For investors looking for a disciplined method for long-term wealth creation, few strategies hold the importance of Peter Lynch’s approach. The former Fidelity Magellan Fund manager supported investing in what you understand, companies with clear business models, lasting growth, and fair valuations. His structure highlights fundamental power over market timing, concentrating on firms that show sound profitability, controlled debt, and earnings expansion that is strong but not extreme. This thinking, often grouped as Growth at a Reasonable Price (GARP), seeks to find good businesses before they turn into Wall Street favorites.

One firm presently fitting Lynch’s investment standards is WILLIAMS-SONOMA INC (NYSE:WSM). The specialty retailer, recognized for brands such as Williams Sonoma, Pottery Barn, and West Elm, works in the home products industry, a standard case of Lynch’s liking for clear, everyday companies. Its omnichannel method, merging e-commerce, retail stores, and catalogs, has built a dedicated customer group, matching Lynch’s concept that investment chances frequently exist in products and services buyers know and rely on.

Growth and Valuation Alignment

A key part of Lynch’s strategy is finding companies with solid, but not extreme, earnings expansion combined with fair valuation. WSM does well here:

- EPS Growth (5-Year): 29.28% – above Lynch’s 15% minimum level, showing good historical increase.

- PEG Ratio: 0.76 – much lower than Lynch’s ideal of ≤1, signaling the stock could be priced low compared to its growth path.

The PEG ratio, calculated as the P/E ratio divided by earnings growth, is especially significant in Lynch’s structure. It modifies valuation for growth, helping prevent paying too much for high performers. WSM’s sub-1 PEG implies it provides growth without a high cost, a balance Lynch viewed as key for long-term gains.

Financial Health and Profitability

Lynch favored companies with solid balance sheets and high returns on equity, lowering risk while confirming capital efficiency. WSM shows clear power in these areas:

- Debt/Equity: 0.0 – the firm has no debt, greatly surpassing Lynch’s choice for a ratio under 0.6 and matching his careful view on leverage.

- Return on Equity (ROE): 50.47% – much higher than the 15% minimum Lynch needed, showing outstanding profitability and efficient use of shareholder capital.

- Current Ratio: 1.51 – shows enough short-term liquidity, meeting Lynch’s standard for financial steadiness.

These measures not only meet Lynch’s standards but also indicate a well-run company with very little financial risk and high operational success.

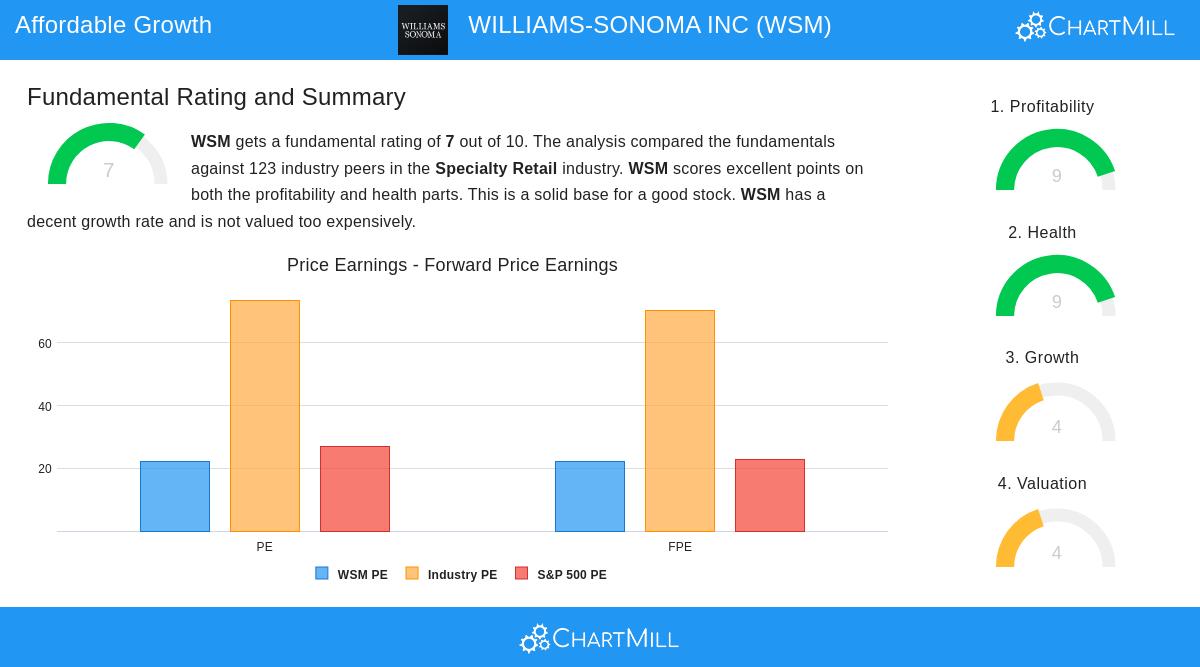

Fundamental Strength Overview

A detailed fundamental analysis of WSM supports its attraction within the Lynch structure. The company receives an overall score of 7 out of 10, with very high marks in profitability (9/10) and financial health (9/10). It does better than most industry competitors in return on assets, return on invested capital, and operating margins. Even though revenue expansion has been low lately, its earnings growth stays solid, and its absence of debt puts it in a strong spot within the specialty retail industry. The valuation, while not very low, is fair relative to the company’s quality and growth picture.

Conclusion

WILLIAMS-SONOMA INC stands as a strong option for investors following the Peter Lynch philosophy of discovering growth at a fair price. Its solid brand collection, balance sheet with no debt, high profitability, and appealing PEG ratio match closely with Lynch’s main investment principles. While previous results are not a promise, the company’s fundamental power indicates it is set for continued long-term expansion.

For investors wanting to research other firms that match this strategy, additional results are available using the Peter Lynch stock screener.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation before making any investment decisions.