(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – November 3, 2025 (After Market Close)

SPY and QQQ grinding higher...

Short Term Trend

- Short-Term Trend: Positive (No Change)

- Next Support at $680

- Next Resistance $690

- Volume: Well Below Average (50)

- Pattern: Down Day - Triple Bottom

- Short-Term Trend: Positive (No Change)

- Next Support at $613

- Next Resistance /

- Volume: Far Below Average (50)

- Pattern: Down Day - Close to ATH

- Short-Term Trend: Neutral (No Change)

- Next Support at $235

- Next Resistance at $252

- Volume: Well Below Average (50)

- Pattern: Down Day - Doji Candle - Reversal Pattern (up)

Long Term Trend

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Positive (no change)

Daily Market Breadth Analysis – November 3, 2025 (After Market Close)

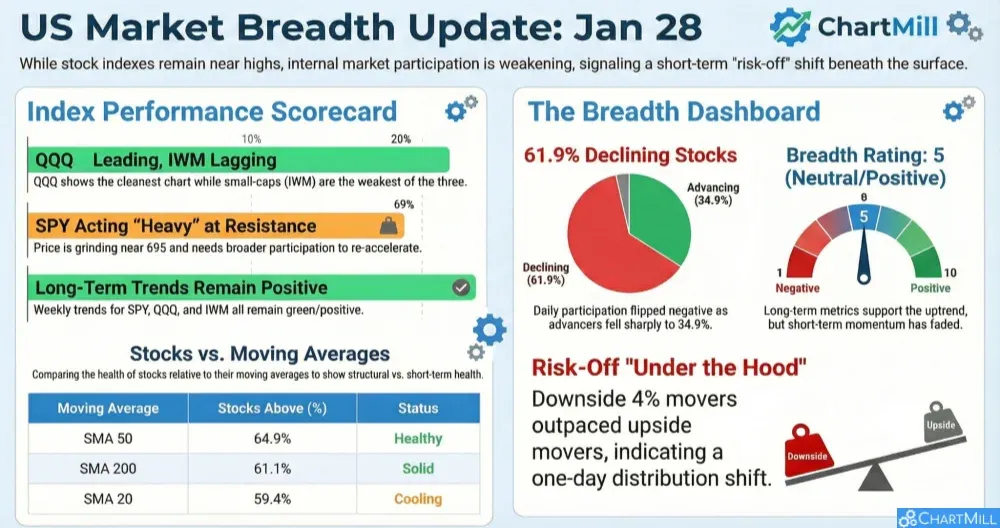

Despite a strong showing from a few tech giants, Monday’s market breadth deteriorated sharply, with most stocks declining and key breadth metrics reversing course. The data confirms a continuation of weakening participation beneath the surface, raising red flags about the sustainability of the broader market’s gains.

After a brief glimmer of strength last Thursday (Oct 31), the market’s internal health worsened again on Monday.

While headline indices may not fully reflect it, the underlying participation deteriorated significantly, mirroring an increasingly narrow rally, a concern already highlighted in our most recent news commentary.

Here’s what the data reveals:

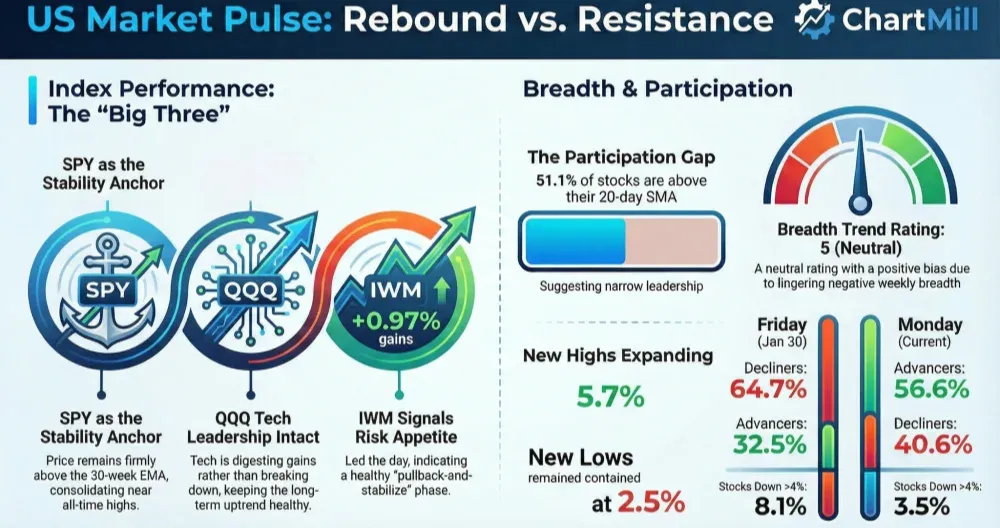

Broad Weakness Returns

-

Advancers vs. Decliners: Only 38.6% of stocks advanced Monday, while 58.8% declined, a sharp reversal from Thursday’s more constructive 57.9% advancers. This decline brings us back in line with the heavy downside seen on Oct 30 and Oct 29.

-

High-Momentum Moves: Just 2.6% of stocks rose more than 4%, while 6.6% fell over 4%. These are weak numbers, showing few strong upside breakouts, and a rising number of large losses.

