Market Monitor May 10 (Lyft, Microchip Technology UP - Affirm Holdings, Expedia Group DOWN)

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: May 10, 2025

Wall Street Slips Slightly as Trade Talks Loom and Earnings Send Mixed Signals

Markets Edge Lower Amid Renewed Trade Concerns

On Friday, U.S. stock markets ended marginally lower, weighed down by uncertainty surrounding global trade policies and mixed earnings results.

The Dow Jones slipped 0.3%, the S&P 500 declined by 0.1%, and the Nasdaq finished the day flat, reflecting a cautious investor stance ahead of upcoming trade negotiations between the U.S. and China.

Upcoming U.S.-China Trade Talks

This weekend, U.S. Treasury Secretary Scott Bessent and China's top economic official He Lifeng are scheduled to meet in Switzerland. Tensions remain high, with the current U.S. import tariff on Chinese goods at 145%, while China’s tariff on American goods stands at 125%.

Former President Donald Trump weighed in via Truth Social, stating that an 80% tariff on Chinese goods “seems right.” Analysts argue, however, that tariffs must drop below 60% to meaningfully revive trade activity.

While a new U.S.-UK trade deal offered some optimism, market participants remain wary of the broader implications of ongoing tariff stress, particularly in sectors like automotive manufacturing.

