Alphabet ended the day wearing Apple’s market-cap crown, even as the broader market took a breather. Falling yields gave tech just enough oxygen to keep the AI trade upright, while Washington-driven headlines kneecapped defense and tugged oil lower.

The Tape: Red Ink… With a Tech Escape Hatch

Wednesday felt like the market exhaling after a strong start to the year. The Dow did what the Dow does on nervous days - leaned into “less fun” and sold off - while the Nasdaq managed to squeeze out a gain as long-term yields slipped.

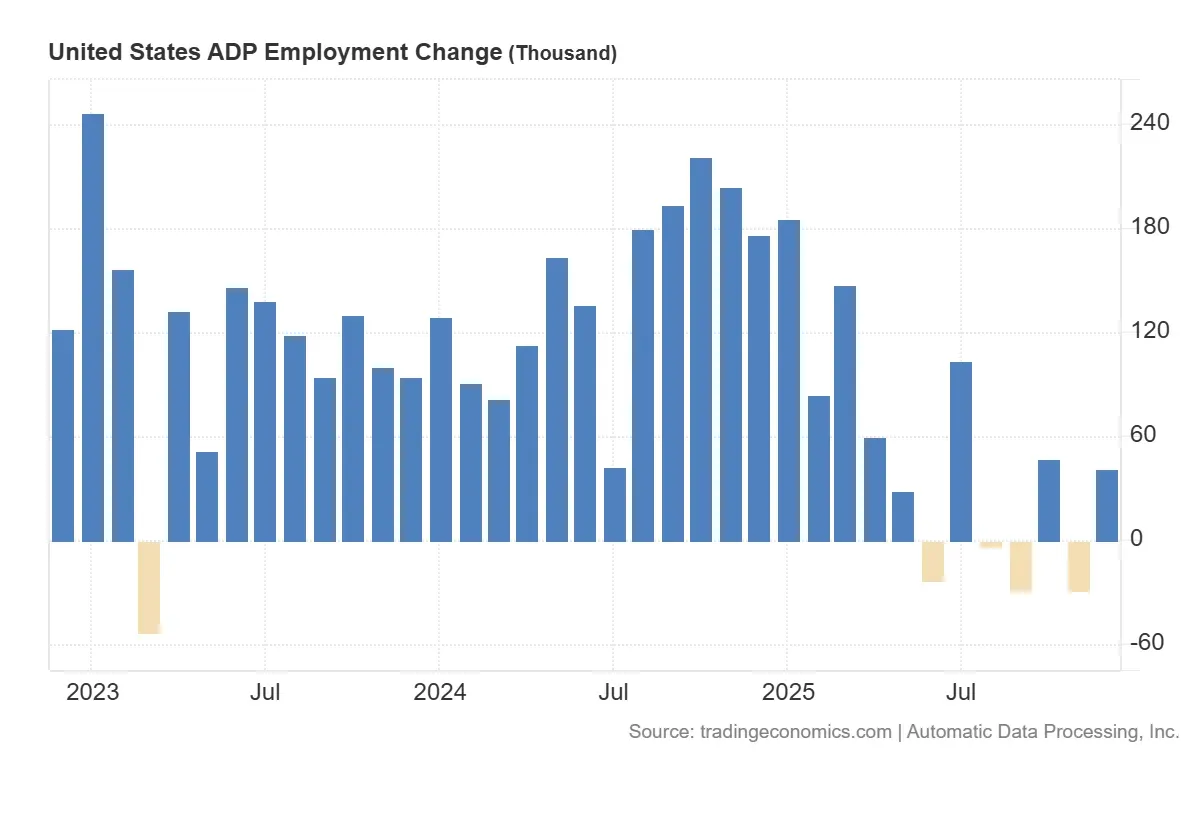

The rate move wasn’t random. The ADP private payrolls print came in at +41,000 for December, a touch lighter than expected, with pay up 4.4% YoY, not recession material, but enough to keep the “Fed can cut later” crowd comfortably loud.

