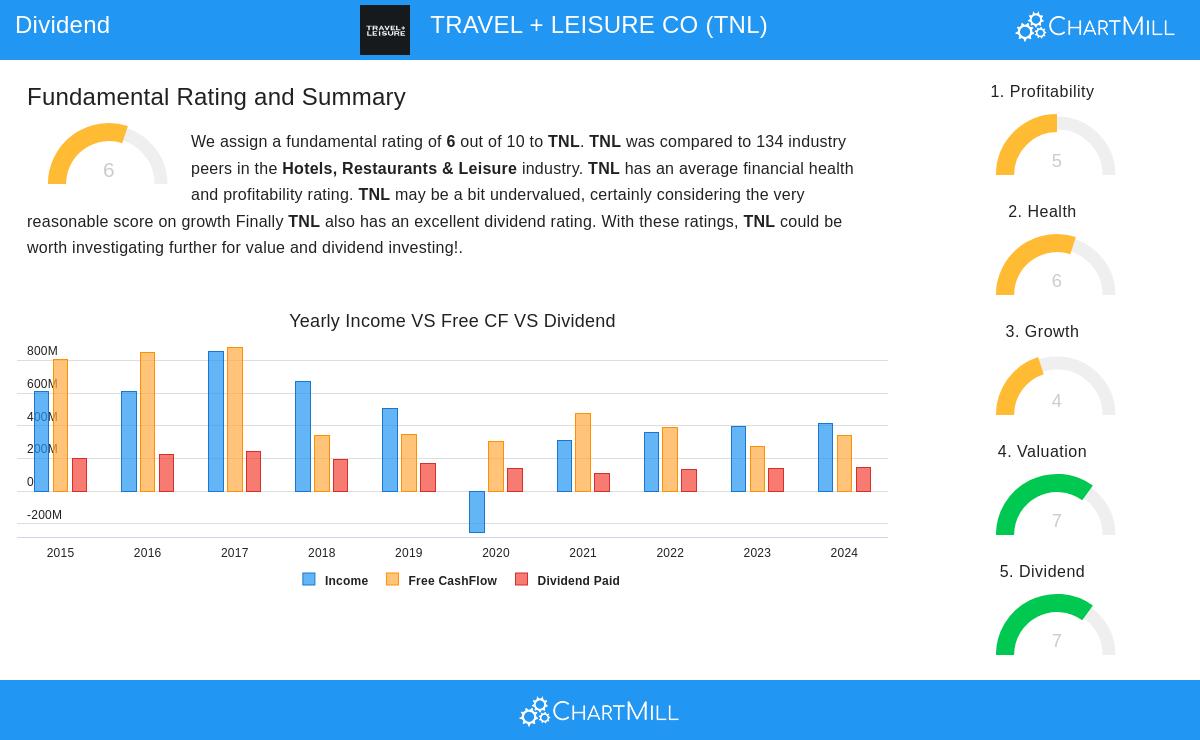

Travel + Leisure Co (NYSE:TNL) has appeared as a notable option for dividend investors after passing a detailed screening process made to find high-quality income-generating stocks. The screening method focuses on companies with solid dividend traits while keeping sufficient financial health and profitability, important factors for lasting dividend payments. Stocks were chosen for a minimum ChartMill Dividend Rating of 7, together with Health and Profitability Ratings of at least 5, making sure that picks not only provide good yields but also have the business strength to support them.

Dividend Strength and Sustainability

TNL’s appeal to dividend-focused investors is based on its strong dividend profile, which shows both good income and a maintainable payout structure. The company’s dividend metrics are notable in several main areas:

- Dividend Yield: At 3.57%, TNL gives a yield that is higher than the S&P 500 average of 2.32%, offering income-seeking investors a meaningful cash return.

- Payout Ratio: With a payout ratio of 37.03%, the company keeps a large part of its earnings for reinvestment and growth, lowering the chance of dividend cuts during economic slowdowns.

- Track Record: TNL has paid dividends without interruption for more than ten years and has not lowered its payout in the last three years, highlighting its dedication to returning capital to shareholders.

These traits match a central idea of dividend investing: focusing on dependable and well-backed income streams over very high but uncertain yields. A maintainable payout ratio and a history of consistent payments decrease the chance of negative changes to dividend policy, which is important for long-term income portfolios.

Profitability and Operational Efficiency

While the main focus is dividends, TNL also shows good profitability, which supports its capacity to keep creating shareholder returns. Key profitability points include:

- Return on Invested Capital (ROIC): At 10.78%, TNL does better than 75% of its industry peers, showing efficient use of capital.

- Profit Margin: The company’s profit margin of 10.14% is higher than almost 77% of competitors in the Hotels, Restaurants & Leisure industry.

- Operating Margin: A good operating margin of 19.84% further shows strong operational control and pricing power.

These metrics are important because profitable companies are in a better position to maintain and increase their dividends over time. Without steady earnings, even the most generous dividend policies can become hard to keep. TNL’s profitability offers a cushion against economic challenges and helps future dividend growth.

Financial Health and Stability

TNL’s financial health metrics strengthen the argument for its dividend sustainability. The company shows positives in liquidity and solvency, which are crucial for handling uncertain economic situations:

- Liquidity Position: The current ratio of 3.71 and quick ratio of 2.70 are much higher than industry averages, showing plenty of short-term financial flexibility.

- Debt Management: Although the debt-to-free-cash-flow ratio is high at 11.31, this is normal for the industry, and the company’s overall solvency stays steady.

- Share Reduction: TNL has lowered its share count over the past five years, which can improve earnings per share and help higher dividend payments per share over time.

A solid balance sheet ensures that a company can meet its dividend commitments even during times of lower earnings or market pressure. For dividend investors, financial health is essential—without it, dividend sustainability is always doubtful.

Valuation and Growth Prospects

From a valuation viewpoint, TNL seems fairly priced, trading at a P/E ratio of 10.32, which is under both the industry and S&P 500 averages. This indicates that the stock provides value along with its income traits. Also, analysts forecast earnings growth of 12.84% each year, which might help future dividend raises. For dividend investors, a mix of low valuation and growth possibility improves the total return outlook, giving not only income but also possible capital gains.

Conclusion

Travel + Leisure Co represents a balanced opportunity for dividend investors, mixing a good yield with the financial and operational strength to maintain it. Its careful payout ratio, steady profitability, and firm balance sheet fit the screening criteria that stress quality and sustainability over high yield alone. For those making a dividend portfolio, TNL offers a notable mix of income and steadiness.

For further research and to explore additional dividend stock ideas, you can review the full results of the Best Dividend Stocks screen here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.