META PLATFORMS INC-CLASS A (NASDAQ:META) Presents a High Growth Momentum Opportunity

By Mill Chart

Last update: Sep 11, 2025

META PLATFORMS INC-CLASS A (NASDAQ:META) appears as a notable option for investors using a high growth momentum strategy, which joins solid fundamental growth traits with strong technical patterns. This method looks for companies showing accelerating earnings, increasing profit margins, and favorable analyst revisions, all signs of continued growth potential, while also displaying positive chart patterns that indicate good entry points. The strategy tries to identify stocks in the beginning phase of a major upward move, mixing growth measurements with technical timing to improve risk and reward.

High Growth Momentum Fundamentals

META displays a number of important qualities that fit high growth momentum investing. The company has reported outstanding financial results, emphasized by major growth in earnings and revenue. These measurements are vital for momentum strategies, as they show a company’s capacity to grow profitability and market position, frequently resulting in upward revisions and positive surprises that drive additional price gains.

- Earnings Per Share (TTM): $27.62, with year-over-year growth of 40.99%

- Revenue Growth (TTM): 19.38%, indicating solid top-line increase

- Quarterly EPS Growth (Q2Q): Recent quarters show growth rates of 38.37%, 36.52%, and 50.47%, pointing to steady momentum

- Free Cash Flow Growth: 108.61% over the past year, indicating good financial condition and operational effectiveness

- Profit Margin Expansion: Improved from 19.90% two years ago to 37.91% in the last full year, showing better profitability

Also, META has a flawless history of EPS estimate beats over the last four quarters, with an average surprise of 16.58%. Analyst revisions have also been favorable, with next-year EPS estimates increasing by 11.06% over the past three months. These elements are important for high growth momentum strategies, as they show not only past performance but also future optimism from the market.

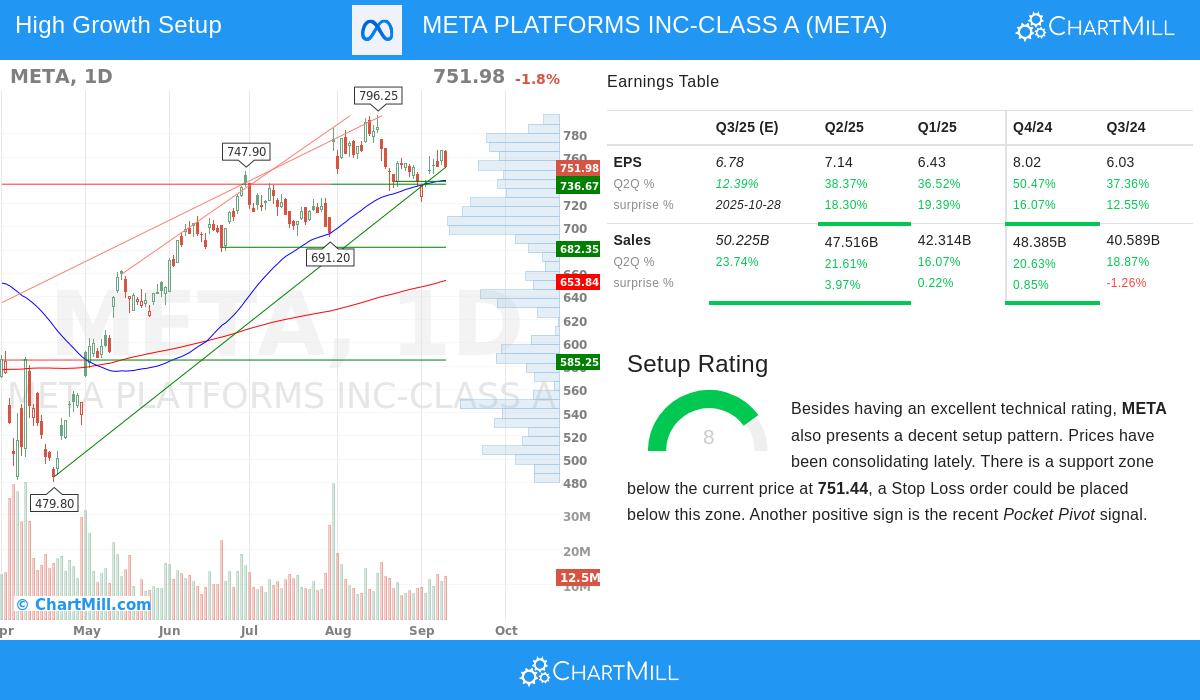

Technical Strength and Setup Quality

From a technical viewpoint, META shows positive bullish traits, making it an interesting option for breakout investors. The stock has a ChartMill Technical Rating of 9 out of 10, showing very good trend condition and relative strength. Both short-term and long-term trends are good, and the stock is trading near the high part of its 52-week range, though it is a bit behind the wider S&P 500, which is also in a positive trend.

The setup quality is also encouraging, with a rating of 8 out of 10. This shows that META is now consolidating inside a set range, offering a possible entry point for investors. Important technical observations include:

- Support and Resistance: Good support is found between $729.48 and $751.44, giving a sensible level for stop-loss orders. Resistance is seen near $785.24 to $790.01, which might act as a near-term ceiling.

- Consolidation Pattern: Over the past month, META has traded between $721.73 and $796.25, with recent price action settling in the middle of this range. This consolidation often comes before a major breakout.

- Recent Signals: A pocket pivot signal was recently found, indicating accumulation by institutional investors and adding assurance to the setup.

For a complete technical analysis, readers can see the full technical report here.

Investment Considerations

META’s mix of high growth momentum fundamentals and a good technical setup makes it a significant candidate for investors looking for exposure to a leader in interactive media and services. The company’s capacity to regularly exceed earnings expectations, along with increasing profit margins and favorable analyst sentiment, offers a solid fundamental foundation. Technically, the stock’s consolidation inside a positive trend provides a measured entry point with well-defined risk levels.

It is important to recognize that while the setup indicates a possible breakout, investors should always perform their own research, thinking about wider market conditions and company-specific news. The existence of several support levels gives a strategic benefit for risk management, but market volatility can always affect short-term price changes.

Explore More High Growth Momentum Setups

For investors interested in finding comparable opportunities, other high growth momentum stocks with positive technical setups can be located using this customized screen. This tool screens for securities with good growth ratings, high technical scores, and quality setup patterns, helping to find possible candidates matching this strategy.

,

Disclaimer: This article is for informational purposes only and does not constitute investment advice. The author does not hold a position in META at the time of writing. Investors should conduct their own research and consider their financial situation and risk tolerance before making any investment decisions.

NASDAQ:META (9/30/2025, 3:28:07 PM)

733.496

-9.9 (-1.33%)

Find more stocks in the Stock Screener

META Latest News and Analysis