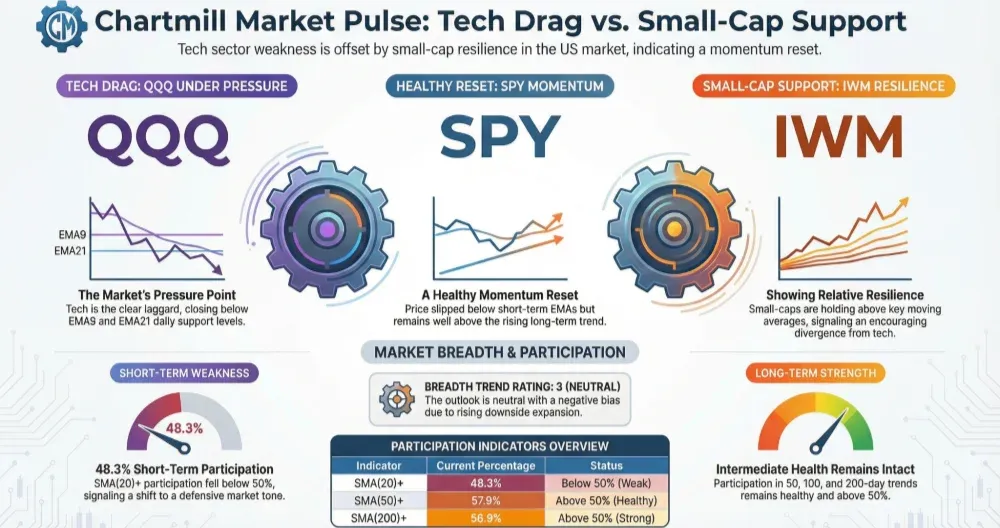

Trend Participation Slipping

The percentage of stocks trading above key moving averages continued to erode:

-

SMA(20)+ dropped to 39.6%, the lowest in 6 sessions.

-

SMA(50)+ fell to 43.9%, and SMA(100)+ to 53.6%, both now clearly trending lower.

-

SMA(200)+ also declined to 57.5%, suggesting even long-term trends are starting to break down for more stocks.

In just two sessions, we’ve seen a steady bleed in trend participation metrics after peaking mid-last week (Oct 28–30).

New Highs Remain Depressed

-

New Highs (NH): Only 2.9% of stocks hit a new high, barely higher than Thursday’s 2.2%.

-

New Lows (NL): At 3%, new lows now exceed new highs for the third time in four sessions.

Reversal in Weekly Momentum

After a strong weekly advance seen on Oct 24–28, this metric has now flipped:

-

Weekly Advancers: Down to 26% (from 56.7% on Oct 28).

-

Weekly Decliners: Up to 73.1%, the worst weekly breadth since Oct 22.

This is a key shift, the short-term momentum clearly turned negative again, erasing the midweek rebound optimism from last Thursday.

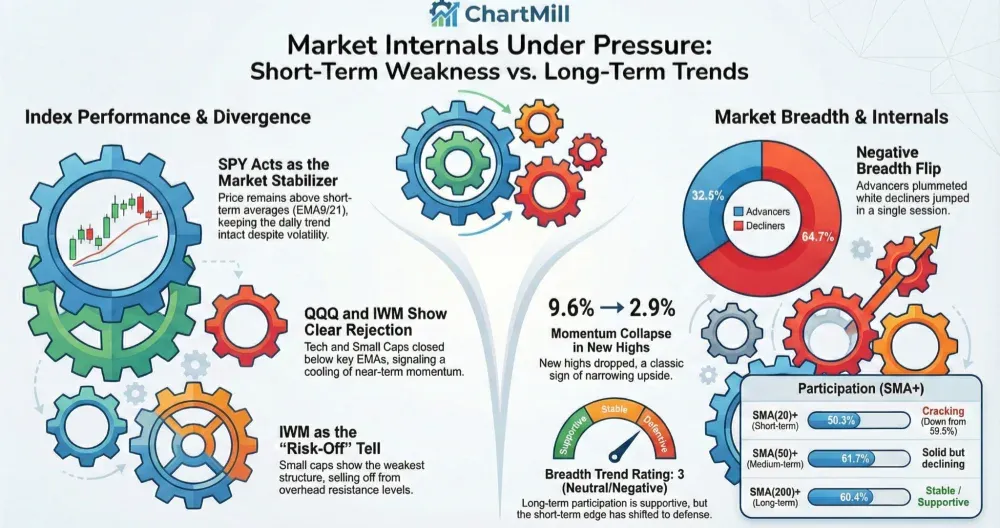

Longer-Term Metrics Starting to Weaken

-

Advancers over 3 months: Dropped to 62.5% from 67.2%.

-

25%+ 3-month gainers: Fell to 14.5%, the lowest level since mid-October.

This suggests that longer-term momentum leaders are fading, even before any significant correction in the indices.

Interpretation

The market breadth has returned to a broadly negative condition.

After Thursday’s brief respite, we’re seeing renewed selling pressure under the surface. The number of stocks above key moving averages is declining, fewer stocks are hitting new highs, and downside momentum is picking up again.

This fits the narrative of a narrow market being carried by a handful of mega cap stocks, as stated in the accompanying market commentary, where 63% of S&P 500 stocks were down despite bullish headlines.

That kind of divergence is often a precursor to sharper corrections, especially if leadership falters.

Breadth Rating: Negative

Despite a temporary bounce late last week, the data clearly confirms the market’s underlying weakness. Breadth has rolled over again with deteriorating short- and medium-term metrics. The trend is firmly pointing downward for most stocks.

Kristoff - ChartMill

Next to read: Amazon Fuels AI Frenzy, Wall Street Remains Split