Johnson & Johnson (NYSE:JNJ) was identified as a strong dividend candidate by our stock screener, which filters for companies with high dividend ratings while maintaining solid profitability and financial health. JNJ stands out as a dependable choice for income-focused investors, thanks to its consistent dividend history and stable business model.

Dividend Strength

- Attractive Yield: JNJ offers a dividend yield of 3.32%, which is above the S&P 500 average of 2.40%. It also ranks higher than 94% of its pharmaceutical industry peers.

- Reliable Growth: The company has increased its dividend at an average annual rate of 9.24% over the past years, demonstrating a strong commitment to shareholder returns.

- Long Track Record: JNJ has paid dividends for at least 10 consecutive years without any reductions, reinforcing its reputation as a dependable income stock.

Profitability & Financial Health

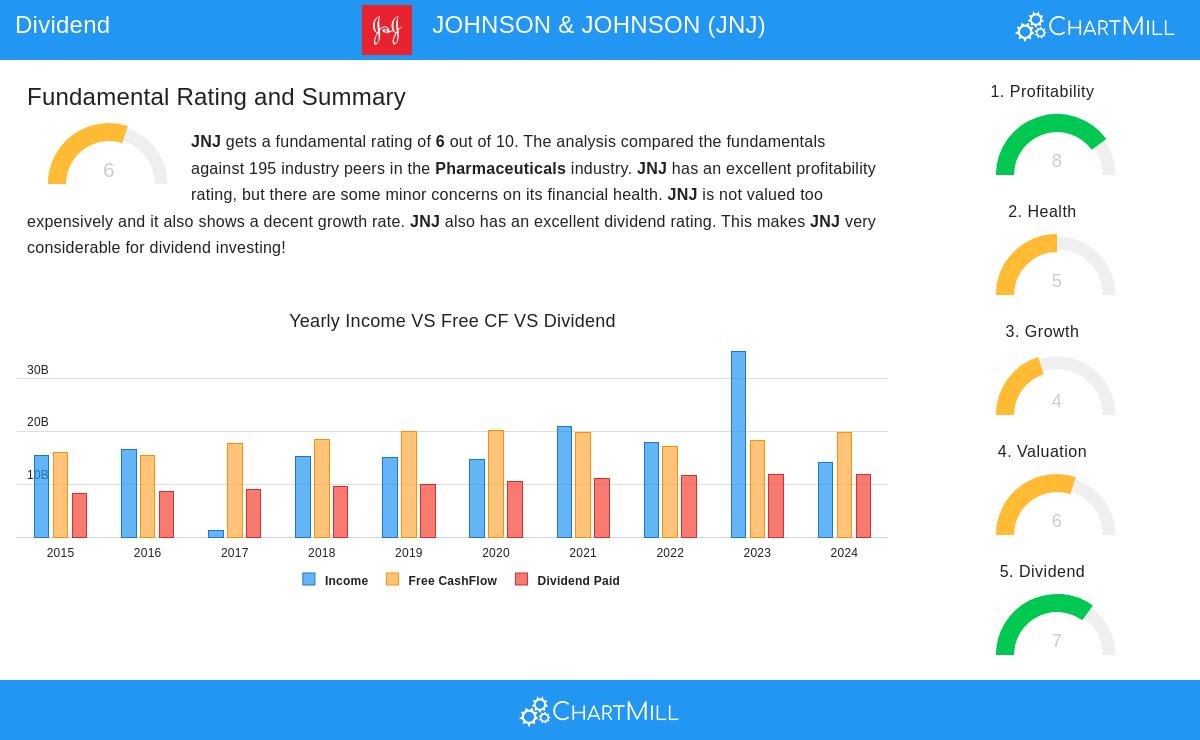

- High Profitability Rating (8/10): JNJ excels in profitability, with strong margins, including a 24.41% profit margin and 26.16% operating margin, outperforming most industry competitors.

- Solid Financial Health (5/10): While the company carries some debt (Debt/Equity of 0.63), its Altman-Z score of 4.06 indicates low bankruptcy risk, and its free cash flow comfortably covers obligations.

Valuation & Growth Outlook

- Reasonable Valuation: Trading at a P/E ratio of 15.44, JNJ appears undervalued compared to both the industry and the broader market.

- Stable Growth Prospects: Revenue and earnings are expected to grow modestly in the coming years, supported by its diversified healthcare business.

For a deeper analysis, review the full fundamental report on JNJ.

Our Best Dividend Stocks screener provides more high-quality dividend stock ideas, updated daily.

Disclaimer

This is not investment advice. The observations here are based on current data, but investors should conduct their own research before making decisions.