TRADERS - Sizing Positions - Part 2

Published on Chartmill with kind permission of TRADERS’ Magazine. Check the original PDF article here

Trading and investing is simple, very simple actually. Particularly in financial markets. Because all we can do there, is just buy and sell stuff. Yet at this very basic level of making decisions, things already start to go awfully wrong. So however simple it may be, it sure isn’t easy. In this article we explain the single most important formula any trader and investor should know. In fact, it’s probably the only formula everyone should know about in life. And we’ll discover how most people who know the formula already, probably interpret and apply it the wrong way. Finally we’ll get into how to exploit this and work the numbers.

Recap

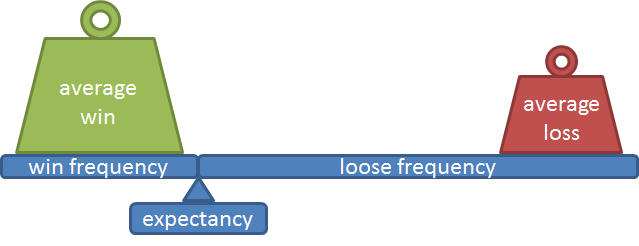

In the first article of this series we introduced expectancy as a way to measure overall profitability of a system. The average result per trade being the result of the frequency of profitable trades, multiplied by the average profit of those winners. From this we have to subtract the frequency of losing trades, multiplied by the average loss of those losses:

There are two points to take away from this formula. First, this is no magic formula. Even worse, we can’t use it by just filling in the numbers. As much as system builders like to believe, this formula cannot tell anything about a system’s future behavior. As we can only know past wins and losses, this formula will give us nothing more than historical expectancy. So we definitely shouldn’t focus on using the formula in a numerical way. This formula isn’t about predicting system quality, it’s about control and effort. This brings us to the second important take-away for this formula. There are two dimensions to profitability. And as much as traders like to focus on maxing the number of winning trades, we have far more control with far less effort containing the average size of profits and losses. This article goes into how to do just that.

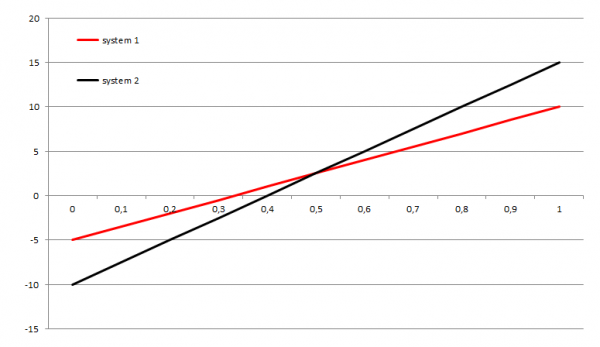

Figure 1 shows a metaphorical scales indicating that traders should take care of the weights instead of trying to change the scales’ arms. Figure 2 shows two systems in comparison, illustrating the existence of two dimensions. System 1 (red) has an average loss of -5 and an average profit of 10, while system 2 (black) has profitable trades of 15 on average and average losses of -10. As you can see on the comparison chart, there’s isn’t an overall better system. It depends on frequency. As soon as the frequency of winners gets bigger than 1 out of 2, the black system is the better choice. The red system is profitable as long as there’s one winner for every two losses.

This whole idea of control focus, actually comes down to cutting losses and letting profits run. A Wall Street wisdom before long. Expectancy provides it’s mathematical proof. Finally, adding power laws to this mix provided us with the informal evidence that trend following strategies might be the most plausible for people not having an artificial edge such as no cost advantages and spread or commission income. Perhaps it’s even one, if not the only, strategy the will keep working overtime.

Expectancy (and statistics for that matter) proves that cutting losers and maximizing winners will eventually work out to be consistently (but not always) profitable.

Risk

So how can we control the average size of winners and losers? Although controlling the average size of winners and losers is a long term perspective, it starts with handling every single trade the right way in our expectancy framework.

