The market giveth, the market taketh away and on Tuesday, it did both.

After an initially warm reception to the latest inflation figures, U.S. equities lost steam by the close, as investors digested a mixed bag of economic signals, political interference, and explosive company news.

Spoiler alert: Nvidia (NVDA | +4.00%) stole the show.

Inflation Cools (Kind Of), But the Fed Stays in the Spotlight

Let’s start macro. June’s headline U.S. inflation came in at 2.7% year-over-year, exactly as expected. More interesting, core inflation dropped to 2.9%, a notch below the consensus.

Initially, this gave Wall Street a little hop in its step. But the rally quickly faded.

The Dow Jones ended the day 1% lower, and while the Nasdaq (+0.15%) kept its head above water, that was mostly thanks to Nvidia’s fireworks (more on that in a second).

Why the hesitation? The bond market says it all. The 30-year Treasury yield climbed almost 5 basis points to 5.02%, a level we haven’t seen since late May.

Investors are clearly scaling back their expectations for aggressive Fed rate cuts. Rising prices for tariff-sensitive goods - like electronics and toys - are beginning to seep into the inflation data, as Morgan Stanley’s Ellen Zentner warns. That could keep the Fed on pause a little longer.

The Nvidia Effect: Washington Blinks, Wall Street Cheers

Now, let’s talk about the elephant in the server room. Nvidia (NVDA | +4.04%) added a staggering $160 billion to its market cap in a single day after the Trump administration made a stunning U-turn. The White House has lifted key export restrictions, clearing the way for Nvidia’s H20 and RTX PRO chips to return to China.

This is massive. Nvidia had warned that the restrictions could cost it up to $15 billion in revenue, with $8 billion worth of Q2 orders alone sitting on ice. Now, that pipeline is back in play.

Credit where it’s due, CEO Jensen Huang didn’t just whine. He made his case directly to Trump, arguing that U.S. AI leadership depends on Nvidia’s chips. Apparently, that did the trick. Huang even went so far as to call the previous export bans a “gift to Huawei and DeepSeek.” A little tough love diplomacy goes a long way.

