Trump, Tarrifs, Tesla

U.S. President Donald Trump has announced significant new tariffs on international trade, imposing a universal import duty of 10% on all trading partners, with higher reciprocal rates for select countries. The European Union will face tariffs of at least 20%, China 34%, Japan 24%, and other countries like Switzerland, India, and South Korea also see substantial increases.

Trump claims these tariffs are intended to correct trade imbalances, alleging the EU charges the U.S. 39% on imports, though the European Commission states the real rate is approximately 1%.

This tariff escalation could significantly impact the U.S. economy, with Goldman Sachs estimating it could reduce growth by 1.3 percentage points. It may also trigger increased inflation, potentially driving the rate up to around 3%. Trump's strategy aims to eliminate the trade deficit, create U.S. jobs, and boost the economy, projecting an annual addition of $700 billion to government revenues to facilitate tax cuts.

However, the tariffs have already unsettled financial markets, causing notable volatility. Nasdaq futures notably dropped 2.6% immediately following the announcement, reflecting investor concerns over disrupted global supply chains and potential economic fallout.

Meanwhile, Tesla (TSLA | +5.33%) faces a challenging start to the year, reporting a 13% decrease in vehicle deliveries in the first quarter, significantly underperforming analysts' expectations. Tesla attributes this decline primarily to production disruptions caused by transitioning to the updated Model Y.

However, competitive pressures from traditional automakers and rapidly growing rivals like China's BYD, now the world's largest electric vehicle manufacturer, also play a critical role. Tesla's European sales have additionally suffered due to consumer backlash over CEO Elon Musk's political activities linked to the Trump administration.

Despite initial stock price drops, Tesla shares rebounded following reports of Musk planning to withdraw from his advisory roles with the Trump government. Nevertheless, BYD's exceptional 58% growth highlights Tesla's vulnerability in an increasingly competitive global electric vehicle market.

Shares of electric vehicle manufacturer Rivian (RIVN | -6.9%) fell 6.9% in the morning session after the company reported weak first-quarter vehicle deliveries of 8,640 units, marking a 36% decline compared to the same period in the previous year.

Daily Market Analysis – April 2, 2025 (After Market Close)

Short Term Trend

- Short-Term Trend: Down (no change)

- Short-Term Trend: Down (no change)

- Short-Term Trend: Down (no change)

Long Term Trend

- Long-Term Trend: Down (no change)

- Long-Term Trend: Down (no change)

- Long-Term Trend: Down (no change)

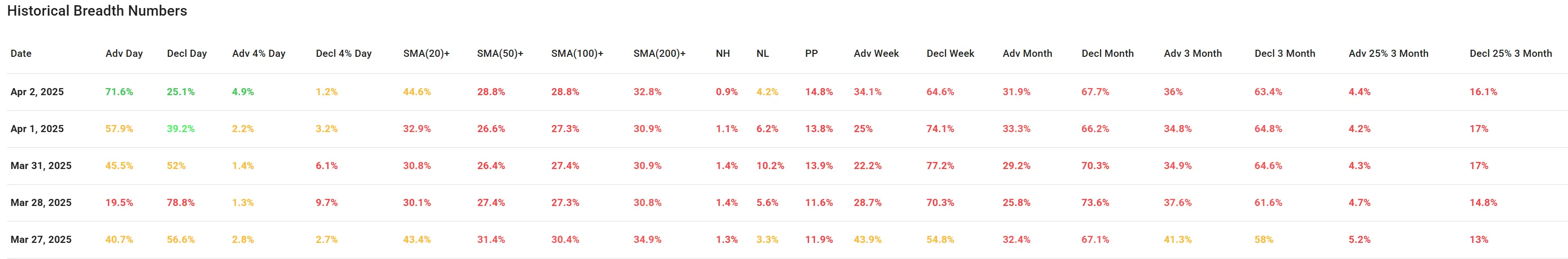

Market Breadth Analysis for April 02, 2025

Apr 2 shows clear improvement in breadth, marking a potential short-term rebound although longer-term trend metrics remain weak, with most stocks still underperforming their moving averages.

The market is trying to turn the corner, but more participation and follow-through is needed for a sustained bullish shift. However, it looks like we are heading for a red opening after President Trump announced import tariffs on U.S. trading partners.