Market Monitor Trends (SPY, QQQ, IWM) and Breadth May 22

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: May 22, 2025

(All data & visualisations by ChartMill.com)

Daily Market Trend Analysis – May 21, 2025 (After Market Close)

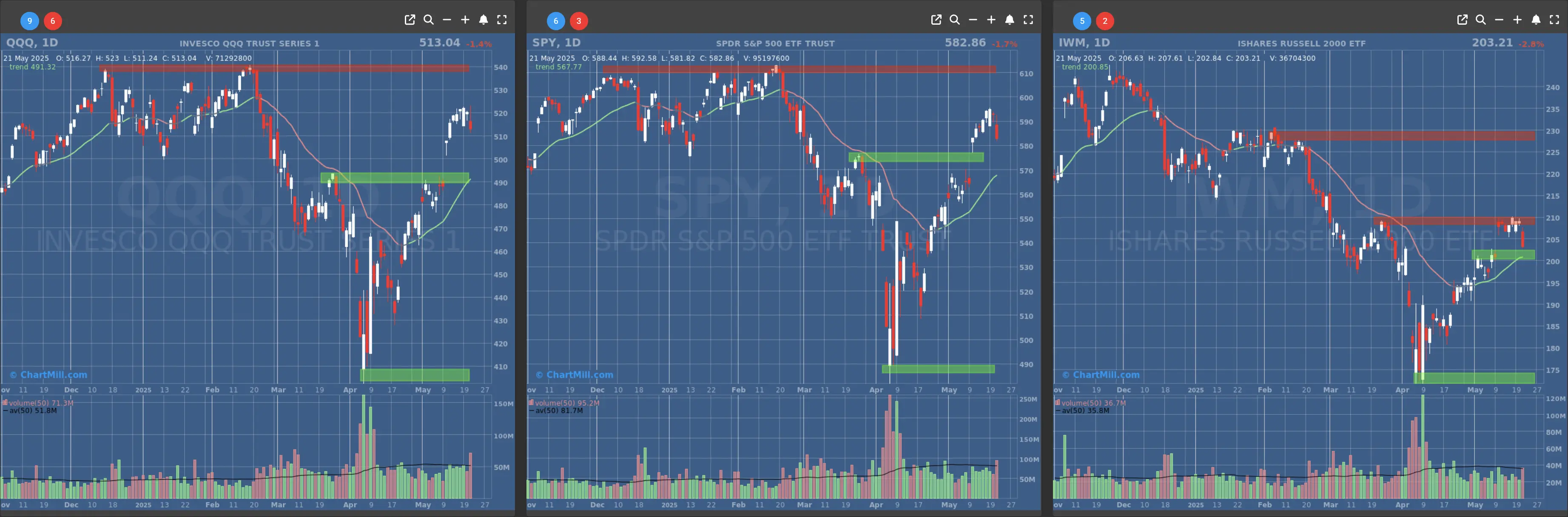

All three major ETFs QQQ, SPY, and IWM) show short-term weakness. On the daily charts, each ETF pulled back from key supply levels with elevated volume, confirming the breadth deterioration seen earlier.

