A Day of Green: Markets Rally as Warner Headlines the Show

Let me get straight to the point, if you were long U.S. equities on Thursday, it probably felt like Christmas came early.

The Dow Jones shattered expectations and cracked a fresh high, closing up 1.4% at 46,108, while the Nasdaq added 0.7%, also notching a new record above the 22,000 mark.

Sure, inflation on a monthly base came in slightly hotter than expected, but Wall Street seemed more focused on what could be rather than what is.

And at the center of that optimism? Warner Bros. Discovery, which soared after a bombshell report suggested a full buyout might be on the table.

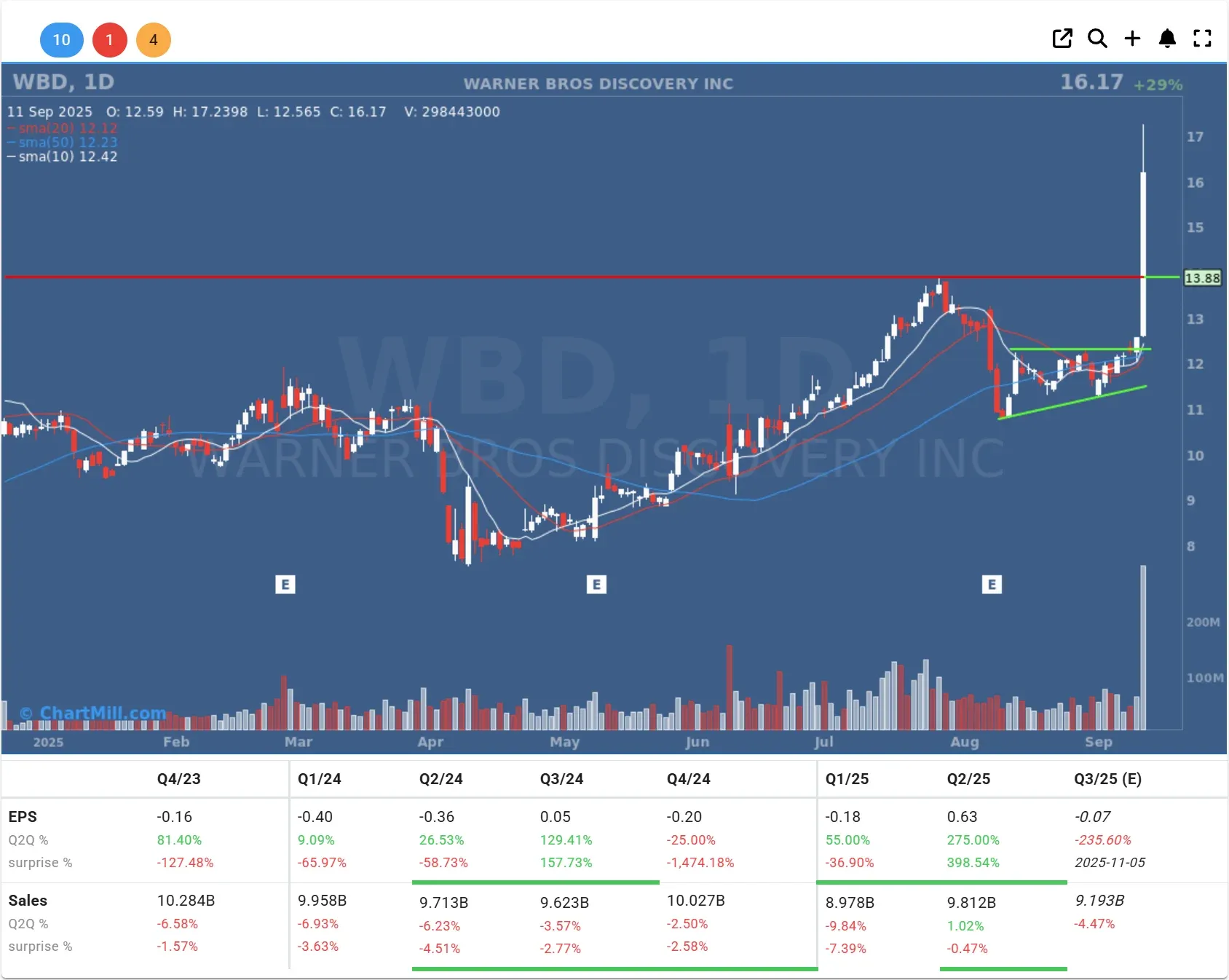

Paramount Eyes Warner Bros: Entertainment Shakeup in the Making?

It’s not every day that a major entertainment conglomerate gains nearly 30% in a single session.

