What is Growth Investing?

Stocks that are expected to grow significantly faster than their sector peers and the overall market average (both in terms of earnings and price evolution) are considered growth stocks. Investors who invest in growth stocks do so specifically because they expect the price of the stock to rise exponentially, thereby aiming for capital appreciation rather than dividends.

A major advantage of growth stocks is that the price gains can be enormous, which means that a limited investment can offer the prospect of exceptionally high returns. However, it should be noted that not every growth stock is an equal success story. Also keep in mind that for typical growth stocks you cannot count on substantial dividends. High-growth companies invest any profits in the continued growth of the company rather than distributing them to shareholders.

Both Amazon and Netflix are classic examples of growth stocks.

HOW TO RECOGNIZE GROWTH STOCKS?

Investing in growth stocks is very popular but to be successful you should not rush when it comes to picking the right stocks. Be aware that investing in growth stocks remains a risky investment and that not all stocks will be equally successful, a considerable number of companies that look attractive at first sight will never even succeed in realizing their growth perspectives. Fortunately, in order to significantly increase your chances of success when selecting the right growth stocks, there are a number of common criteria that can help you when valuing growth stocks.

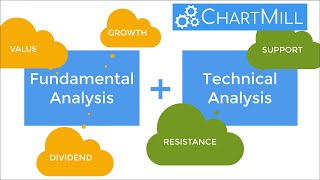

In this article, we focus on a number of quantitative fundamental ratios that are important when choosing the right growth stocks. These are criteria that derive directly from published company figures, their quantitative nature makes them objective and generally quite easy to interpret.

In addition, we list a number of additional and more general basic conditions that are at least as essential when assessing potential growth stocks. Many investors make the mistake of focusing only on the quantitative aspects of the company itself and the sector to which it belongs, while it is precisely the more qualitative general conditions that largely determine the success of growth stocks. Make sure you take this into account!

QUALITATIVE CONDITIONS

Target Market

To clarify the importance of the target market I will start with a very simple example, being the language in which this article is written; English. After all, there are more than 380 million people worldwide who have English as their mother language and another 1 billion people speak English as a second or third language. More than 50 countries worldwide use English as an official language.

A simple comparison with the French language tells us that there are about 250 million people worldwide who speak French as a mother tongue and another 200 million as a second language. This is all spread across 33 countries where French is the official language.

Suppose I wrote this article only in French, then the target group who can read this article would be significantly smaller. It is the same when selecting growth stocks. The larger the target market on which the company focuses, the larger the number of potential customers and the greater the chance that the growth stock will actually be a success. Particularly in the case of exclusive or niche products that are not intended for the masses, it is important to have a sufficiently large and broad target market.

Growth Potential

Besides having a sufficiently large sales market, there is a second additional condition that is crucial for typical growth companies. The market must at least be ready for growth or - even better - the growth is already in the initial phase. It makes little sense to invest in (new) companies whose activity is still focused on long-trodden paths where there are already signs that the industry is stagnating or will disappear altogether. The classic car industry, for example. The current transition that car manufacturers worldwide are having to make in terms of the electrification of their vehicle fleets speaks volumes and is a textbook example of a business sector that needs to adapt to changing social trends at lightning speed. Sectors that do not keep up with this transition will fall behind and eventually disappear. A similar phenomenon was seen many years ago with the switch from analogue to digital photography.

As an investor, it is crucial to have a special eye for these new emerging social trends and sensibilities. The global awareness of everything to do with the environment and climate, for example, are two very typical issues that companies will have to take into account in their business plans.

Market Share

The companies you are retaining do not necessarily have to be the very largest in their sector (otherwise they would probably no longer be typical growth stocks), yet it is important that the company in question has sufficient market share in the new growth market. This is only possible if the company is able to maintain its competitive advantage in the future. In this sense, it is important to look at whether there is sufficient focus on the further development and improvement of the product and to ask oneself whether the company is able to provide new innovative products that can become just as successful.

Management

Without the necessary experience and dynamics of a driven team, it is nearly impossible to become (or remain) successful in the long term. However, dynamism and leadership should not be confused with recklessness. It comes down to management's ability to create its own clear innovative story within the sector in which it operates. A clear vision forward focused on the long term is crucial in this regard. Sufficient introspection and an open mind to be able to adapt adequately - if necessary - to ever more rapidly changing social trends are qualities that are of prime importance in today's society. Who these people are and what their track record is definitely deserves the necessary attention before investing in these companies.

QUANTITATIVE CRITERIA

The quantitative criteria for identifying typical growth stocks can be found in this separate article.

SUMMARIZED

Those who choose to invest in growth stocks do so because they are convinced that the stock in question will outperform its sector peers, ultimately resulting in a larger price gain. Selecting the right growth stocks requires sufficient analysis and experience. Do not make the mistake of looking only at current or historic company results and ratios. Past performance is no guarantee of future results. Future-oriented thinking and incorporating more general social trends in the analysis are extremely important. Is the current target market large enough and management strong enough to at least maintain the existing competitive advantage? Is there still sufficient growth potential in the industry in which the company operates and are the resources and know-how in place to make the switch and develop new innovative products?

Investing in the right growth stocks can be enormously lucrative; there are plenty of examples that have shown what phenomenal returns are possible by investing early in such stocks and giving them every opportunity to develop into the mega-companies they have now become.

A successful investment in growth stocks could be defined as stocks that you bought a long time ago because of the growth potential, but which have since become so big that now, with the same stocks in your portfolio, you have become more of a value investor!