After a brief rebound midweek, Wall Street stumbled again on Thursday as renewed concerns over the labor market, the prolonged government shutdown, and stretched valuations weighed on sentiment. The Dow Jones fell 0.8%, the S&P 500 lost 1.1%, and the Nasdaq Composite dropped 1.9%.

A Troubled Job Market and Growing Recession Fears

Fresh data from Challenger, Gray & Christmas revealed that U.S. companies cut 153,074 jobs in October, almost triple the number from a year earlier, the highest October reading since 2003.

Ironically, the disruption then was caused by the rise of mobile phones; today, it’s artificial intelligence reshaping industries and eliminating jobs.

Markets quickly priced in a higher likelihood of another Fed rate cut in December, triggering a rally in Treasuries that sent the 10-year yield down seven basis points. But optimism was short-lived, as the specter of a weaker economy overshadowed hopes for lower borrowing costs.

Shutdown Turbulence Grounds Airlines

The ongoing U.S. government shutdown, now in its 37th day and the longest in history, continues to wreak havoc.

The Federal Aviation Administration ordered a 10% cut in flight activity across 40 airports as thousands of air traffic controllers and TSA agents remain unpaid.

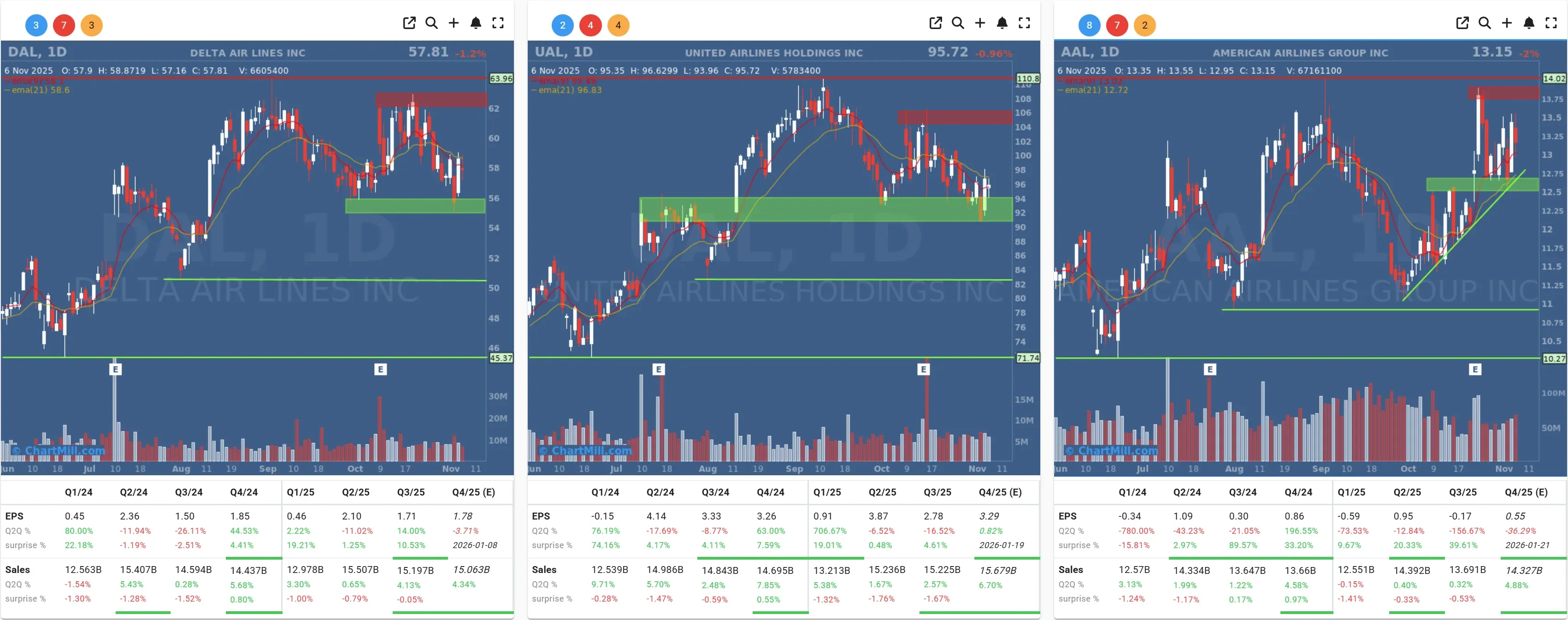

Airline stocks went slightly down, United Airlines (UAL | -1.0%), Delta Air Lines (DAL | -1.25%), and American Airlines (AAL | -2.01%) all declined. With the Thanksgiving travel season approaching, investors fear widespread disruptions that could hurt the sector even more.