Corporate Earnings in Focus

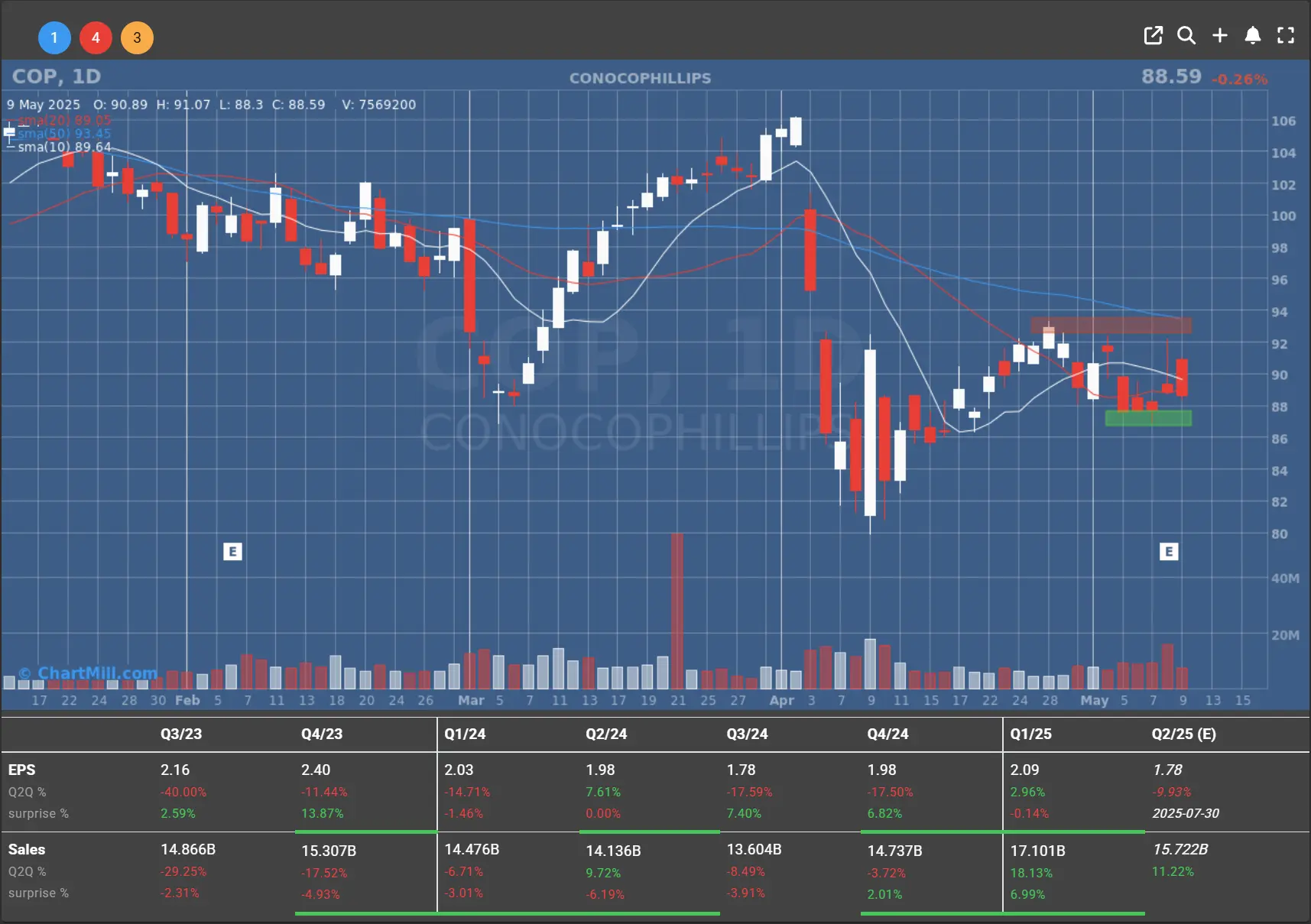

ConocoPhillips Beats Estimates but Fails to Rally

Despite strong first-quarter results, ConocoPhillips (COP | -0.26%) ended the day slightly lower. The company reported revenue of $17.1 billion, topping estimates of $15.68 billion, and earnings per share of $2.09 against a forecast of $2.04.

Operational and capital cost guidance was revised downward, suggesting improved capital efficiency driven by lower oil prices. Analysts from JPMorgan, Scotiabank, and Piper Sandler praised the company’s operational strength and positive outlook. Still, shares couldn’t maintain early-session gains.

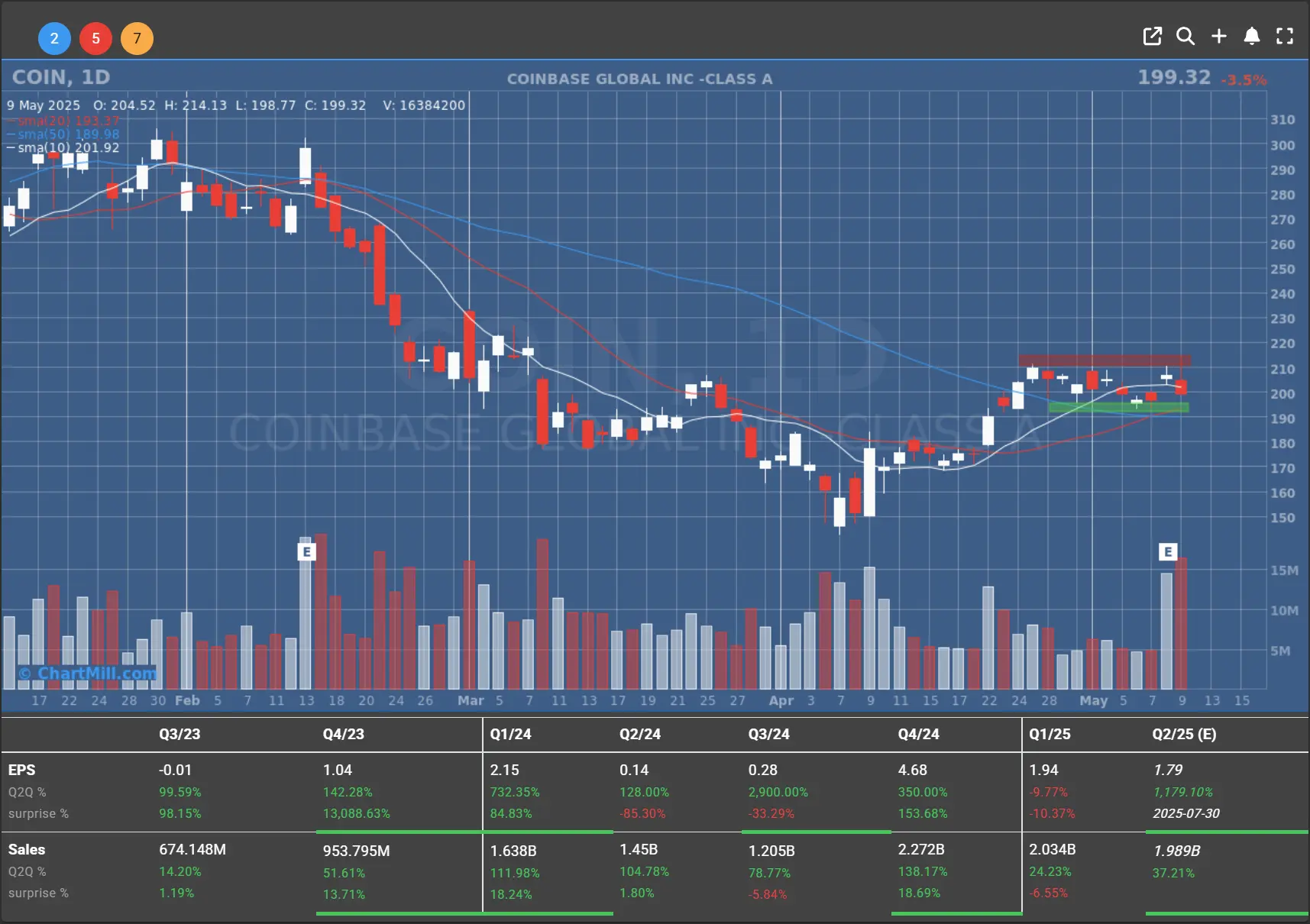

Coinbase Drops After Earnings Miss and Acquisition News

Coinbase (COIN | -3.48%) fell sharply after reporting disappointing Q1 earnings and a weaker-than-expected forecast for Q2. Revenue rose 24% to $2.03 billion, but missed the $2.11 billion consensus. EPS came in at just $0.24, far below expectations of $2.09.

The company also announced a $2.9 billion acquisition of crypto-options platform Deribit, aiming to scale its derivatives business. While analysts at Citi and KBW highlighted strategic positives, concerns over falling retail and institutional trading activity led to downgrades.

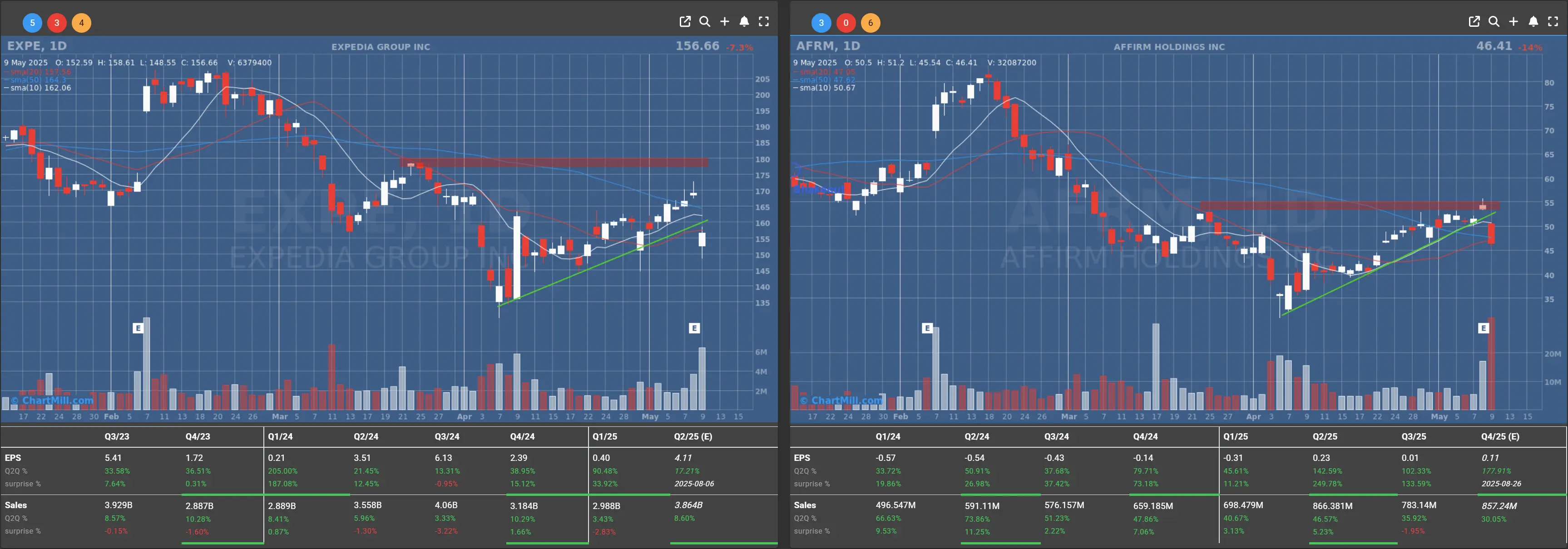

Affirm Holdings and Expedia Slide on Weak Outlooks

Buy-now-pay-later provider Affirm Holdings (AFRM | -14.47%) saw a steep decline following a disappointing forecast.

Travel firm Expedia Group (EXPE | -7.3%) also tumbled, as Q1 results reflected softer demand for U.S.-related travel, a trend expected to continue.

Winners in a Flat Session

Not all companies disappointed:

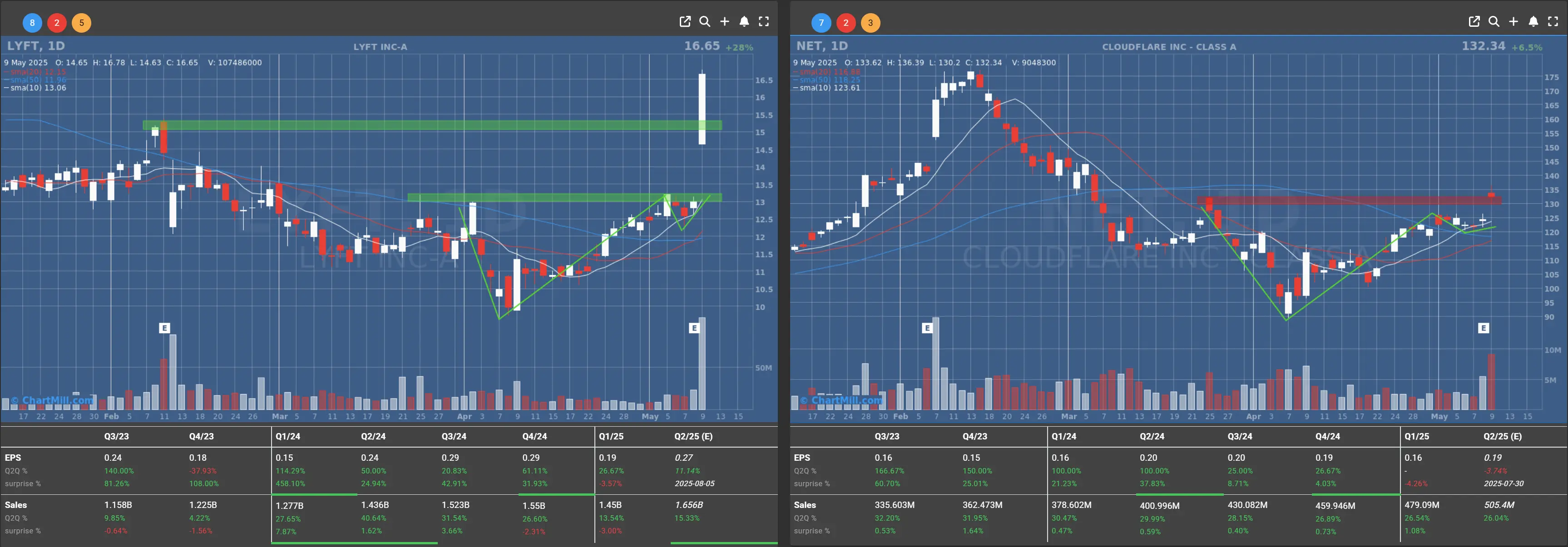

- Lyft (LYFT | +28.1%) surged after an unexpected quarterly profit, raised guidance, and a boost to its stock buyback program.

- Cloudflare (NET | +6.46%) gained after meeting profit expectations.

- Microchip Technology (MCHP | +12.6%) rallied as its CEO signaled the end of a downcycle and issued a bullish outlook.

- Pinterest (PINS | +4.8%) rose despite an earnings miss, driven by better-than-expected revenue.

Oil & EUR/USD

- Oil prices rose 1.9% on Friday to $61.02 per barrel, closing the week 4.7% higher.

- The EUR/USD pair ended slightly higher at 1.1253.

Outlook

With earnings season wrapping up and no major economic data expected on Monday, investor attention turns to the weekend's U.S.-China trade meeting for potential market-moving developments. The outcome could set the tone for global markets in the weeks ahead.

Daily Market Analysis – May 9, 2025 (After Market Close)

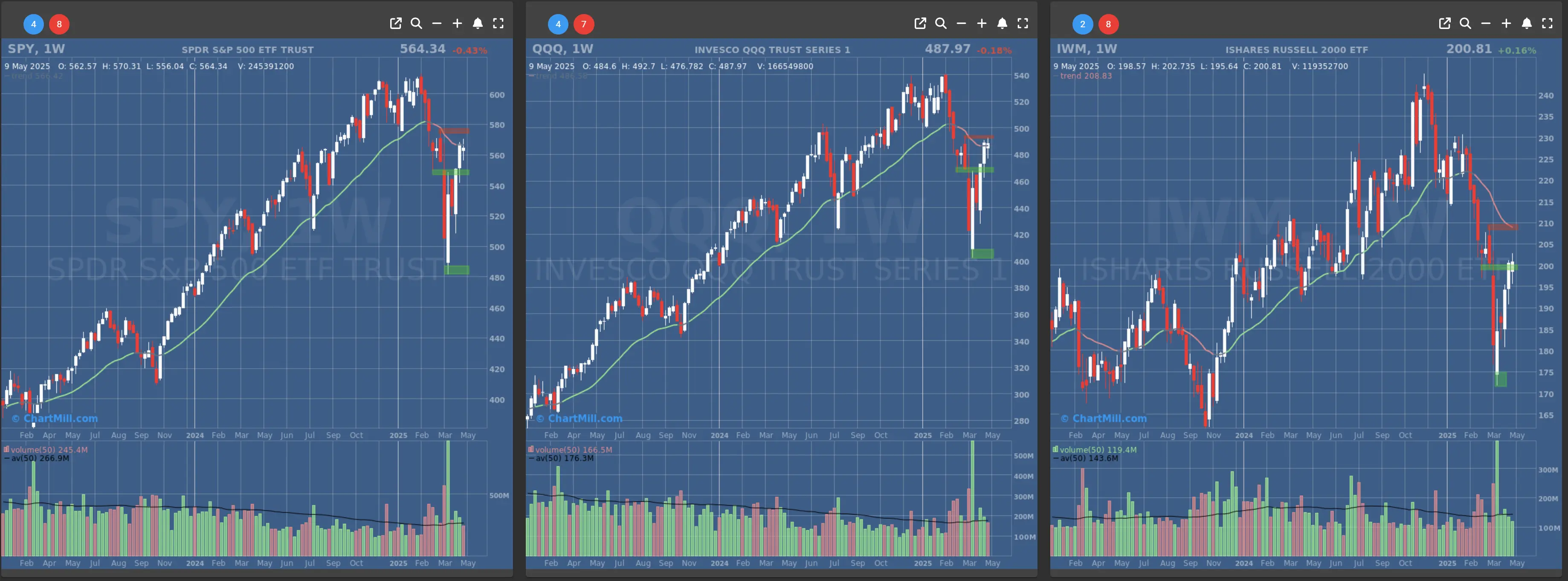

Short Term Trend

- Short-Term Trend: Bullish (no change)

- Support at $490 - $550

- Resistance at $570 - $580

- Volume: Far Below average (50)

- Pattern: Bearish Engulfing - Double Top

- Short-Term Trend: Bullish (no change)

- Support at $470

- Resistance at $490

- Volume: Far Below average (50)

- Pattern: Bearish Engulfing - Double Top

- Short-Term Trend: Bullish (no change)

- Support at $200

- Resistance at $210-215

- Volume: Far below average (50)

- Pattern: Inside Day

Long Term Trend

- Long-Term Trend: Neutral (no change)

- Long-Term Trend: Neutral (no change)

- Long-Term Trend: Down (no change)