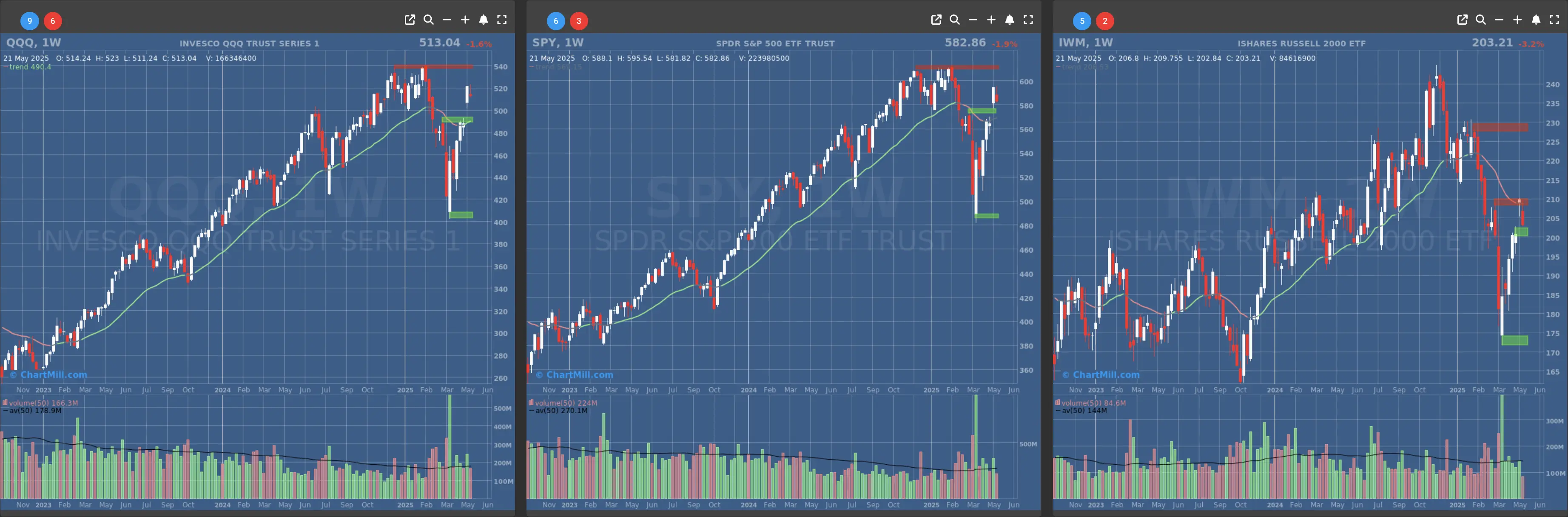

On the weekly charts, the uptrend is intact, but this week’s rejection at resistance (especially in IWM) suggests potential stalling momentum. The broader market remains vulnerable if follow-through selling continues and key support zones are tested.

Short Term Trend

- Short-Term Trend: Bullish (no change)

- Next Support at $570

- Next Resistance at $595

- Volume: Above Average (50)

- Pattern: Hanging Man Candle, Gap Down

- Short-Term Trend: Bullish (no change)

- Next Support at $490

- Next Resistance at $520

- Volume: Above Average (50)

- Pattern: Hanging Man Candle, Gap Down

- Short-Term Trend: Bullish (no change)

- Next Support at $200

- Next Resistance at $205 & $210

- Volume: At Average (50)

- Pattern: Heavy Down Day, Break Down Sideways Range

Long Term Trend

- Long-Term Trend: Neutral (no change)

- Long-Term Trend: Positive (no change)

- Long-Term Trend: Neutral (no change)