But that’s exactly what happened when The Wall Street Journal reported that Paramount Skydance is prepping an all-cash bid for Warner Bros. Discovery (WBD | +28.95%), backed by the Ellison family. The offer reportedly covers Warner's entire portfolio, from cable networks to film studios, including its streaming arm HBO Max.

This comes just weeks after Warner announced a strategic shift to split its operations between traditional TV and streaming. Coupled with a string of box office hits last quarter, Warner appears to be back on Hollywood’s A-list and now, potentially, on someone else’s balance sheet.

Opendoor Makes a Splash with New CEO

Another stock that stole the spotlight was Opendoor Technologies (OPEN | +79.52%), which skyrocketed after naming Kaz Nejatian (formerly COO at Shopify) as its new CEO. Investors welcomed the news with open arms, perhaps hoping Nejatian’s tech-savvy approach can revive the struggling proptech company.

Let’s not forget, the stock is still trading at $10.52, miles away from its 2021 peak of $34.59, but this appointment adds a spark of hope.

The business model - using AI to buy and sell homes - was once revolutionary. But rising interest rates in 2022 and 2023 put the brakes on housing turnover, a death knell for Opendoor’s volume-based engine.

Apple and AI: A Reality Check

Apple (AAPL | +1.43%) found its way back into the green, but the mood isn’t exactly celebratory. Analyst Gil Luria of D.A. Davidson downgraded the stock from Buy to Hold, citing lukewarm enthusiasm around Apple’s AI push.

"Apple Intelligence," the highly anticipated AI suite, is beginning to look more like "Apple Disappointment." Delayed rollouts, unclear messaging, and a Siri upgrade that feels more like a half-promise than a product, it’s no wonder investors are squinting at the company’s future.

Luria’s take is blunt: even the rumored foldable iPhone, expected in 2026, might not be enough to jumpstart a fresh upgrade cycle.

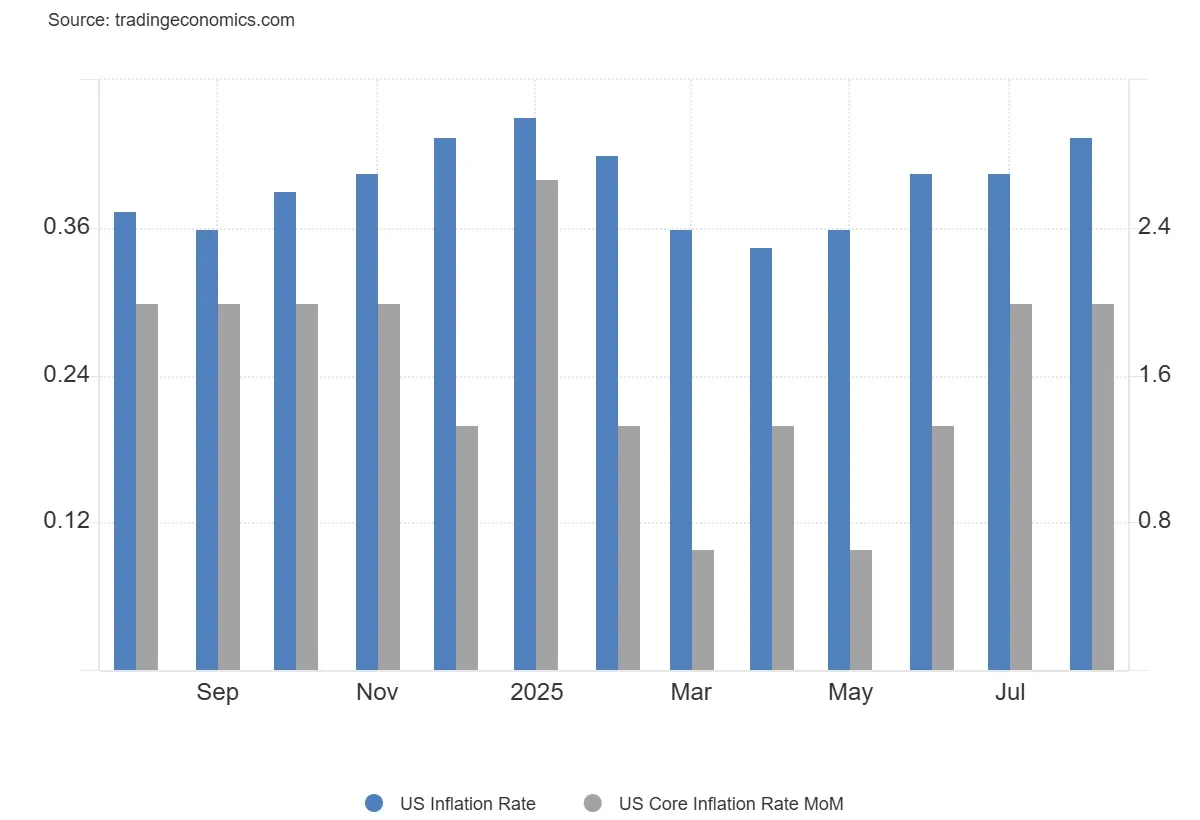

Inflation, Jobs, and the Fed: Mixed Signals

The macro data painted a conflicting picture.

