Just when it looked like Tuesday would turn into another red day for Wall Street, Jerome Powell managed to pull a rabbit out of his hat.

The Fed chair hinted during a speech in Philadelphia that the central bank might soon end its balance sheet runoff, a signal markets took as a step toward looser financial conditions.

Stocks, which had opened more than 1% lower, rebounded sharply. The Dow Jones finished +0.45%, while the Nasdaq trimmed its losses to –0.75%.

Powell emphasized that the Fed is “monitoring a wide range of indicators” and may soon stop shrinking its bond holdings, a process known as quantitative tightening. The program, launched in 2022, has gradually drained liquidity from the system and according to Powell, it’s starting to show in the money markets. “We want to avoid tensions like those of 2019,” he said, referring to the sudden liquidity crunch that forced emergency interventions back then.

The Fed chief also acknowledged a cooling labor market, reinforcing expectations for another rate cut later this month, the second one this year.

“The downside risks for employment appear to have increased,” he noted.

Big Banks Kick Off Earnings Season

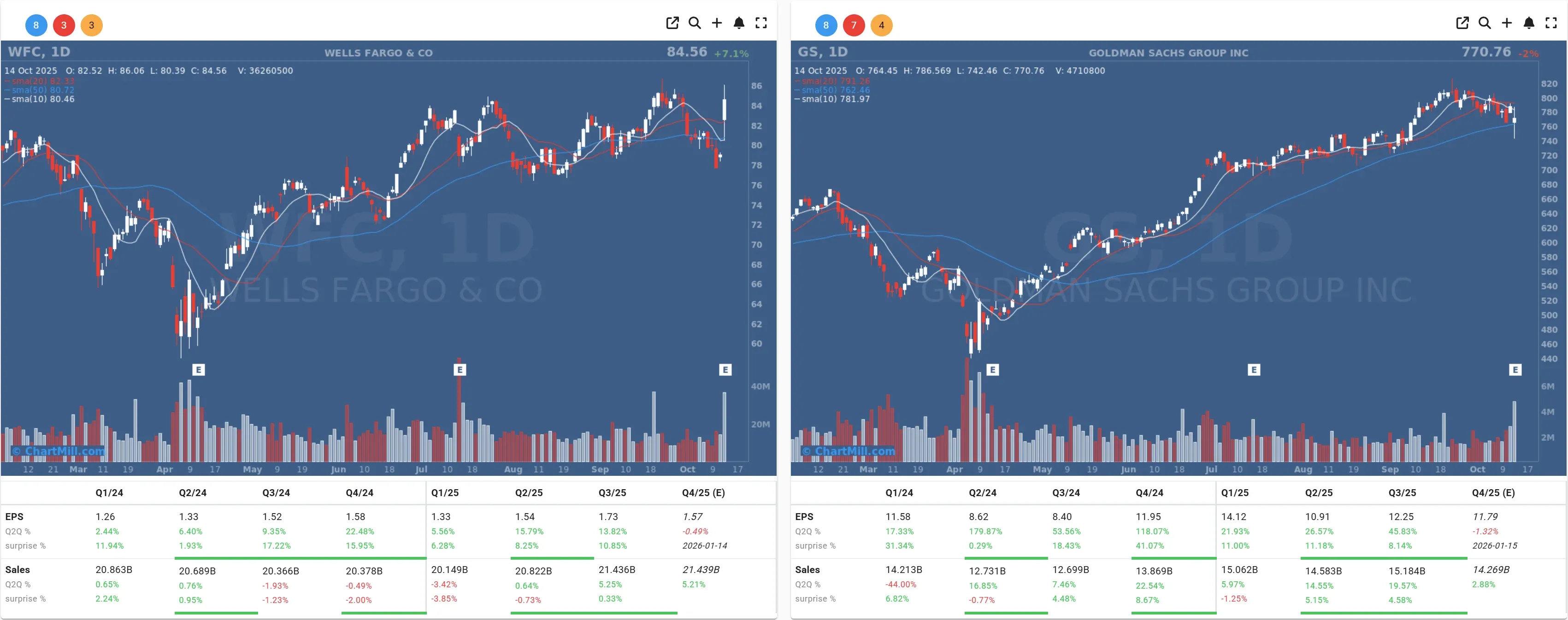

Earnings season opened in typical fashion, with the big four banks taking the stage.

JPMorgan Chase (JPM | –1.91%), Goldman Sachs (GS | -2.04%), Citigroup (C | +3.89%), and Wells Fargo (WFC | +7.15%) all reported solid third-quarter results, but the market reactions were far from uniform.

JPMorgan’s profit rose 12% to $14.4 billion, yet the stock fell after CEO Jamie Dimon warned about “persistent uncertainties” tied to geopolitics, inflation, and the labor market. He also highlighted higher loan-loss provisions, now $3.4 billion, up from $3.1 billion a year ago.

Meanwhile, Wells Fargo stood out as the S&P 500’s top performer after earnings of $1.66 per share, easily topping analyst expectations of $1.55. CEO Charlie Scharf credited “a resilient U.S. consumer” for the strong performance.

