I love a market that yawns while a few corners party.

Monday delivered exactly that: headline indices barely moved, but solar stocks threw a mini‑rager and one software name went vertical. The set‑up into Powell’s Jackson Hole speech is classic late‑summer “don’t do anything dumb” positioning, unless, of course, you were long renewables or Dayforce.

Market at a Glance

The indexes tiptoed: S&P 500 was essentially flat, the Dow dipped ~0.1%, and the Nasdaq eked out a hair of green, as investors stared down Fed minutes (Wed) and Powell’s Friday remarks at Jackson Hole.

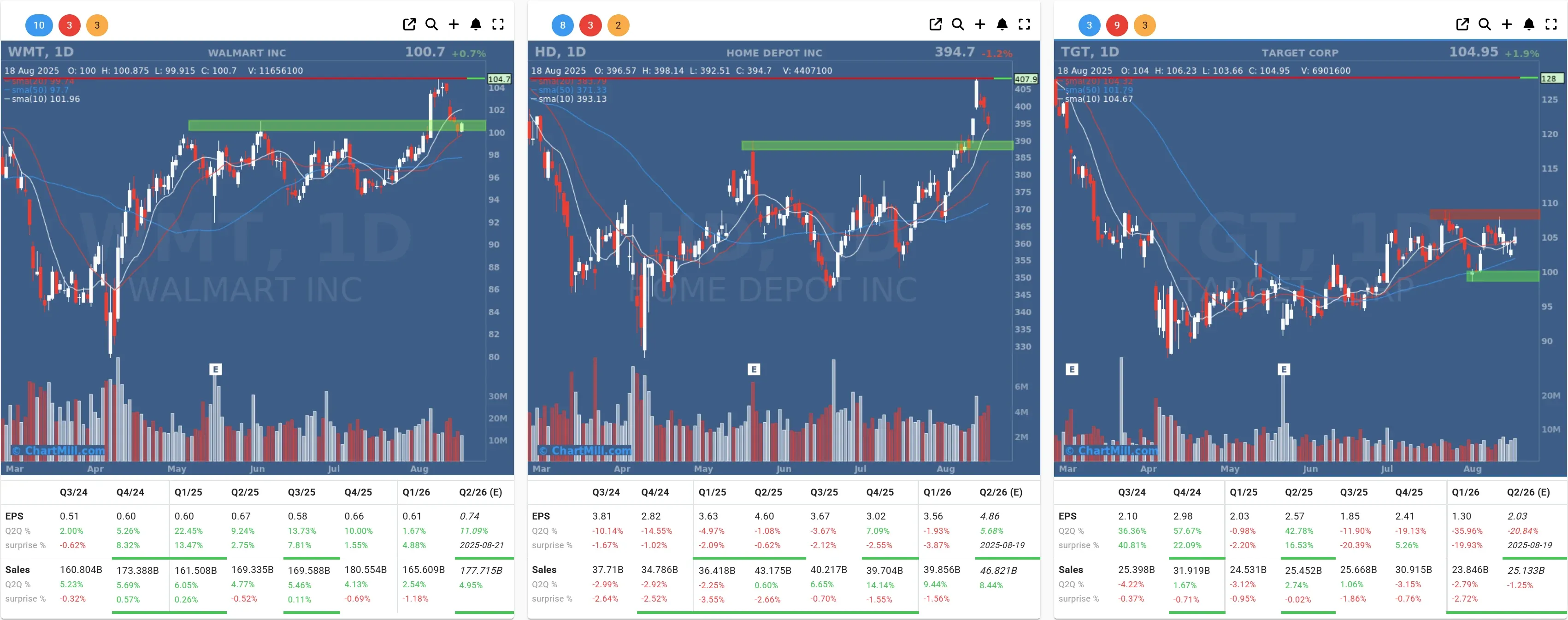

On deck this week: the consumer pulse via Home Depot (HD | −1.17%), Walmart (WMT | +0.7%) and Target (TGT | +1.87%). These retail prints are the cleanest real‑time read on household demand we’ll get before the next macro wave.

