Wall Street Stumbles as Trump Targets Fed Chair Powell Again, While Netflix Shines

Wall Street had a rough start to the week as markets reopened after the Easter holiday. U.S. stocks plunged Monday, triggered by renewed political pressure from former President Donald Trump on Federal Reserve Chair Jerome Powell and growing concerns over global trade tensions.

The Dow Jones lost 2.5%, the S&P 500 dropped 2.4%, and the tech-heavy Nasdaq fell 2.6%. The declines came amid increasing doubts about the Fed's independence, a key pillar of investor confidence.

Trump intensified his attacks on Powell, calling him a "major loser" on his social platform Truth Social and blaming him for not lowering interest rates fast enough. These remarks followed earlier reports that Trump’s team is exploring legal options to remove Powell before his term ends in May 2026.

Trump's criticism has drawn bipartisan concern. Both Fed officials and some Republican senators emphasized the importance of central bank independence. Chicago Fed President Austan Goolsbee warned that political interference in monetary policy could be damaging, while Senator John Kennedy reminded the public that a president cannot simply fire the Fed chair.

Markets reacted sharply to the political turmoil. The U.S. dollar dropped to multi-year lows against both the euro and Swiss franc, while gold prices surged past $3,400, setting a new record. Bond yields also rose, with the 10-year Treasury yield climbing to 4.39%, reflecting investor anxiety.

Trade tensions added to the sour mood. A Japanese trade delegation left Washington without a deal, while China threatened retaliation against countries that support U.S. efforts to isolate Beijing economically. Trump, meanwhile, called on CEOs to move production back to the U.S. to avoid his tariffs and criticized what he sees as unfair trade practices.

Despite the broad sell-off, Netflix (NFLX | +1.53%) stood out as a rare winner. The streaming giant gained 1.5% after strong Q1 earnings, beating expectations with $6.61 in EPS and $10.54 billion in revenue. Analysts highlighted Netflix’s pricing power, predictable subscription model, and a weaker dollar as tailwinds.

Morgan Stanley’s Benjamin Swinburne noted that currency effects could further boost reported earnings, while Piper Sandler's Tom Champion labeled Netflix a "defensive stock" in turbulent times.

Tesla (TSLA | -5.75%), on the other hand, dropped 5.8% ahead of its earnings release Tuesday after weak delivery numbers earlier this month.

Nvidia (NVDA | -4.51%) fell 4.5% amid news it will write off $5.5 billion due to new U.S. export restrictions, and Uber (UBER | -3.08%) lost 3.1% after facing a lawsuit from the FTC over its subscription service.

Meanwhile, UnitedHealth (UNH | -6.34%) continued its plunge, down another 6.4% following a guidance cut.

Looking ahead, investors will be watching earnings reports from major firms including Alphabet (GOOG | -2.28%) , Intel (INTC | -0.48%), IBM (IBM | -1.08%), Texas Instruments (TXT | -1.91%), Boeing (BA | -1.58%), and Lockheed Martin (LMT | -1.24%) later this week.

With political uncertainty and macroeconomic concerns swirling, markets remain on edge—and all eyes are on whether Powell can maintain the Fed’s course amid growing external pressures.

Daily Market Analysis – April 21, 2025 (After Market Close)

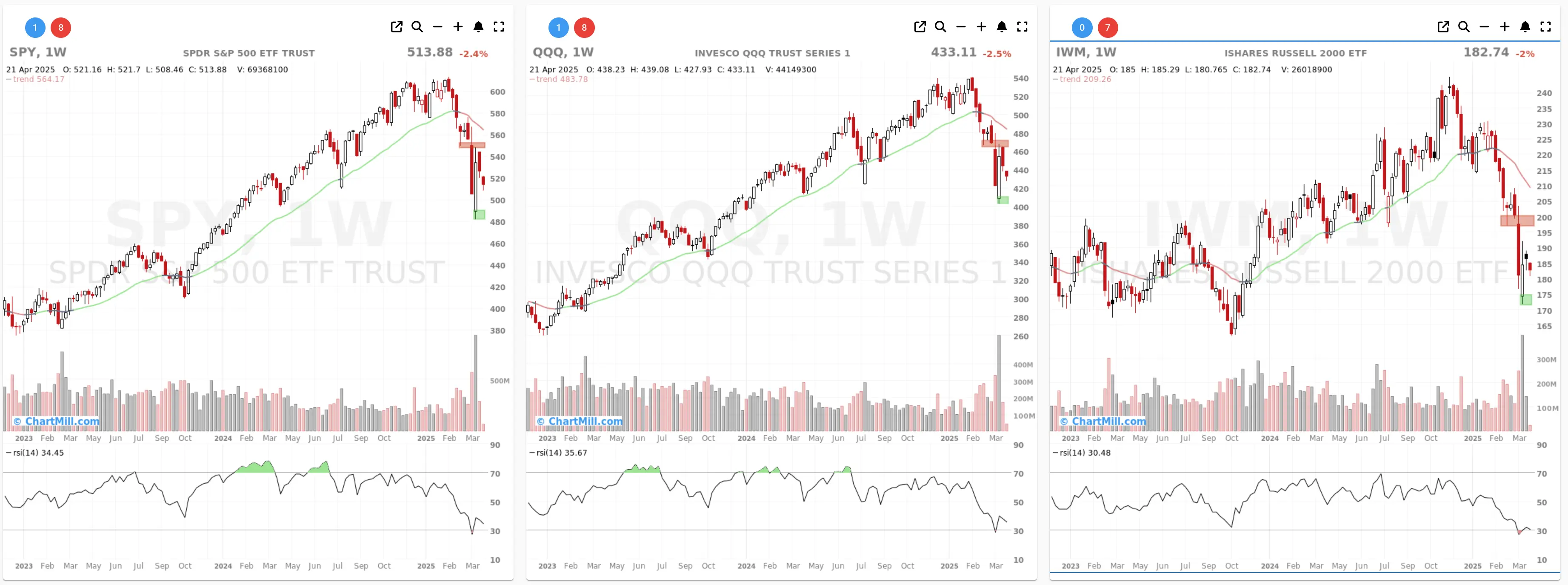

Short Term Trend

- Short-Term Trend: Down (no change)

