NVIDIA CORP (NASDAQ:NVDA) Emerges as a Top GARP Stock Pick

By Mill Chart

Last update: Dec 8, 2025

For investors looking to balance the search for high-growth companies with a careful view on price, the "Growth at a Reasonable Price" (GARP) method provides a useful framework. This approach seeks to find businesses that are increasing quickly but are not valued at extreme levels, trying to lower the danger of paying too much for future prospects. One useful way to apply this method is with screening tools that assess stocks using key fundamental areas: growth, valuation, profitability, and financial condition. A stock that performs well in growth while keeping sensible valuation measures, backed by good profitability and a strong balance sheet, can be a leading choice for this method.

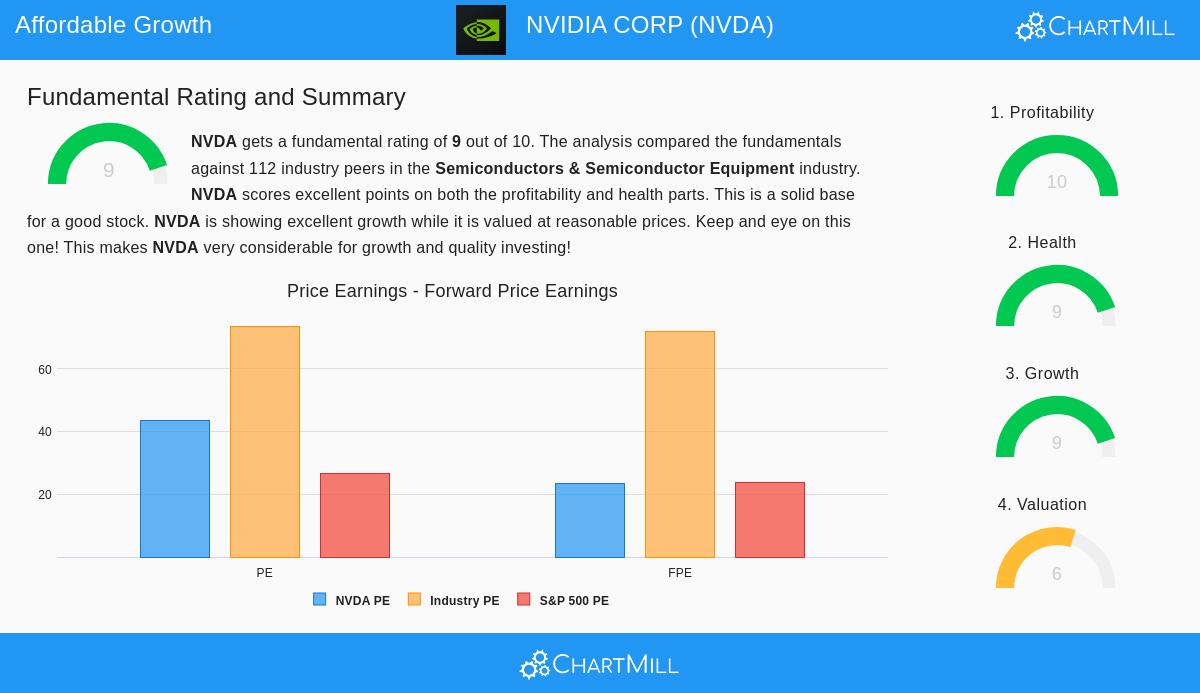

NVIDIA CORP (NASDAQ:NVDA) recently appeared from such an "Affordable Growth" screen, which looks for stocks with a growth rating above 7, a valuation score above 5, and acceptable scores in profitability and financial condition. The company's latest fundamental analysis report gives a full look at its advantages and possible points to review across these important areas.

Exceptional Growth Path

NVIDIA’s growth story is its most noticeable feature, receiving a top ChartMill Growth Rating of 9 out of 10. The company is not only showing strong historical increase but is also expected to keep a solid speed.

- Strong Historical Performance: Over the last year, NVIDIA recorded a notable 65.22% increase in revenue. Even more notable is the 83.26% average yearly increase in Earnings Per Share (EPS) measured over recent years, showing effective operational scale and profitability growing with sales.

- Solid Forward-Looking Estimates: The growth momentum is anticipated to persist, though at a slower speed. Analysts forecast an average yearly EPS increase of 32.99% and revenue increase of 30.03% for the next years. While these numbers show a slowdown from the recent very high speed, they still represent a very solid growth picture that is much faster than the wider market.

For the GARP investor, this continued high growth is the main draw, as it creates the foundation for supporting the company's current market price.

Valuation in Perspective

With a ChartMill Valuation Rating of 6, NVIDIA presents a more mixed picture. On its own, some standard measures seem high, but they need to be considered alongside the company's unusual growth and profitability.

- Standard Multiples: The stock's Price-to-Earnings (P/E) ratio of 43.43 is above the current S&P 500 average of 26.49, which initially indicates a high price. Its Price-to-Forward Earnings ratio of 23.49 is closer to the wider market.

- Relative and Growth-Adjusted View: The valuation view gets better notably when measured against industry competitors and when growth is included. NVIDIA's P/E ratio is actually lower than about 64% of other companies in the Semiconductors & Semiconductor Equipment industry. More significantly, the Price/Earnings-to-Growth (PEG) ratio, which modifies the P/E for expected earnings growth, suggests a "fairly low price." This is the center of the GARP case: the higher price is being given for a higher, and clearly fast, growth rate.

Supported by Strong Fundamentals

The high growth and sensible valuation are supported by a base of excellent operational performance and financial soundness, which are important for the durability needed by a GARP method.

Profitability: A Top-Tier Performer NVIDIA receives a complete ChartMill Profitability Rating of 10. The company's margins are industry-best, with a Profit Margin of 53.01% and an Operating Margin of 59.12%, doing better than most of its competitors. Its returns on capital are also notable, with a Return on Invested Capital (ROIC) of 71.56%, showing very effective use of shareholder capital. This high profitability offers a safety buffer and pays for continued innovation and growth.

Financial Health: A Strong Balance Sheet The company’s Financial Health Rating is a solid 9. NVIDIA holds a clean balance sheet with very little debt use, shown by a very low Debt-to-Equity ratio of 0.06. Its liquidity is very good, with a Current Ratio of 4.47, making certain sufficient resources to meet needs and handle economic changes. A high Altman-Z score further indicates its distance from any financial trouble. This financial strength lowers risk and helps the company's ability to execute its long-term growth plan.

Conclusion

NVIDIA CORP shows the kind of company sought by an Affordable Growth or GARP screening method. It joins a powerful, clear growth narrative—both historical and expected—with a valuation that, while not low in simple terms, seems sensible compared to its industry and, importantly, when balanced against its unusual growth rate. This possibility is firmly based on top-level profitability and a very sound financial base, which together reduce risk and help the company's ambitious path.

For investors curious about finding other companies that fit similar standards of solid growth, sensible valuation, and good fundamentals, more results are available through this Affordable Growth stock screen.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. Investors should conduct their own research and consider their individual financial circumstances and risk tolerance before making any investment decisions.

NASDAQ:NVDA (12/31/2025, 11:44:10 AM)

188.89

+1.35 (+0.72%)

Find more stocks in the Stock Screener

NVDA Latest News and Analysis