HIMS & HERS HEALTH INC (HIMS) Stock Price, Forecast & Analysis

NYSE:HIMS • US4330001060

HIMS Key Statistics, Chart & Performance

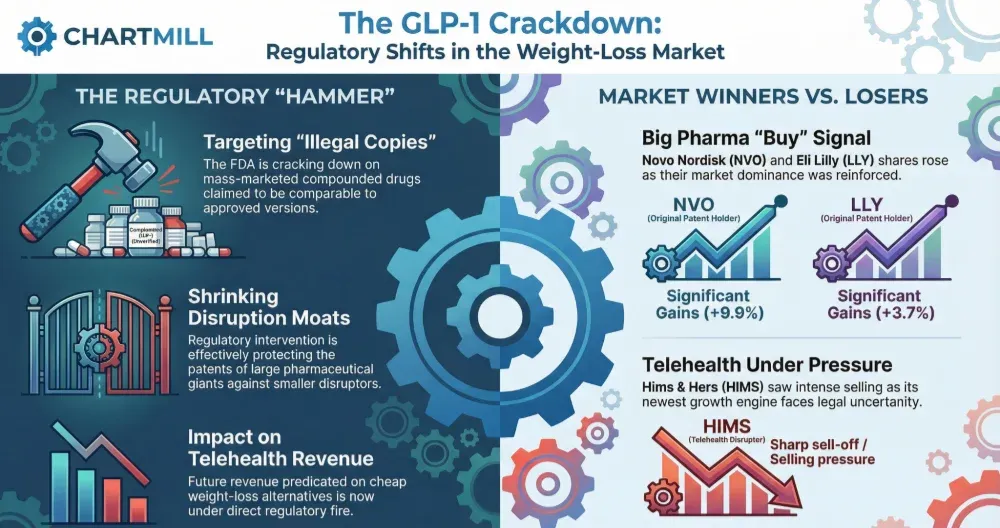

The current stock price of HIMS is 14.52 USD. In the past month the price decreased by -51.39%. In the past year, price decreased by -67.8%.

HIMS Technical Analysis

HIMS Fundamental Analysis

ChartMill assigns a fundamental rating of 4 / 10 to HIMS. While HIMS is still in line with the averages on profitability rating, there are concerns on its financial health.

HIMS Financial Highlights

Over the last trailing twelve months HIMS reported a non-GAAP Earnings per Share(EPS) of 0.5. The EPS decreased by -7.41% compared to the year before.

| Industry Rank | Sector Rank | ||

|---|---|---|---|

| PM (TTM) | 5.47% | ||

| ROA | 5.96% | ||

| ROE | 23.73% | ||

| Debt/Equity | 1.8 |

HIMS Forecast & Estimates

22 analysts have analysed HIMS and the average price target is 30 USD. This implies a price increase of 106.64% is expected in the next year compared to the current price of 14.52.

For the next year, analysts expect an EPS growth of 16.28% and a revenue growth 16.69% for HIMS

HIMS Ownership

HIMS Latest News, Press Relases and Analysis

HIMS Competitors/Peers

| Symbol | Company Name | Technical Rating | Fundamental Rating | FPE | Market Cap |

|---|---|---|---|---|---|

| CVS | CVS HEALTH CORP | 11.03 | 101.427B | ||

| CI | THE CIGNA GROUP | 9.27 | 76.356B | ||

| BTSGU | BRIGHTSPRING HEALTH SERV - BTSG 6 3/4 02/01/27 | 100.72 | 24.888B | ||

| LH | LABCORP HOLDINGS INC | 16.05 | 23.968B | ||

| DGX | QUEST DIAGNOSTICS INC | 20.16 | 23.573B | ||

| GH | GUARDANT HEALTH INC | N/A | 12.098B | ||

| DVA | DAVITA INC | 11.82 | 10.714B | ||

| BTSG | BRIGHTSPRING HEALTH SERVICES | 30.24 | 7.472B | ||

| CHE | CHEMED CORP | 15.98 | 5.806B | ||

| RDNT | RADNET INC | 87.75 | 5.403B |

Related stock screener links

View all stocks in the Health Care Services Industry | View all stocks in the Health Care Sector | View all stocks on the New York Stock Exchange Exchange | Find stocks with similar TA and Setup ratings on the USA exchanges | Find stocks with similar Fundamental rating on the USA exchanges | Find the competitors with the best technical ratings on the USA exchanges | Find the competitors with the best fundamentals on the USA exchanges | Find the competitors with the best valuation on the USA exchanges | Find the competitors with the best dividend on the USA exchanges | Find the competitors with the best analyst ratings on the USA exchanges

About HIMS

Company Profile

Company Info

HIMS & HERS HEALTH INC

2269 Chestnut St, #523

San Francisco CALIFORNIA 94123 US

CEO: Andrew Dudum

Employees: 1637

Phone: 18003166660

HIMS & HERS HEALTH INC / HIMS FAQ

What does HIMS & HERS HEALTH INC do?

Hims & Hers Health, Inc. operates a telehealth consultation platform. The company is headquartered in San Francisco, California and currently employs 1,637 full-time employees. The company went IPO on 2019-09-09. Its platform includes access to a provider network, a clinically focused electronic medical record system, digital prescriptions, cloud pharmacy fulfillment, and personalization capabilities. Its digital platform enables access to treatments for a range of chronic conditions, including those related to sexual health, hair loss, dermatology, mental health, and weight loss. The company connects patients to licensed healthcare professionals who can prescribe medications when appropriate and prescriptions are fulfilled online through licensed pharmacies on a subscription basis. The company also offers access to a range of health and wellness products designed to meet individual needs, which can include curated prescription and non-prescription products. Through its mobile applications, consumers can access a range of educational programs, wellness content, and other services.

What is the stock price of HIMS & HERS HEALTH INC today?

The current stock price of HIMS is 14.52 USD. The price decreased by -6.92% in the last trading session.

Does HIMS stock pay dividends?

HIMS does not pay a dividend.

How is the ChartMill rating for HIMS & HERS HEALTH INC?

HIMS has a ChartMill Technical rating of 0 out of 10 and a ChartMill Fundamental rating of 4 out of 10.

Can you provide the PE ratio for HIMS stock?

The PE ratio for HIMS & HERS HEALTH INC (HIMS) is 29.04. This is based on the reported non-GAAP earnings per share of 0.5 and the current share price of 14.52 USD.

Can you provide the upcoming earnings date for HIMS & HERS HEALTH INC?

HIMS & HERS HEALTH INC (HIMS) will report earnings on 2026-05-04.