US Markets Sink as Yields Surge and Budget Worries Intensify

Sharp Losses for Dow, Nasdaq, and S&P 500

US stock markets closed sharply lower on May 20, 2025. The Dow Jones fell 1.9%, te Nasdaq dropped 1.3% and the S&P 500 lost 1.6%.

The selloff was fueled by a disappointing auction of 20-year US Treasuries, deepening concerns over the country's fiscal stability.

Soaring Yields Create New Headwinds for Stocks

The 10-year Treasury yield rose 10 basis points to 4.59%, while the 30-year yield climbed above 5%. The 20-year yield jumped 12 basis points to 5.113%.

Matt Maley from Miller Tabak noted a fundamental shift in long-term rates: “Higher yields make it harder to justify today’s elevated stock valuations.”

Budget Concerns Cast Shadow Over Markets

The latest Republican budget proposal could increase deficits by $3 trillion over the next decade.

President Trump is pressuring his party to extend and expand tax cuts, further fueling debt concerns.

Meanwhile, mortgage applications fell by 5.1%, signaling the impact of rising rates on the housing market.

Corporate Results: Big Movers, Bigger Misses

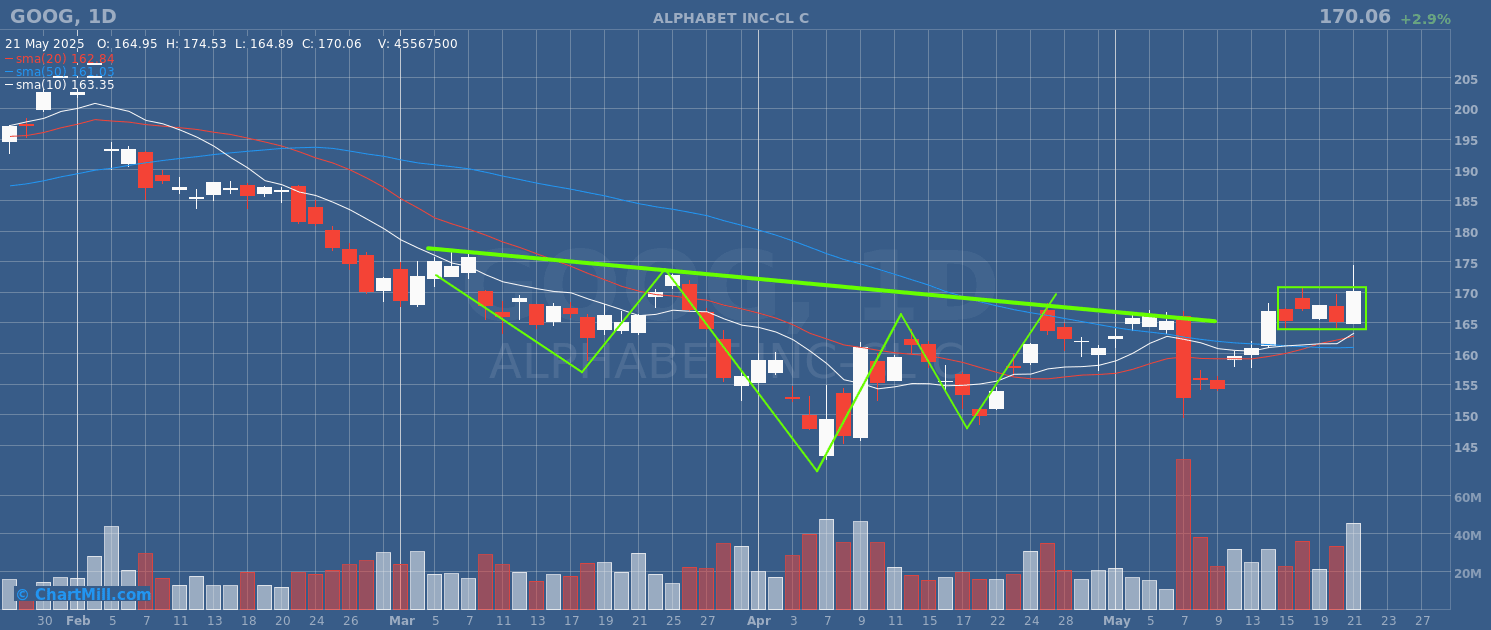

Google (GOOGL | +2.87%) gains on impressive AI showcase

At its I/O developer conference, Google unveiled AI Mode, allowing users to enter longer and more complex search queries. Analysts from Bank of America and Piper Sandler praised the demo, easing fears that AI chatbots like ChatGPT would undermine Google's core search business.