Corporate Highlights: Winners and Losers

Snap (SNAP | +9.73%) was Thursday’s surprise winner, soaring nearly 10% after announcing a deal with Perplexity AI to integrate the start-up’s search engine into Snapchat. The partnership, worth $400 million in cash and stock, is expected to boost ad revenue starting in 2026 and help Snap compete with Meta’s Facebook and Instagram.

Not all tech names fared so well. The AI-heavy Nasdaq was dragged down by selling in Nvidia (NVDA | -3.7%), Palantir (PLTR | -4.1%), Oracle (ORCL | -2.9%), and Amazon (AMZN | -2.2%) as investors fretted about lofty valuations.

Elsewhere, Duolingo (DUOL | -25.49%) collapsed after guiding for slower future bookings despite solid Q3 revenue of $271.7 million. CEO Luis von Ahn tried to reassure investors that the company is prioritizing user growth and product quality, but Wall Street wasn’t buying it.

DoorDash (DASH | -17.45%) also nosedived after announcing another round of heavy spending for 2025, even though revenue grew to $3.45 billion. The company’s remark - “we wish there were a way to grow a baby into an adult without investment” - may have been candid, but it didn’t calm investors.

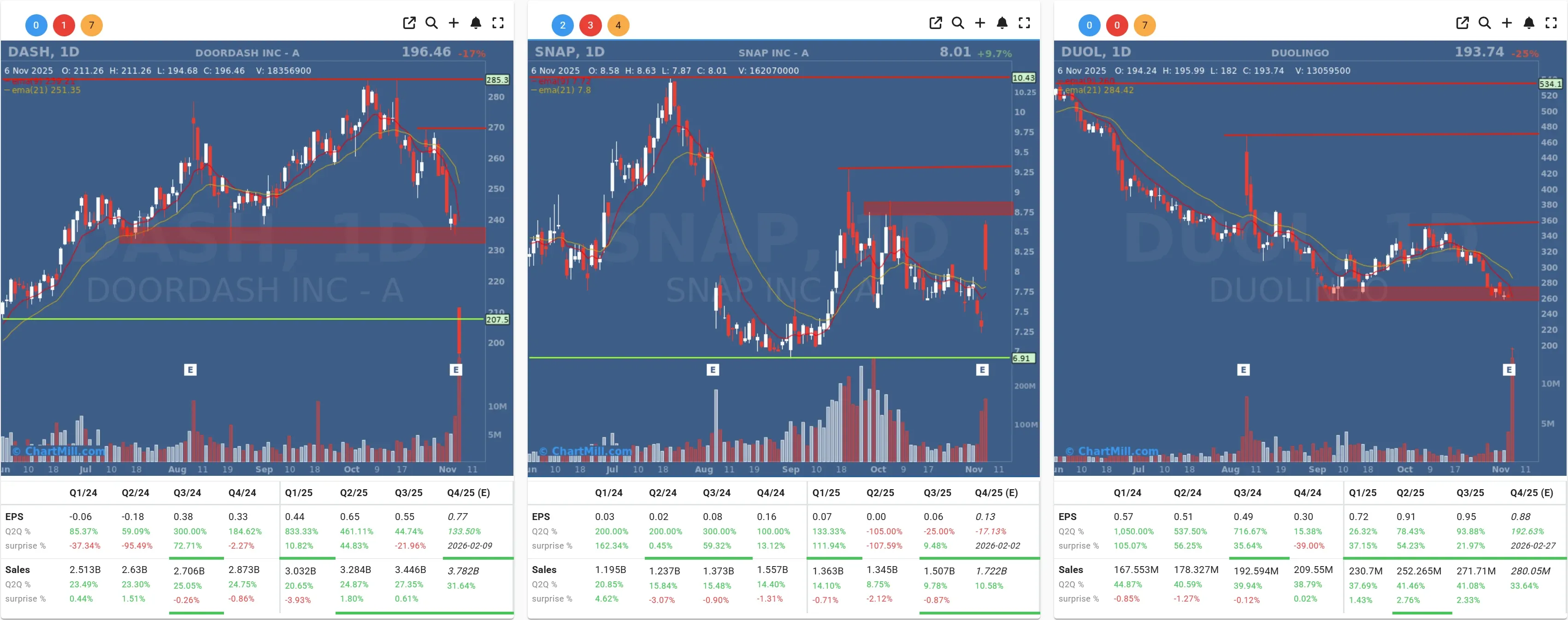

AppLovin (APP | +0.7%) beat expectations slightly, while Robinhood (HOOD | -10.81%) tumbled despite strong results.

