What is Asset Turnover?

Asset turnover is a financial metric that measures how efficiently a company utilizes its assets to generate revenue. It indicates the company's ability to generate sales from its assets, such as inventory, property, plant, and equipment.

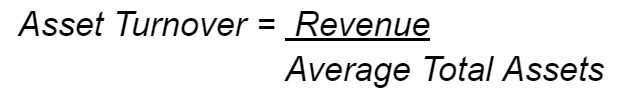

The formula for asset turnover is:

Calculation of the Average Total Assets

- Retrieve the company's total revenue from the income statement.

- Obtain the average total assets, usually calculated by adding the beginning and ending total assets for a period and dividing by 2.

- Plug these values into the formula to calculate the asset turnover ratio.

Interpretation

High Ratio

A high asset turnover ratio generally indicates that the company is efficiently using its assets to generate sales. It suggests that the company is effective in managing its resources and has a strong sales operation.

Low Ratio

Conversely, a low asset turnover ratio may suggest that the company is not effectively utilizing its assets to generate revenue. It might indicate overinvestment in assets, poor inventory management, or a lack of sales effectiveness.

Comparing Asset Turnover Ratios

Compare the asset turnover ratio with industry averages or competitors. A higher ratio than peers might suggest better asset utilization, while a lower ratio might raise questions about efficiency relative to industry standards.

Asset Turnover Trend Analysis

As is the case with many other financial ratios, you should pay particular attention to the ratio's trend over time. A consistent improvement may indicate efficiency improvements, while a declining trend may warrant further investigation into operational problems.

Do Not Compare Apples To Oranges

Keep in mind that different industries have different asset turnover norms. Capital-intensive industries (like manufacturing) may have lower asset turnover ratios compared to service-oriented or tech companies.

Don’t Forget Contextual Analysis

Consider the company's business model. For instance, a retail company might have a higher asset turnover ratio due to faster inventory turnover, while a manufacturing company might have a lower ratio due to longer production cycles.

What This Ratio Doesn't Tell You

Ignores Profit Margins

Asset turnover focuses on the relationship between revenue and total assets but doesn't account for profit margins. A company with a high asset turnover may still have low profitability if its profit margins are slim.

It's essential to consider both the asset turnover and profit margin for a comprehensive analysis.

Doesn't Differentiate Asset Types

The ratio treats all assets as equally contributing to revenue generation. However, different types of assets have different turnover characteristics.

For example, land and buildings might have a low turnover, but that doesn't necessarily mean they aren't contributing to the company's overall success.

Averages Can Mask Changes

Using average total assets in the denominator can smooth out fluctuations. While this is helpful in some cases, it might mask significant changes in asset utilization that occurred during the period.

Examining the trend and individual components of total assets can provide a more nuanced analysis.

Quality of Assets

Asset turnover doesn't distinguish between efficient and inefficient use of assets. For example, a company might be selling obsolete inventory at discounted prices, leading to a higher turnover ratio without indicating operational efficiency.

Inflation Effects

Changes in the value of assets due to inflation can impact the asset turnover ratio. If the assets are revalued upwards due to inflation, it might artificially inflate the turnover ratio without corresponding improvements in operational efficiency.

Doesn't Consider Liabilities

Asset turnover only looks at total assets, not considering the company's liabilities. A company might have a high turnover ratio but also high debt, leading to increased financial risk.

Ignores Business Model Complexity

For companies with complex business models, such as those with diverse product lines or global operations, asset turnover might not capture the nuances of how different assets contribute to revenue generation.