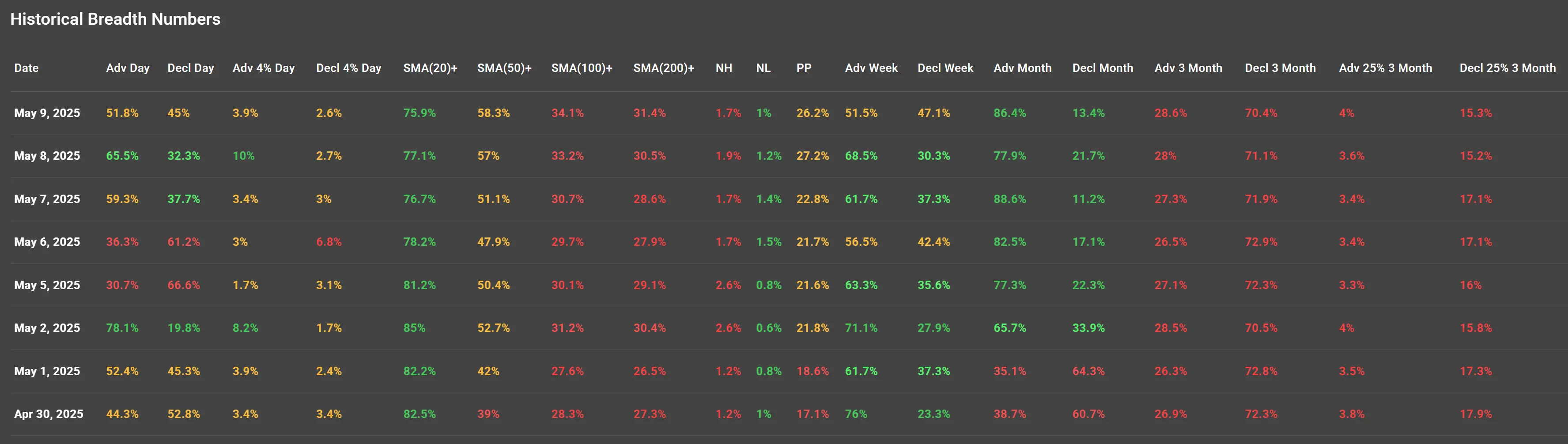

Market Breadth Analysis for May 9, 2025 (After Market Close)

(All data & visualisation by ChartMill.com)

After a week of whipsaw price action, Friday's market breadth data revealed a market that's attempting to stabilize, but remains fragile under the surface. Despite a modestly positive close for advancing stocks, broader participation continues to reflect uncertainty, particularly when viewed across longer timeframes.

Short-Term Resilience Returns, but It's Not Convincing Yet

The percentage of advancing stocks on May 9 rose to 51.8%, bouncing back from midweek weakness. While this is a slight improvement, it's hardly decisive — especially when compared to the 65.5% reading from just the day before.

More importantly, strong upside movers (>4%) fell back to just 3.9%, indicating that the strength was modest and lacked conviction.

The market showed less follow-through than one might hope for at this stage in a recovery attempt. This suggests that buyers are still hesitant to chase higher prices, perhaps waiting for more clarity from macro developments (like U.S.-China trade negotiations) or leadership confirmation from key sectors.

Breadth Participation Above Key Moving Averages Paints a Mixed Picture

One of the more telling signs lies in the breakdown of stocks trading above their key moving averages. While a healthy 76% of stocks remain above their 20-day moving average, that number drops off significantly when we zoom out:

-

50-day: Just 58.3% of stocks are above it

-

100-day: Only 34.1%

-

200-day: Even weaker at 31.4%

This disparity reflects a market that has seen a short-term rebound, but one that hasn't yet flipped its medium- or long-term trends. In other words, we're in a bounce — not yet a breakout.

New Highs Still Muted Despite Monthly Strength

Despite a solid 86.4% of stocks showing gains over the past month, new 52-week highs remain anemic at just 1.7%. That’s an important divergence — one would expect more leadership and breakout activity at this stage.

The low new-high count suggests that many stocks are recovering from deeply oversold levels, rather than pushing into true momentum territory.

Meanwhile, new lows remain under control at 1%, indicating that the worst selling pressure may be behind us — for now.