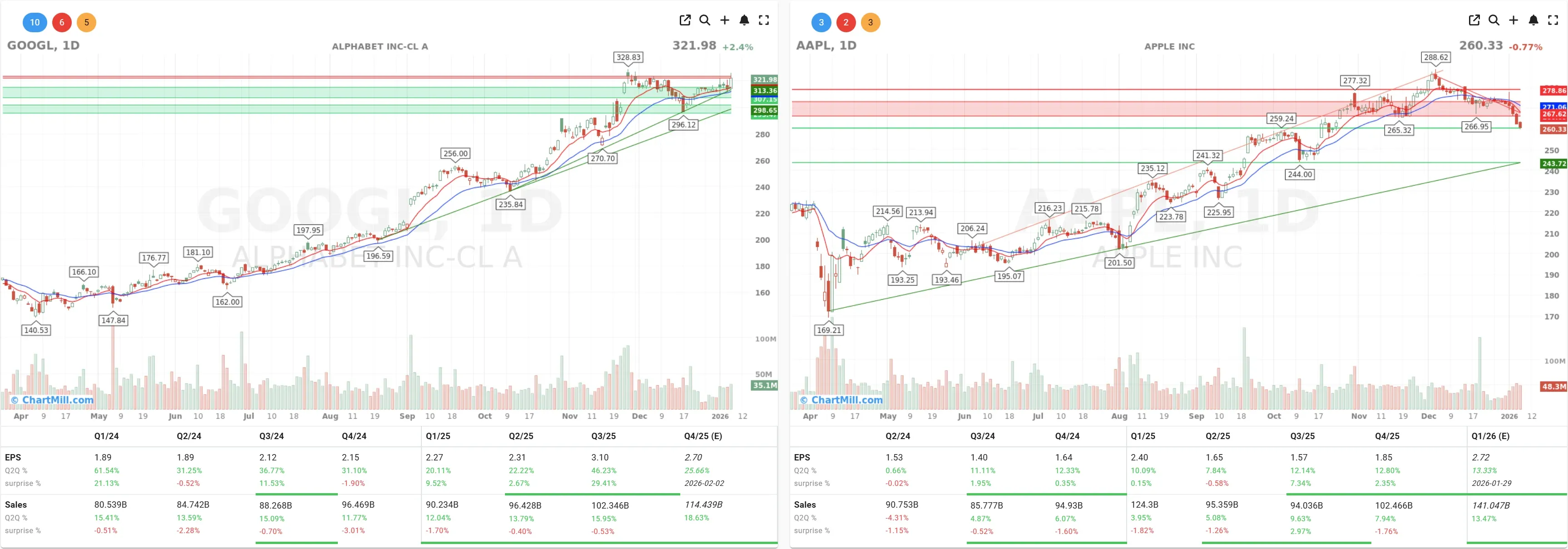

Alphabet Takes the Throne (and the AI Narrative Helps)

The headline that will stick: Alphabet (GOOGL | +2.43%) leapfrogged Apple (AAPL | -0.77%) in market capitalization, with Alphabet around $3.89T versus Apple near $3.85T by day’s end.

The story underneath is even simpler: investors keep paying up for credible AI momentum. Alphabet’s rally has been riding strong AI sentiment - its Gemini line in particular - while Apple keeps getting priced like an AI latecomer.

And yes, the usual AI bellwethers helped keep the complex buoyant: Nvidia (NVDA | +1.00%) and Microsoft (MSFT | +1.04%) added to the “tech is fine, probably” vibe.

