Advanced Micro Devices (NASDAQ:AMD) Reports Mixed Q2 2025 Results Amid Export Restrictions

Advanced Micro Devices (AMD) delivered a mixed earnings report for the second quarter of 2025, with revenue surpassing expectations but earnings per share (EPS) falling slightly short. The company also faced significant headwinds from U.S. export controls, which weighed on profitability.

Key Financial Highlights

- Revenue: $7.685 billion, beating analyst estimates of $7.494 billion.

- Non-GAAP EPS: $0.48, slightly below the consensus estimate of $0.496.

- Gross Margin: 43% on a non-GAAP basis, but would have been 54% excluding $800 million in charges related to export restrictions on its Instinct MI308 data center GPUs.

- Operating Income: $897 million (non-GAAP), down from prior quarters due to inventory write-downs.

- Net Income: $781 million (non-GAAP), reflecting margin pressures.

Market Reaction

Following the earnings release, AMD shares fell approximately 3.5% in after-hours trading. The decline appears driven by concerns over the export-related charges and weaker-than-expected profitability, despite the revenue beat. Over the past month, AMD had gained 26.5%, suggesting some investors may have priced in stronger results.

Outlook vs. Analyst Estimates

AMD provided third-quarter revenue guidance of $8.4 billion to $9 billion, which aligns closely with Wall Street’s $8.368 billion estimate. However, the company’s full-year sales projection remains uncertain due to ongoing export restrictions in China, a key market for its AI and data center products.

Press Release Takeaways

- Export Controls Impact: The U.S. government’s restrictions on GPU sales to China resulted in $800 million in charges, significantly affecting gross margins.

- AI Demand Remains Strong: Despite the challenges, AMD highlighted robust demand for its AI accelerators, supporting its optimistic revenue forecast.

- Data Center Weakness: The company’s operating loss of $134 million (GAAP) reflects the drag from inventory write-downs, though underlying demand in data center and gaming segments remains solid.

Broader Context

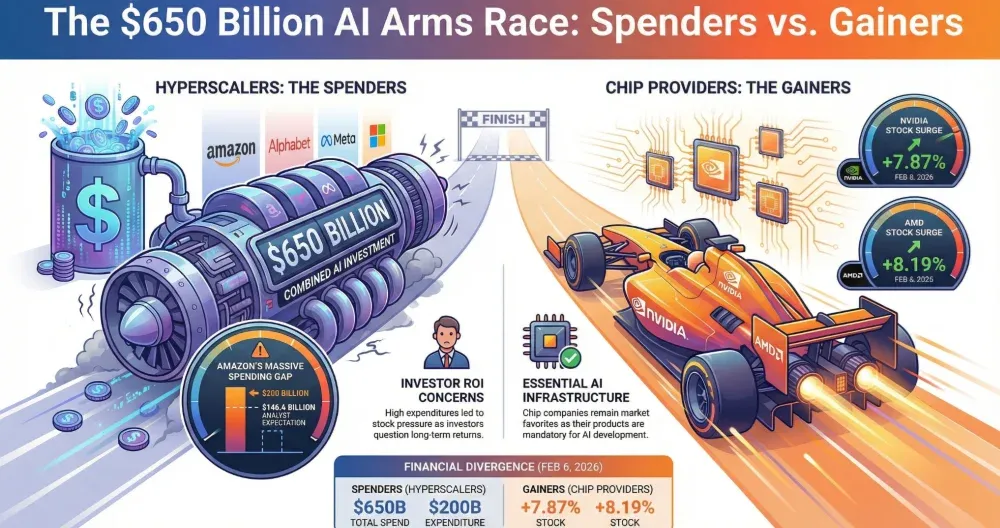

Recent headlines underscore the mixed sentiment around AMD’s earnings. While some reports emphasize the revenue beat and strong AI demand, others highlight the earnings miss and export-related risks. Additionally, broader trade tensions, including potential new tariffs on semiconductors, could further complicate AMD’s outlook.

For a deeper dive into AMD’s earnings history and future estimates, see the full earnings and estimates breakdown here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice.