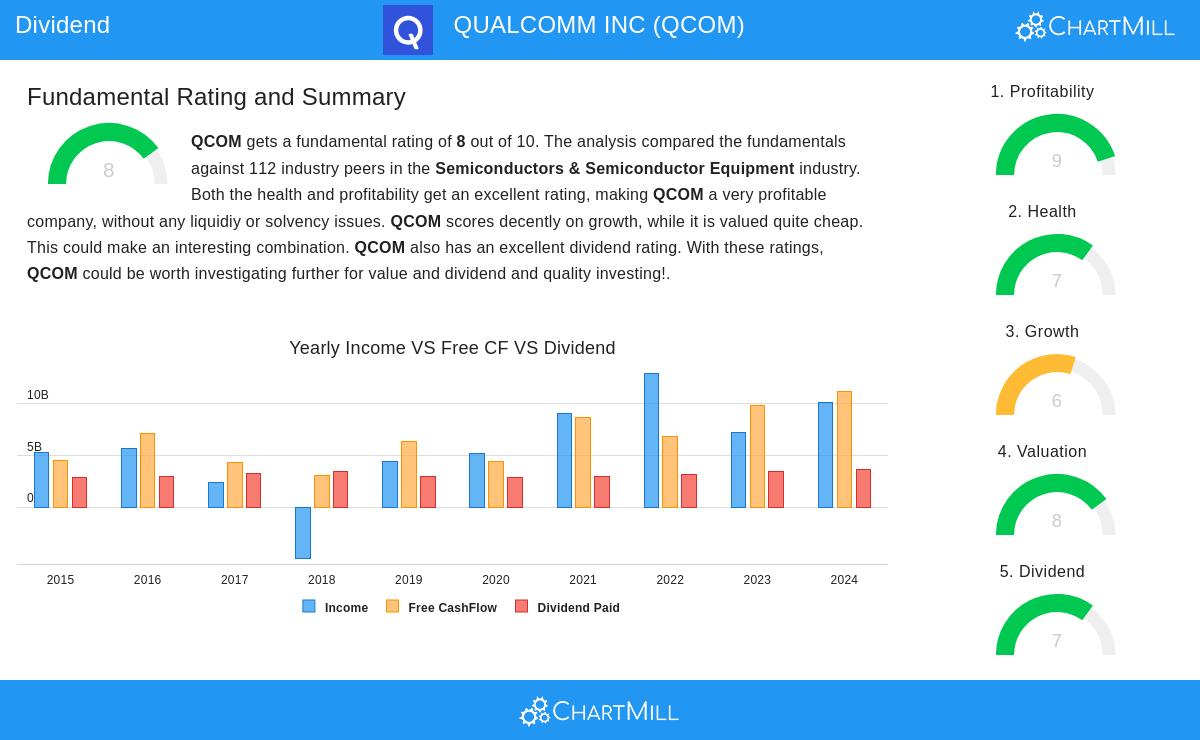

Investors looking for dependable income sources frequently choose dividend investing, a method centered on finding companies that not only provide regular dividends but also have the financial capacity to continue and possibly increase these distributions in the future. Applying a structured filtering system helps select stocks that satisfy strict requirements for dividend quality, profitability, and financial condition. This process highlights lasting payouts by confirming companies are both earning profits and financially sound, lowering the chance of dividend reductions. One stock that appears from this filtering method is QUALCOMM INC (NASDAQ:QCOM), a company that shows solid fundamental qualities fitting with dividend-oriented approaches.

Dividend Reliability and Sustainability

QUALCOMM’s dividend characteristics are notable for their mix of yield, growth, and longevity. The company provides a dividend yield of 2.10%, which is strong for its sector and matches the wider market average. Significantly, QUALCOMM has built a history of dependability, having distributed dividends for more than ten years with no decreases. This steadiness is supported by a payout ratio of 32.79%, showing that a small part of earnings is used for dividends, allowing significant room for internal investment and protection during economic declines. The dividend’s yearly growth rate of 5.69%, though not high, shows a consistent and controlled rise that matches the company’s earnings path. For dividend investors, these figures highlight a dedication to shareholder returns while keeping financial adaptability.

Profitability Strengths

A main element of QUALCOMM’s attractiveness is its outstanding profitability, which directly fuels its capability to maintain and raise dividends. The company has a ChartMill Profitability Rating of 9, indicating high performance on important measures:

- Return on Equity of 42.55% and Return on Assets of 21.10%, both placing in the highest group of the semiconductor sector.

- A profit margin of 26.77%, greatly exceeding many competitors and showing effective management.

- Steady increases in operating and profit margins in recent years, pointing to continuous operational betterment.

These profitability measures are important for dividend investors, as they show a company’s ability to produce earnings that finance dividend payments without depending on borrowing or reducing growth plans.

Financial Health and Stability

QUALCOMM’s financial condition, shown by a ChartMill Health Rating of 7, further supports its dividend argument. The company displays good solvency and liquidity, with an Altman-Z score of 6.52 suggesting a minimal chance of financial trouble. Important condition measures include:

- A debt-to-free-cash-flow ratio of 1.27, meaning the company can settle its debts fast with its cash flow.

- A current ratio of 3.19 and a quick ratio of 2.38, making certain that short-term liabilities are easily covered.

While the debt-to-equity ratio of 0.54 is average, it is backed by strong cash flow, easing worries about debt levels. For dividend investors, this financial steadiness lessens the possibility of dividend disruptions in times of economic instability.

Valuation and Growth Considerations

QUALCOMM is priced at appealing levels, with a price-to-earnings ratio of 14.41 that is much lower than sector norms. This lower valuation, paired with good historical growth in revenue and earnings per share, makes the company an interesting possibility for value-focused dividend investors. Still, it is important to recognize that future growth forecasts are more conservative, with estimated revenue growth of 5.11% and EPS growth of 8.66%. Although this deceleration should be watched, the company’s profitability and financial condition offer a safety net to keep dividend payments even in a lower growth phase.

Conclusion

QUALCOMM INC presents a balanced option for dividend investors, merging a dependable payment history with high profitability and good financial condition. Its lasting dividend, supported by earnings capacity and a strong balance sheet, fits the main ideas of dividend investing, which focus on stability and long-term income. Investors doing more examination can see the complete fundamental analysis report for more detailed information on QUALCOMM’s financial data.

For people wanting to find other dividend stock options, the Best Dividend Stocks screen provides a selected group of companies meeting comparable standards for dividend quality, profitability, and financial condition.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.