The Nasdaq took a sharp hit on Tuesday as investors cashed in on AI and tech names, dragging major indices lower.

The “Magnificent Seven” tech stocks all ended in the red, led by Nvidia and Meta, while Intel soared on SoftBank’s $2 billion investment.

Home Depot bucked the trend, offering [a reassuring earnings outlook despite soft results. Geopolitical tailwinds nudged oil prices lower as peace talks on Ukraine gained traction.

Big Tech Hits Pause — “Perfect” Can’t Last Forever

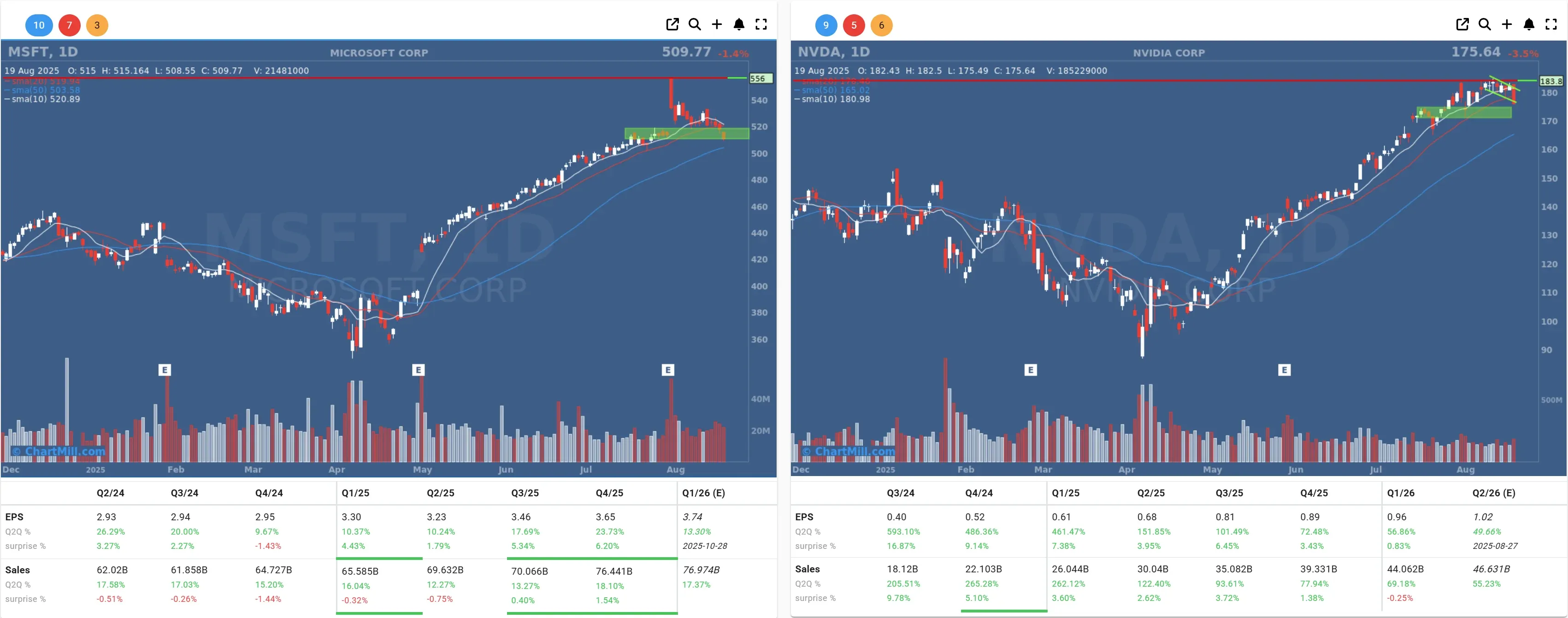

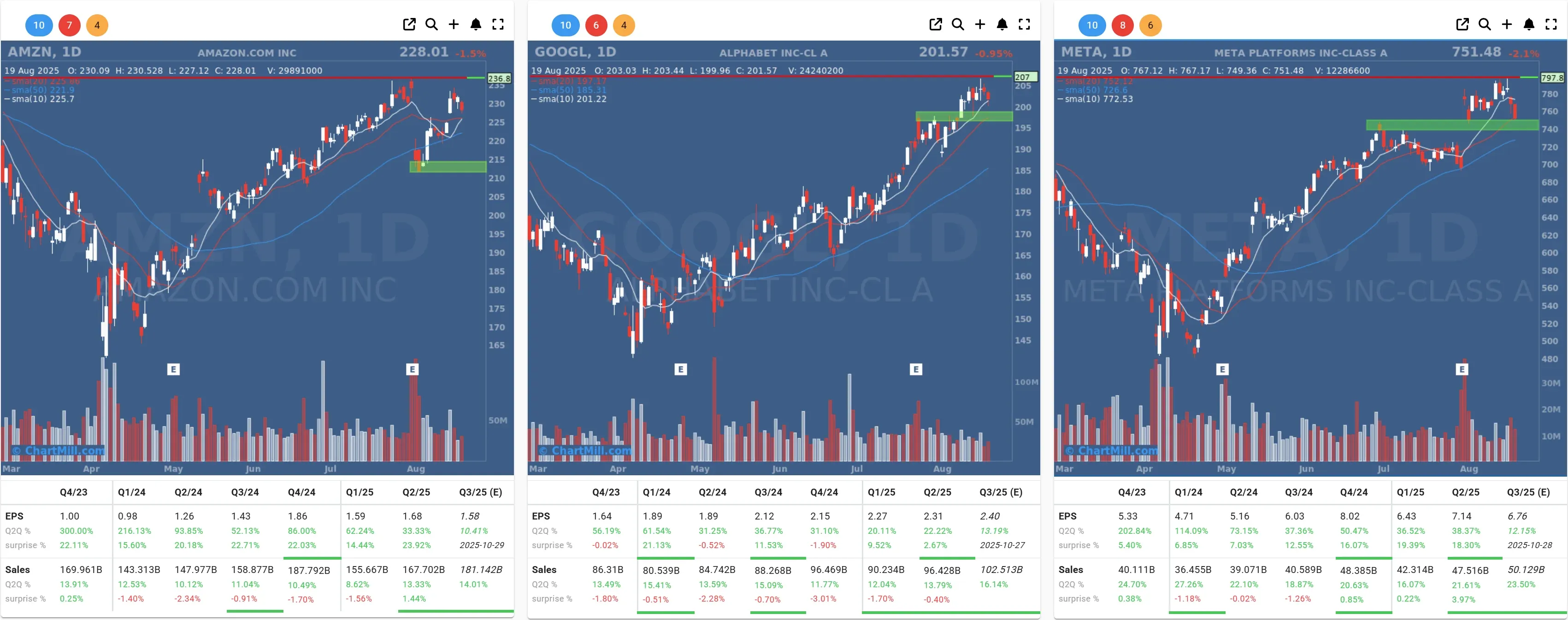

Let’s be honest, the air was getting pretty thin up there. After a relentless climb fueled by AI hype and sky-high expectations, the Nasdaq finally flinched, dropping 1.5%. The culprit? The usual suspects: Nvidia (NVDA | -3.5%), Microsoft (MSFT | -1.42%), Alphabet (GOOGL | -0.95%), Meta (META | -2.07%) and even Amazon (AMZN | -1.5%).

What we’re seeing is classic profit-taking in names that were priced for perfection. As Strategas’ Nicholas Bohnsack put it, “It’s easy to invest when the path of least resistance is up.” But perfection is fragile, especially when valuation gets stretched.

Intel Defies the Trend — SoftBank Bets Big

One name that didn’t get the memo about the tech selloff was Intel (INTC | +6.97%).

The chipmaker rallied hard after SoftBank disclosed a $2 billion stake, and additional reports suggested the Trump administration is mulling a 10% government stake to shore up U.S. chip capacity. Intel closed at $25.31, making it the day’s outlier among tech.

Home Depot Holds the Line Amid Consumer Uncertainty

Over in the real world — the one with bricks, mortar, and rising interest rates — Home Depot (HD | +3.17%) posted a mixed earnings report.

