Valuation Screens - Undervalued Stocks

The Decent Value Stocks screen is a Fundamental (FA) screen which will filter for stocks with a good fundamental valuation, while still showing decent profitability, health and growth.

Fundamental Valuation Filters

A description of the fundamental filters related to valuation, like price/earnings, price/book, peg ratio

Fundamental Analysis Reports and Ratings

Fundamental analysis reports for growth, valuation, health, profitability and dividend.

What is Value Investing?

Simply put, the value investor specifically looks for companies whose market value (stock price) is lower than their current intrinsic value.

Analyzer Intro

The analyzer module introduced

Which Stocks to Pick when Inflation is Rising?

Which stocks to buy when inflation is rising strongly?

How to find the best value stocks?

Using our stock screener to find the best value stocks

Related Videos

How To Find Undervalued Stocks? 3 Ways Using the Stock Screener ChartMill

In this video, I'm going to show you three different ways you can use the ChartMill stock screener to find undervalued stocks.

How to find high quality VALUE stocks?

In this video, I use the stock screener to arrive at a basic list of high-quality value stocks of interest to value investors.

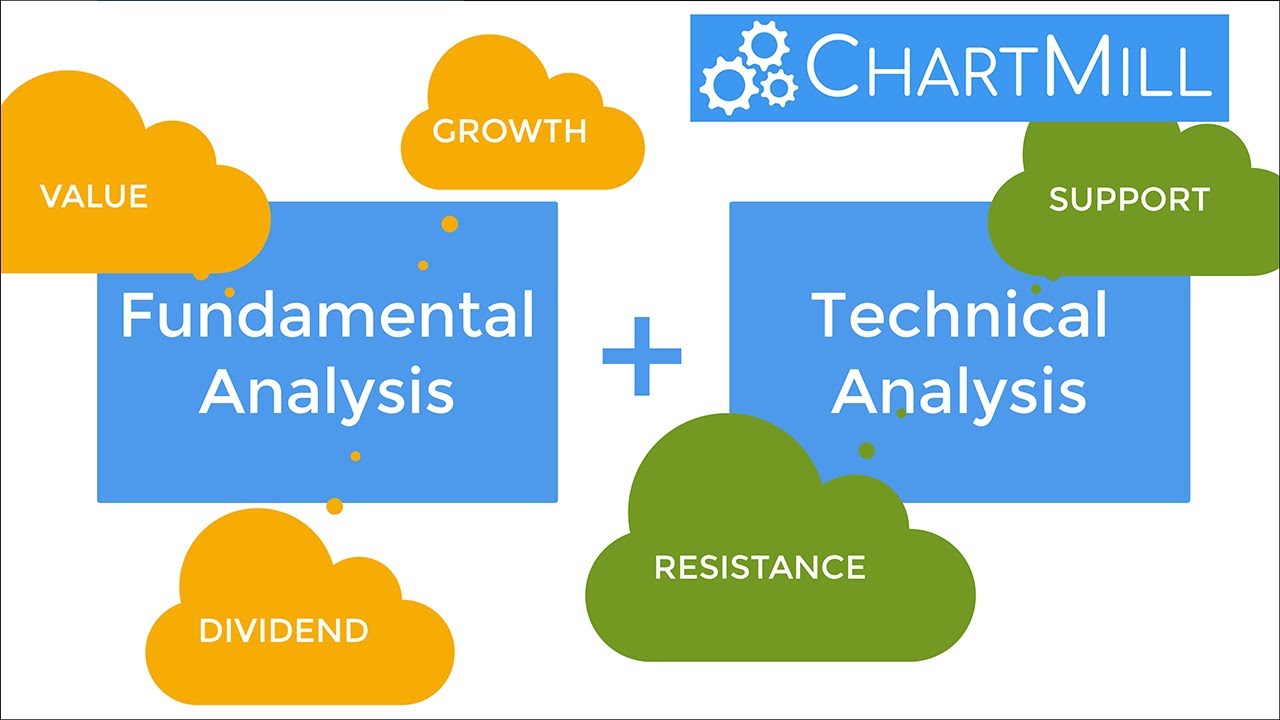

How to find financially sound Growth, Value or Dividend stocks that quote at key technical levels?

In this video you will learn: How to use ChartMill to find financially sound growth, value or dividend stocks using the predefined ChartMill Fundamental ratings And then use the technical screening capabilities to focus on stocks whose price currently coincides with a key technical price level, either support or resistance levels. The beauty of this is that we start from a fundamental perspective by first filtering on the basis of specific fundamental criteria. Within that selection, we then look specifically for price technical characteristics. In this way we combine fundamental with technical analysis.

Price: Above 20

A minimum price

Average Volume: 50 SMA > 500K

A minimum volume to avoid less liquid stocks

Chartmill Valuation Rating: Rating >= 7

A ChartMill Fundamental Valuation Rating of at least 7, which means the stocks is undervalued.

Chartmill Health Rating: Rating >= 5

A ChartMill Fundamental Health Rating of at least 5, which means the stock has decent financial health.

Chartmill Growth Rating: Rating >= 4

A ChartMill Fundamental Growth Rating of at least 4, which means the stocks is at least growing a bit.

Chartmill Profitability Rating: Rating >= 5

A ChartMill Fundamental Profitability Rating of at least 5, which means the stock has decent profitability statistics.

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.