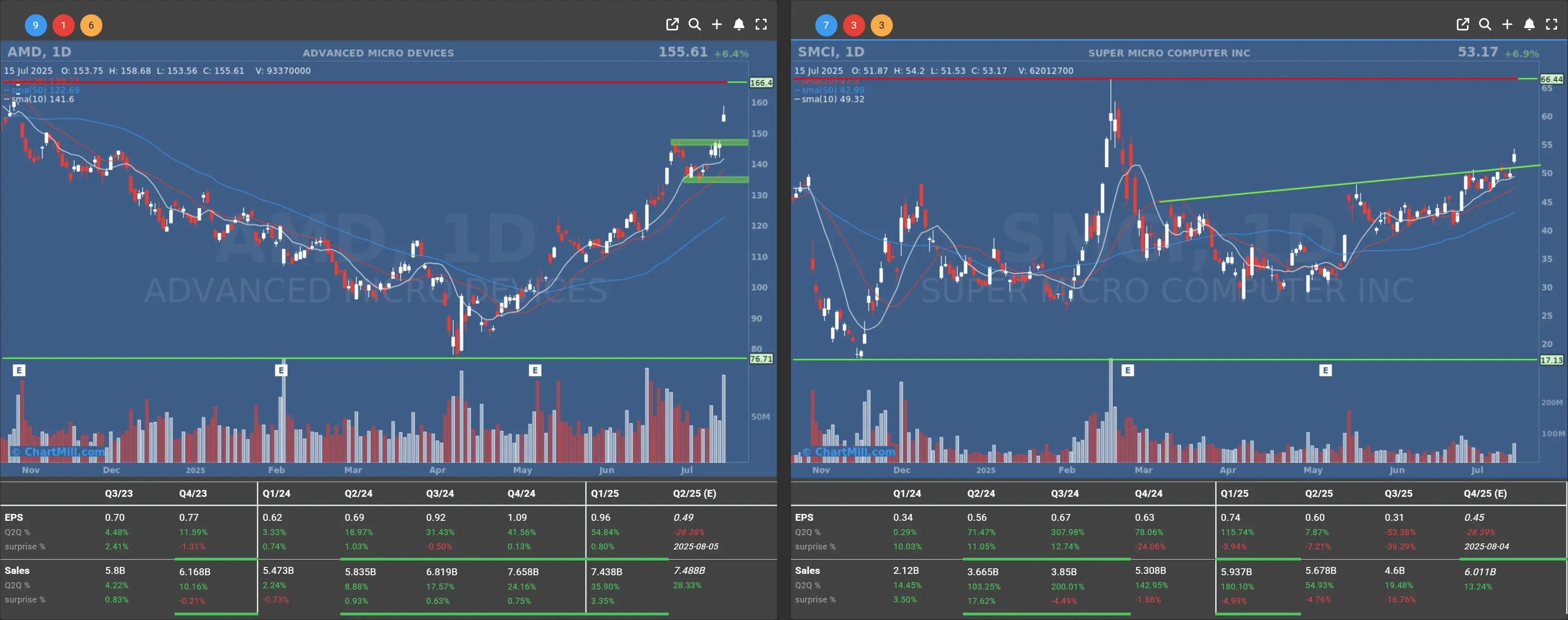

Chip sibling AMD (AMD | +6.41%) also rallied, with plans to resume shipments of its MI308 chips once the paperwork clears.

Super Micro (SMCI | +6.00%) - a key Nvidia supplier - was swept up in the momentum as well.

Analyst reactions were swift. Oppenheimer raised its price target for Nvidia to $200. Based on Tuesday’s close, there’s still room to run.

Banks Say “Meh” to Q2

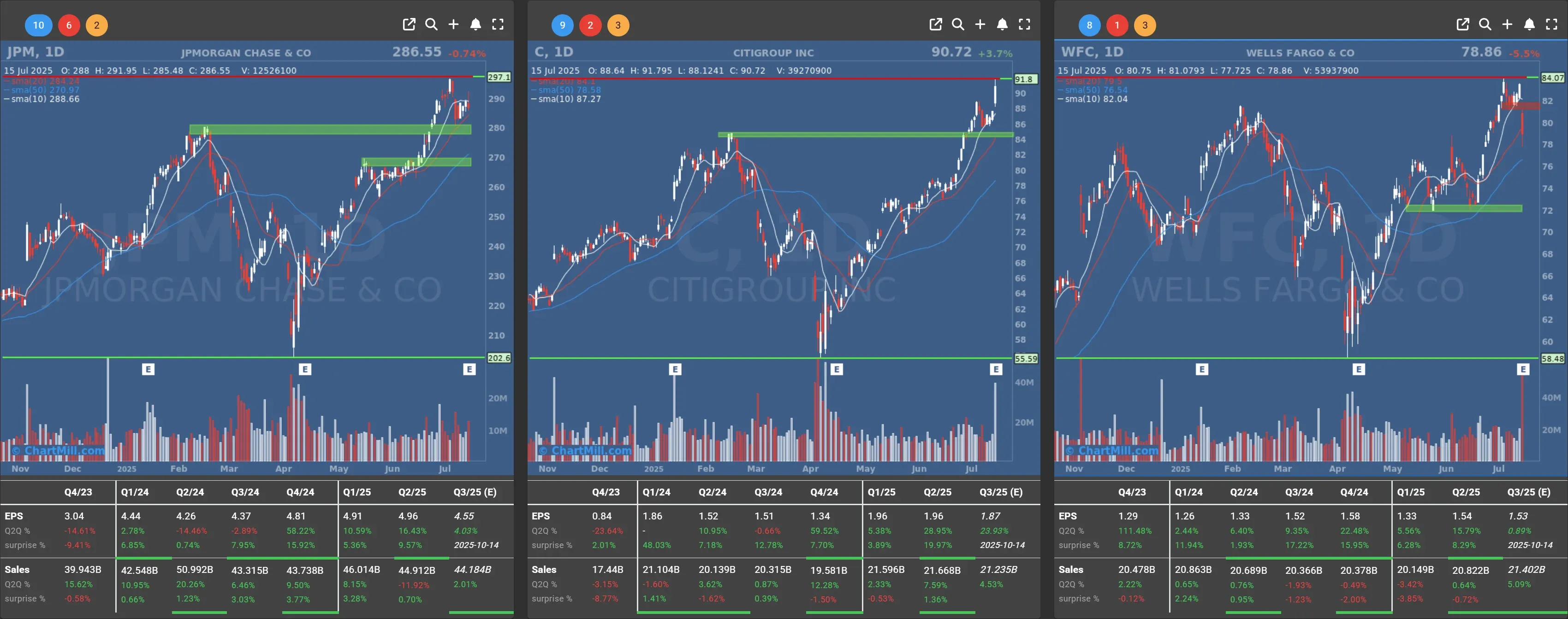

Three of the biggest U.S. banks opened their books and the results were more mixed than a bag of Halloween candy on November 1st.