Revenue hit $45.3B, up 4.9% year-on-year, and EPS came in at $4.58, both just shy of estimates. Customers are hitting the pause button on big-ticket renovations like kitchens and bathrooms, according to CFO Richard McPhail, but they’re not canceling entirely.

Despite lukewarm figures, the company reaffirmed its full-year guidance, which markets welcomed. Analysts remain positive, citing Home Depot’s investments in contractor services, online growth, and logistics as long-term tailwinds — especially once the housing market stabilizes.

Bonus tension? The company now expects to raise prices in the second half of the year in response to Trump’s fresh wave of import tariffs.

Palo Alto Networks Delivers the Goods

Amid the broader tech gloom, Palo Alto Networks (PANW | +3.06%) offered a bright spot.

The cybersecurity firm raised its full-year revenue forecast to $10.5B, beating expectations by $100 million. Investors applauded not just the numbers, but the company’s aggressive push into AI-enhanced security tools and its blockbuster $25B acquisition of CyberArk last month.

Still, the recent departure of CTO Nir Zuk raised some eyebrows — a potential wildcard in the company’s evolving strategy. Morgan Stanley raised its price target to $210 and reiterated its bullish stance, noting that the firm's “platformization” strategy is gaining traction.

Macro: Housing Resilience & Fed Watch

Tuesday’s surprise came from housing starts, which unexpectedly jumped 5% in July to 1.358 million, bucking forecasts of a decline. That’s a rare positive beat in recent U.S. macro data.

Building permits dipped slightly, but the overall message is that housing supply is still showing signs of life — perhaps in anticipation of eventual rate cuts.