Macro & Geopolitics: Powell Friday, Politics Always

Rate‑cut odds for September still lean dovish, futures price roughly an ~80–85% chance of a 25 bp trim. Powell’s Friday Jackson Hole speech will calibrate how much (if any) “50 bp” chatter should survive into September. (Pro tip: probably not.)

Meanwhile in Washington, President Trump met Ukraine’s Zelensky alongside European leaders, a delicate diplomatic dance after the Trump‑Putin Alaska meeting produced no cease‑fire. Markets care because energy and European risk premia care.

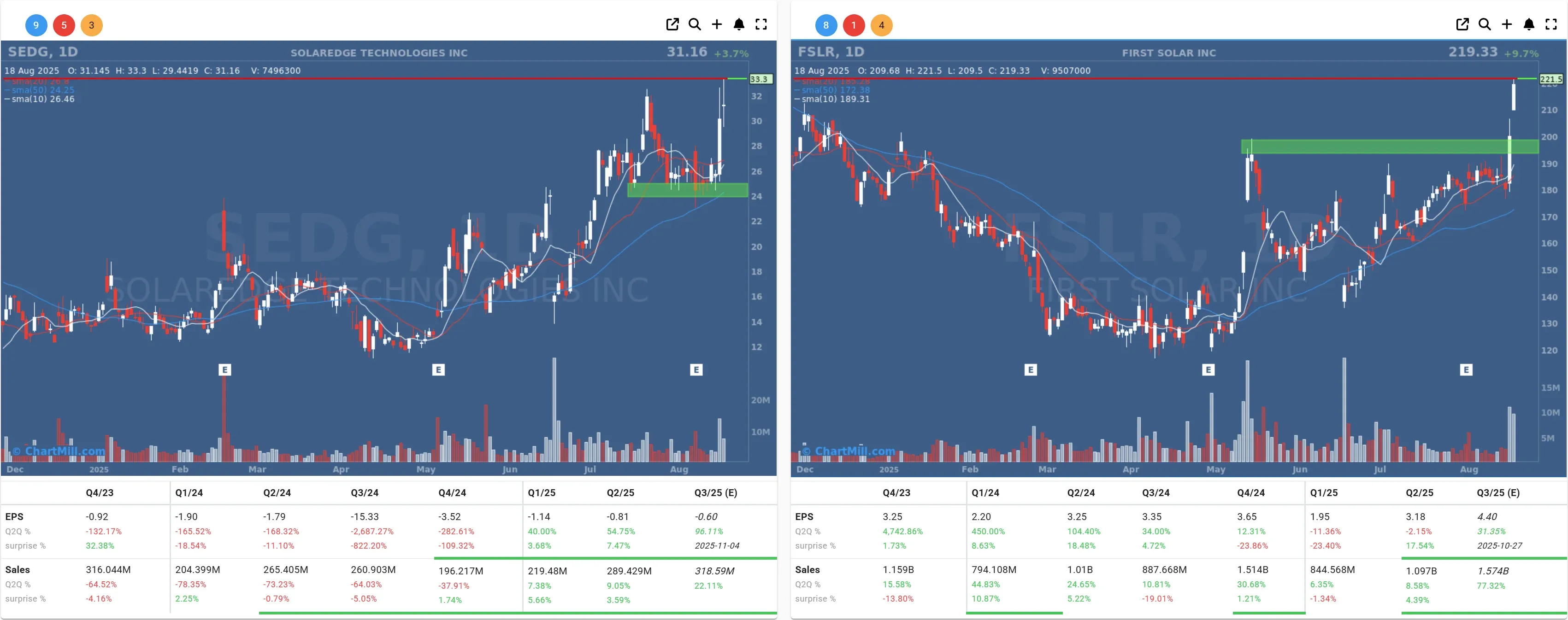

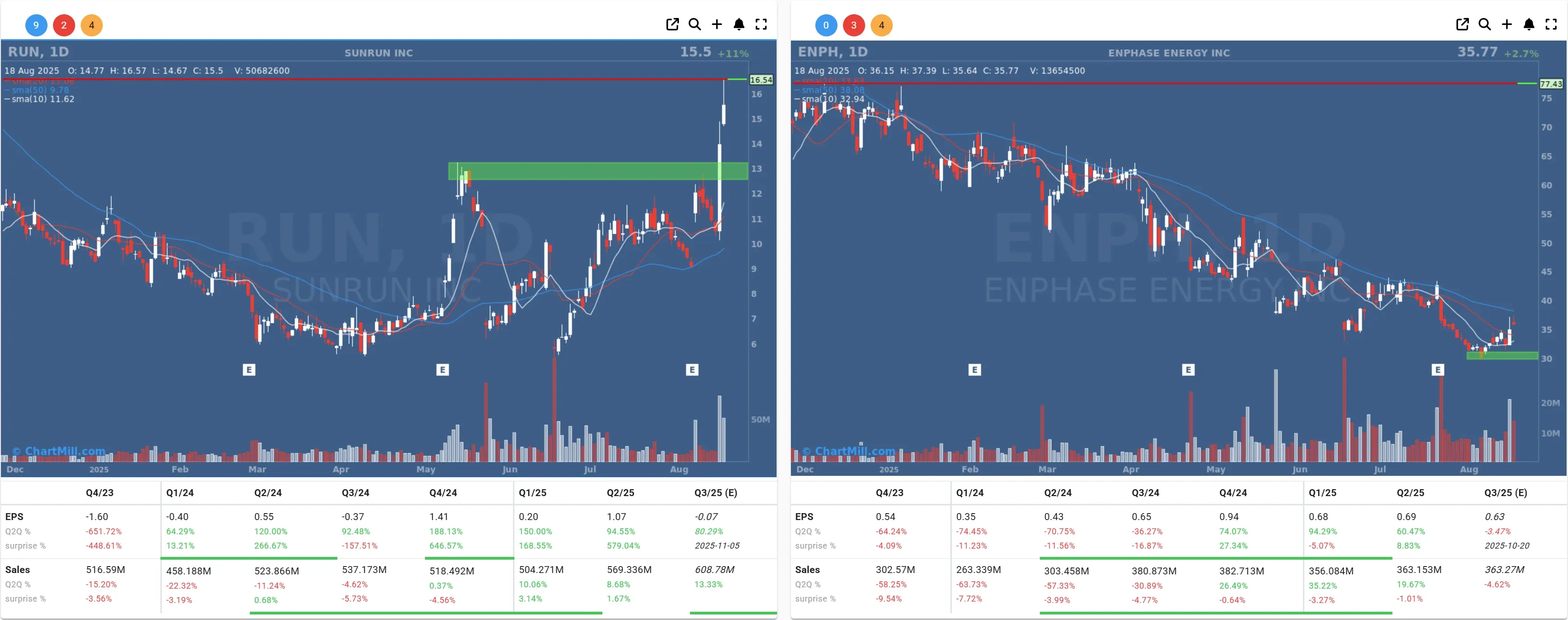

Solar Shines: Policy Math Got Less Scary

The IRS dropped long‑awaited “beginning of construction” rules for wind and solar (Notice 2025‑42).

Bottom line: to dodge the strict 12/31/2027 in‑service deadline, projects must begin significant physical work by July 5, 2026; the popular 5% spending safe harbor is largely gone for big projects, but the final is less draconian than feared and preserves meaningful runway. That nuance was enough to light a fire under the group.

Winners: Enphase (ENPH | +2,67%), Sunrun (RUN | +11.35%), First Solar (FSLR | +9.69%), and SolarEdge (SEDG | +3.66%). Friday’s initial pop extended after investors re‑ran models with the new timelines.

(Context from the attached brief: the new guidance came after the administration’s “One Big Beautiful Bill” rewrote parts of the green subsidy regime. Monday’s tape reflected relief that the transition path is manageable—at least for developers who can mobilize quickly.)