Also:

Trump Rekindles the Trade Fire

Just when the market started breathing easier, President Donald Trump decided to remind investors that calm is always temporary. He lashed out at Beijing once again, threatening additional 100% tariffs on Chinese imports, accusing China of deliberately reducing U.S. soybean purchases, an “economically hostile act,” in his words.

“Much depends on what the Chinese do,” said trade envoy Jamieson Greer, while assuring that the planned Trump–Xi meeting at the end of October is still on track. It’s hard to imagine those handshakes being warm, though.

Sector Moves and Other Highlights

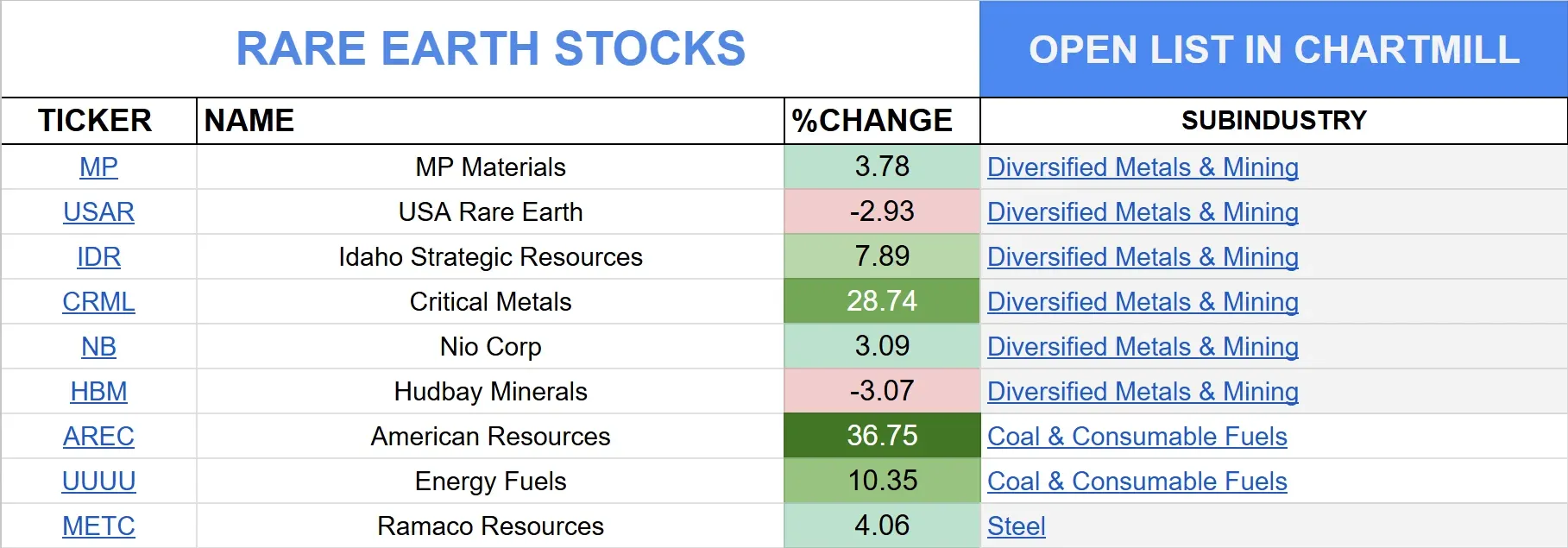

Shares related to rare earth metals extended Monday’s rally, with Critical Metals (CRML | +28.74%) and MP Materials (MP | +3.78%) gaining further after Monday’s 20% surge, as traders bet on more supply disruptions.

Direct link to 'Rare Earth Stock Charts' in ChartMill

Among other major movers, BlackRock (BLK | +3.39%) climbed after reporting assets under management of $13.5 trillion. Yes, trillion with a t.

Walmart (WMT | +4.98%) also surprised positively after announcing a partnership with OpenAI, allowing customers to shop directly through ChatGPT. The retail giant seems to understand that AI is more than just a buzzword.

Meanwhile, Johnson & Johnson (JNJ | –0.3%) edged lower despite raising its guidance and announcing plans to spin off its artificial joint business, DePuy Synthes.

Macro Picture: Caution Prevails

With the U.S. government still partially shut down, fresh economic data remain scarce. The NFIB small business confidence index dropped two points to 98.8, the first decline in three months. The uncertainty subindex jumped seven points to 100? one of the highest readings in over five decades.

On the macro front, the 10-year Treasury yield fell to 4.03%, while the euro/dollar rose to 1.1602. Gold gained modestly, silver slipped, and WTI crude oil dropped nearly 2%.

My Take

Powell’s tone gave Wall Street exactly what it wanted to hear, a signal that the Fed might soon stop tightening the liquidity screws. But before investors get too comfortable, the renewed trade rhetoric from Trump serves as a timely reminder that geopolitics can derail sentiment at any moment.

In short: the market may have found some relief, but this rally still feels like it’s walking on eggshells.

Kristoff - ChartMill

Next to read: Two-Day Thrust, But Short-Term Repair Work Remains