Investors looking for growth chances at acceptable prices often use screening methods that weigh several basic factors. The "Affordable Growth" method focuses on companies showing solid expansion possibility without overly high valuation premiums, while keeping sufficient financial condition and earnings. This process helps find businesses that mix speeding up results with reasonable pricing, possibly presenting good risk-return setups in different market environments.

Growth Path

UBER TECHNOLOGIES INC (NYSE:UBER) shows notable growth traits that build the base of its attraction for affordable growth investors. The company's recent results indicate important speed in main financial measures, with special force in earnings increase and sales creation.

- Earnings Per Share rose by 214.13% over the last year, showing greatly bettered final-profit results

- Sales increase stays solid at 18.15% each year, adding to a good past growth speed of 27.60% per year

- Coming estimates point to ongoing growth with EPS predicted to increase 23.67% yearly and sales expected to go up 13.27% each year

These growth numbers are especially significant for the affordable growth plan because they indicate the company is in a growth stage that could support future price gains, while the screening method makes sure this growth is not already priced into a too high valuation measure.

Valuation Picture

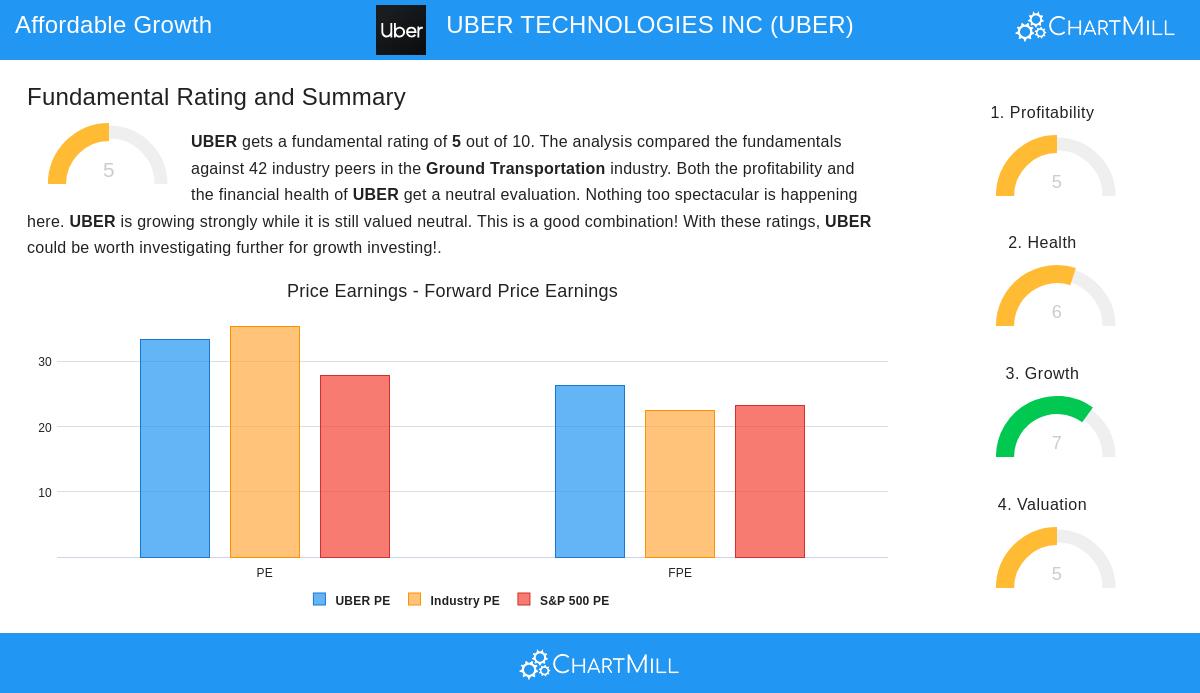

The valuation view for Uber shows a varied but finally acceptable situation when seen through the idea of growth payback. While some classic valuation measures seem high, others indicate the market may not be completely costing the company's growth possibility.

- The Price/Earnings number of 33.43 is higher than the S&P 500 average of 27.86, though it stays similar to industry companies

- Price/Forward Earnings of 26.37 matches more nearly with market averages and industry matches

- The Price/Free Cash Flow number seems good, priced lower than 83.33% of industry rivals

- Most importantly, the small PEG number, which changes the P/E for growth forecasts, shows the valuation could be acceptable considering the company's growth path

For affordable growth investors, this valuation outline is critical, it indicates the market has not fully valued Uber's growth account, possibly leaving space for measure growth as the company keeps doing its business plan.

Earnings and Financial Condition

Beyond growth and valuation, Uber shows sufficient earnings and financial condition features that back the affordable growth idea. The company's change toward lasting earnings and workable financial setup lowers investment danger while keeping growth possibility.

Earnings numbers show major betterment, with Return on Assets at 22.55% and Return on Equity at 55.87%, both placed in the high group of the ground transport industry. The company's earnings margin of 26.68% does better than 90.48% of industry matches, though operating margin at 9.53% and gross margin at 33.93% show there could be space for more efficiency gains.

Financial condition signs give extra assurance, with an Altman-Z score of 4.32 pointing to low failure danger and a debt-to-free-cash-flow number of 1.12 showing strong payment ability. The company's current and quick numbers near 1.11 show enough short-term cash availability, though investors should watch these amounts for any weakening.

Investment Points

Uber's basic profile, as described in the full study report, presents a notable case for growth-focused investors looking for acceptable valuations. The company's unusual growth measures, especially in earnings increase, join with a valuation that seems workable when considering coming growth forecasts. The sufficient earnings and financial condition marks give more trust that the company has the working steadiness to keep doing its growth plan.

The affordable growth screening process specially looks for companies like Uber that balance these features, solid growth without too high valuation, backed by acceptable financial bases. This method tries to find companies where growth possibility may not be completely understood by the market, possibly making chances for investors who see this difference.

For investors wanting to look into similar chances, more affordable growth choices can be found using our special screening tool, which uses steady basic rules to find companies showing these balanced features across markets.

Disclaimer: This study is based on basic data and screening processes for information only. It does not form investment guidance, suggestion, or support of any security. Investors should do their own study and talk with money advisors before making investment choices. Past results do not ensure future outcomes, and all investments have risk including possible loss of original money.