For investors looking for dependable income sources, dividend investing stands as a proven way to build wealth with regular payments. One organized process for finding good dividend stocks uses filters for firms with good dividend traits while keeping sufficient financial condition and earnings. This measured method helps prevent the typical mistake of pursuing very high yields that could point to fundamental business problems. By concentrating on stocks with good dividend scores along with acceptable business measures, investors can create a portfolio intended for lasting income creation.

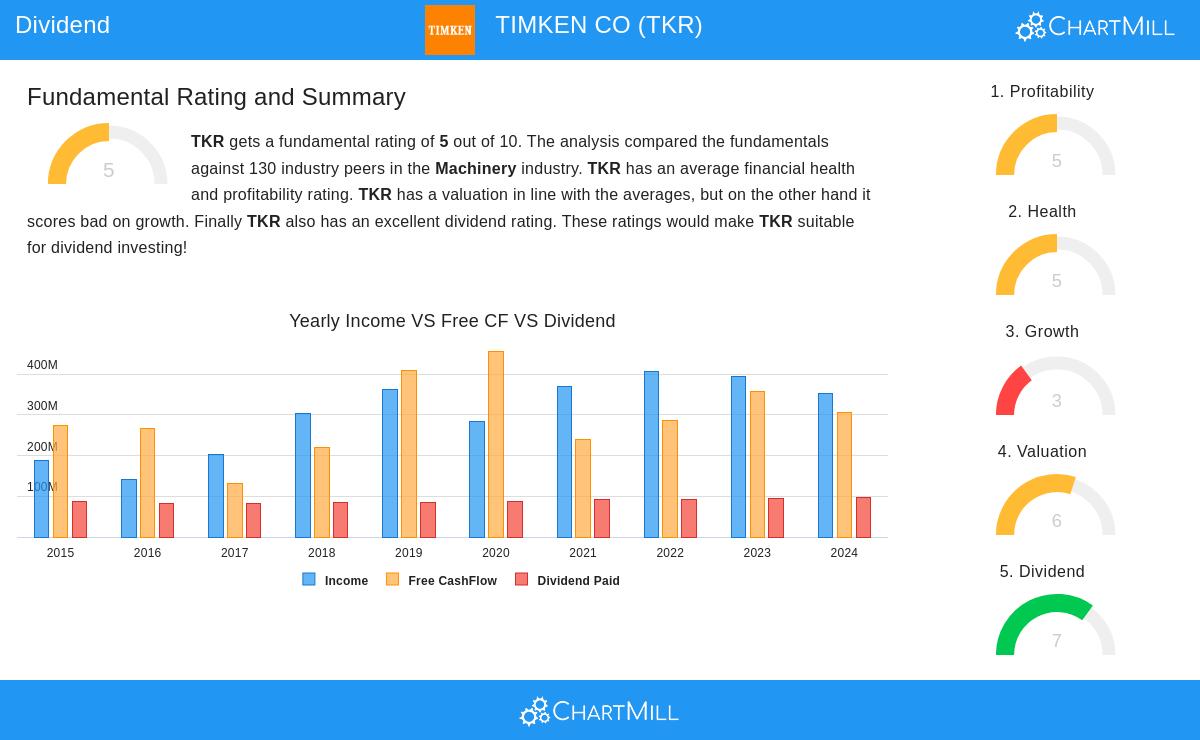

TIMKEN CO (NYSE:TKR) appears as an interesting option through this filtering method, especially for investors who value dividend steadiness over the highest possible yield. The company's engineering and manufacturing work on bearings and industrial motion products offers a steady base for regular dividend distributions, aided by its long-term market position and varied industrial client base.

Dividend Steadiness and Long-Term Viability

The main reason for TKR's attraction to dividend investors is its long-running payment history and maintainable distribution framework. The company displays the traits that dividend-oriented filters aim to find:

- Established History: TIMKEN CO has continued dividend distributions for at least ten straight years without cuts, creating a dependable practice of giving capital back to shareholders

- Maintainable Payout Ratio: At 32.90% of income, the dividend payout ratio sits in a manageable zone that permits both shareholder distributions and business investment

- Cautious Growth: The dividend has increased at a yearly rate of 4.12%, showing management's dedication to steady, maintainable raises instead of fast enlargement that could risk future payments

These dividend traits match the filtering criteria's focus on dependability rather than seeking the highest yields, which frequently carry more risk of cuts or stoppage.

Earnings and Business Strength

TIMKEN CO's business results supply the needed base for its dividend continuity. The company keeps earnings measures that back ongoing dividend distributions:

- Steady Earnings History: The company has produced positive earnings in every one of the last five years, showing the business consistency that dividend investors appreciate

- Good Operating Margin: At 13.21%, the operating margin is better than that of 65% of industry competitors, suggesting efficient business activities and pricing ability within the machinery field

- Cash Flow Production: Positive operating cash flow over the past five years guarantees the company has the money required to finance dividend payments without weakening financial soundness

These earnings assessments are vital for dividend continuity, as they show the company's capacity to produce the income needed to continue and possibly increase dividend payments over time.

Financial Condition Evaluation

The company's financial situation supports its dividend-distributing ability, with several measures showing enough strength to handle economic variations:

- Good Liquidity Situation: A current ratio of 3.11 gives plenty of short-term financial adaptability, greatly surpassing industry norms

- Controlled Borrowing: While having some debt with a Debt/Equity ratio of 0.67, the amount stays within acceptable limits for the industry

- Better Financial Makeup: The company has shown advancement in lowering its debt-to-assets ratio compared to the prior year

These condition measures are important for dividend investors, as they lower the chance that economic declines or short-term difficulties will cause dividend cuts.

Price and Growth Factors

From a price standpoint, TIMKEN CO shows a notable profile for dividend-oriented investors:

- Fair Pricing: Trading at a P/E ratio of 14.62, the company seems fairly valued next to both industry competitors and the wider market

- Industry Contrast: About 83% of machinery industry firms trade at higher earnings multiples, indicating a possible value chance

- Growth Prospect: While historical growth has been moderate, analysts forecast better EPS growth of 8.67% per year in coming years, which might support future dividend raises

The mix of fair pricing and anticipated earnings growth gives a positive setting for dividend investors wanting both income and possible price gains.

Full Assessment Accessible

For investors wanting more detailed understanding of TIMKEN CO's fundamental profile, a thorough fundamental analysis report supplies a full evaluation across many financial areas. This report judges the company's standing compared to industry competitors and gives detailed assessment of the elements influencing its dividend score.

Reviewing Other Possibilities

Investors curious about finding other firms that fit similar dividend quality standards can review the full filtering outcomes to find more potential options for dividend-focused portfolios. The filtering process can be adjusted further based on personal investment choices and risk comfort.

This assessment is given for information purposes only and does not form investment guidance, suggestion, or backing of any security. Investors should perform their own investigation and think about their personal financial situations before making investment choices. Past results do not assure future outcomes, and dividend payments depend on company decisions and different market conditions.