-

JPMorgan (JPM | - 0.74%) posted a near-record $15 billion net profit. But CEO Jamie Dimon also raised spending guidance, which spooked investors.

-

Wells Fargo (WFC | -5.48%) beat earnings expectations but disappointed on net interest income, arguably the metric to watch in this environment.

-

Citigroup (C | +3.68%), on the other hand, surprised to the upside thanks to a strong showing in bond trading.

Despite the noise, the underlying trend remains: banks are adapting to a higher-for-longer rate world. But margin compression is real, and not every lender is handling it equally.

Powell in the Crosshairs

Meanwhile, Washington drama continues. Treasury Secretary Scott Bessent suggested it would be "logical" for Fed Chair Jerome Powell to step down entirely in 2026, even though his board term runs until 2028. President Trump has made no secret of his frustration with Powell’s cautious approach to rate cuts.

This kind of pressure on the Fed makes bankers and markets nervous. Jamie Dimon was blunt: Fed independence is "absolutely essential."

“The independence of the Fed is absolutely critical, not just for the current Fed chair, whom I respect, Jay Powell, but for the next Fed chair” - Jamie Dimon

I agree. A central bank that takes marching orders from a politician with campaign promises to keep is a dangerous game.

Quick Hits: Baidu, Trade Desk, RH

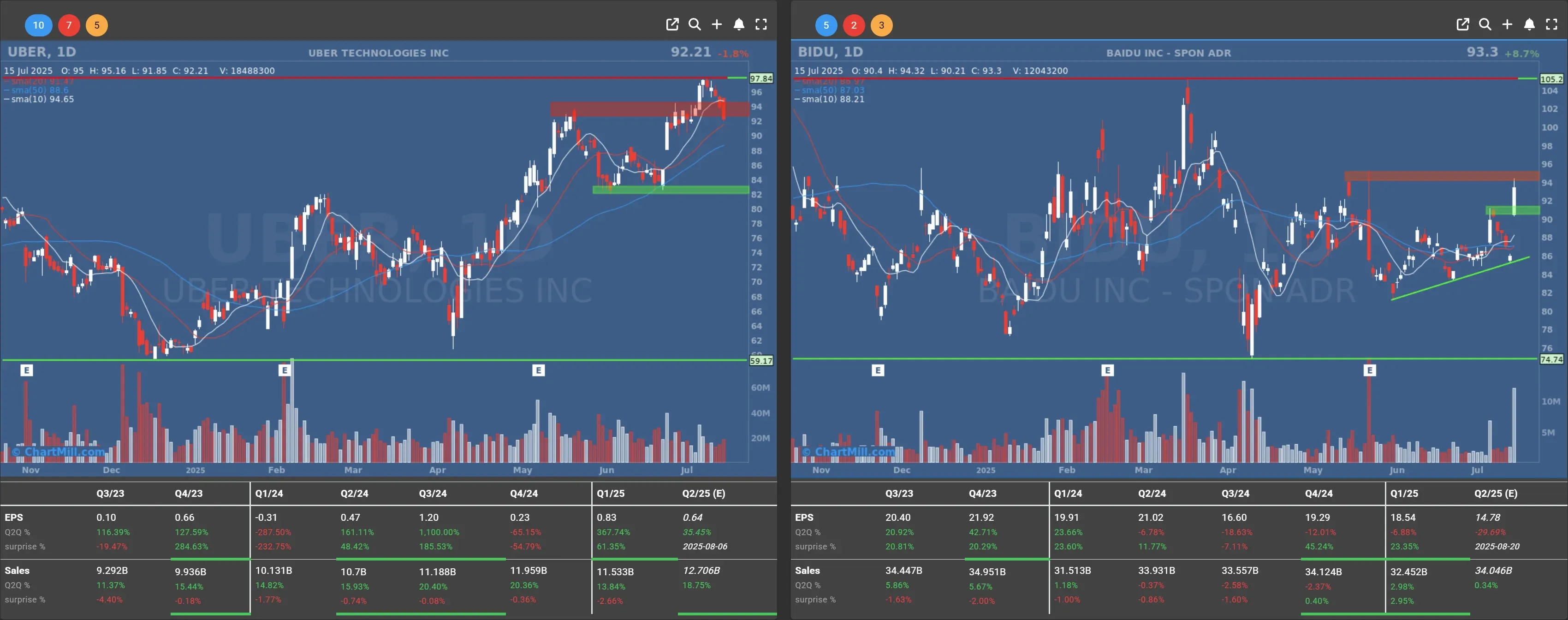

- Baidu (BIDU | +8.65%) and Uber (UBER | -1.79%) are teaming up on autonomous vehicles, though curiously, only outside the U.S. and China. Interesting pivot.

