(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – August 18, 2025 (After Market Close)

Calm tape, waiting on Powell

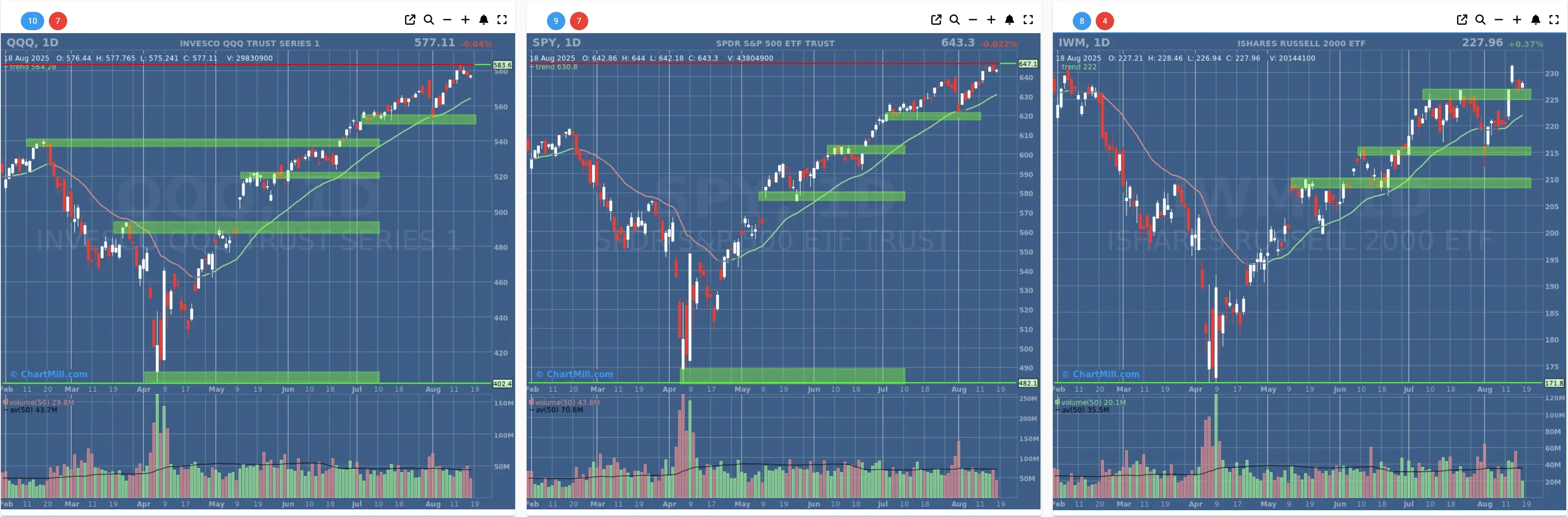

Short Term Trend

- Short-Term Trend: Bullish (from neutral)

- Next Support at $620 - $600

- Next Resistance at /

- Volume: Well Below Average (50)

- Pattern: Down Day -Narrow Trading Range

- Short-Term Trend: Bullish (no change)

- Next Support at $550 - $540

- Next Resistance at /

- Volume: Well Below Average (50)

- Pattern: Down Day - Bull Flag Pattern

- Short-Term Trend: Positive (from neutral)

- Next Support at $225

- Next Resistance at $245

- Volume: Far Below Average (50)

