ALPHABET INC-CL C (GOOG) Stock Price, Forecast & Analysis

NASDAQ:GOOG • US02079K1079

GOOG Key Statistics, Chart & Performance

The current stock price of GOOG is 301.18 USD. In the past month the price decreased by -8.15%. In the past year, price increased by 63.76%.

GOOG Technical Analysis

ChartMill assigns a technical rating of 6 / 10 to GOOG. When comparing the yearly performance of all stocks, GOOG is one of the better performing stocks in the market, outperforming 89.36% of all stocks.

GOOG Fundamental Analysis

ChartMill assigns a fundamental rating of 7 / 10 to GOOG. GOOG has outstanding health and profitabily ratings, belonging to the best of the industry. This is a solid base for any company.

GOOG Financial Highlights

Over the last trailing twelve months GOOG reported a non-GAAP Earnings per Share(EPS) of 10.5. The EPS increased by 30.43% compared to the year before.

| Industry Rank | Sector Rank | ||

|---|---|---|---|

| PM (TTM) | 32.81% | ||

| ROA | 22.2% | ||

| ROE | 31.83% | ||

| Debt/Equity | 0.11 |

GOOG Forecast & Estimates

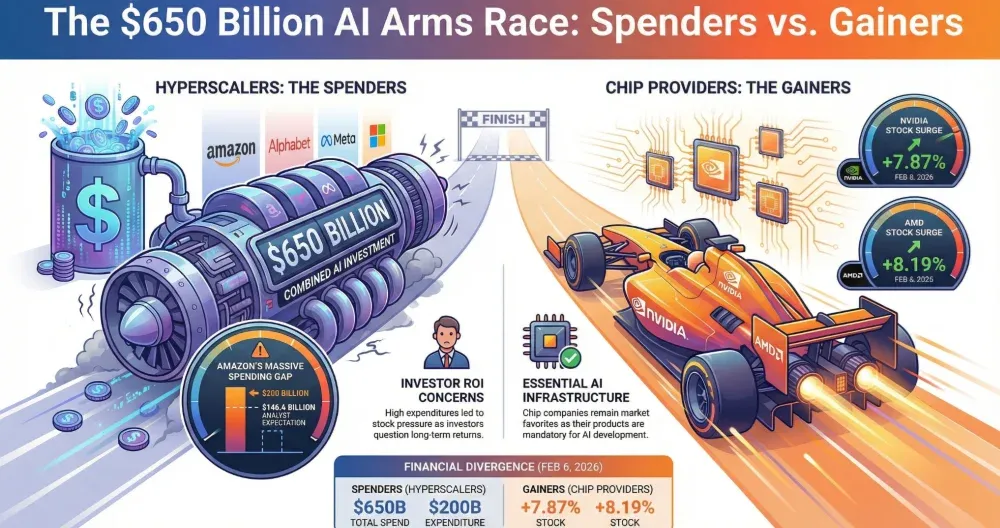

69 analysts have analysed GOOG and the average price target is 338.69 USD. This implies a price increase of 12.45% is expected in the next year compared to the current price of 301.18.

For the next year, analysts expect an EPS growth of 10.01% and a revenue growth 13.86% for GOOG

GOOG Ownership

GOOG Latest News, Press Relases and Analysis

GOOG Competitors/Peers

| Symbol | Company Name | Technical Rating | Fundamental Rating | FPE | Market Cap |

|---|---|---|---|---|---|

| GOOGL | ALPHABET INC-CL A | 26.03 | 3.698T | ||

| META | META PLATFORMS INC-CLASS A | 20.81 | 1.618T | ||

| RDDT | REDDIT INC-CL A | 36.41 | 26.679B | ||

| PINS | PINTEREST INC- CLASS A | 8.03 | 10.417B | ||

| SNAP | SNAP INC - A | 9.46 | 8.158B | ||

| MTCH | MATCH GROUP INC | 10.83 | 7.2B | ||

| DJT | TRUMP MEDIA & TECHNOLOGY GRO | N/A | 3.036B | ||

| IAC | IAC INC | 73.46 | 2.656B | ||

| CARG | CARGURUS INC | 10.53 | 2.61B |

Related stock screener links

View all stocks in the Interactive Media & Services Industry | View all stocks in the Communication Services Sector | View all stocks on the Nasdaq Exchange | Find stocks with similar TA and Setup ratings on the USA exchanges | Find stocks with similar Fundamental rating on the USA exchanges | Find more growth stocks the USA exchanges | Find the competitors with the best technical ratings on the USA exchanges | Find the competitors with the best fundamentals on the USA exchanges | Find the competitors with the best valuation on the USA exchanges | Find the competitors with the best dividend on the USA exchanges | Find the competitors with the best analyst ratings on the USA exchanges

About GOOG

Company Profile

Company Info

ALPHABET INC-CL C

1600 Amphitheatre Parkway

Mountain View CALIFORNIA 94043 US

CEO: Larry Page

Employees: 190167

Phone: 13026365400

ALPHABET INC-CL C / GOOG FAQ

Can you describe the business of ALPHABET INC-CL C?

Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. The company is headquartered in Mountain View, California and currently employs 190,167 full-time employees. The company went IPO on 2004-08-19. The firm's segments include Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes infrastructure and platform services, collaboration tools, and other services for enterprise customers. Its Other Bets segment is engaged in the sale of healthcare-related services and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform provides access to solutions such as artificial intelligence (AI) offerings, including its AI infrastructure, Vertex AI platform, and Gemini for Google Cloud; cybersecurity, and data and analytics. Google Workspace includes cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet.

Can you provide the latest stock price for ALPHABET INC-CL C?

The current stock price of GOOG is 301.18 USD. The price decreased by -1.58% in the last trading session.

Does ALPHABET INC-CL C pay dividends?

ALPHABET INC-CL C (GOOG) has a dividend yield of 0.27%. The yearly dividend amount is currently 0.83.

What is the ChartMill technical and fundamental rating of GOOG stock?

GOOG has a ChartMill Technical rating of 6 out of 10 and a ChartMill Fundamental rating of 7 out of 10.

On which exchange is GOOG stock listed?

GOOG stock is listed on the Nasdaq exchange.

What do analysts say about ALPHABET INC-CL C (GOOG) stock?

69 analysts have analysed GOOG and the average price target is 338.69 USD. This implies a price increase of 12.45% is expected in the next year compared to the current price of 301.18.

What is the Short Interest ratio of ALPHABET INC-CL C (GOOG) stock?

The outstanding short interest for ALPHABET INC-CL C (GOOG) is 0.84% of its float.