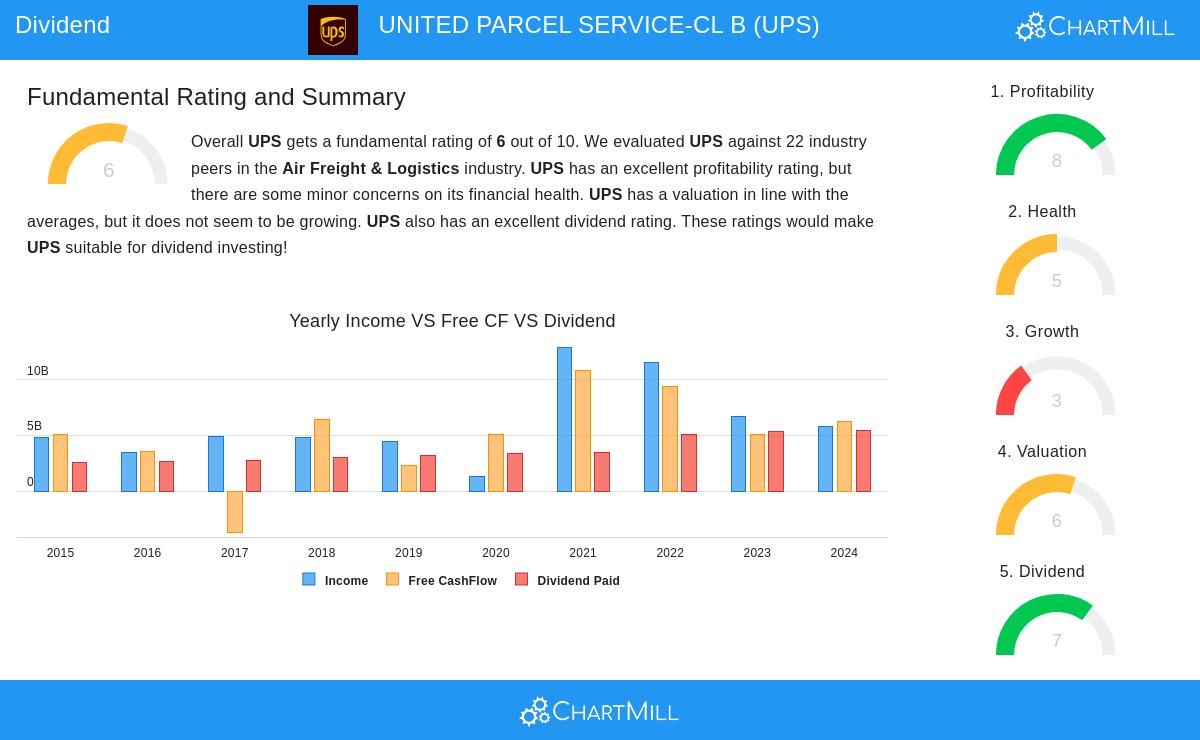

UNITED PARCEL SERVICE-CL B (NYSE:UPS) stands out as a compelling choice for dividend investors, according to our Best Dividend screen. The company combines a strong dividend profile with solid profitability and reasonable financial health, making it a candidate for income-focused portfolios.

Dividend Strength

- Attractive Yield: UPS offers a 6.52% dividend yield, well above the S&P 500 average of 2.42% and outperforming 95% of its industry peers.

- Reliable Growth: The company has increased its dividend at an average annual rate of 11.18% over the past five years, demonstrating a commitment to rewarding shareholders.

- Long Track Record: UPS has paid dividends consistently for at least 10 years without reductions, reinforcing its reliability for income investors.

Profitability Supports Payouts

- Strong Margins: UPS maintains a profit margin of 6.44%, ranking better than 86% of competitors in the air freight and logistics sector.

- High Returns: The company’s return on equity (37.39%) and return on invested capital (12.73%) are among the best in its industry.

- Consistent Earnings: Despite a slight dip in recent EPS growth, UPS has remained profitable over the past five years, supporting its dividend sustainability.

Financial Health Considerations

- Solvency: UPS has a Debt-to-Equity ratio of 1.25, indicating higher leverage, but its Altman-Z score (3.15) suggests low near-term bankruptcy risk.

- Cash Flow Coverage: The company’s free cash flow covers its debt obligations, with a Debt-to-FCF ratio of 3.98, better than 73% of peers.

Valuation

UPS trades at a P/E ratio of 12.96, below the S&P 500 average (27.15) and reasonably priced compared to industry peers.

For a deeper look, review the full fundamental report on UPS.

Our Best Dividend Stocks screener provides more high-quality dividend ideas, updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.