After several weeks of relentless AI-fueled optimism, Wall Street finally exhaled.

The Dow Jones fell 0.2%, the S&P 500 lost 0.4%, and the Nasdaq dropped 0.7%. A mild decline, but enough to show that traders are getting cautious after a dizzying run-up.

Tuesday’s session brought a mix of stories, from Dell’s confident outlook to Oracle’s margin jitters and a jaw-dropping rally in a little-known mining stock.

Dell Ups the Ante on AI Growth

Dell Technologies (DELL | +3.51%) was Tuesday’s clear large-cap winner. The company boosted its four-year outlook dramatically, now expecting 7–9% annual revenue growth and at least 15% yearly EPS growth, compared to just 3–4% and 8% in earlier guidance.

CEO Jeff Clarke admitted the company “completely underestimated the size of the AI market.” With booming demand for AI servers from clients like CoreWeave and the U.S. government, that’s proving a good problem to have.

Citi reiterated its Buy rating with a $160 price target, noting that Dell deserves a valuation premium thanks to its growing AI exposure.

Oracle Under Pressure on Cloud Margins

Not everyone shared Dell’s glow. Oracle (ORCL | -2.52%) slipped 2.5% to $284.24, after Invezz reported its cloud margins were thinner than expected. Some investors feared Oracle was sacrificing profitability to gain AI market share.

However, Guggenheim’s John DiFuci quickly pcoured cold water on that theory, arguing it’s “highly unlikely” Oracle would sign long-term deals with less than 25% gross margin. Still, the damage was done, investors hate uncertainty, especially when it’s about margins.

Tesla Misses the Mark on Price Cuts

Tesla (TSLA | -4.45%) introduced cheaper versions of its Model 3 and Model Y, trimming about $5,000 from the price tags. Unfortunately, analysts had hoped for cuts closer to $7,500–$10,000, leading to a 4.5% drop in the stock.

It’s yet another reminder that the EV market has matured and Tesla can no longer move the needle as easily as it once did.