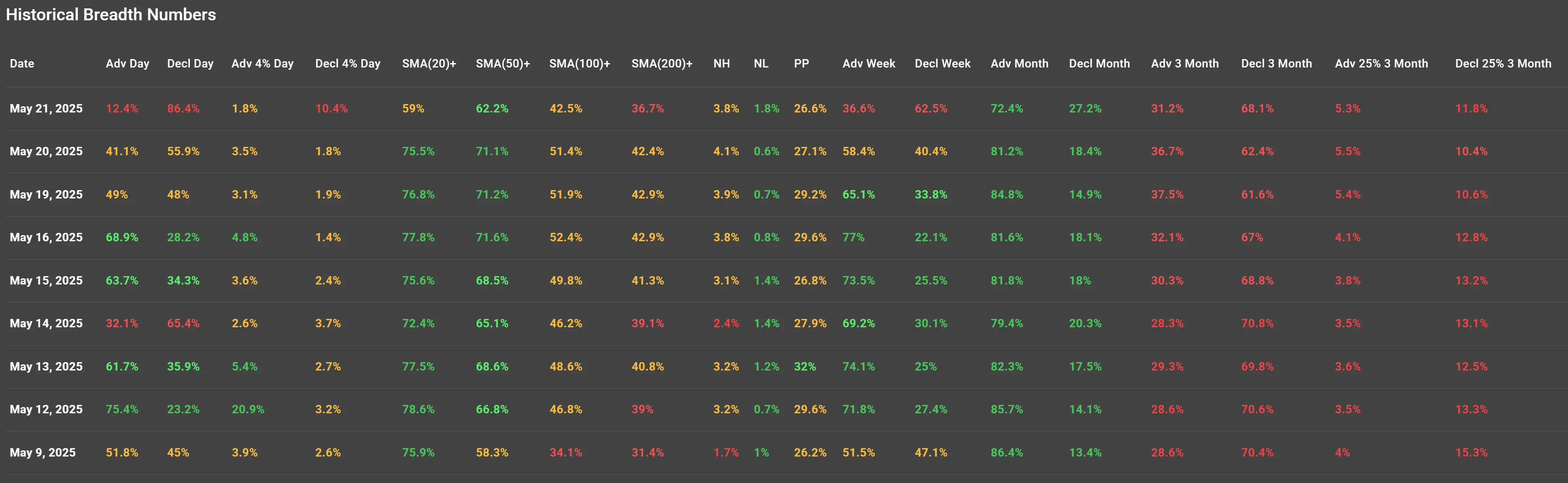

Daily Market Breadth Analysis – May 21, 2025 (After Market Close)

Breadth Weakening Significantly into May 21

On May 21, 2025, only 12.4% of stocks advanced, while a stark 86.4% declined, one of the weakest breadth days in the period. This contrasts sharply with May 12, where 75.4% of stocks advanced and only 23.2% declined, a broad-based up day.

Gradual Erosion in Participation

From May 12 through May 20, there was a steady decline in advancing issues and a rise in decliners, indicating narrowing participation in rallies.

Breadth deteriorated ahead of the major drop on May 21, signaling weakening market internals before the breakdown.

Stocks Above Key Moving Averages

-

Stocks above the SMA(20) peaked at 78.6% on May 12 but dropped to 59% by May 21.

-

A similar decline is seen in the SMA(50)+ (from 71% to 62%) and SMA(100)+ (51.4% to 42.5%).

-

The SMA(200)+ measure - a long-term health indicator - remains below 43% throughout, suggesting the broader market is still not fully healthy even prior to May 21.

New Highs vs New Lows

-

New Highs remained modest (~3–4%) throughout the period, peaking slightly before May 21.

-

New Lows, while low until May 20, spiked to 1.8% on May 21 — a warning sign of internal damage beneath the surface.