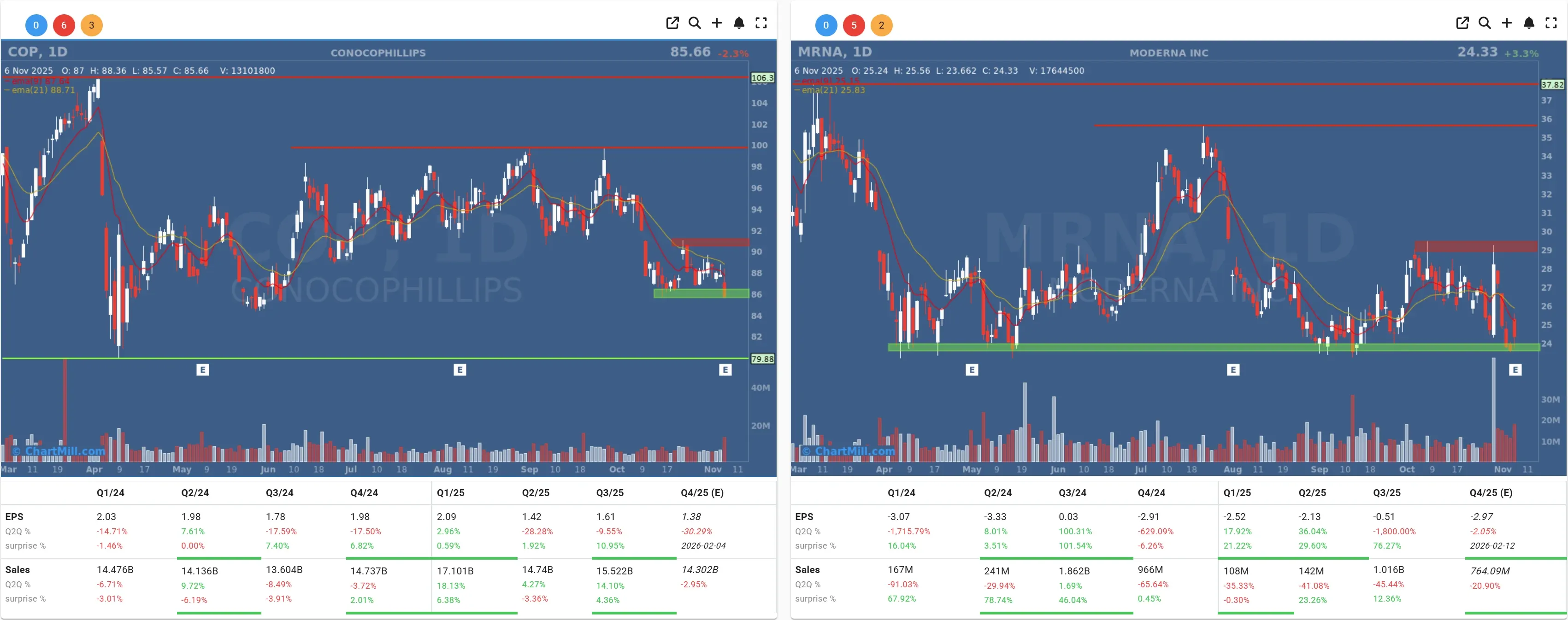

Moderna (MRNA | +3.27%) gained after reporting a narrower loss, and ConocoPhillips (COP | -2.33%) fell as profit came in below expectations despite a dividend hike.