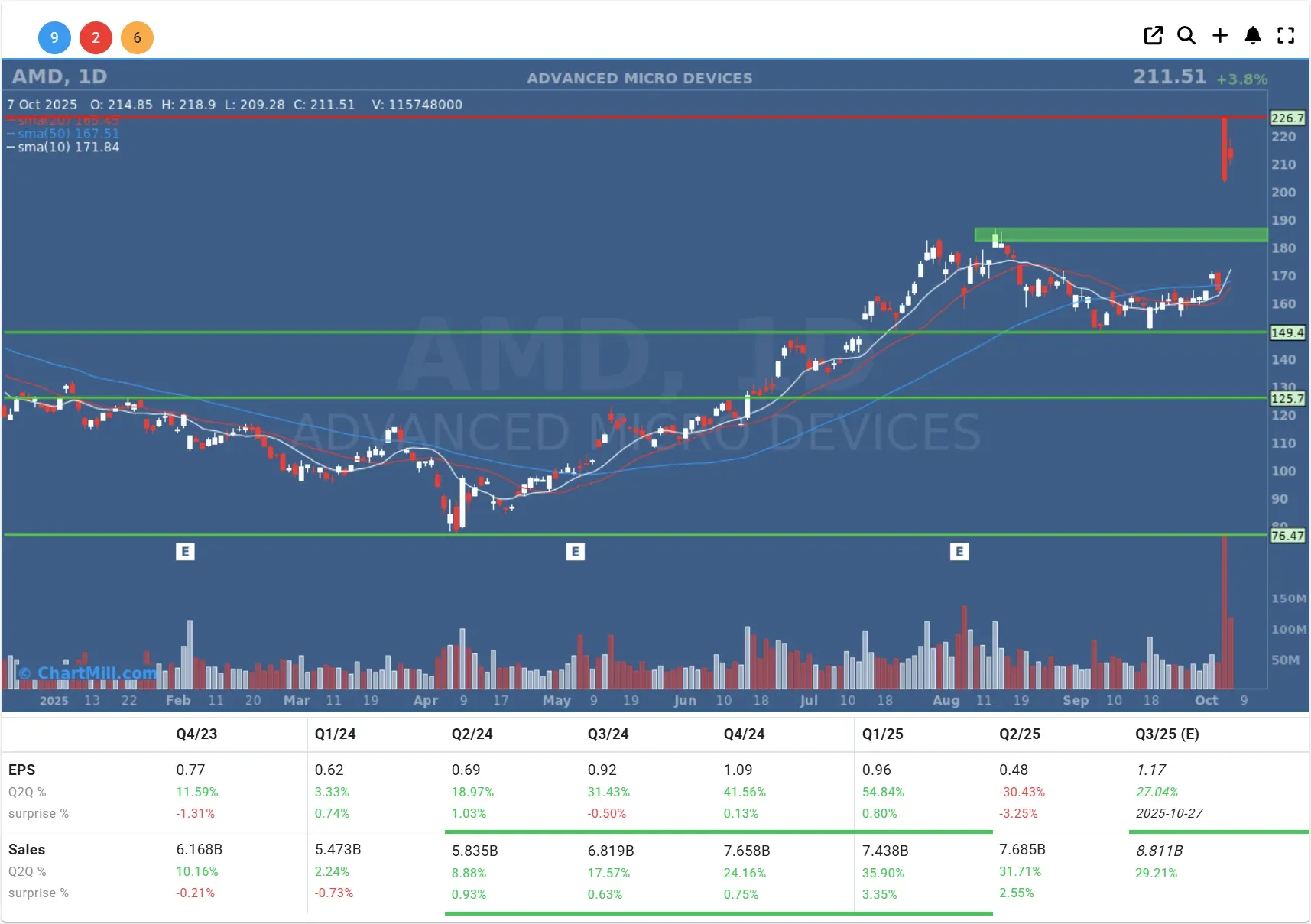

AMD Keeps Riding the OpenAI Wave

Advanced Micro Devices (AMD | +3.83%) continued its incredible two-day rally, gaining another 3.8% to $211 after Monday’s 24% surge. The catalyst remains the same? a blockbuster deal with OpenAI that positions AMD as a key chip supplier for the AI infrastructure boom.

Momentum traders are still piling in, this stock could probably use a breather too.

Trilogy Metals - From Penny Stock to Pentagon Partner

And then there was Trilogy Metals (TMQ | +211%), the day’s ultimate outlier. The small-cap miner skyrocketed 211% after the U.S. Department of Defense announced plans to take a 10% stake in the company and invest another $17.8 million to acquire shares from South32.

The deal marks a rare government move into the mining sector — and one that catapulted Trilogy from obscurity straight into every trader’s watchlist overnight. Whether it can hold those gains is another story entirely.

Lucid Delivers More Cars, But Still Disappoints

Over in the EV space, Lucid Group (LCID | -8.37%) saw its shares sink 8.3% after reporting deliveries that, while 47% higher than a year ago, still missed expectations. Investors have grown tired of growth that doesn’t translate into profitability — especially in a market where Tesla’s margins already look fragile.

Macroeconomics: Inflation Expectations Rise Again

On the macro side, the New York Fed’s monthly survey showed that U.S. consumers now expect 3.4% inflation over the next year, up from 3.2% in August. The five-year outlook rose to 3% as well.

That’s an uncomfortable trend for the Federal Reserve, which aims for 2%. With the government shutdown now in its second week, critical economic data like the jobs report remain unavailable? leaving the Fed with more guesswork ahead of its next rate decision.

Gold and Bitcoin Stay Hot

- Meanwhile, the gold price surged past $4,000 per troy ounce, reaching yet another record high.

- Bitcoin (BTC | $126,000) hovered just below its recent peak, showing that investors are still hedging their bets with both digital and traditional stores of value.

Final Thoughts

After weeks of tech euphoria, Tuesday’s session reminded us that markets don’t move in straight lines. Dell proved that AI-driven growth can still come with reasonable valuation.

Oracle showed how quickly sentiment can turn. And Trilogy Metals? Well, it proved that miracles do happen? sometimes with a little help from Washington.

As earnings season looms, expect more reality checks. The AI story is far from over, but even the strongest rallies need to catch their breath.

Kristoff - ChartMill

Next to read: Market Breadth Deteriorates Sharply as Selling Pressure Intensifies