- Pattern: Up Day - Inside Day

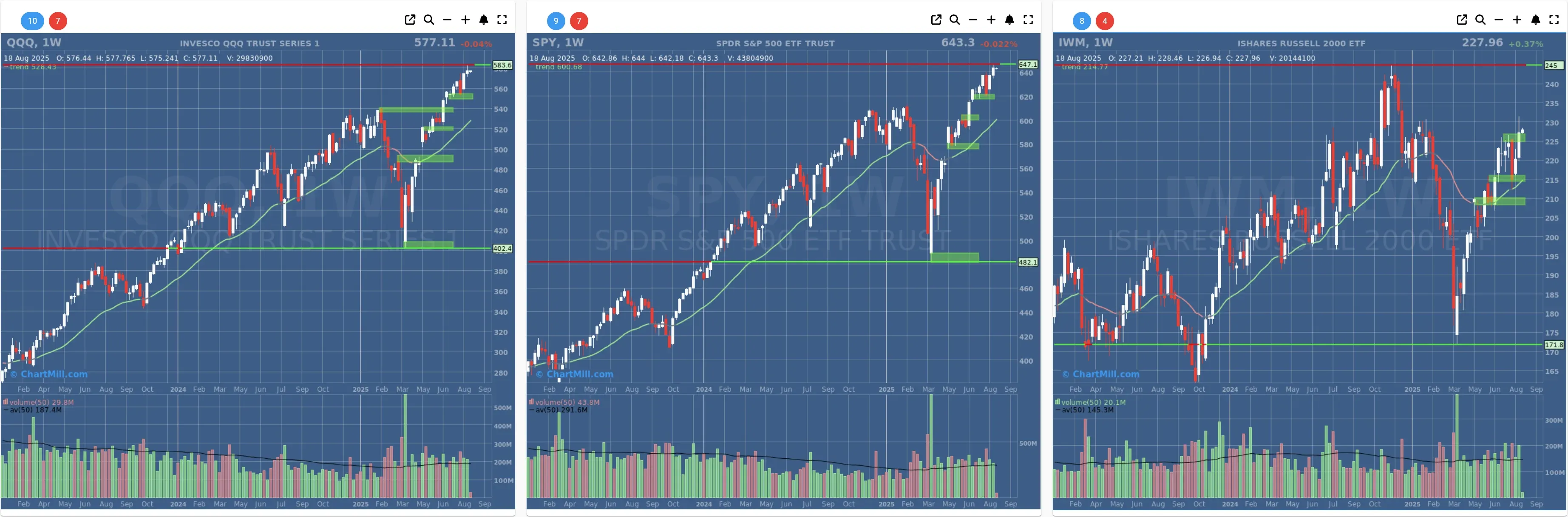

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (from neutral)

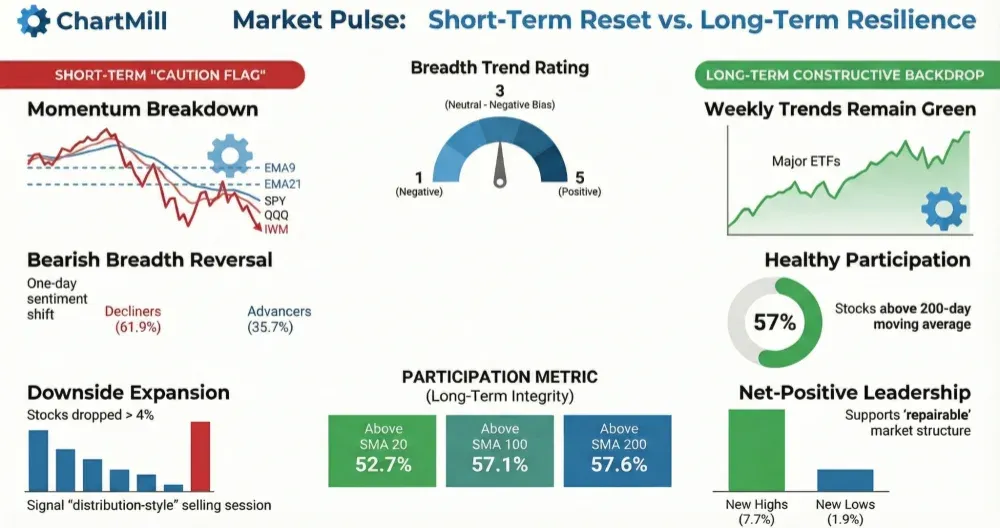

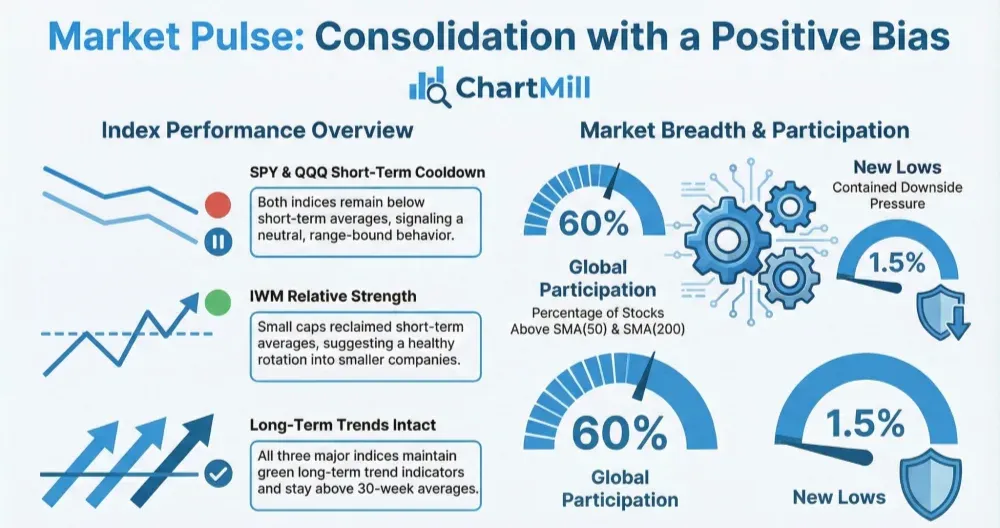

Daily Market Breadth Analysis – August 18, 2025 (After Market Close)

