For investors looking for dependable income, dividend investing is a fundamental method. The process focuses on finding firms that provide good yields and show the monetary capacity to maintain and increase their distributions over the long term. A good screen for these chances usually highlights a strong dividend score, which includes both present yield and past consistency, and also calls for adequate earnings and a sound balance sheet to limit danger. This measured system helps steer clear of "yield traps," situations where high dividends could be unstable because of core operational issues.

TIMKEN CO (NYSE:TKR) appears as a company to consider using this method. The firm, an established producer of bearings and industrial motion products, works in industries like renewable energy, farming, and aerospace. Its operational approach, focused on designed industrial parts, gives some resistance to economic cycles and client retention, which aids steady cash flow.

Dividend Consistency and Increase

A central part of dividend investing is the durability and direction of distributions. TKR’s dividend history displays a number of positive indicators:

- A dividend yield of 1.81%, moderate by itself but good compared to its industry group, exceeding 81% of machinery sector firms.

- A 10-year history of continuous dividend payments with no decreases, highlighting management’s dedication to investors.

- A payout ratio of 31.38%, showing that dividends are comfortably paid from profits and allow significant room for internal investment or later raises.

- A 5-year dividend growth rate of 4.12%, showing a careful but steady upward movement that matches profit growth.

These figures are important since they lower the chance of dividend reductions, a primary worry for those targeting income. A low payout ratio and a record of steadiness imply that TKR’s payments are not threatened by temporary profit changes.

Earnings and Monetary Soundness

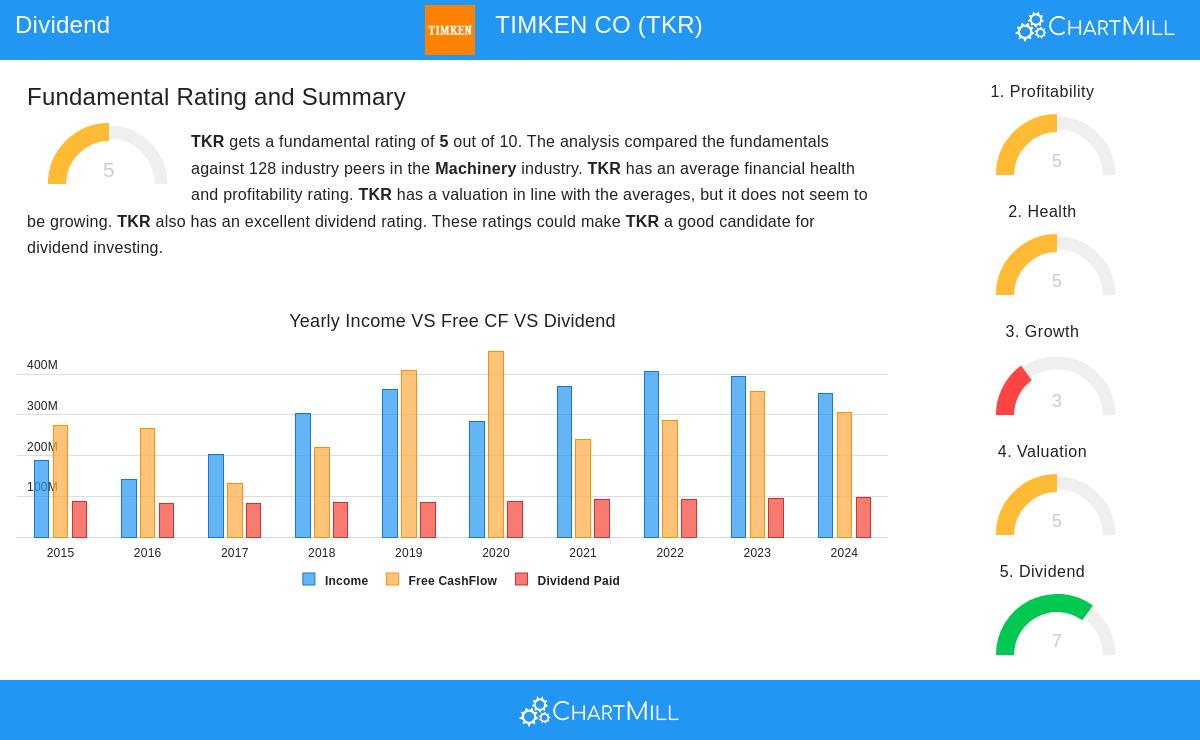

Although the dividend numbers are good, TKR’s basic advantages in earnings and monetary soundness add to its appeal. The company receives a ChartMill Earnings Rating of 5 and a Soundness Rating of 5, pointing to no significant concerns even with certain points of average performance.

Important advantages consist of:

- Operating margin of 12.38%, doing better than 63% of industry rivals, showing effective cost control and pricing ability.

- Good short-term assets, with a current ratio of 3.13, indicating solid immediate monetary adaptability.

- Steady past profitability, with positive net income and operational cash flow in every one of the previous five years.

These elements are crucial for dividend durability: earnings confirm the firm can finance payments from operations, while healthy short-term assets and acceptable debt amounts (even with a somewhat high debt-to-FCF ratio) lower refinancing dangers.

Price and Expansion Background

TKR trades at a P/E ratio of 14.61, which is fair both compared to the industry and the wider market. This price implies the stock is not expensive, giving a buffer for investment. Still, expansion has been slow lately, with a small drop in sales and profits over the last year. While this is not unusual for older industrial companies, it emphasizes the value of TKR’s protective features, stable dividends, reliable margins, and firm market positions, instead of fast growth.

For a more detailed look at TKR’s monetary numbers and scores, readers can examine the complete fundamental analysis report here.

Conclusion

TIMKEN CO presents a strong example of measured dividend investing. It brings together a decent and well-backed yield with the operational steadiness and monetary strength needed to continue distributions across economic periods. Although it might not supply the greatest yield available, its careful capital distribution, industry position, and investor-oriented practices fit nicely with a lasting, income-focused plan.

For investors wanting to research comparable dividend chances, more screened outcomes are available using the Best Dividend Stocks screener.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial objectives before making any investment decisions.