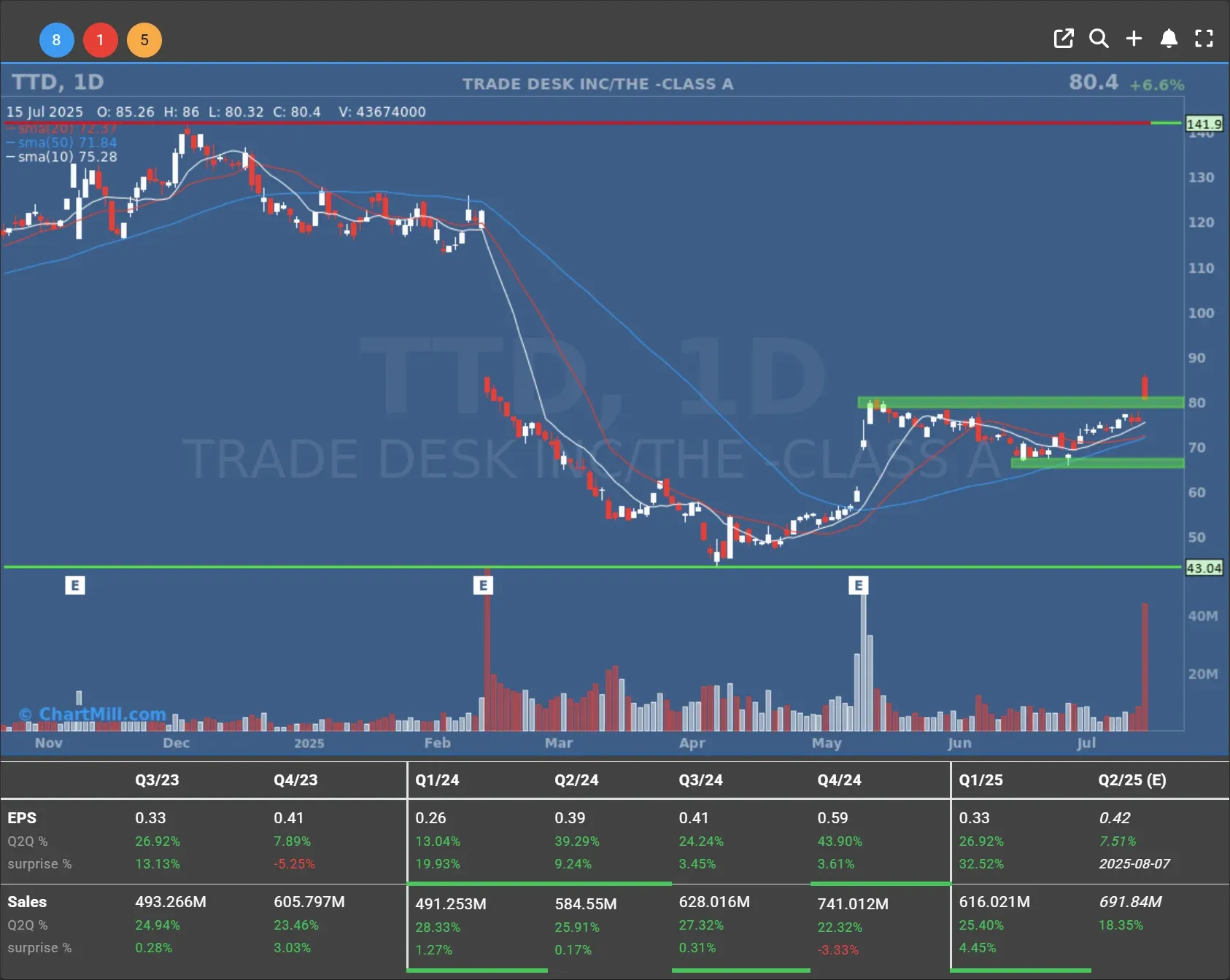

- Trade Desk (TTD | +6.59%) is being added to the S&P 500.