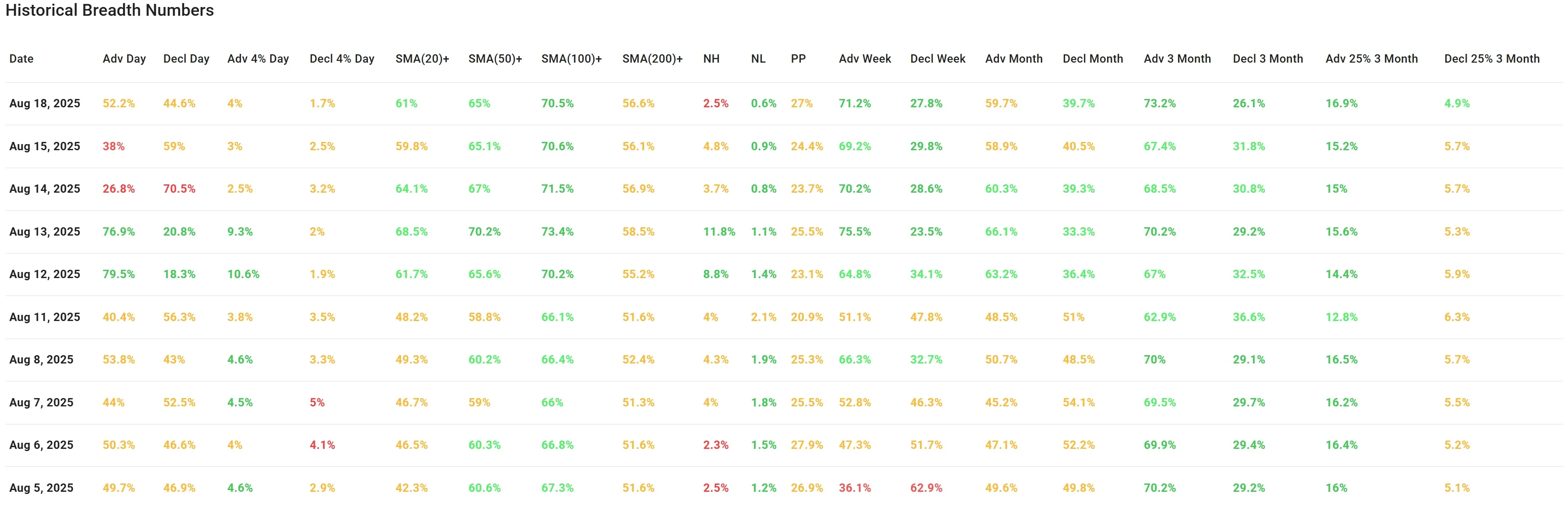

After Friday’s cooling, breadth improved modestly. Participation above key moving averages ticked up, weekly and multi‑month advance/decline composites strengthened, while new highs softened—suggesting a constructive trend with leadership still a bit hesitant.

Daily participation (Aug 18, 2025):

-

Advancers 52.2% vs. decliners 44.6% — a small positive swing from Friday’s 38%/59%.

-

Big movers: +4% advancers at 4.0% outpaced −4% decliners at 1.7%, indicating healthier upside momentum than on Friday (3.0% / 2.5%).

-

“Pocket Pivots” improved to 27% (from 24.4%).

Breadth vs. moving averages:

-

Above SMA20: 61% (from 59.8%).

-

Above SMA50: 65% (roughly unchanged vs. 65.1%).

-

Above SMA100: 70.5% (flat).

-

Above SMA200: 56.6% (from 56.1%).

This keeps a majority of stocks above all key SMAs, a constructive backdrop that we highlighted earlier last week despite the mid‑week sell pressure.

Breakouts and breakdowns:

-

New highs: 2.5% (down from 4.8%).

-

New lows: 0.6% (down from 0.9%).

Leadership breadth softened (fewer NH), but stress stayed contained (very few NL).

Multi‑period advance/decline composites:

-

Weekly: Adv 71.2% / Decl 27.8% (better than 69.2% / 29.8%).

-

Monthly: Adv 59.7% / Decl 39.7% (from 58.9% / 40.5%).

-

3‑Month: Adv 73.2% / Decl 26.1% (strong jump from 67.4% / 31.8%).

-

3‑Month, ±25% movers: Adv 16.9% / Decl 4.9% (from 15.2% / 5.7%).

These mark a clear improvement in medium‑term participation, consistent with the broader trend we’ve been tracking since early August.

Context vs. the prior note:

On Friday we noted breadth had cooled after two strong sessions.

Today’s data show a stabilization and mild re‑acceleration: more stocks above short‑term averages, stronger weekly/monthly composites, and fewer deep decliners. The one caveat is weaker new‑highs, implying leadership is still cautious even as participation broadens.

Bottom line — Breadth Trend Rating: Positive

Kristoff - ChartMill

Next to read: Market Monitor News, August 19 BMO