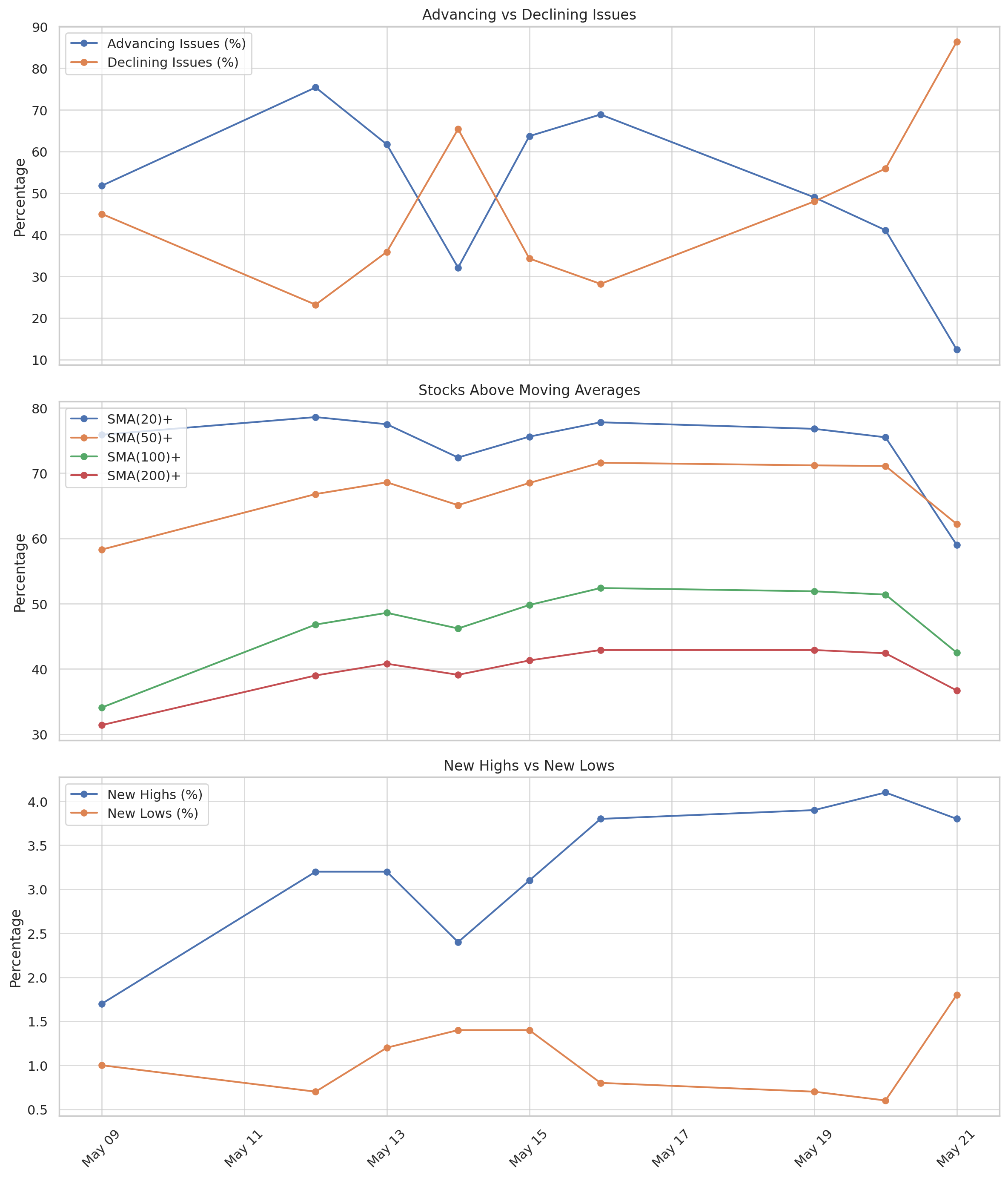

Visual Highlights:

Advancers vs Decliners:

The drastic inversion on May 21 (majority of stocks declining) visually underscores the breadth collapse.

Stocks Above Moving Averages:

A steady downtrend from short- to long-term averages shows internal weakness building.

New Highs vs New Lows:

The spread between NH and NL narrowed, with lows increasing — a classic sign of a deteriorating market.

Implications:

The broad-based selling on May 21 wasn't a surprise, it was preceded by several days of narrowing breadth. Participation is thinning, and without a reversal in moving average support or a broad uptick in advancers, market risk remains elevated.

Traders and investors should be cautious of rallies that lack broad participation and consider risk management or defensive positioning.

202.56

-0.64 (-0.31%)

509.24

-4.76 (-0.93%)

579.11

-3.98 (-0.68%)

Find more stocks in the Stock Screener

IWM Latest News and Analysis

2 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 23

2 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 23The market is in a cautious phase with waning momentum.

3 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 22

3 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 22The broad-based selling on May 21 wasn't a surprise, it was preceded by several days of narrowing breadth.

4 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 21

4 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 21While the major indices are holding up, breadth is beginning to diverge and fewer stocks are driving the rally, market participation is waning.

5 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 20

5 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 20Markets continued to show resilience at the start of the week, with all major indices maintaining their short-term bullish trends.

6 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 19

6 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 19The short-term trend remains bullish across all major indices, supported by strong market breadth and price action.

9 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 16

9 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 16Short-term market trends remain bullish as strong breadth and rising moving average participation support the ongoing rally across U.S. indices.

10 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 15

10 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 15While some longer-term measures still reflect strength, the short-term internal weakness suggests the market could be due for further consolidation or a deeper pullback, unless leadership broadens again.

11 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 14

11 days ago - ChartmillMarket Monitor Trends (SPY, QQQ, IWM) and Breadth May 14Over the past several trading sessions, market breadth has shown a clear and encouraging shift toward strength, particularly in the short to medium term.