On the one hand, inflation ticked up from 2.7% to 2.9% in August, in line with market expectations. On a monthly basis, the CPI went up 0.4%, the most since January and slightly above expectations (0.3%). Core inflation held steady at 3.1%, still well above the Fed’s 2% target.

But the labor market is cracking. Jobless claims jumped to 263,000, their highest level in nearly four years. This, combined with a cooling job market and persistently sticky inflation, has traders speculating that the Fed might finally cut rates as early as next week.

Analysts like John Kerschner (Janus Henderson) warn that inflation trends are worsening again on a three-month annualized basis.

Oil and the Dollar: A Soft Landing?

Elsewhere, oil prices took a hit. WTI crude dropped 2% to $62.37, dragged down by weak demand data and a gloomy global outlook. Even the IEA chimed in, warning of a possible supply glut. OPEC, ever the optimist, held firm on demand projections.

In FX land, the euro/dollar pair settled at 1.1738, while the 10-year U.S. Treasury yield slipped slightly to 4.02%, reflecting a market cautiously optimistic that rate cuts are around the corner.

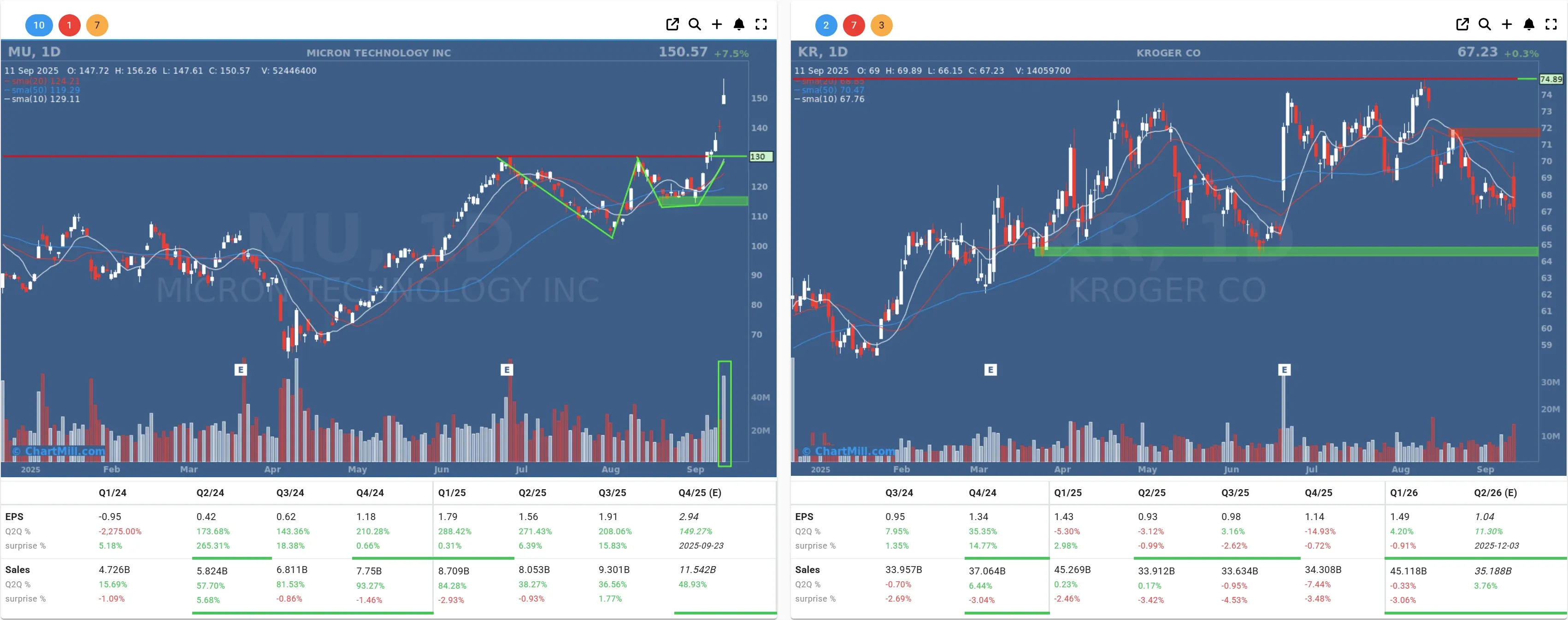

Micron and Kroger Shine in Sector Highlights

Micron Technology (MU | +7.55%) surged after Citi reaffirmed its Buy rating and bumped the price target from $150 to $175, citing its strategic positioning in AI-related chip demand.

