For investors aiming to build a portfolio that produces steady passive income, a systematic screening method is important. One useful tactic involves selecting for companies that provide a good dividend now and also have the basic financial soundness to maintain and possibly raise those payments in the future. This method frequently focuses on using combined ratings that assess several fundamental areas. A functional technique is to select for stocks with a strong dividend rating, confirming the payout is both meaningful and durable, while also setting baseline scores for earnings power and balance sheet condition. This tiered filter aids in sidestepping the typical dividend trap—a high yield hiding a weakening business—by focusing on companies with good operations and firm balance sheets.

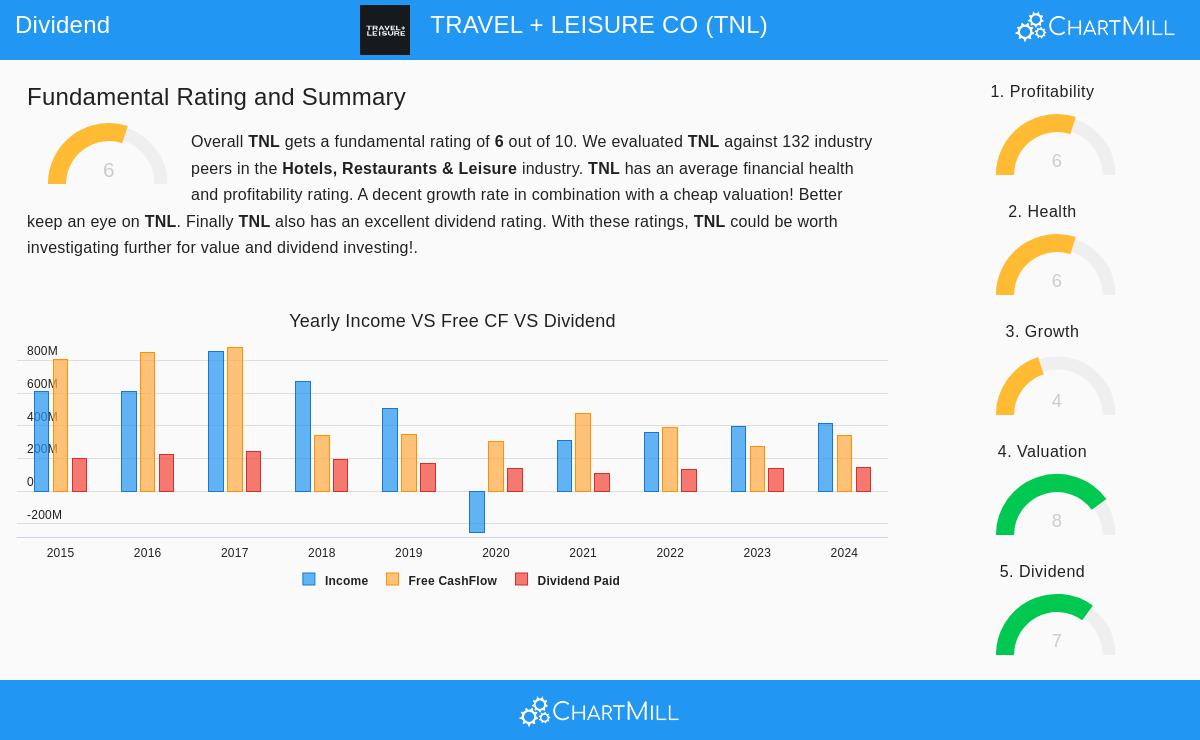

Travel + Leisure Co. (NYSE:TNL), a notable company in the hospitality and vacation ownership sector, appears as a candidate from this kind of screening method. The company’s fundamental picture indicates it may deserve more examination from income-oriented investors.

Dividend Attraction and Durability

The central draw for dividend investors is, clearly, the income. TNL makes a strong case here, receiving a 7 out of 10 on the ChartMill Dividend Rating. This rating combines important measures into one number, and a detailed view shows the parts that create it.

- Good Yield: TNL provides a yearly dividend yield of 3.12%. This is a solid return that exceeds both the average yield of its Hotels, Restaurants & Leisure industry group (1.48%) and the wider S&P 500 (about 1.87%).

- Consistent History: The company has distributed dividends for at least ten years, showing a history of dedication to giving capital back to shareholders. This history is a good sign for investors who value regularity.

- Durable Payout: Maybe most importantly, the dividend seems well-covered. The payout ratio—the part of earnings given as dividends—is at a low 36.01%. This small ratio shows the company keeps a large part of its profits for internal use and offers a good cushion, making the present dividend level very durable even if earnings experience short-term challenges.

- Increase Possibility: While the past yearly dividend increase rate is small at 2.47%, analysts estimate earnings per share (EPS) to rise by more than 13% each year in the near future. This anticipated earnings rise is greater than the recent dividend growth, hinting there is room for future dividend raises without stressing the company’s funds.

Supporting Fundamentals: Earnings Power and Condition

A high dividend is only as reliable as the business that provides it. This is why the screening tactic requires acceptable scores in earnings power and balance sheet condition. TNL’s ratings of 6 in both areas point to a stable core business, which is key for the lasting endurance of its dividend.

Earnings Power: The company shows firm operational performance. Its profit margin of 10.36% and operating margin of almost 20% are better than most of its industry rivals. More significantly, its Return on Invested Capital (ROIC) of 10.73% is not only good but has displayed a recent rise, indicating efficient use of capital to create earnings. This steady earnings power is the source that pays for the dividend.

Balance Sheet Review: TNL’s balance sheet displays a varied but generally sufficient situation. A key positive is its liquidity; with a Current Ratio of 3.79 and a Quick Ratio of 2.76, the company has enough short-term assets to meet its near-term debts, rating well against industry groups. On long-term stability, the situation is more detailed. The company has been steadily lowering its debt-to-assets ratio and repurchasing shares, both good indicators. However, its debt amount compared to free cash flow is high, a typical aspect in its asset-heavy industry and similar to peers. This is a point for investors to watch, though it is presently offset by firm liquidity and an acceptable Altman-Z score.

Valuation Setting

For dividend investors mindful of price, the cost paid is relevant. TNL sells at a Price-to-Earnings (P/E) ratio of 11.4 and a forward P/E of 9.8, which is viewed as low compared to both the general market and most of its industry. When combined with its dividend yield, this valuation implies the market may not be completely valuing the company’s income-producing ability and estimated earnings rise.

A Candidate for More Study

Travel + Leisure Co. displays a profile that matches a careful dividend investment tactic. It offers a yield that is good on its own and compared to others, supported by a durable payout ratio and a long record of payments. These dividend positives are backed by acceptable earnings measures and a financially sound position, especially concerning liquidity. The stock’s price appears fair, possibly offering some protection.

It is vital to note that past results and present measures are not certainties. The travel and leisure industry can shift with the economy, and the company’s debt situation, while controlled, needs observation. A full review of TNL’s complete fundamental analysis report is advised to grasp all details.

For investors wanting to review other companies that match this systematic method of joining high dividend quality with fundamental soundness, more options can be seen by using the Best Dividend Stocks screen.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any security. Investing involves risk, including the potential loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.