Universal Health Services-B (NYSE:UHS) has been found using a value investing screen that focuses on stocks with good fundamental valuation scores while also having acceptable amounts of profitability, financial condition, and expansion. This method fits with the ideas of value investing, which looks for companies priced under their true worth but with fundamental operational soundness, providing a possible safety buffer and chance for price growth as the market adjusts its assessment.

Valuation Metrics

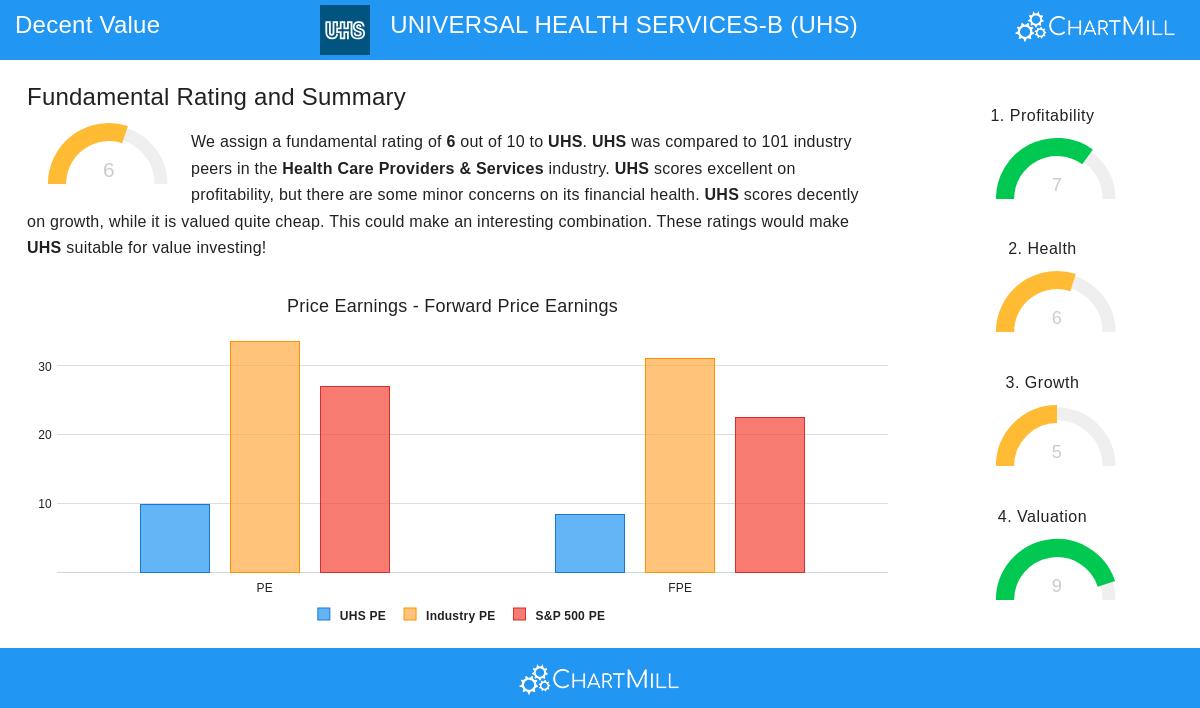

The valuation metrics for UHS are notable, receiving a ChartMill Valuation Rating of 9 out of 10. Important numbers behind this rating are:

- A Price/Earnings (P/E) ratio of 9.89, much less than the industry average of 33.58 and the S&P 500 average of 27.03.

- A Forward P/E ratio of 8.43, also below industry and wider market comparisons.

- An Enterprise Value to EBITDA ratio showing UHS is less expensive than 86% of its industry group.

These numbers imply the stock is valued cautiously compared to its earnings and cash flow ability, a sign of undervalued cases that value investors frequently seek. When the market values a stock this modestly relative to its financial results, it can point to a mispricing that might adjust, particularly if the company keeps performing adequately.

Profitability Assessment

UHS shows good profitability, shown by a ChartMill Profitability Rating of 7. Important positives here are:

- Return on Assets of 8.41%, doing better than 92% of industry rivals.

- Return on Equity of 17.94% and Return on Invested Capital of 11.02%, both placed in the high end of the sector.

- Consistent and sector-leading net and operating margins.

Profitability is vital in value investing since it shows a company’s capacity to produce returns from its assets and equity, important parts of true value. A profitable company with good returns on capital is more able to maintain and increase its worth, lowering investment risk.

Financial Health

Having a Financial Health Rating of 6, UHS shows a reasonable yet somewhat varied picture. Good signs are:

- A reducing share count in recent years, indicating effective capital use.

- A good Altman-Z score of 3.10, implying low bankruptcy danger and doing better than 62% of peers.

- Acceptable debt amounts, with a Debt-to-Equity ratio of 0.65 matching industry standards.

Still, liquidity measures like Current and Quick ratios are sufficient but not outstanding, showing area for betterment. For value investors, financial condition confirms the company can endure economic slumps and steer clear of value traps, cases where seeming low cost hides fundamental weakness.

Growth Prospects

UHS has a Growth Rating of 5, backed by both past results and future outlooks:

- Earnings Per Share increased 37.47% over the previous year, with a 10.74% average yearly growth rate in recent years.

- Revenue rose 9.61% in the last year and has displayed steady past expansion.

- Analysts forecast an 11.65% yearly EPS growth ahead, although revenue expansion is predicted to slow.

Growth is an important addition to valuation in value investing, as it backs the view that true worth will rise. Even small growth can improve returns when beginning from a low valuation starting point.

Investment Considerations

For value-focused investors, UHS stands as a candidate fulfilling several significant standards: low valuation multiples, sound profitability, satisfactory financial condition, and a favorable expansion path. These parts, explained in the full fundamental analysis report, indicate the market might be underestimating the company’s steady operational results and future possibilities.

It is necessary to recognize specific risks, including the average dividend yield and predictions for reduced revenue expansion. Also, the healthcare industry deals with regulatory and competitive forces that may influence future performance. Investors must balance these items against the obvious valuation chance.

For those wanting to investigate comparable investment chances, more outcomes from the "Decent Value" screen are available here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research and consult with a qualified financial advisor before making investment decisions.