Is NASDAQ:QCOM suited for dividend investing?

By Mill Chart

Last update: Feb 6, 2025

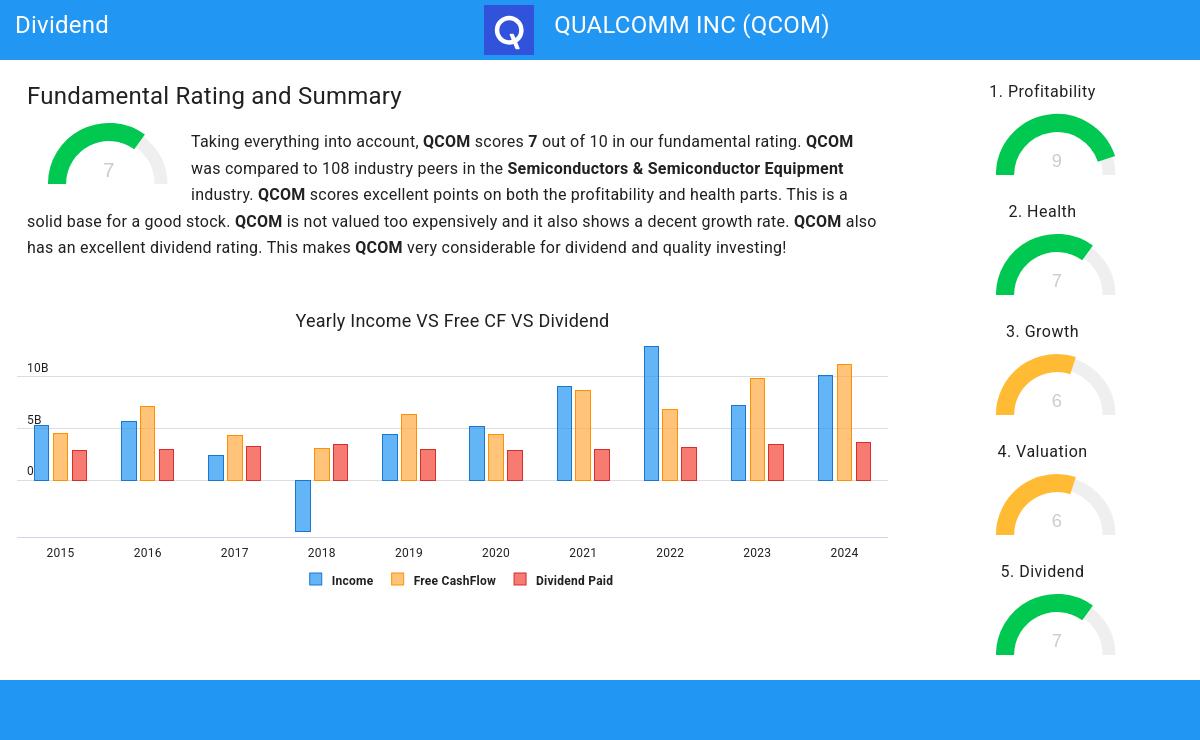

Our stock screener has singled out QUALCOMM INC (NASDAQ:QCOM) as a promising choice for dividend investors. NASDAQ:QCOM not only scores well in profitability, solvency, and liquidity but also offers a decent dividend. We'll explore this further.

Analyzing Dividend Metrics

ChartMill provides a Dividend Rating for every stock, ranging from 0 to 10. This rating assesses various dividend aspects, including yield, growth, and sustainability. NASDAQ:QCOM earns a 7 out of 10:

- QCOM's Dividend Yield is rather good when compared to the industry average which is at 2.36. QCOM pays more dividend than 89.81% of the companies in the same industry.

- QCOM has been paying a dividend for at least 10 years, so it has a reliable track record.

- QCOM has not decreased their dividend for at least 10 years, which is a reliable track record.

- QCOM pays out 36.35% of its income as dividend. This is a sustainable payout ratio.

- The dividend of QCOM is growing, but earnings are growing more, so the dividend growth is sustainable.

Health Analysis for NASDAQ:QCOM

ChartMill employs a unique Health Rating system for all stocks. This rating, ranging from 0 to 10, is determined by analyzing various liquidity and solvency ratios. For NASDAQ:QCOM, the assigned 7 for health provides valuable insights:

- An Altman-Z score of 6.35 indicates that QCOM is not in any danger for bankruptcy at the moment.

- QCOM has a Altman-Z score of 6.35. This is in the better half of the industry: QCOM outperforms 66.67% of its industry peers.

- QCOM has a debt to FCF ratio of 1.31. This is a very positive value and a sign of high solvency as it would only need 1.31 years to pay back of all of its debts.

- QCOM has a better Debt to FCF ratio (1.31) than 76.85% of its industry peers.

- Although QCOM does not score too well on debt/equity it has very limited outstanding debt, which is well covered by the FCF. We will not put too much weight on the debt/equity number as it may be because of low equity, which could be a consequence of a share buyback program for instance. This needs to be investigated.

- A Current Ratio of 2.40 indicates that QCOM has no problem at all paying its short term obligations.

Profitability Examination for NASDAQ:QCOM

ChartMill employs its own Profitability Rating system for stock evaluation. This score, ranging from 0 to 10, is derived from an analysis of diverse profitability metrics and margins. In the case of NASDAQ:QCOM, the assigned 9 is noteworthy for profitability:

- With an excellent Return On Assets value of 18.39%, QCOM belongs to the best of the industry, outperforming 92.59% of the companies in the same industry.

- With an excellent Return On Equity value of 38.60%, QCOM belongs to the best of the industry, outperforming 93.52% of the companies in the same industry.

- The Return On Invested Capital of QCOM (18.14%) is better than 90.74% of its industry peers.

- The Average Return On Invested Capital over the past 3 years for QCOM is significantly above the industry average of 11.99%.

- The Profit Margin of QCOM (26.03%) is better than 86.11% of its industry peers.

- QCOM's Profit Margin has improved in the last couple of years.

- With an excellent Operating Margin value of 26.32%, QCOM belongs to the best of the industry, outperforming 86.11% of the companies in the same industry.

- QCOM's Operating Margin has improved in the last couple of years.

- QCOM has a better Gross Margin (56.22%) than 77.78% of its industry peers.

Every day, new Best Dividend stocks can be found on ChartMill in our Best Dividend screener.

Our latest full fundamental report of QCOM contains the most current fundamental analsysis.

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

163.45

-0.63 (-0.38%)

Find more stocks in the Stock Screener

QCOM Latest News and Analysis