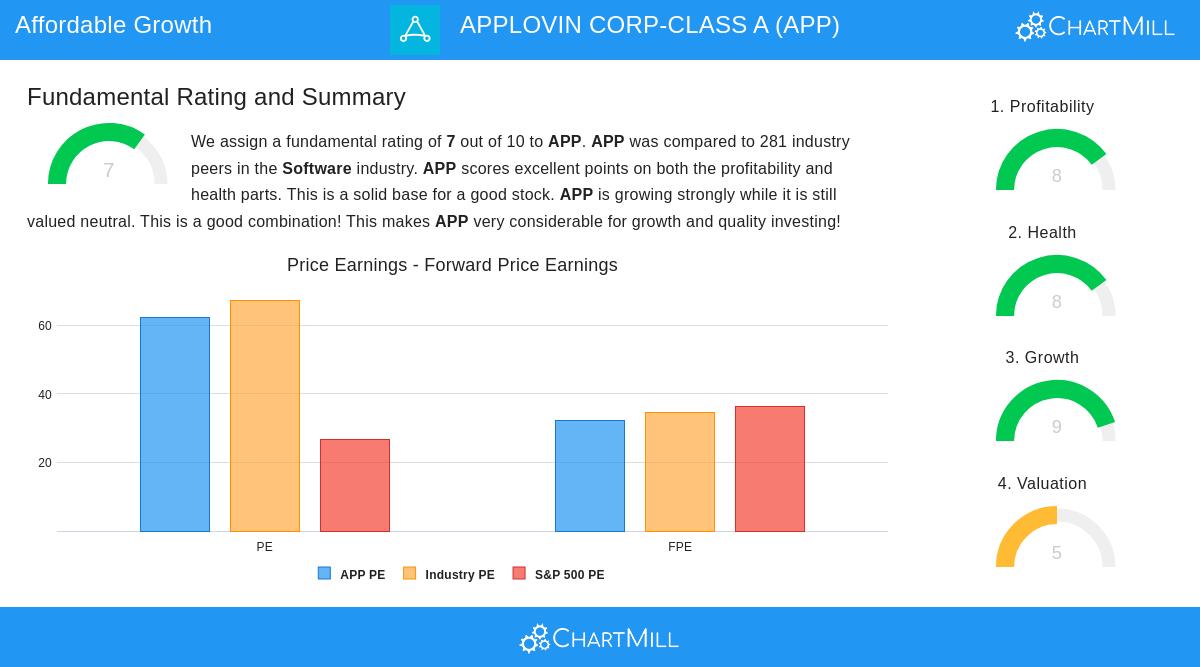

Investors looking for growth opportunities at fair prices often consider the "Affordable Growth" strategy, which finds companies with good growth potential, steady profits, and strong finances, all while steering clear of expensive stocks. This method balances the search for fast-growing businesses with careful price analysis, lowering the chance of paying too much for future earnings. One stock that meets these standards is APPLOVIN CORP-CLASS A (NASDAQ:APP), a mobile marketing and app development firm with solid fundamentals.

Growth: A Major Factor

APPLOVIN stands out with a ChartMill Growth Rating of 9, showing its strong past and expected growth. The company’s revenue rose by 41.6% year-over-year, with a three-year average growth rate of 36.5%. Earnings per share (EPS) jumped by 262.5% in the last year, backed by an average yearly EPS growth of 84.9% in recent years. Analysts predict EPS will grow by 32% per year, while revenue is expected to climb by 24.9%, both well above industry averages. This steady growth makes APP a strong choice for investors focused on expansion.

Valuation: Weighing Price and Potential

APPLOVIN’s ChartMill Valuation Rating of 5 suggests a neutral view, but closer inspection reveals more. The stock trades at a P/E ratio of 62.3, which seems high compared to the S&P 500 average of 26.8. However, its forward P/E of 32.1 is more reasonable, slightly below the S&P 500’s 36.2 and lower than 64.8% of its software industry peers. The PEG ratio is also low, meaning the stock’s higher price might be fair given its earnings growth. For Affordable Growth investors, this mix of price and growth is key—APP isn’t cheap, but its growth could justify the cost.

Profitability and Financial Health: Solid Base

APPLOVIN’s Profitability Rating of 8 highlights its ability to turn revenue into earnings effectively. Key points include:

- Return on Equity (ROE) of 333.5% and Return on Invested Capital (ROIC) of 43.9%, both among the best in the software industry.

- Operating margins of 46.5% and profit margins of 37.4%, beating nearly all competitors.

Its Health Rating of 8 reflects a strong balance sheet: - A Debt-to-FCF ratio of 1.5 suggests manageable debt, with enough cash flow to cover payments.

- An Altman-Z score of 18.0 points to very low bankruptcy risk, though its high debt-to-equity ratio (6.1) needs watching.

Why These Metrics Fit Affordable Growth

The Affordable Growth strategy favors companies like APPLOVIN because they mix high growth with steady profits and fair prices. Paying too much for growth can lead to poor returns if earnings fall short, but APP’s strong performance—especially its top-tier margins and growth rates—suggests it can succeed. The stock’s price, while not a bargain, seems fair given its growth potential and operational strength.

For investors wanting to find more stocks like this, the Affordable Growth screener offers other options.

Disclaimer: This article is not investment advice. Do your own research or talk to a financial advisor before making investment decisions.