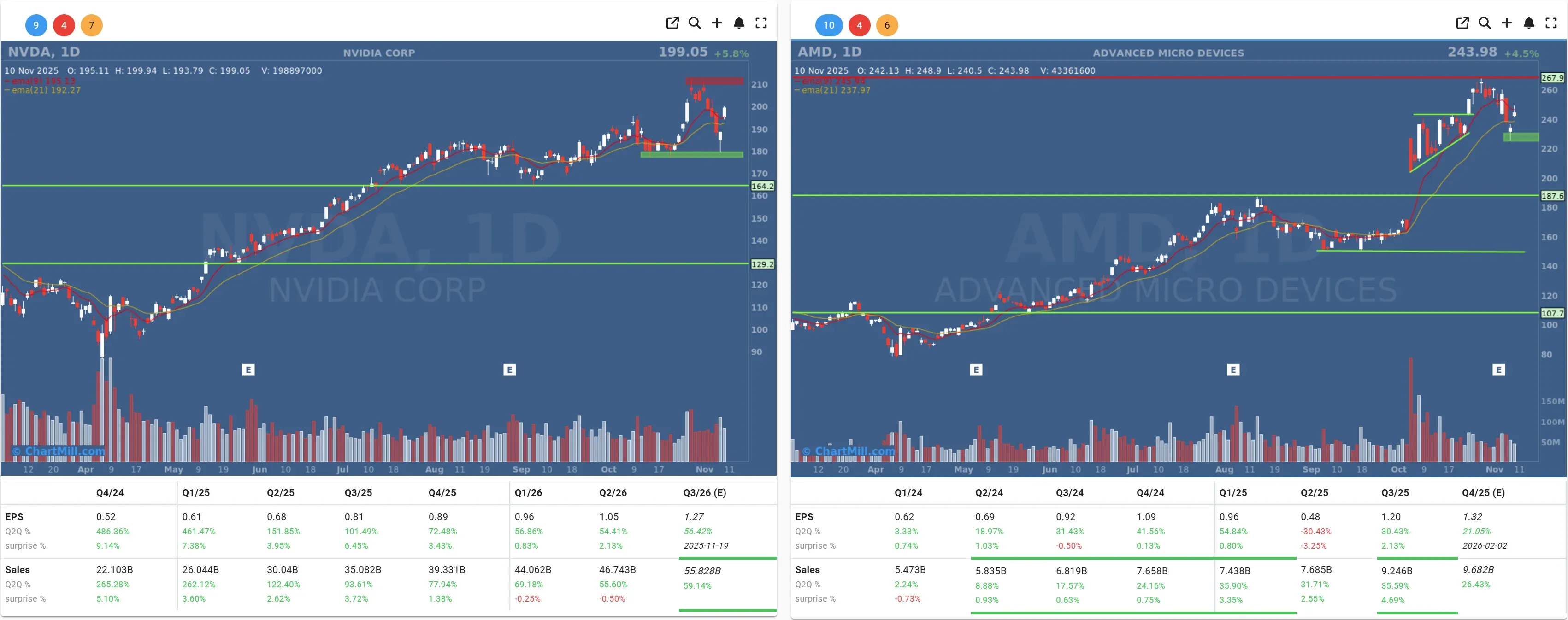

Micron (MU | +6.46%), Applied Materials (AMAT | +2.18%), and others followed the move.

Notably, Nvidia’s CEO Jensen Huang met with TSMC (TSM | +3.06%) over the weekend to secure additional chip supply. That says a lot about demand and expectations surrounding AI.

Still, JPMorgan remains cautious: the Magnificent 7 delivered strong earnings, but the future of AI demand won’t be a straight upward line. Diversification across sectors and regions is more important than ever, they warn.

Looking ahead: Nvidia reports earnings on November 19, and that release may shape sentiment for weeks.

Corporate News: From Buyouts to Subsidy Shocks

Beyond tech, the corporate news flow was lively. A few highlights:

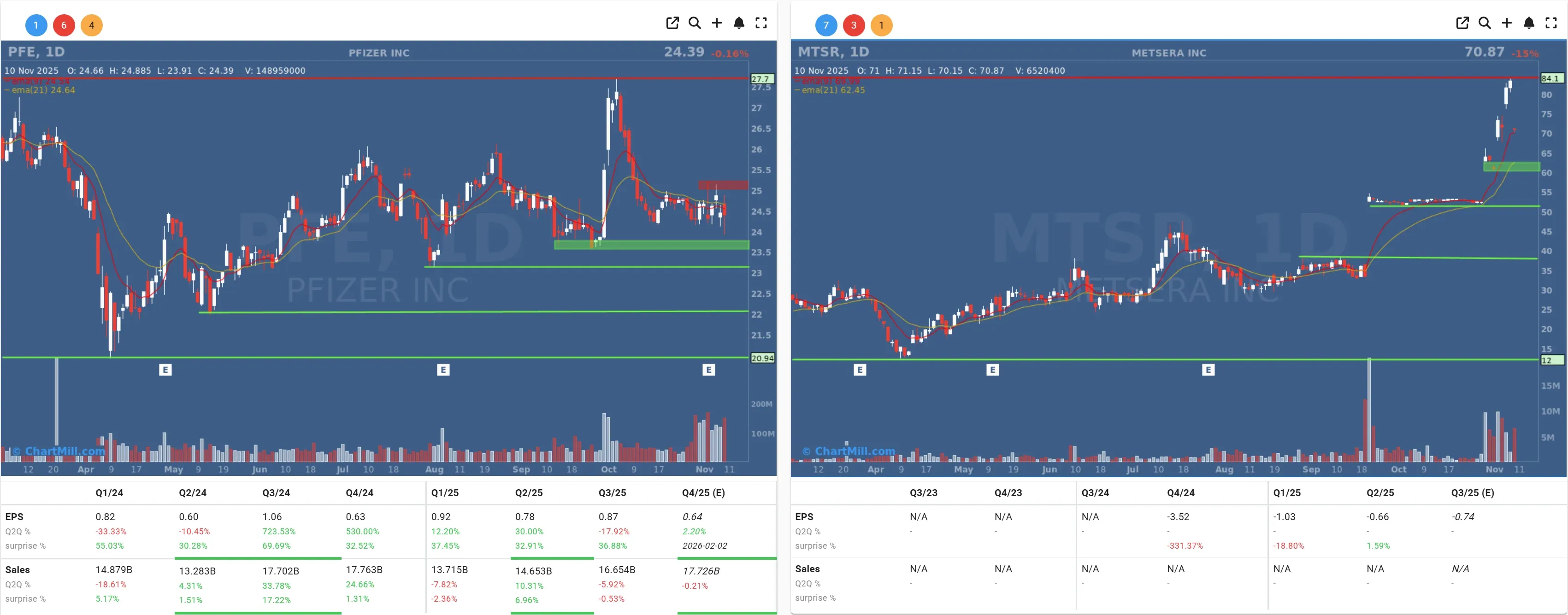

Pfizer Wins the Battle for Metsera

Pfizer (PFE | -0.16%) secured the acquisition of biotech startup Metsera (MTSR | -14.8%) after Novo Nordisk stepped aside.

The deal could reach $10 billion, depending on Metsera’s future performance milestones.

The muted market reaction reflects skepticism toward large pharma acquisitions in an expensive environment.

Apple Pushes Back Its Next iPhone Air

Apple (AAPL | +0.36%) is again facing weaker-than-expected sales of its current model. The next iPhone Air - originally planned for late 2026 - has been delayed. Not disastrous, but another reminder that the smartphone market remains tough.

Palantir Springs Back to Life

After a sharp drop earlier in the week, Palantir (PLTR | +8.81%) rebounded strongly. Volatility is part of the package for a company walking the tightrope between defense contracts, AI exposure, and realistic growth expectations.

Rumble Acquires Northern Data

Rumble (RUM | +11.38%) announced it will acquire Northern Data for $970 million. A surprisingly positive market reaction for a company that often attracts attention for reasons unrelated to revenue growth.

Markets in Motion: Currencies and Energy

-

The euro/dollar traded at 1.1565 on Monday evening, a reminder that the currency mainly tracks expectations around the US rate path.

-

Oil ticked slightly higher as well. Nothing dramatic, but energy prices remain highly sensitive to geopolitical developments.

My Take on the Day Ahead

The relief surrounding the potential end of the shutdown feels justified, but it’s too early to celebrate. Political instability in Washington remains an unresolved variable, and every new negotiation introduces fresh noise.

What stands out most is how heavily the market still revolves around a single theme: AI. If Nvidia delivers strong guidance and confident commentary next week, sentiment could accelerate again. If not, the disappointment could ripple through the entire market.

For now, the environment remains risk-on, but with an undercurrent of uncertainty no investor should ignore.

Kristoff - ChartMill

Next to read: Market Breadth Kicks Off the Week on a Strong Note