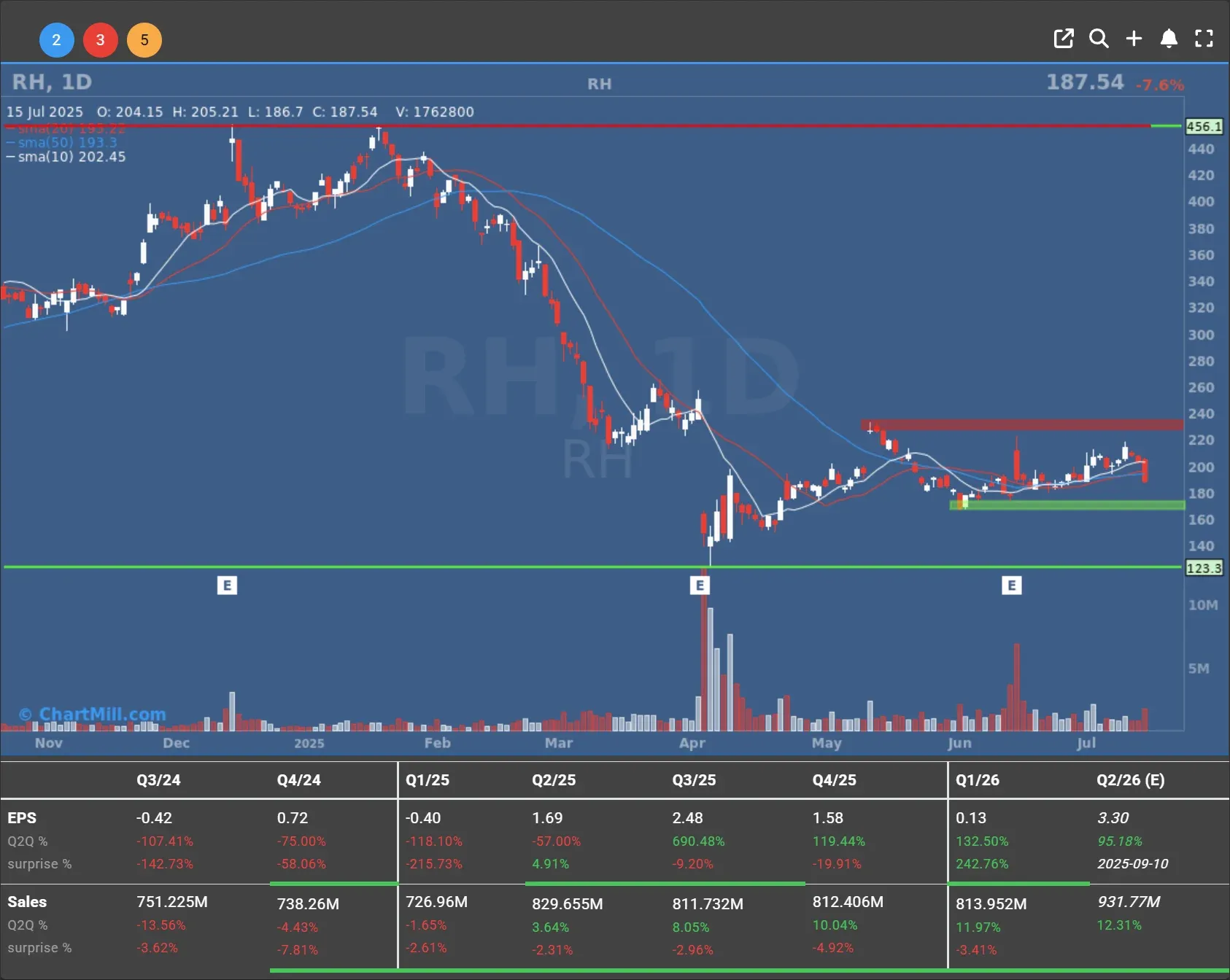

- RH (RH | -7.57%) was hit hard and lost more than 7%. Goldman Sachs Downgrades RH (RH) from ‘Neutral’ to ‘Sell’ a couple of days ago.

Wrap-Up

Tuesday’s session reminds us how quickly market narratives can shift, from inflation relief to political overreach, and from cautious central banking to record-breaking chip optimism.

The real standout here isn’t inflation or Powell, it’s Nvidia’s power to bend Washington and markets in the same breath.

Until tomorrow, stay sharp, stay skeptical.

Kristoff - ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, July 16