Target (TGT | -5.21%) tumbles after disappointing Q1

The retailer missed revenue estimates and lowered full-year guidance. Target cited declining transactions and lingering backlash after reversing some of its diversity, equity, and inclusion policies.

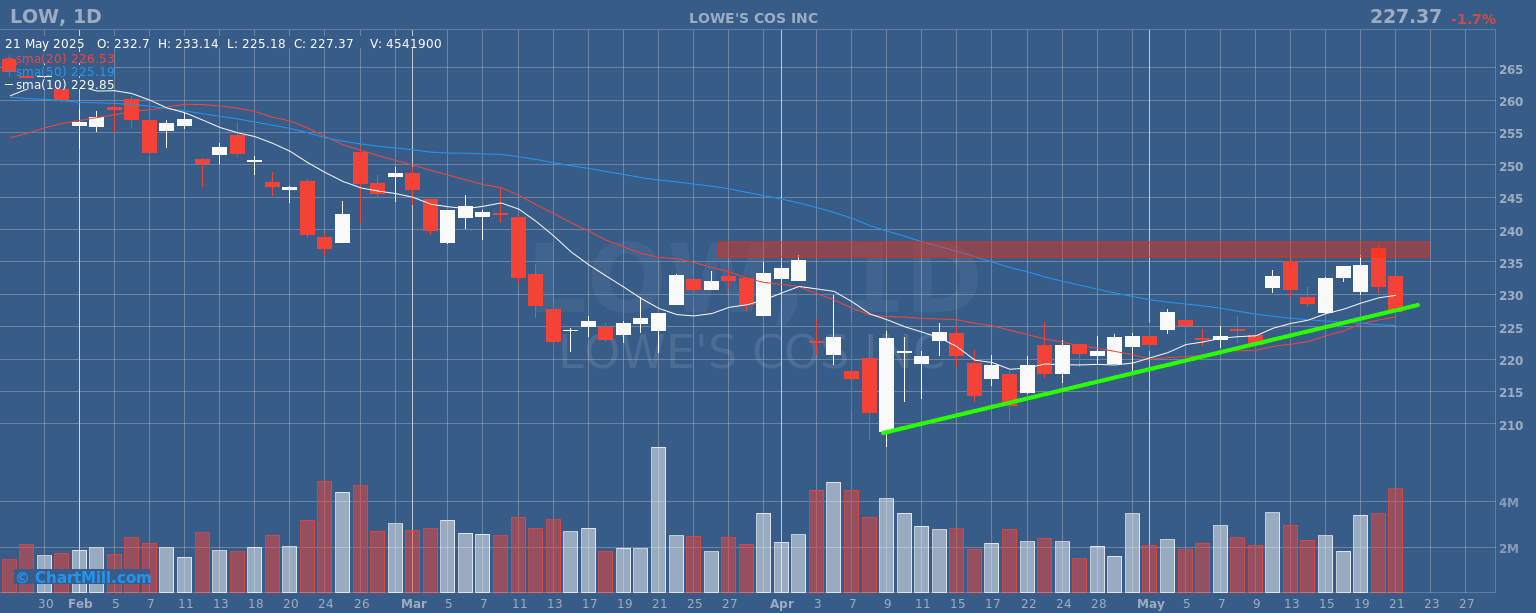

Lowe’s (LOW | -1.68%) falls despite solid earnings

The home improvement chain beat expectations, with same-store sales down just 1.7% (better than forecast). Still, analysts remain skeptical about the company’s full-year growth outlook.