After-Hours Action: Airbnb and Tesla in the Spotlight

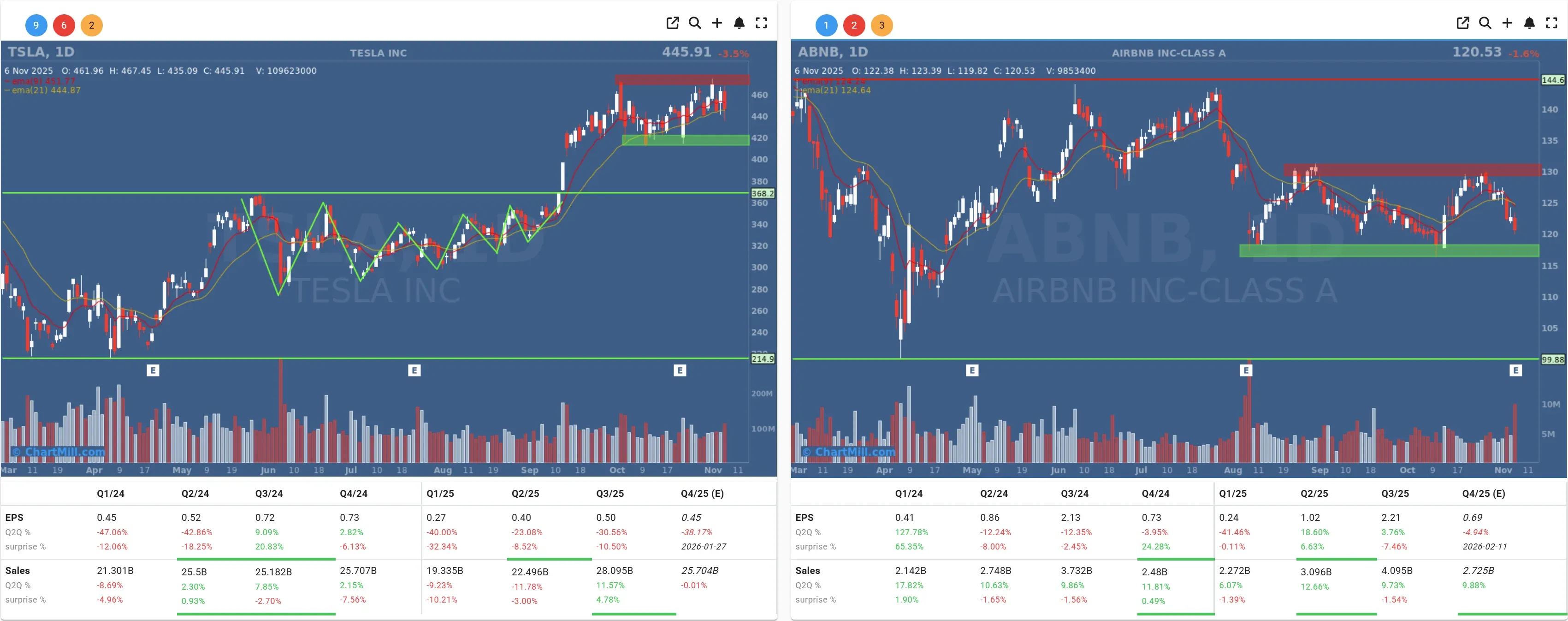

After the closing bell, Airbnb (ABNB | +5.0% after hours) reported a 10% revenue increase to $4.1 billion, beating expectations thanks to resilient travel demand. The company expects Q4 revenue between $2.66 and $2.72 billion, right in line with Wall Street forecasts.

Meanwhile, Tesla (TSLA | -3.5% regular session, +1.5% after hours) shareholders approved Elon Musk’s $1 trillion performance-based compensation package, tied to ambitious milestones like reaching a market cap of $8.5 trillion and producing one million Robotaxis and AI bots.

Musk defended the package, saying it ensures his “robot army” won’t fall into the wrong hands, a statement only Musk could deliver with a straight face.

Oil, Trade, and the Bigger Picture

Oil prices fell for a third straight day as OPEC+’s recent production hikes kept buyers on the sidelines. Meanwhile, uncertainty around Trump’s new import tariffs and the Supreme Court’s skepticism about their legality added another layer of volatility.

With every additional week of government paralysis, economists estimate that U.S. GDP growth loses 0.1 to 0.2 percentage points. Lawmakers remain hopeful for a breakthrough this weekend, but investors are learning the hard way that hope doesn’t pay dividends.

Looking Ahead

All eyes now turn to Friday’s nonfarm payroll report, if it’s ever released. The shutdown has delayed key economic data for a second straight month, leaving markets flying blind.

In the meantime, volatility looks here to stay. Between AI exuberance, political gridlock, and a cooling labor market, investors might want to keep their seatbelts fastened and perhaps their sense of humor intact.

Kristoff - ChartMill

Next to read: Breadth Collapses Again After One-Day Rebound