There are two ingredients to handle this control: risk management and position size. On the one hand we have different types of risk, all of which must be contained and controlled. On the other hand, there’s the size of a position helping to take care of the former. We will focus on risk handling in this article. In the next article we will have a close look at determining position size in its own right.

Cut your losses

Profits take care of themselves (hold that thought though), losses never do. The basic idea is simple. Minimize every loss and the average overall loss will be minimal. Theoretically, the average loss cannot ever get bigger than x% if we limit each and every loss to x%.

This idea amounts to guarding against two possible harmful things a trader can do. Not cutting losers and, to an even worse degree, buying more of them. These are mainly mental problems. Selling for a loss means admitting being wrong, materializing the loss and selling all hope things could turn for the better. One way to deal with the mental part is putting every title that gets stopped out in your agenda or trading dairy a few weeks from now, forcing you to look back at the charts then and see how the stop protected you from the worst.

Both problems can be solved by using stops. And even though one can use mental stops, automatic stops do have several advantages. Not having to watch markets being the biggest one. Not only can you do more interesting things meanwhile, you also don’t run the risk of getting caught up in daily action and the ‘need for speed’.

Stops do however have two big disadvantages. Stops can get ran (i.e. work if they shouldn’t) or they can be gapped over (i.e. not work if they should). Adhering to this is of course our mind playing tricks with us, justifying for not putting in stops. For starters, a perfect place for a stop doesn’t exist. If it would, that would equal a 100% winning system. Stops are not perfect, but who wouldn’t jump with a parachute having an 80% chance of opening rather than with no chute at all. Also limits are dangerous with exit orders. It’s a guarantee that gaps eventually will get the better of you. Exit orders should get you out in the first place. They don’t get executed at the place and time to start bargaining for cents. Getting out is their primary objective. Good advice thereby would be to use limits with entry orders but use exit orders only without limits.

All disadvantages of stops really are pure technical problems, not conceptual ones. Never before traders had such an abundance of tools and financial products to their disposal to manage risk to the cent.

Take, for one example, options. A simple call instead of a materialized position in the underlying asset caps off risk and prevents gaps from being any problem at all. We will address the example of a simple call again as a tool while maximizing profits. The main message here is that possibilities for managing risk are endless nowadays. So any excuse for not using them is merely in the eye of the beholder. But even a gapped over stop will average out in the long run. So if you have slippage, this will eventually dry up as you keep minimizing losses.

Although addressing all types of risk would be far beyond the scope of this article series, there are a few we have to mention with respect to containing losses.

To begin with, illiquidity is by far the most underestimated risk of all. Illiquidity has killed many a trader. So always watch out that you are trading things that are liquid enough for your position sizes. Specific risk, coming with the financial asset you are trading, is another one. Stocks have company risk, futures have lock limit days, end so on. Get to know specific risks.

To wrap up the cutting losses part of the equation: never add to losses. Losers average losers. So behold every system using dollar cost averaging of any kind (like Lichello’s AIM). Let’s leave that to ‘investors’. Apart from inertia minimizing your chances to buy at bottoms, it’s a mathematical fact that averaging down is a bad deal. Without showing you the mathematical proof, picture it this way: if you sell something and buy it back after it bounces from going down first, you will be better off than adding to the position on the way down. To worsen matters, if you average down, you still have an overall losing position. Red is an awful color to live with in a traders’ portfolio. It tears you down mentally. Also, averaging down, absorbs more money. It’s throwing good money after bad. And while it sucks up more of your money, you eventually become an involuntary investor instead of a trader. To put it another way, most people don’t have the money nor the stomach to add to losers. Yet most do.

Let you profits run

Capping losses is an easy concept. The hard part is in consistently doing it. In contrast, maximizing profits, to most traders, translates in finding more winners. But that’s trying to steer the wrong dimension. We should maximize profits by maximizing each individual trade’s profit. So even though Jesse Livermore might have mentioned that profits take care of themselves, in reality they don’t. We can maximize profits by not taking them in the first place.