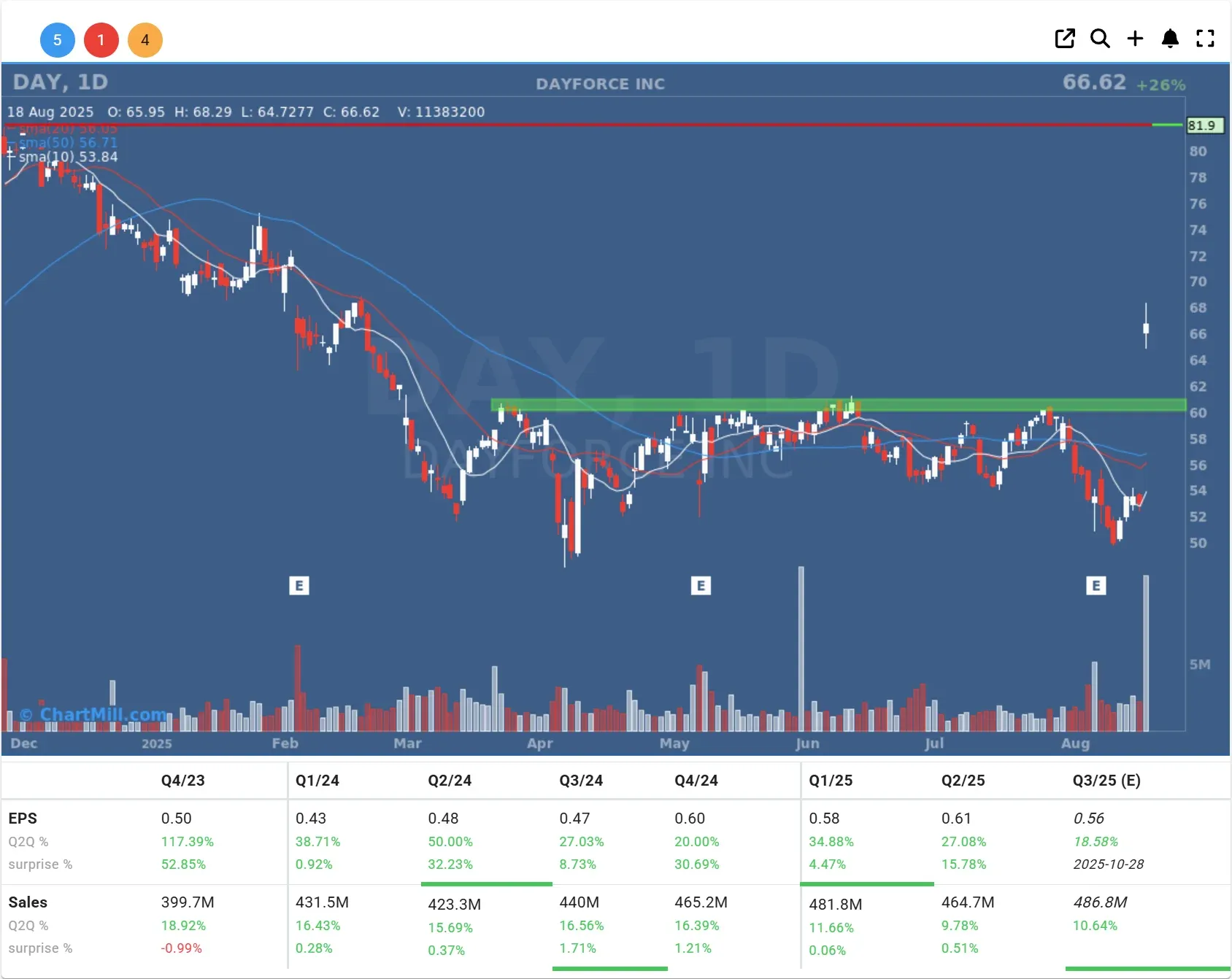

Deal Talk: Dayforce Goes Vertical

HR software maker Dayforce (DAY | +25.98%) ripped after reports that Thoma Bravo is in advanced talks to take the company private. A deal could be announced in coming weeks, caveat that talks can still wobble. This was the S&P 500’s standout.