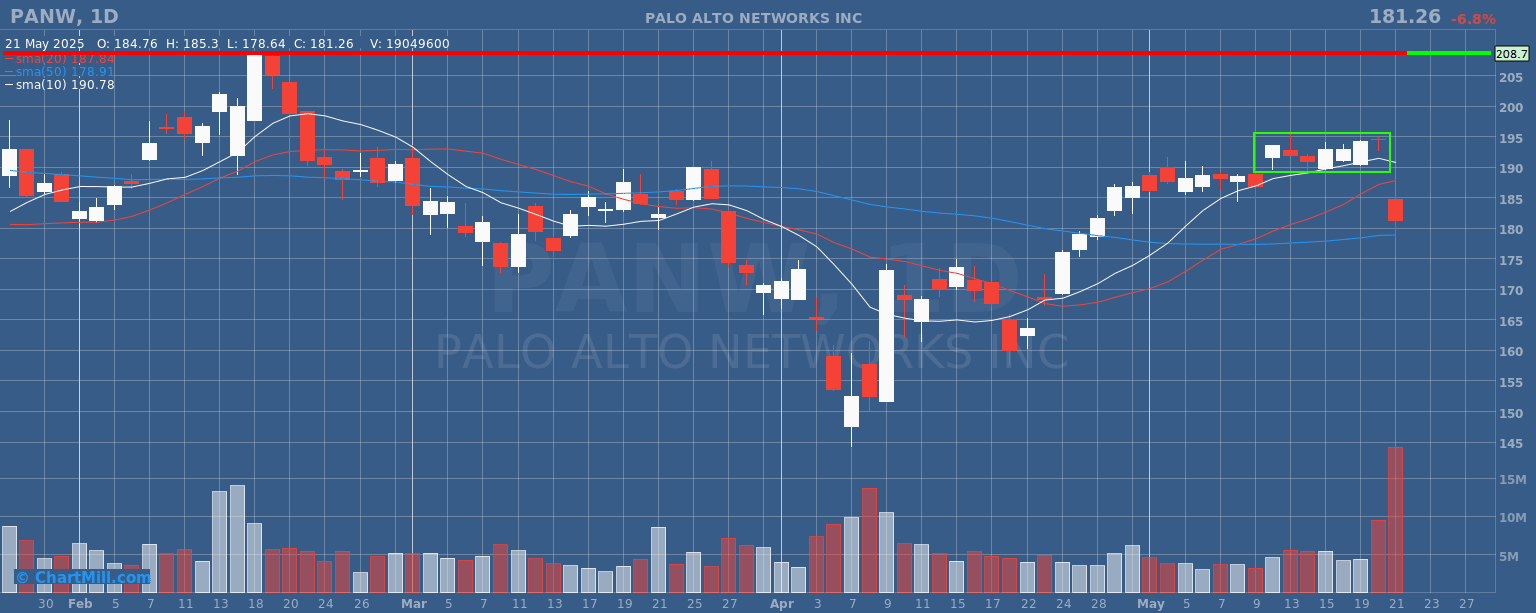

Palo Alto Networks (PANW | -6.8%) slumps despite raising guidance

The cybersecurity firm beat expectations but issued a soft revenue forecast for the current quarter, which disappointed investors.

More Declines in Tech and Retail

Other notable losers included:

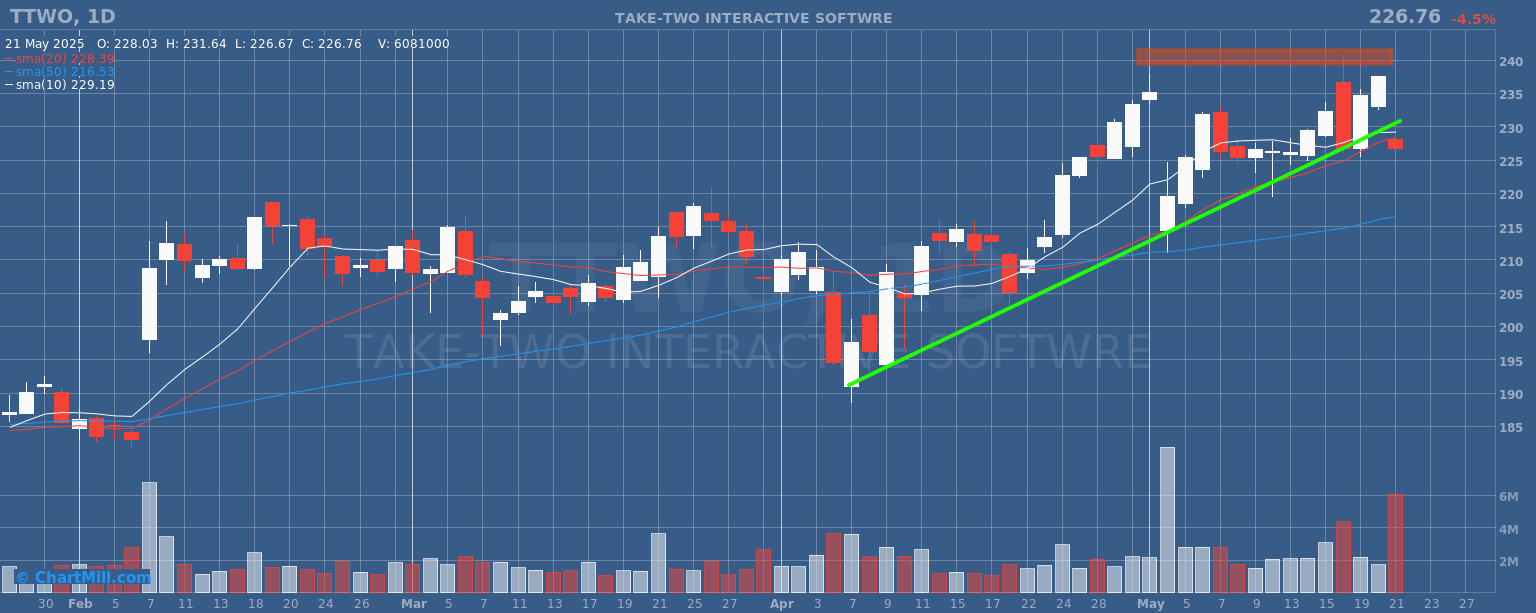

Take-Two Interactive (TTWO | -4.52%): announced a $1 billion stock offering.

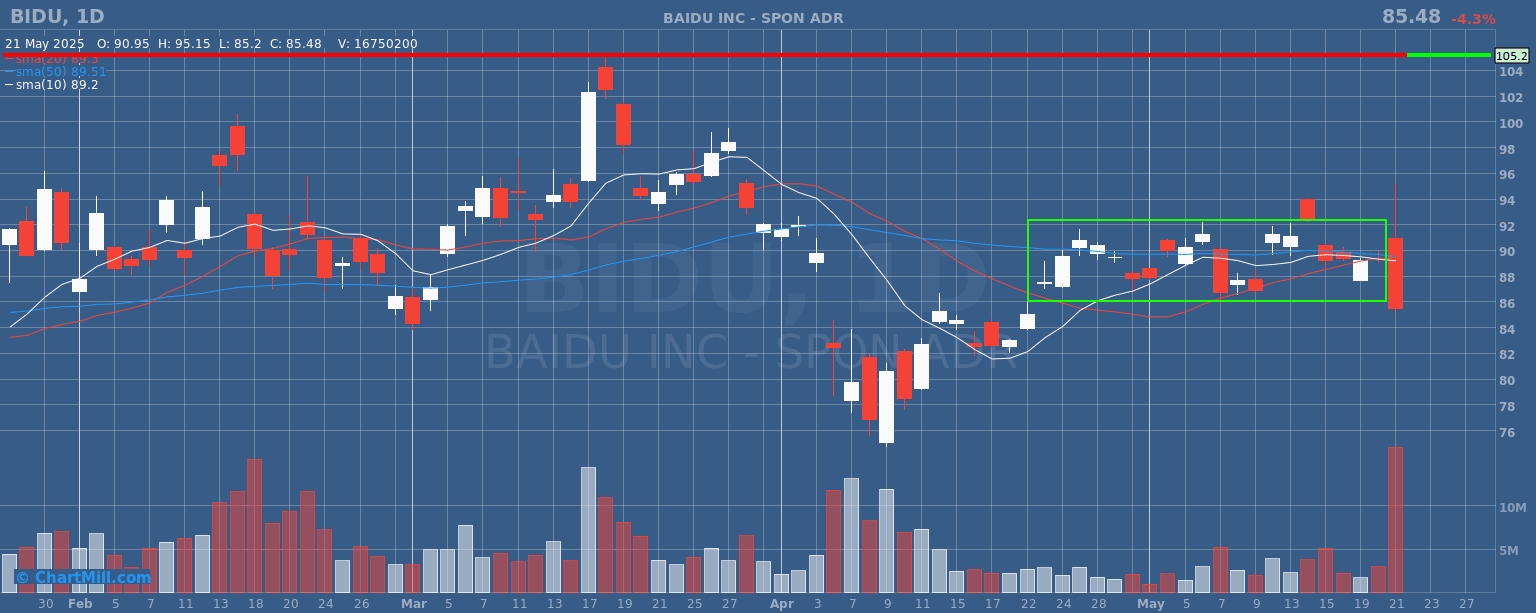

Baidu (BIDU | -4.32%): fell despite strong AI-driven earnings.