All eyes now turn to the Fed minutes due Wednesday and Jerome Powell’s speech at Jackson Hole on Friday. Russell Investments warned markets not to expect a soft dovish tone; while a September cut remains likely, the odds of a 50 basis point move are virtually off the table.

Ukraine Peace Hopes Nudge Oil Down

Geopolitics stirred the pot again as President Trump hosted Ukrainian President Zelensky, along with NATO leadership and European allies.

Talks reportedly included U.S. security guarantees and an eventual Putin–Zelensky meeting. Polymarket puts the odds of a ceasefire before year-end at 38%, well down from 78% in March but still a noticeable bump from recent lows.

That hint of diplomacy pressured oil prices, with WTI crude falling 1.7% to $62.35, as traders priced in lower odds of further sanctions on Russian oil.

What to Watch Next

With Jackson Hole looming and Powell set to speak, expect markets to stay jumpy. I’ll be watching:

-

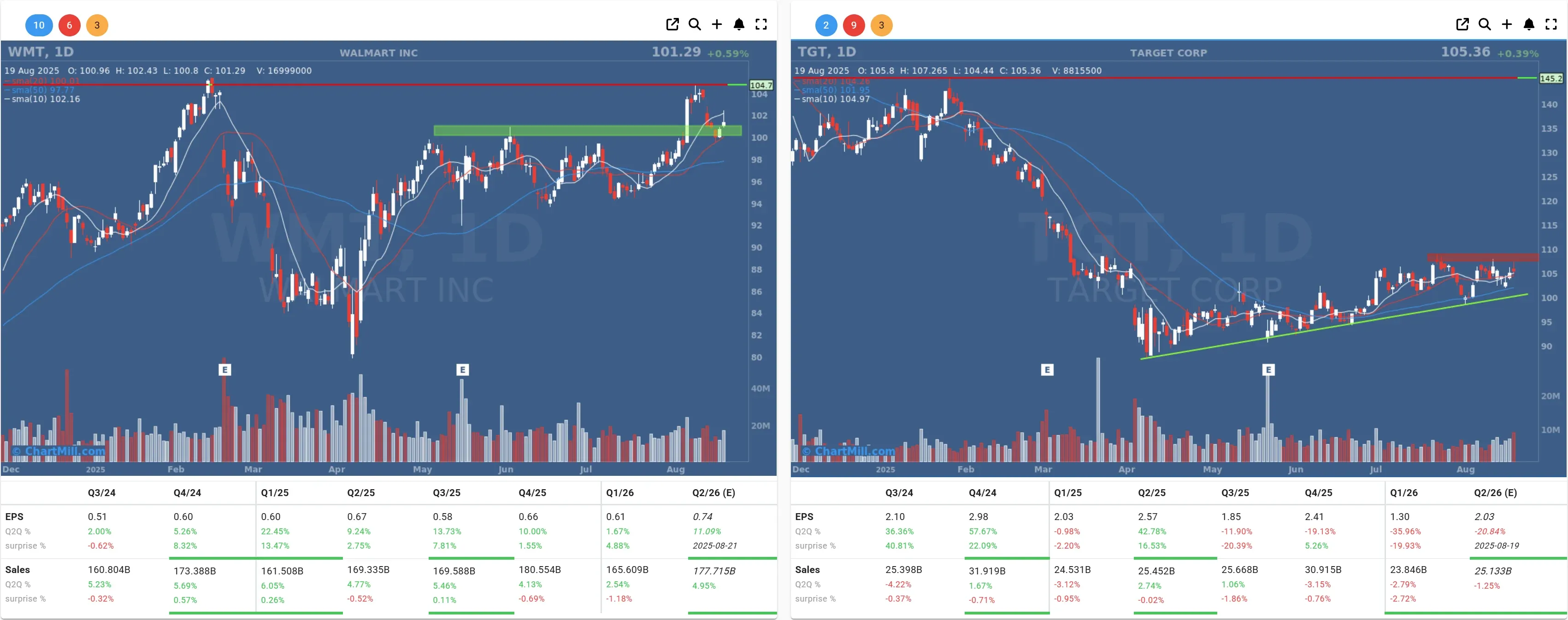

Retail earnings from Walmart (WMT | +0.59%) and Target (TGT | +0.39%) later this week — a litmus test for U.S. consumers and tariff impact.

-

Any follow-up chatter on government equity stakes in Intel or other chipmakers.

-

How the market digests potential peace developments in Ukraine — a wildcard for oil, defense, and broader risk appetite.

My Takeaway

Yesterday was a recalibration.

The AI trade isn’t dead, but it just got a dose of valuation sobriety. In the meantime, there’s still money rotating under the surface, into names like Intel, Home Depot, and Palo Alto. That tells me the market isn’t afraid, just pickier. And honestly, after this year's melt-up, that’s probably a healthy thing.

Let’s see what Powell throws at us on Friday. Buckle up.

Kristoff - ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, August 20 BMO