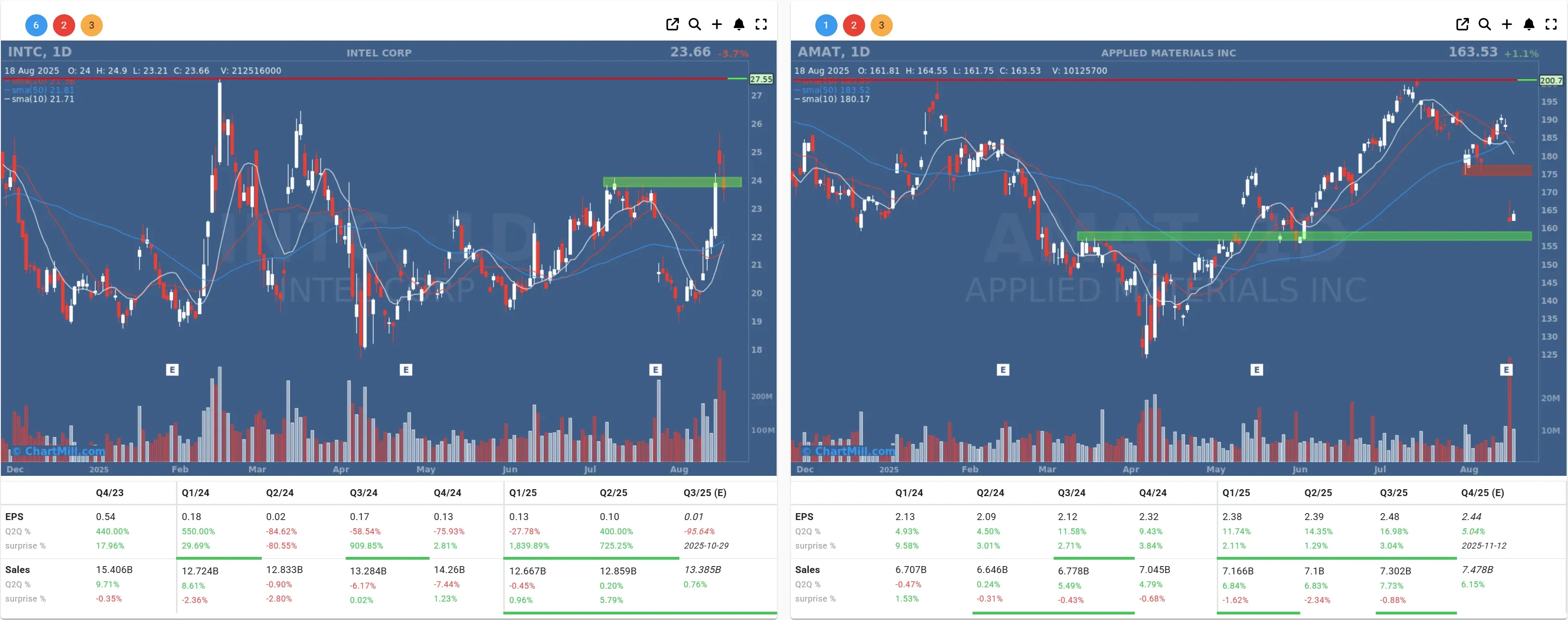

Semis Under Scrutiny: Intel & AMAT

Intel (INTC | −3.66%) fell on reports the administration may convert a chunk of CHIPS Act grants into a ~10% equity stake, raising dilution and governance questions. The idea: align taxpayer support with upside if the turnaround works. Markets were… unconvinced.

Applied Materials (AMAT | +1.1%) stabilized after Friday’s 12–14% dump on a weak outlook tied to China pauses and export‑license friction. A little bargain‑hunting, but the thesis risk hasn’t vanished.

FX & Commodities: Energy Eyes the Peace Track

-

Brent settled +1.14% to ~$66.60 and WTI +0.99% to ~$63.42 as traders weighed the White House meetings and ongoing supply headlines.

-

EUR/USD hovered near 1.1667.

What I’m Watching Next

-

Powell’s tone at Jackson Hole on Friday: does he validate the market’s September cut as “insurance,” or push back? (My bias: he keeps optionality and leans cautious.)

-

Retail earnings: any signs that tariffs + a softening labor market are pinching basket size or mix at Walmart, Home Depot, and Target.

-

Dayforce rumor drift, PE deals love quiet periods, but this one already isn’t.

-

Solar order books: management color on timelines now that IRS guidance is live.

Kristoff - ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, August 19 BMO