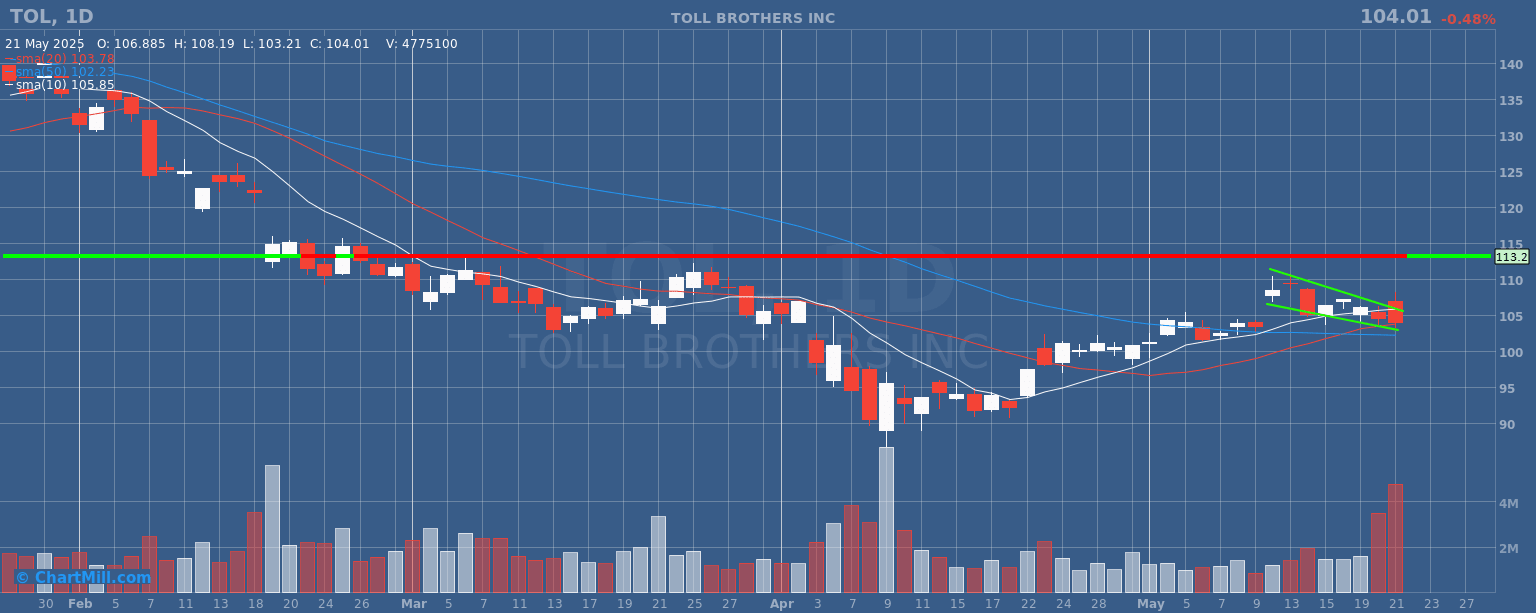

Toll Brothers (TOL | -0.48%): hit a record in homebuilding revenue but investors stayed cautious.

Gold, Bitcoin, and Euro Gain Ground

-

Gold rose back above $3,300 per troy ounce amid debt concerns.

-

Bitcoin hit a new high, trading at $109,400.

-

The EUR/USD closed at 1.1327, up from the previous day’s close of 1.1285.

Conclusion

US stock markets were rattled on May 21, 2025 by surging bond yields and renewed budget fears. While Alphabet impressed with its AI strategy, Target, Take-Two Interactive and others took serious losses.

The bond market and political developments continue to dominate investor sentiment.