A Sudden Turn in Sentiment

It started as a calm, slightly positive trading day, until Donald Trump decided to shake things up again.

A single Truth Social post of roughly 500 words was enough to wipe billions off the markets. The U.S. president threatened “gigantic tariffs against China", accusing the country of ”holding the world hostage” through its control over rare earth exports.

The result? A brutal sell-off that left nearly no corner of the market untouched. The Nasdaq plunged 3.6%, the S&P 500 dropped 2.7%, and the Dow Jones lost 1.9%, marking the worst trading day since April. Roughly 400 of the 500 S&P constituents ended the day in the red.

AI Stocks Take the Hardest Hits

When investors rush to de-risk, they often start by dumping their most expensive darlings and this time, that meant the AI favorites.

Nvidia (NVDA | -4.89%), Apple (AAPL | -3.45%), Amazon (AMZN | -4.99%), and Meta (META | -3.85%) all took sharp hits.

Ironically, these are the same stocks that have powered much of Wall Street’s rally this year. And as is often the case, what goes up too fast can come down just as quickly. Some analysts even whispered the unholy word: bubble.

Trade War Déjà Vu

The trigger for all this chaos was Beijing’s decision to further restrict exports of rare earth elements, critical components for both the tech and defense industries. Trump’s fiery response instantly reminded investors of the 2018–2019 trade war days.

Adding fuel to the fire, Trump hinted he may skip his planned meeting with China’s President Xi at the upcoming APEC summit in Seoul. “There’s no reason to meet if China keeps acting hostile,” he posted.

Few Safe Havens Left

In times of panic, investors instinctively reach for shelter.

Gold jumped back above $4,000 per troy ounce (+1%), while yields on U.S. 10-year Treasuries fell 9 basis points to 4.05% as money flowed into bonds.

But that didn’t help Levi Strauss (LEVI | -12.55%), which saw its shares tumble more than 10% despite solid quarterly results. The company raised its full-year revenue outlook, but CFO Harmit Singh warned that tariffs are already starting to bite.

That was enough to spark a round of profit-taking after a strong 40% rally year-to-date.

A Few Bright Spots Amid the Gloom

Not everyone bled red ink.

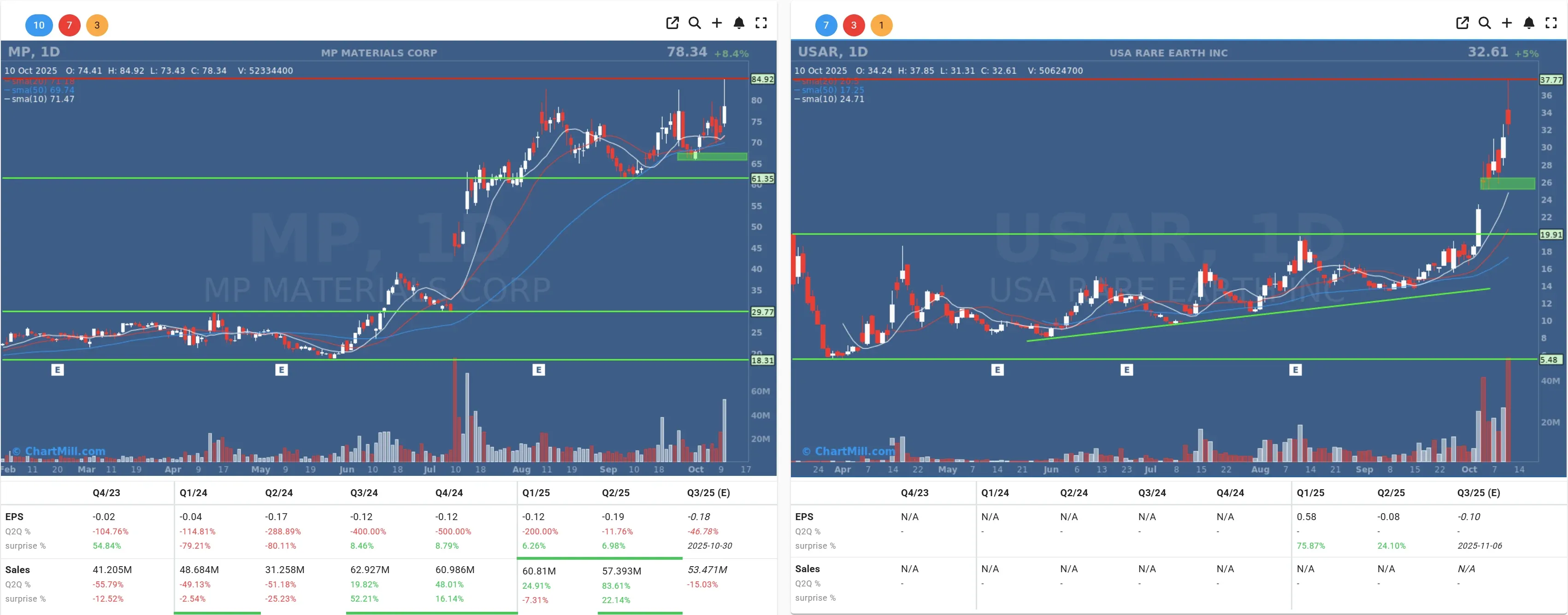

MP Materials (MP | +8.37%) and USA Rare Earth (USAR | +4.96%) surged as investors bet they could benefit from the renewed focus on domestic rare-earth production.

Meanwhile, Protagonist Therapeutics (PTGX | +29.77%) rocketed higher on reports that Johnson & Johnson (JNJ | -0.19%) is in acquisition talks with the biotech firm.

Applied Digital (APLD | +16.05%) also impressed after announcing stronger-than-expected resultsand a new deal with AI infrastructure player CoreWeave.

Crypto’s Flash Crash: When Leverage Met Geopolitics

Friday’s tariff bombshell from Trump was especially toxic for the crypto world, and for one simple reason: leverage.

Over $19 billion worth of crypto positions were liquidated in 24 hours, the largest single-day wipeout in crypto history. Bitcoin alone saw more than $3.7 billion in liquidations on long positions in just one hour, while Ethereum and a host of altcoins were also caught in the carnage.

Because many crypto traders use extremely high leverage (20×, 50× or even 100× isn’t unusual), even a relatively modest directional shock can cascade into margin calls and forced liquidations.

As prices started dropping, auto-deleveraging mechanisms kicked in at exchanges, sucking momentum further downward in a vicious feedback loop.

What’s especially telling is that this crash wasn’t triggered by a crypto-specific scandal, hack, or regulatory surprise, it came from an external macro policy move. That tells you how sensitive the crypto market now is to flows, leverage, and macro shocks more than fundamentals.

As one crypto commentator put it, the crash “exposed the dark side of the leverage boom.”

A Weekend of Damage Control

In an almost comedic twist, Trump tried to soften his tone over the weekend: “Don’t worry about China? it’s all going to work out,” he wrote.

Investors weren’t entirely convinced, but at least it offers a chance for a small relief rally when markets reopen Monday.

Still, the message is clear: the trade war ghost is back, and it’s haunting Wall Street once again. Investors would do well to fasten their seatbelts, because this ride isn’t over yet.

Kristoff - ChartMill

Next to read: Market Breadth Worsens Sharply as Selling Pressure Intensifies