Meanwhile, Kroger (KR | +0.83%) nudged higher after raising its full-year guidance, signaling that even in a world of economic uncertainty, people still have to eat, preferably with coupons.

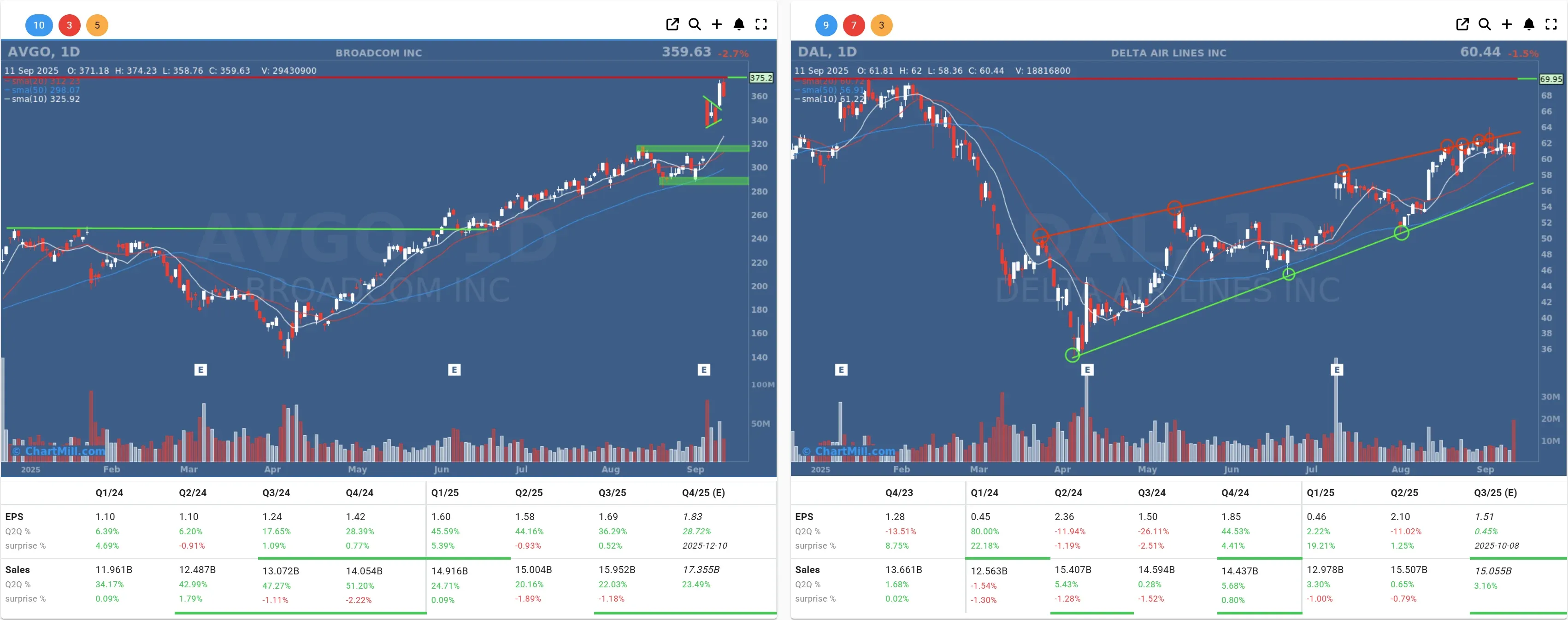

On the flip side, Broadcom (AVGO | -2.69%) took a breather after Wednesday’s Oracle-fueled surge, and Delta Air Lines (DAL | -1.55%) dropped as economy-class seat bookings faltered despite maintaining Q3 guidance.

Wrapping Up

Wall Street’s Thursday session was anything but boring, a cocktail of M&A buzz, shifting Fed expectations, and some eyebrow-raising stock moves.

If nothing else, the day proved one thing: markets still love a good story. And Warner’s potential blockbuster buyout was just that.

Let’s see if the script keeps improving as we head into the weekend.

Kristoff - ChartMill

Next to read: Broad Participation Pushes Breadth Strongly Positive