- Support at $500

- Resistance at $550

- Volume: slightly below average (50)

- Pattern: Gap Down Day

- Short-Term Trend: Down (no change)

- Support at $415

- Resistance at $466

- Volume: slightly below average (50)

- Pattern: Gap Down Day

- Short-Term Trend: Down (no change)

- Support at $170

- Resistance at $197

- Volume: below average (50)

- Pattern: /

Long Term Trend

- Long-Term Trend: Down (no change)

- Long-Term Trend: Down (no change)

- Long-Term Trend: Down (no change)

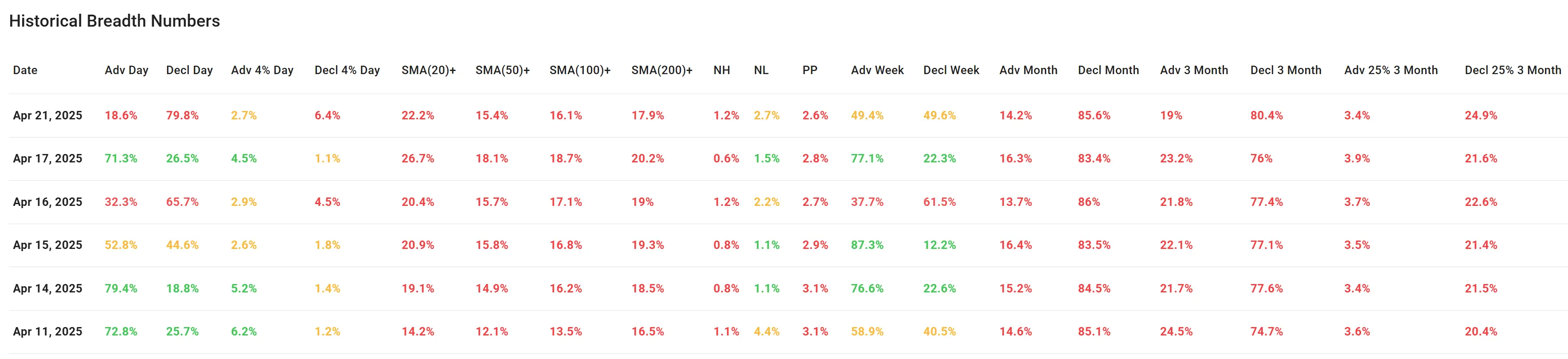

Market Breadth Analysis for April 21, 2025 (After Market Close)

The data shows a clear and sharp decline in market breadth on April 21, 2025, suggesting a broadly bearish shift across equities:

1. Daily Breadth Metrics (Apr 21)

-

Advancing Stocks: Only 18.6%, a significant drop from 71.3% on April 17.

-

Declining Stocks: Spiked to 79.8%, a major red flag for market sentiment.

-

4% Up/Down Moves: Only 2.7% of stocks rose more than 4%, while 6.4% fell more than 4%.

→ This shows strong downside momentum and broad selling pressure.

2. Short-Term Breadth Momentum Fades

Percentage Above Moving Averages (MA) on Apr 21

-

SMA(20): 22.2%

-

SMA(50): 15.4%

-

SMA(100): 16.1%

-

SMA(200): 17.9%

The drop from April 14–17 is clear:

-

For instance, SMA(20)+ was at 26.7% on April 17 and fell to 22.2% on April 21.

-

SMA(200)+ dropped from 20.2% to 17.9%.

→ These numbers show that a large majority of stocks are trading below key moving averages, indicating weak technical support and short-term bearish bias.

3. Weekly Breadth Turning Neutral to Negative

-

Advancing Stocks This Week: 49.4%

-

Declining Stocks This Week: 49.6%

After several strong breadth days in the previous week (e.g., 87.3% advancers on April 15), this week started flat, signaling loss of momentum and possible market fatigue.

4. Monthly and 3-Month Breadth Shows Deep Weakness

-

Advancers (Month): 14.2% vs. Decliners: 85.6%

-

Advancers (3 Month): 19% vs. Decliners: 80.4%

-

Advancers >25% (3M): Just 3.4%

-

Decliners >25% (3M): A concerning 24.9%

→ This highlights a longer-term downtrend, with a dominance of heavy losers and few meaningful gainers over the past three months.

5. Summary & Market Outlook

The market has shifted sharply into bearish territory.

Both short-term (daily) and longer-term (monthly, 3-month) breadth indicators are heavily skewed toward decliners. Participation in rallies has weakened, with very few stocks showing strength above their key moving averages.

The sharp decline on April 21, combined with a broad breakdown in trend support, suggests rising risk of further downside unless a strong reversal or catalyst emerges.