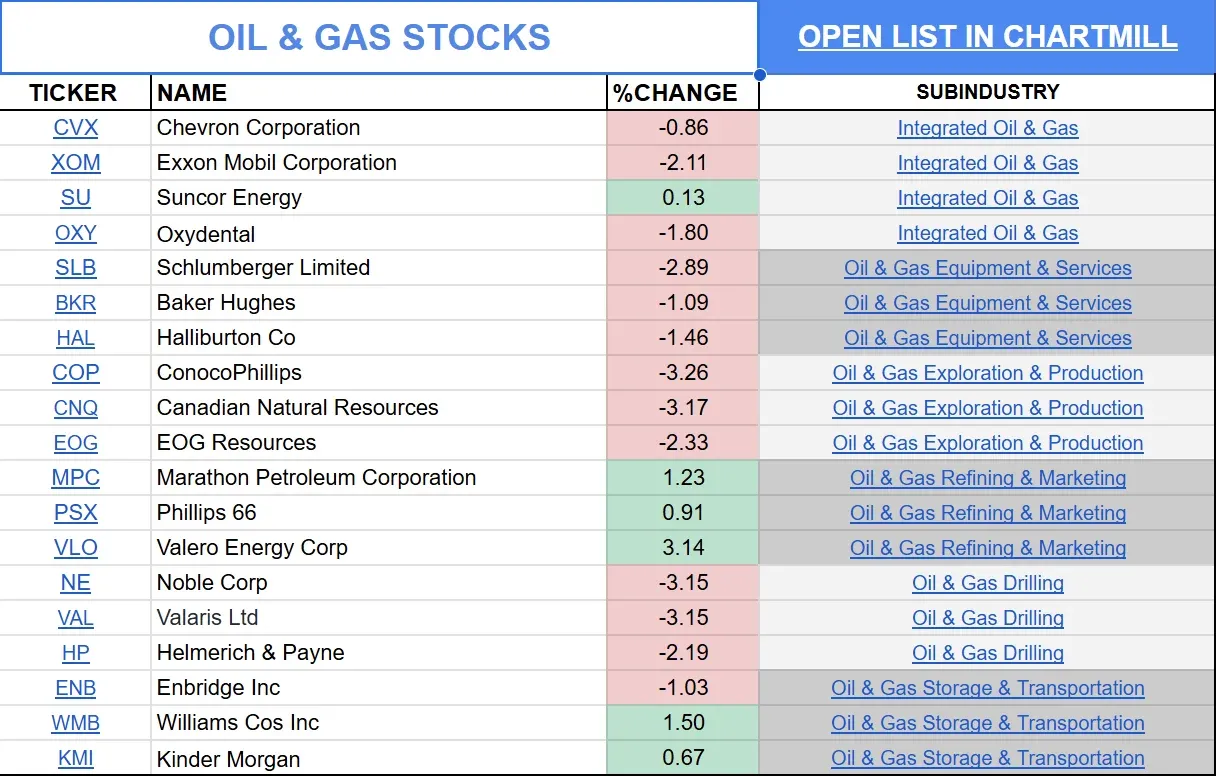

Oil Slips on Venezuela Supply Headlines (Geopolitics Still Looms)

Crude took the hint and backed off after headlines around Venezuelan oil being sold into the market under U.S. oversight. Markets read it the way they always do: more barrels + uncertain politics = bigger supply tail risk, at least near-term.

At the same time, geopolitical noise didn’t exactly go away. Beyond Venezuela, the Greenland sovereignty flare-up stayed in the background, one of those stories that can move from “headline risk” to “portfolio risk” faster than anyone wants to admit.

Defense: Policy Risk Shows Up With a Baseball Bat

Defense stocks didn’t need earnings, they got politics. After President Trump signaled pressure to curb dividends and buybacks until contractors invest more in production and R&D, the sector sold off hard.

The damage was not subtle: Lockheed Martin (LMT | -4.82%), Northrop Grumman (NOC | -5.5%), and General Dynamics (GD | -4.18%) all got clipped.

Housing Affordability… via Social Media? Homebuilders Slide

Homebuilders also felt the policy heat after talk of restricting large institutional investors from buying single-family homes, aimed at improving affordability, but immediately read as “less marginal demand.”

Lennar (LEN | -2.28%) and D.R. Horton (DHI | -3.59%) ended lower.