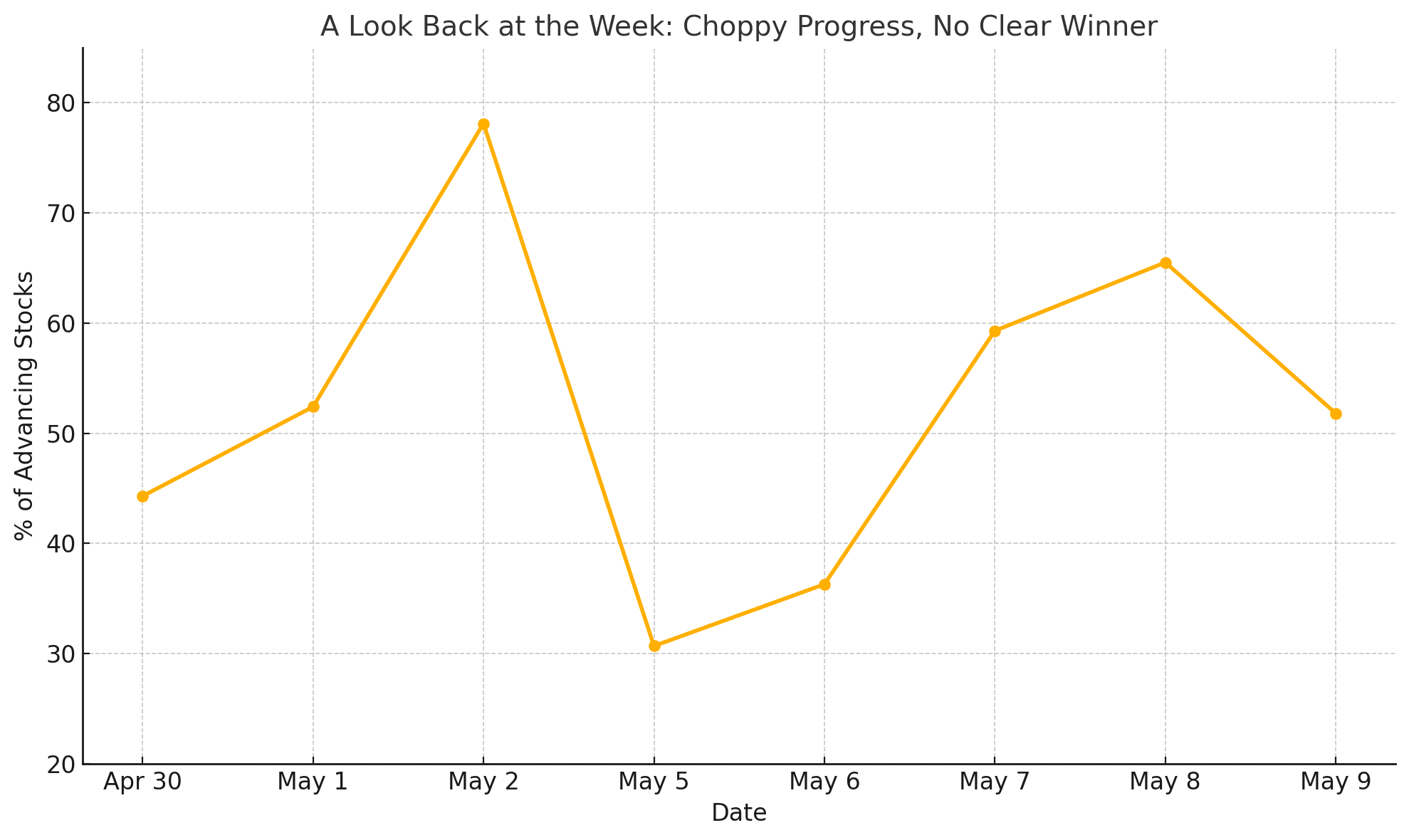

A Look Back at the Week: Choppy Progress, No Clear Winner

This past week featured sharp rotations in breadth. Tuesday and Wednesday saw more than 59% of stocks advance, while Monday and Thursday were more defensive.

Notably, May 2nd (last Friday) stood out with a massive 78.1% advance rate — a rare show of strength — but this was followed by two weaker sessions before breadth recovered somewhat into the weekend.

This kind of inconsistency reinforces the idea that the market is still searching for direction. Sentiment is improving, but not all sectors or styles are participating equally, and rallies are still being sold rather than chased.

Long-Term Breadth Remains a Warning Sign

Zooming out to the 3-month trend, only 28.6% of stocks are higher over that span. Worse, just 4% are in the top quartile of performance — compared to over 15% that are among the worst performers.

This means that despite recent rallies, the bulk of the market is still climbing out of drawdowns, not setting new trends.

This is often a phase where short-term rallies can quickly fade, especially if broader macro or earnings-related catalysts fail to deliver.

Conclusion: Don’t Trust the Bounce Just Yet

Friday’s breadth numbers suggest incremental progress, not a sea change. Bulls may feel encouraged by improving short-term metrics and monthly momentum, but deeper cracks remain visible in longer-term participation and lack of leadership.

Until we see meaningful improvement above the 100- and 200-day SMAs — paired with a rising number of new highs and fewer laggards — this market remains in repair mode, not yet in full recovery.

85.35

-0.25 (-0.29%)

166.75

+1.1 (+0.66%)

58.04

-0.07 (-0.12%)

15.24

-0.11 (-0.72%)

31.11

+0.05 (+0.16%)

51.9

-0.15 (-0.29%)

246.62

-2.22 (-0.89%)

Find more stocks in the Stock Screener