Sluggish Services Data Stalls Market Momentum

After a strong start to the week, Wall Street hit the brakes on Tuesday, reversing Monday’s gains.

The culprits? Weak macro data and a fresh wave of trade tension threats. The ISM services index for July slid unexpectedly from 50.8 to 50.1, just a hair above contraction territory. Economists had actually penciled in a rise to 51.4.

Given that the service sector accounts for over 80% of U.S. economic output, this dip raised a few eyebrows (mine included).

The Dow Jones eased 0.15%, the Nasdaq took a heavier hit with a 0.65% drop, and underlying concerns are growing that the U.S. economy may be cooling more quickly than expected. We’re not in recession territory yet, but the signs are definitely worth watching.

S&P Global’s own services PMI offered a more optimistic view, rising sharply to 55.7 from 52.9, but investors mostly reacted to the ISM figure, which tends to carry more weight.

Fed Rate Cuts Back on the Table?

If last Friday’s soft jobs report hadn’t already tipped the scales, this new round of weak data may just be the nudge the Fed needed. Economists at UBS expect rate cuts to resume in September, with total easing of around 100 basis points by early 2026.

UBS’s Ulrike Hoffmann-Burchardi summed it up neatly: the labor and services data are “weak enough” for the Fed to act.

'The labor and services data are “weak enough” for the Fed to act.' - Ulrike Hoffmann-Burchardi

Inflation fears still linger, especially with the price component in the ISM report rising due to tariffs.

Palantir Smashes Through the $400 Billion Mark

Meanwhile, the AI-fueled rocket that is Palantir (PLTR | +7.85%) blasted off again. The company beat Wall Street estimates with Q2 revenue soaring 48% to just over $1 billion for the first time ever.

CEO Alex Karp upgraded full-year guidance to $4.1 billion, and with controlled spending (up just 22%), operating profit jumped to $269 million. EPS more than doubled to $0.13.

Let’s put that into perspective: Palantir is now valued at over $400 billion, more than Adobe (144B) and Salesforce ($236B) combined. The stock is up more than 600% in the past year, placing it among the top 20 in the S&P 500.

AI isn’t just a buzzword anymore; for Palantir, it’s a profit machine.

Winners and Losers: A Tale of Extremes

It was a classic day of haves and have-nots.

On the winning side:

-

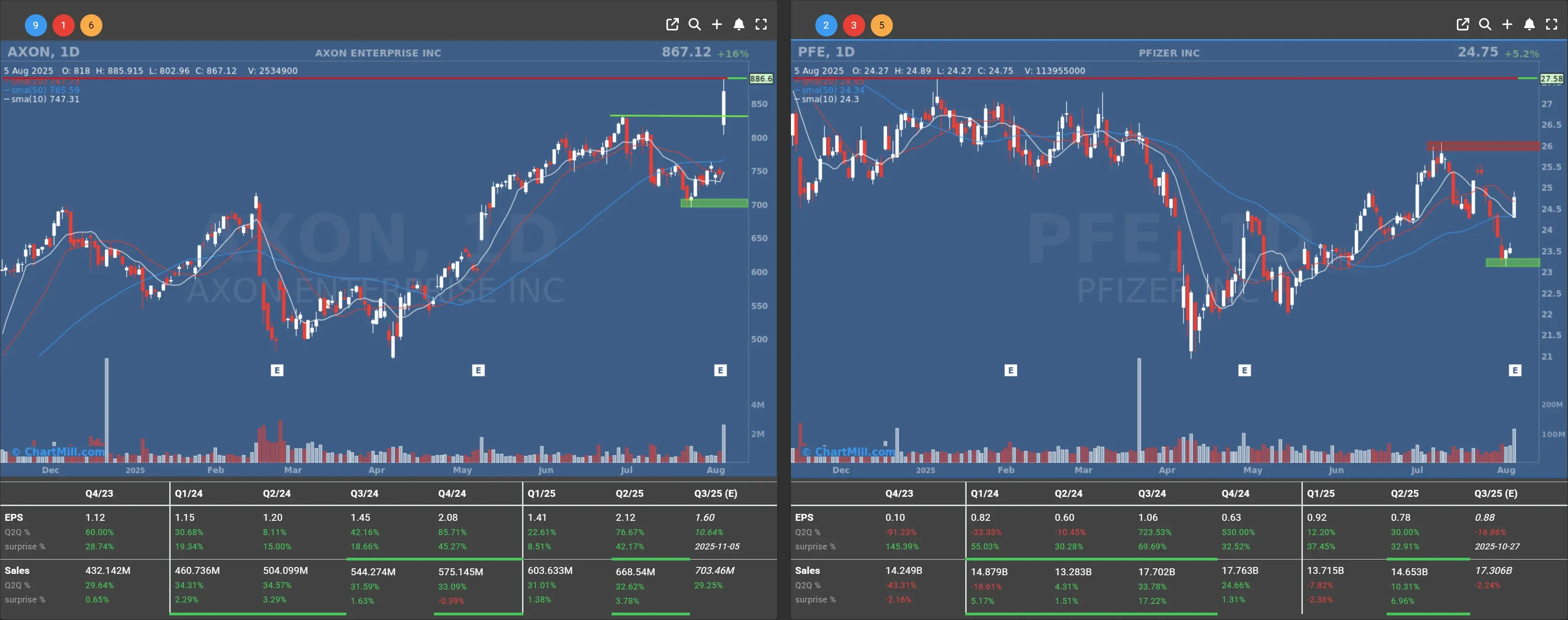

Axon Enterprise (AXON | +16.41%): The Taser maker hiked its full-year forecast and crushed earnings estimates. Investors zapped into the stock.

-

Pfizer (PFE | +5.18%): Helped by cost cuts and strong H1 performance, the pharma giant raised its full-year outlook.

And the losers:

-

Vertex Pharmaceuticals (VRTX | -20.6%): A brutal day after pulling the plug on its next-gen painkiller, which failed to meet the primary endpoint in trials.

-

Hims & Hers Health (HIMS | -12.36%): Despite a 73% YoY revenue jump to $545M, the telehealth firm missed consensus estimates. Regulatory scrutiny over weight-loss drugs didn’t help either. EPS beat by two cents ($0.17), but that wasn’t enough to justify its high-flying valuation.

- Kyndryl (KD | -21.14%): Weak Q2 sales sent the IT infrastructure stock into freefall.

Geopolitics: Trump’s Tariff Talk Stirs the Pot Again

Just when you thought tariff tantrums were yesterday’s news, Donald Trump turned up the heat. He threatened the EU with 35% import tariffs - more than double what was previously agreed - if investment commitments aren’t met.

He also took aim at India over oil imports from Russia, saying the country’s trade privileges could face a reset.

Investors don’t love tariff uncertainty, especially in a slowing economy. It’s no coincidence that both equity sentiment and the dollar were wobbling. At Tuesday’s close, EUR/USD stood at 1.1571, up slightly from the day before.

Oil Slips, Trade Gap Narrows

Oil pulled back slightly, with WTI September futures falling $1.13 (-1.7%) to $65.16 a barrel. Meanwhile, the U.S. trade deficit narrowed in June by 16% to $60.2 billion. Imports fell faster than exports - 3.7% vs. 0.5% - as global demand continues to recalibrate.

Looking Ahead

Today (Wednesday), we’ll get fresh data on weekly mortgage applications and crude inventories, minor but useful indicators to gauge economic activity and inflationary pressure.

Until then, the market remains a tug-of-war between cooling economic data (bullish for rates) and lingering policy/geopolitical risks (bearish for sentiment).

I’ll be watching closely whether Palantir fever spreads further into the AI complex, or if this is just another market high with low staying power.

Kristoff - ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, August 6