Hollywood M&A: Still Messy, Still Loud

In media, Warner Bros. Discovery (WBD | +0.42%) stayed in the takeover crossfire after its board recommended shareholders reject the Paramount Skydance bid (a consortium rather than a clean single-ticker story) and reiterated preference for the Netflix (NFLX | +0.09%) path.

One spicy detail: the revised offer has been supported with a personal guarantee from Oracle’s Larry Ellison, which tells you how serious (and leveraged) this chess match has gotten.

After Hours: Earnings Tried to Steal the Mic

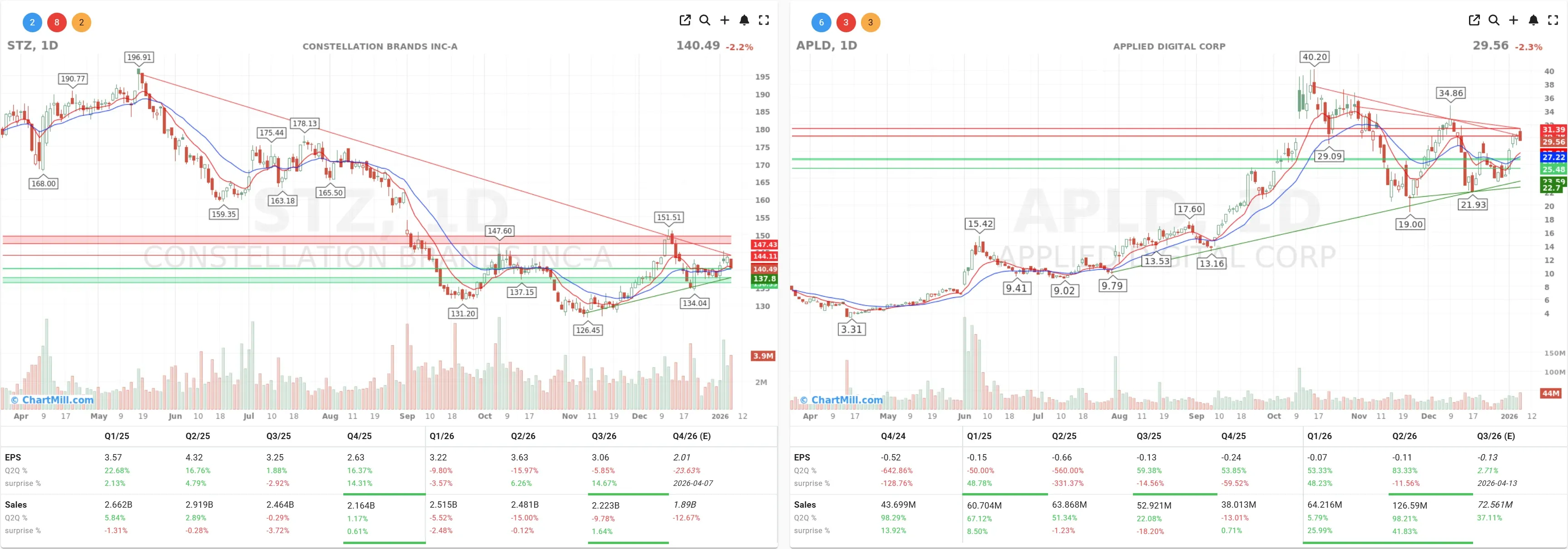

Applied Digital (APLD | -2.31%) and Constellation Brands (STZ | -2.2%) both drew attention after reporting, with notable after-hours swings following the releases.

What I’m Watching Next

The market’s next excuse to move is already queued up: the official jobs report and how it feeds into the Fed’s rate-path pricing.

If yields keep leaking lower, mega-cap tech can keep shrugging off the “mixed tape.” If yields pop back up - or geopolitics escalates - Wednesday’s rotation (tech ok, policy-hit sectors not ok) could get a lot more aggressive.

Kristoff - ChartMill

Next to read: Breadth Pauses Near Resistance, But The Bigger Picture Stays Constructive