For investors looking for steady income, dividend investing stays a key method for creating lasting wealth. The process focuses on finding companies with good dividend features while keeping basic financial soundness and earnings. Using ChartMill's dividend selection process, which sorts for stocks with a Dividend Rating of 7 or more, Health Rating of at least 5, and Profitability Rating of at least 5, we can find companies that provide reliable dividend payments along with business steadiness. This detailed selection helps prevent the usual mistake of pursuing high payouts without looking at the basic financial soundness needed to continue those payouts.

Dividend Profile Assessment

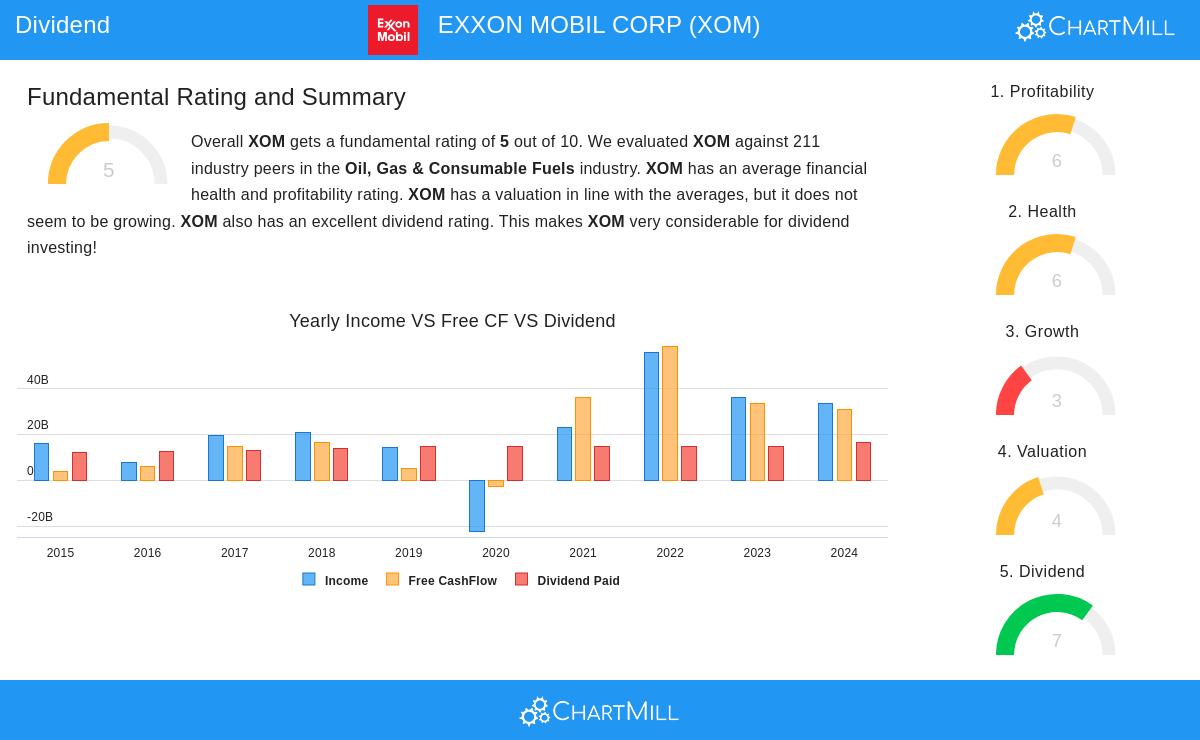

Exxon Mobil Corp (NYSE:XOM) offers a strong case for investors focused on dividends, reaching a ChartMill Dividend Rating of 7 out of 10. The company's dividend features show both steadiness and acceptable long-term viability:

- Dividend Yield: 3.55% gives income higher than the S&P500 average of 2.32%

- Dividend Growth: 3.02% yearly growth rate over previous years

- Payment History: Regular dividend payments for more than 10 years with no cuts

- Payout Ratio: 55.57% of earnings shows distribution levels that are manageable

The company's long history of keeping and slowly raising dividends points to management's dedication to shareholder returns. While the yield might not be the top in the energy field, the mix of stable growth and dependable payment history forms an appealing profile for income investors wanting predictability.

Profitability and Operational Strength

Exxon Mobil's Profitability Rating of 6 shows acceptable business performance that backs its dividend promises. The company displays good returns on capital and getting better margins:

- Return Metrics: ROA of 6.93%, ROE of 11.81%, and ROIC of 7.61% all do better than most industry competitors

- Margin Trends: Both profit margin and operating margin have gotten better in recent years

- Cash Flow Generation: Steady positive operating cash flow over the last five years

These profitability numbers are important for dividend continuity, as they show the company's capacity to create enough earnings to pay for both operations and shareholder payments without weakening financial condition.

Financial Health and Stability

With a Health Rating of 6, Exxon Mobil keeps a sound financial state that supports its dividend plan. The company's solvency numbers are especially notable:

- Debt Management: Debt/Equity ratio of 0.13 shows very little use of debt financing

- Solvency Strength: Altman-Z score of 4.16 points to very low bankruptcy chance

- Industry Comparison: Debt numbers do better than about 75-85% of industry competitors

The solid solvency position gives a safety net during industry slumps, making sure the company can continue dividend payments even in difficult market times. This financial toughness is key for dividend investors who value payment consistency.

Valuation and Growth Considerations

Exxon Mobil's valuation seems fair within its industry setting, trading at a P/E ratio of 16.41 compared to the industry average of 21.01. While growth numbers show some difficulties with recent revenue drops, the company keeps positive earnings growth forecasts of almost 10% each year. For dividend investors, the present valuation gives a satisfactory starting point considering the company's stable dividend profile and sound financial base.

Looking at Other Possibilities

Investors curious about finding more companies with comparable dividend features can look at the complete fundamental analysis report for Exxon Mobil for more detailed information. The selection process that found Exxon Mobil can be used to find other possible dividend options through the Best Dividend Stocks screen, which often updates with new choices meeting these careful standards.

Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security. Investors should conduct their own research and consult with a financial advisor before making investment decisions.