Rather than selling a winner we should let it run, while protecting it. Protection can be provided by increasing the stop in the direction of increasing profits. This sounds counterintuitive to starting traders, because as positions add to their profits, they start representing an ever greater part of one’s portfolio. With it risk seems to increase. But as mentioned in the cutting losses part, our tools aren’t confined to stops. Take a simple call again. It can be used for deflating risk while holding on to the whole position (or even a bigger one) by a strategy called cash extraction. Say you have a large position after having let run profits. We than could sell whole or part of the position and replace it with a call position of the same size (or bigger) for a small part of the money received. As such profits can be kept running while risk is capped off effectively and capital is freed for new opportunities (perhaps even to continue adding to the same position, but then we’re not talking about lowering risk anymore of course).

If not taking profits is one solution to maximizing profits, adding to a winning position is the next step. Not in the least part because we don’t have to start looking for new winners (selection, remember) when we’re already sitting on one for sure. After all, the best proof for a winner is the real profit it’s showing you. It’s remarkable how system builders and back testers very often do not consider adding to winners in their strategy. Adding to winners could turn a marginable profitable and even a losing system into a discernible profitable one. Adding to winners is sometimes called reverse pyramiding (pointing to the opposite of adding to losers as pyramiding). Reverse pyramiding can be done by considering every add-on as a new position with respect to risk management. Also as price increases when running profits, at least for long positions, we want our money in as soon as possible, while prices still are low. As such a pyramiding system should take its smallest position first, as a toe in the water. This probe could easily turn in to a minimized loss. The first add-on should be the biggest with regard to further add-ons. That way we obtain a 1, n, n-1, n-2, n-3 … scheme. Also the total pyramided position can be deflated of risk while even being increased as illustrated before.

Next, we should be very careful with diversification. Much as it lowers our specific risk, it doesn’t lower any systemic risk and it almost certainly averages down our eventual return. Diversification stands directly opposite to using expectancy as we should. Because as profits run, winning positions will suck up an ever larger portion of resources while going against diversification. Diversification is like saying: let’s sell this winner and start looking for 10 new ones. Diversification originally goes back to asset management but crept into speculative asset classes, like the ones publicly traded on financial markets. Although diversification over different asset classes is a mighty good idea, diversifying one’s trading portfolio might not be.

Last but not least, one can further optimize winners by dynamically sizing positions based on the (estimated) profit to loss ratio. We’ll go into that in the next article.

Conclusion

Expectancy is really about control (and the danger for the illusion of it). We have far more control about the average size of our winners and losers then the illusionary control we have over their frequency (which is, by the way, why we indulge in way too many analysis). Patience is the key to success, not speed. In this article we saw how we can obtain this control by managing risk. In the next article we are going to talk about position size as a way to seize further control over expectancy.

[FIGURE 1]

[HEAD] Expectancy equilibrium scales.

[CAPTION] Figure 1: On these scales the average profit (green) is balanced against the average loss (red). More importantly, the arms of the scales are proportional to the frequency of winners and losers. As such, the average loss has a bit more moment of force than its counterpart on the other side. Nevertheless, in this example, the frequency and average profit of winners makes up for the frequency and average loss of the losers. Resulting in an equilibrium with no net profit or loss.

[FIGURE 2]

[HEAD] System expectancy comparison

[CAPTION] Figure 2: Neither the size nor the frequency of profits and losses determines overall profitability. In this chart the red system is the better choice as long as there’s a maximum of 50% winners. From there on the black system starts outperforming the red system. Below 1 win for every 2 losses (0.333 on the x-axis), even the red system becomes a losing system.

DIRK VANDYCKE is actively and independently studying the markets for over 15 year, with a focus on technical analysis, market dynamics and behavioral finance. He writes articles on a regular basis and develops software, which is partly available at his co-owned website www.chartmill.com. Holding master degrees in both Electronics Engineering and Computer Science, he teaches software development and statistics at a Belgian University. He’s also an avid reader of anything he can get his hands on. He can be reached at dirk@monest.net.